2350 Form

What is the 2350?

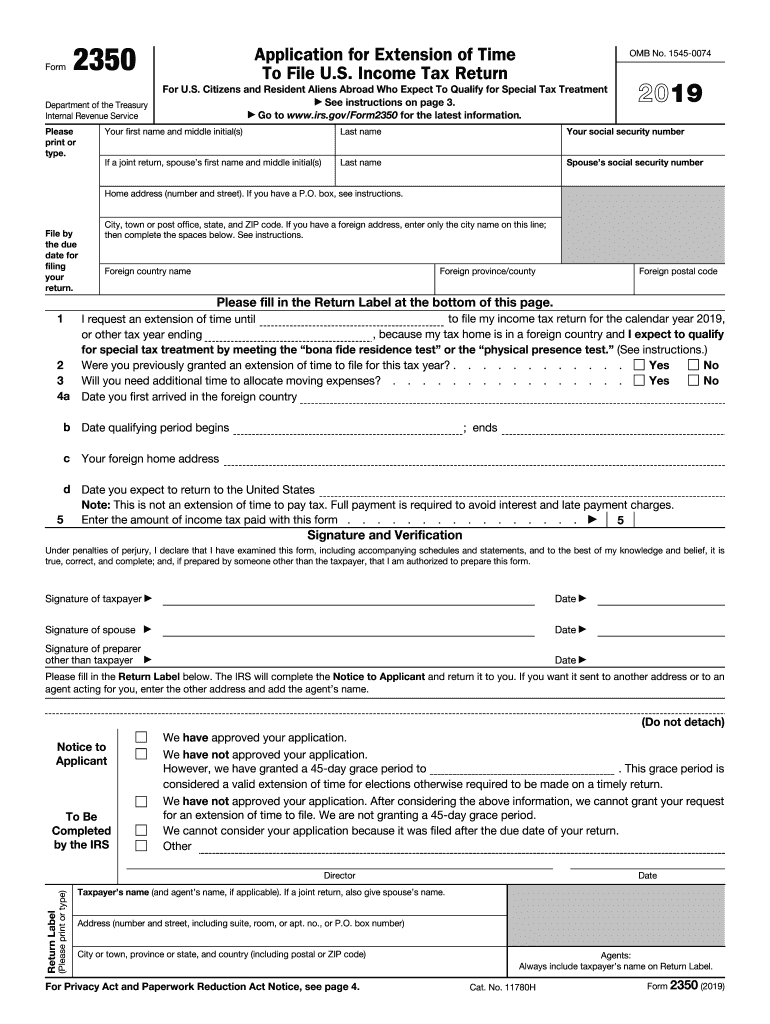

The 2350 form, officially known as the 2350 income tax form, is a tax document used by U.S. citizens and residents who need to report income earned abroad. This form is particularly relevant for individuals who qualify for the foreign earned income exclusion or the foreign housing exclusion. By filing the 2350, taxpayers can claim these exclusions, which can significantly reduce their taxable income. Understanding the purpose and requirements of the 2350 is essential for anyone engaged in international work or living outside the United States.

How to use the 2350

Using the 2350 form involves several steps to ensure accurate reporting of foreign income. First, gather all necessary documentation, including proof of foreign earnings and residency status. Next, complete the form by filling out your personal information, including your name, address, and Social Security number. Be sure to provide details about your foreign income and the specific exclusions you are claiming. Once completed, review the form for accuracy before submission. Utilizing a digital platform like signNow can streamline this process, allowing for easy eSigning and secure submission.

Steps to complete the 2350

Completing the 2350 form requires careful attention to detail. Follow these steps for a successful filing:

- Gather all relevant documents, such as W-2 forms and foreign income statements.

- Provide your personal information at the top of the form.

- Detail your foreign income, specifying the amounts earned and the countries where the income was generated.

- Indicate the exclusions you are claiming, ensuring they meet IRS guidelines.

- Review the form thoroughly to check for any errors or omissions.

- Sign and date the form, either digitally or by hand, before submitting it to the IRS.

Legal use of the 2350

The legal use of the 2350 form is governed by IRS regulations. To be considered valid, the form must be filled out completely and accurately, reflecting true income and residency status. Additionally, the exclusions claimed must align with the criteria set forth by the IRS for foreign earned income and housing costs. By adhering to these legal standards, taxpayers can ensure that their 2350 form is compliant, thereby avoiding potential penalties or issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the 2350 form are crucial for taxpayers to keep in mind. Typically, the form must be submitted by the tax filing deadline, which is usually April 15 for most individuals. However, if you are living abroad, you may qualify for an automatic extension until June 15. It is important to check for any updates or changes to these deadlines each tax year, as they may vary. Filing on time helps avoid penalties and ensures that you remain in good standing with the IRS.

Required Documents

When preparing to file the 2350 form, certain documents are essential for accurate completion. These include:

- Proof of foreign income, such as pay stubs or foreign tax returns.

- Documentation proving residency in a foreign country, like a lease agreement or utility bills.

- Any previous tax returns that may provide context for your current filing.

Having these documents readily available will facilitate a smoother filing process and help ensure compliance with IRS requirements.

Quick guide on how to complete 2019 form 2350 application for extension of time to file us income tax return

Effortlessly Prepare 2350 on Any Device

Digital document management has become increasingly favored by both companies and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can obtain the required form and securely save it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents promptly and without issues. Manage 2350 on any platform using airSlate SignNow's Android or iOS applications and simplify any document-driven procedure today.

The Easiest Way to Edit and eSign 2350 Effortlessly

- Locate 2350 and then click Get Form to begin.

- Use the tools we provide to complete your form.

- Mark important sections of the documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and carries the same legal validity as a traditional ink signature.

- Review all the information and then click the Done button to save your changes.

- Select your preferred method to send your form—by email, SMS, or invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Edit and eSign 2350 and ensure smooth communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 2350 application for extension of time to file us income tax return

How to create an eSignature for your 2019 Form 2350 Application For Extension Of Time To File Us Income Tax Return online

How to generate an eSignature for your 2019 Form 2350 Application For Extension Of Time To File Us Income Tax Return in Chrome

How to create an eSignature for putting it on the 2019 Form 2350 Application For Extension Of Time To File Us Income Tax Return in Gmail

How to make an electronic signature for the 2019 Form 2350 Application For Extension Of Time To File Us Income Tax Return straight from your smart phone

How to make an eSignature for the 2019 Form 2350 Application For Extension Of Time To File Us Income Tax Return on iOS

How to create an eSignature for the 2019 Form 2350 Application For Extension Of Time To File Us Income Tax Return on Android

People also ask

-

What is the 2350 2020 IRS form used for?

The 2350 2020 IRS form is utilized by taxpayers who are looking to request an extension for filing their income tax return. This form is specifically designed to help individuals who need additional time to prepare their taxes, ensuring they can meet their obligations without incurring penalties.

-

How does airSlate SignNow facilitate the signing of the 2350 2020 IRS form?

airSlate SignNow streamlines the eSigning process for the 2350 2020 IRS form by providing an intuitive platform where users can easily upload, send, and sign documents electronically. This ensures that you can complete your tax documentation quickly and securely from anywhere.

-

Is airSlate SignNow a cost-effective solution for managing the 2350 2020 IRS form?

Absolutely! airSlate SignNow offers a range of pricing plans that cater to businesses of all sizes, making it a cost-effective solution for managing documents like the 2350 2020 IRS form. You can save time and money by avoiding traditional printing and mailing costs.

-

What features does airSlate SignNow offer for the 2350 2020 IRS documentation?

airSlate SignNow provides features such as customizable templates, collaboration tools, and secure cloud storage specifically for documents like the 2350 2020 IRS form. These features help ensure that all your important tax documents can be managed efficiently and safely.

-

Can I integrate airSlate SignNow with other tools when handling the 2350 2020 IRS form?

Yes, airSlate SignNow integrates seamlessly with various apps and software, allowing for a smooth workflow when dealing with the 2350 2020 IRS form. Whether you use CRM systems or project management tools, you can easily connect them to enhance your document management process.

-

What are the benefits of using airSlate SignNow for the 2350 2020 IRS form?

Using airSlate SignNow for the 2350 2020 IRS form provides numerous benefits, including increased efficiency, reduced errors, and enhanced security. The electronic signature process is faster than traditional methods, ensuring you can file your taxes on time.

-

How do I ensure my 2350 2020 IRS form is securely signed with airSlate SignNow?

airSlate SignNow uses advanced encryption and secure storage to protect your documents, including the 2350 2020 IRS form. You can be confident that your sensitive information remains safe throughout the eSigning process.

Get more for 2350

Find out other 2350

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now