1120c Form

What is the 1120C?

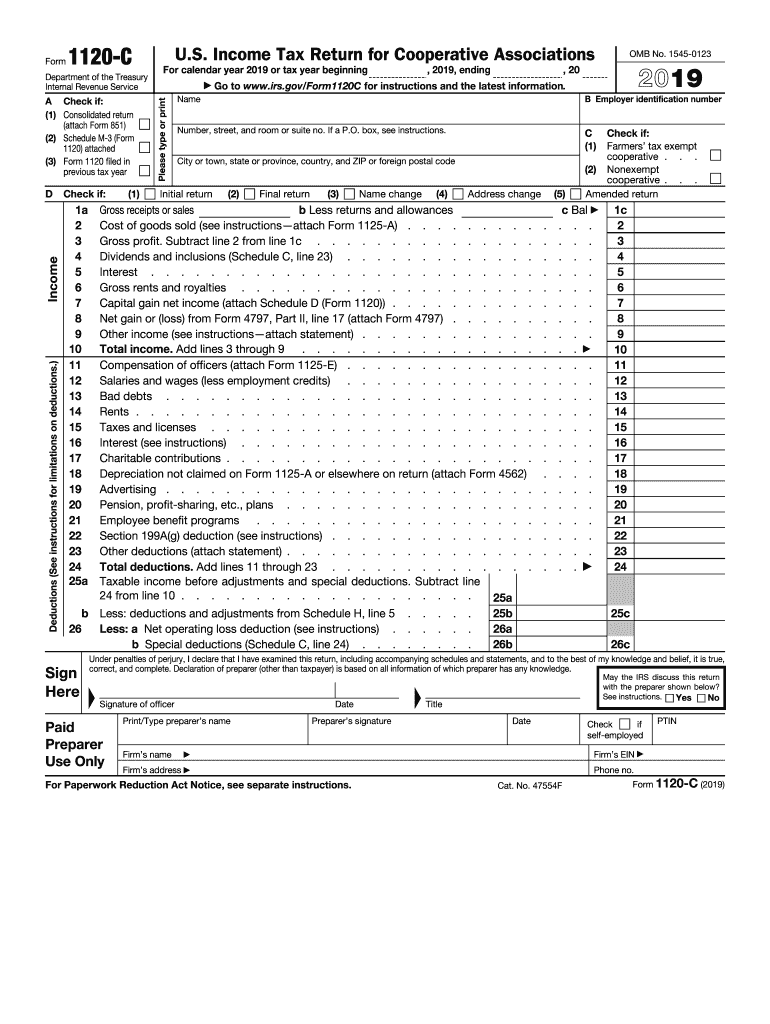

The 1120C is a tax form specifically designed for cooperative associations in the United States. This form is used to report income, gains, losses, deductions, and credits, as well as to calculate the tax liability of a cooperative corporation. Unlike standard corporations, cooperatives operate on a member-based model, distributing profits back to their members based on usage rather than investment. Understanding the unique aspects of the 1120C is essential for ensuring compliance with IRS regulations.

Steps to Complete the 1120C

Completing the 1120C requires careful attention to detail. Here are the key steps involved:

- Gather necessary financial documents, including income statements and expense records.

- Fill out the identification section, providing the cooperative's name, address, and Employer Identification Number (EIN).

- Report income and deductions accurately, ensuring all figures are supported by documentation.

- Calculate the tax liability based on the income reported, applying any applicable credits.

- Review the completed form for accuracy before submission.

How to Obtain the 1120C

The 1120C form can be obtained directly from the IRS website or through tax preparation software that supports cooperative tax filings. It is essential to ensure that you are using the correct version of the form for the tax year you are filing. The 2C PDF can be downloaded for free, allowing cooperatives to prepare their tax returns accurately and efficiently.

Legal Use of the 1120C

The 1120C is legally binding when completed and submitted according to IRS guidelines. It must be signed by an authorized officer of the cooperative, affirming the accuracy of the information provided. Utilizing a reliable electronic signature solution, such as signNow, can enhance the legitimacy of the submission while ensuring compliance with eSignature laws.

Filing Deadlines / Important Dates

Filing the 1120C is subject to specific deadlines. Generally, the form must be filed by the 15th day of the fourth month following the end of the cooperative's tax year. For cooperatives operating on a calendar year, this typically means the deadline is April 15. It is crucial to stay informed about any changes to these dates to avoid penalties.

IRS Guidelines

The IRS provides detailed guidelines for completing the 1120C, including instructions on how to report various types of income and deductions. It is important for cooperatives to familiarize themselves with these guidelines to ensure compliance and maximize potential tax benefits. Consulting the IRS instructions for the 1120C can provide clarity on specific reporting requirements and any recent updates.

Required Documents

When preparing to file the 1120C, certain documents are essential. These typically include:

- Financial statements, including balance sheets and income statements.

- Records of member distributions and allocations.

- Documentation supporting any claimed deductions or credits.

- Prior year tax returns, if applicable, for reference.

Quick guide on how to complete sample return ad tax services

Effortlessly Complete 1120c on Any Device

Online document management has become increasingly favored by businesses and individuals alike. It serves as an excellent eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely save it online. airSlate SignNow provides all the tools you need to create, modify, and electronically sign your documents quickly and without delays. Manage 1120c on any platform using airSlate SignNow's Android or iOS applications, and enhance any document-related process today.

The Easiest Way to Edit and Electronically Sign 1120c with Ease

- Locate 1120c and click on Get Form to begin.

- Utilize the tools available to complete your document.

- Select important sections of your documents or redact sensitive information using the features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal value as a traditional handwritten signature.

- Review the details and click on the Done button to save your changes.

- Choose how you wish to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you prefer. Edit and electronically sign 1120c and ensure excellent communication at every stage of the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the sample return ad tax services

How to make an eSignature for your Sample Return Ad Tax Services in the online mode

How to make an electronic signature for your Sample Return Ad Tax Services in Chrome

How to generate an eSignature for signing the Sample Return Ad Tax Services in Gmail

How to make an eSignature for the Sample Return Ad Tax Services from your smartphone

How to generate an electronic signature for the Sample Return Ad Tax Services on iOS devices

How to create an eSignature for the Sample Return Ad Tax Services on Android devices

People also ask

-

What is the 2019 1120c PDF form used for?

The 2019 1120c PDF form is utilized by corporations to report income, gains, losses, deductions, and credits to the IRS. This form is essential for ensuring compliance with tax regulations and accurately reflecting a corporation's financial status.

-

How can I fill out the 2019 1120c PDF form using airSlate SignNow?

You can easily fill out the 2019 1120c PDF form using airSlate SignNow by uploading the document and utilizing our intuitive editing tools. These features allow you to input required information directly into the PDF, ensuring it is completed accurately and efficiently.

-

Is there a cost associated with using the 2019 1120c PDF feature on airSlate SignNow?

AirSlate SignNow offers competitive pricing plans that include access to essential features such as filling and eSigning the 2019 1120c PDF. We also provide a free trial, so you can evaluate our services before committing to a subscription.

-

Can I sign the 2019 1120c PDF electronically?

Yes, airSlate SignNow allows you to electronically sign the 2019 1120c PDF securely. Our platform is designed to comply with electronic signature laws, ensuring your signed documents are legally binding and accepted by the IRS.

-

What are the benefits of using airSlate SignNow for the 2019 1120c PDF?

Using airSlate SignNow for the 2019 1120c PDF offers several advantages, including time savings, enhanced accuracy, and improved document security. Our cloud-based solution streamlines the eSigning process, making it easier to manage important tax documents.

-

Does airSlate SignNow integrate with other tax software for the 2019 1120c PDF?

Yes, airSlate SignNow offers integrations with popular tax software solutions, allowing you to seamlessly manage the 2019 1120c PDF and other documents. This integration enhances your workflow by enabling you to access and send documents directly from your preferred tax platform.

-

Can I track the status of my 2019 1120c PDF once it's sent for signature?

Absolutely! airSlate SignNow provides real-time tracking for your sent documents, including the 2019 1120c PDF. You'll receive notifications on the status of your document, ensuring you are always informed about your signatures and submissions.

Get more for 1120c

Find out other 1120c

- Sign Virginia Claim Myself

- Sign New York Permission Slip Free

- Sign Vermont Permission Slip Fast

- Sign Arizona Work Order Safe

- Sign Nebraska Work Order Now

- Sign Colorado Profit Sharing Agreement Template Secure

- Sign Connecticut Profit Sharing Agreement Template Computer

- How Can I Sign Maryland Profit Sharing Agreement Template

- How To Sign New York Profit Sharing Agreement Template

- Sign Pennsylvania Profit Sharing Agreement Template Simple

- Help Me With Sign Delaware Electrical Services Contract

- Sign Louisiana Electrical Services Contract Safe

- How Can I Sign Mississippi Electrical Services Contract

- Help Me With Sign West Virginia Electrical Services Contract

- Can I Sign Wyoming Electrical Services Contract

- Sign Ohio Non-Solicitation Agreement Now

- How Can I Sign Alaska Travel Agency Agreement

- How Can I Sign Missouri Travel Agency Agreement

- How Can I Sign Alabama Amendment to an LLC Operating Agreement

- Can I Sign Alabama Amendment to an LLC Operating Agreement