Irs Tax Tables Form

Understanding the 2 Form

The 2 form is the U.S. Corporation Income Tax Return, used by corporations to report their income, gains, losses, deductions, and credits. This form is essential for corporations to calculate their tax liability and ensure compliance with federal tax laws. It is important for corporations to accurately complete this form to avoid penalties and ensure proper tax reporting.

Key Elements of the 2 Form

The 2 form includes several key sections that must be filled out correctly:

- Income Section: Corporations must report all sources of income, including sales, dividends, and interest.

- Deductions: This section allows corporations to list allowable deductions, such as salaries, rent, and interest expenses.

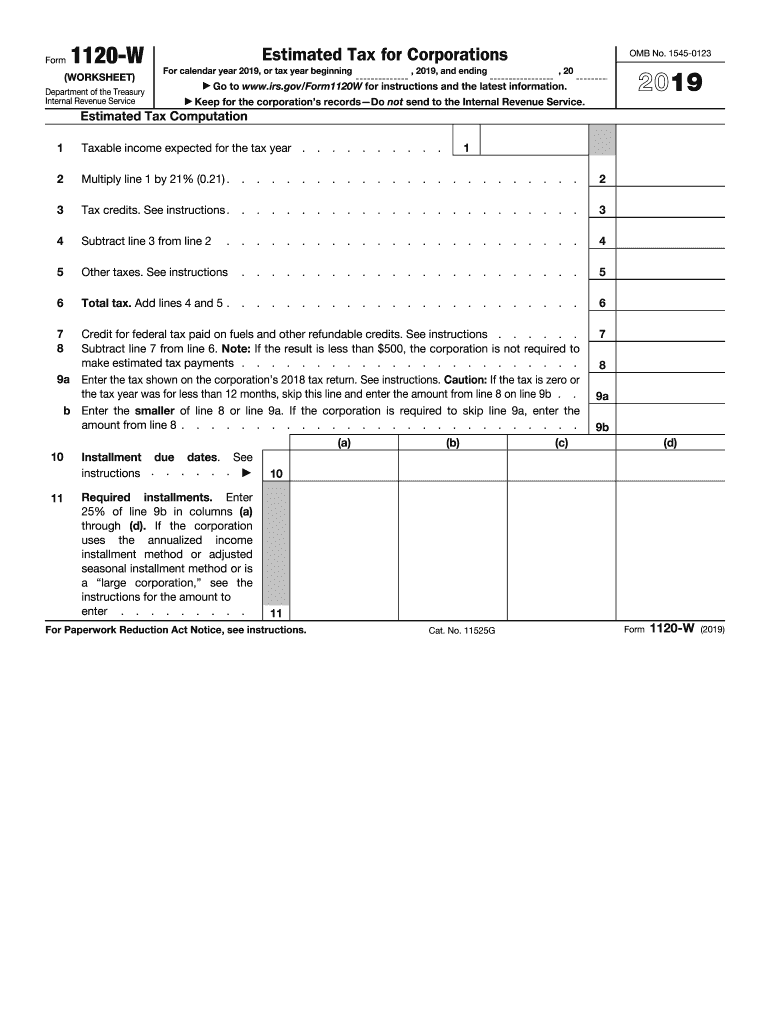

- Tax Computation: Corporations must calculate their tax based on the income reported and applicable tax rates.

- Signature: The form must be signed by an authorized officer of the corporation, affirming the accuracy of the information provided.

Steps to Complete the 2 Form

Filling out the 2 form involves several steps:

- Gather financial records, including income statements and expense reports.

- Fill out the income section, ensuring all income sources are accurately reported.

- List all deductions, making sure to include only those that are allowable under IRS guidelines.

- Calculate the total tax liability using the appropriate tax rates.

- Review the completed form for accuracy and ensure all required signatures are included.

Filing Deadlines for the 2 Form

The filing deadline for the 2 form is typically the fifteenth day of the fourth month following the end of the corporation's tax year. For corporations operating on a calendar year, this means the form is due by April 15, 2020. Corporations can apply for an automatic six-month extension, but this does not extend the time for payment of any taxes owed.

Form Submission Methods

The 2 form can be submitted through various methods:

- Online Filing: Corporations can file electronically using IRS e-file options, which can expedite processing and reduce errors.

- Mail: The form can be printed and mailed to the appropriate IRS address, depending on the corporation's location and whether a payment is included.

- In-Person: Corporations may also submit their forms in person at designated IRS offices, although this method is less common.

Penalties for Non-Compliance

Failure to file the 2 form on time or inaccuracies in reporting can result in significant penalties. The IRS may impose a penalty for late filing, which can be a percentage of the unpaid taxes. Additionally, inaccuracies can lead to interest charges on any unpaid tax amounts. Corporations should ensure timely and accurate filing to avoid these penalties.

Quick guide on how to complete 2019 form 1120 w worksheet estimated tax for corporations

Complete Irs Tax Tables effortlessly on any device

Online document management has gained immense popularity among businesses and individuals. It serves as a perfect eco-friendly substitute for conventional printed and signed documents, allowing you to locate the right form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without delays. Manage Irs Tax Tables on any device with the airSlate SignNow Android or iOS applications and enhance any document-related task today.

The easiest way to edit and eSign Irs Tax Tables without breaking a sweat

- Obtain Irs Tax Tables and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of the documents or redact sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred method to send your form—via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and eSign Irs Tax Tables to ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1120 w worksheet estimated tax for corporations

How to generate an eSignature for the 2019 Form 1120 W Worksheet Estimated Tax For Corporations online

How to create an eSignature for your 2019 Form 1120 W Worksheet Estimated Tax For Corporations in Chrome

How to create an eSignature for signing the 2019 Form 1120 W Worksheet Estimated Tax For Corporations in Gmail

How to generate an electronic signature for the 2019 Form 1120 W Worksheet Estimated Tax For Corporations from your smartphone

How to make an electronic signature for the 2019 Form 1120 W Worksheet Estimated Tax For Corporations on iOS devices

How to create an electronic signature for the 2019 Form 1120 W Worksheet Estimated Tax For Corporations on Android devices

People also ask

-

What is the 2019 1120 form?

The 2019 1120 form is the IRS form used by C corporations to report their income, deductions, and tax liability. It plays a crucial role in ensuring compliance with federal tax regulations and determining the corporation's tax obligations.

-

How can airSlate SignNow help with the 2019 1120 form?

airSlate SignNow provides a secure and efficient way to send, eSign, and manage your 2019 1120 form documents. With its user-friendly interface, you can streamline the signing process, reducing paperwork and saving time.

-

Is airSlate SignNow affordable for businesses preparing the 2019 1120 form?

Yes, airSlate SignNow offers cost-effective pricing options tailored for businesses of all sizes. This allows you to manage your 2019 1120 form and other documents without breaking the bank, ensuring you stay within budget.

-

Can I integrate airSlate SignNow with accounting software for the 2019 1120 form?

Absolutely! airSlate SignNow seamlessly integrates with popular accounting software, allowing you to simplify the data transfer and filing process for your 2019 1120 form. This integration enhances efficiency and reduces the risk of errors.

-

What features does airSlate SignNow provide for the 2019 1120 form?

With airSlate SignNow, you can eSign, track, and store your 2019 1120 form securely in the cloud. Additional features, such as templates and automated reminders, further streamline the document management process.

-

How does using airSlate SignNow benefit my business for the 2019 1120 form?

Using airSlate SignNow for your 2019 1120 form increases efficiency and reduces turnaround times for document signing. This ultimately enhances the overall user experience and ensures that your tax filing process is as seamless as possible.

-

Is my data secure when using airSlate SignNow for the 2019 1120 form?

Yes, security is a top priority for airSlate SignNow. When managing your 2019 1120 form, your data is protected with bank-level encryption and compliance with data protection regulations, ensuring peace of mind.

Get more for Irs Tax Tables

Find out other Irs Tax Tables

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile