The Income Tax Act, 1962 Form No 30 Think Legal

Understanding The Income Tax Act, 1962 Form No 30

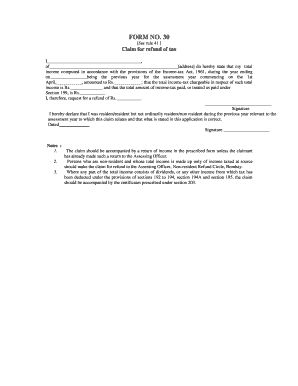

The Income Tax Act, 1962 Form No 30 is a crucial document for individuals and entities that need to report specific income-related information. This form is primarily used in the context of income tax assessments and is essential for compliance with tax regulations. It helps in the declaration of income, deductions, and tax liabilities, ensuring that taxpayers meet their legal obligations. Understanding the purpose and requirements of this form is vital for accurate tax reporting and avoiding potential penalties.

How to Use The Income Tax Act, 1962 Form No 30

Using The Income Tax Act, 1962 Form No 30 involves several steps. Taxpayers must first gather all necessary financial documents, including income statements and deduction records. Once the required information is compiled, the form can be filled out accurately. It is important to ensure that all sections of the form are completed, as incomplete submissions may lead to delays or rejections. After filling out the form, it can be submitted through the appropriate channels, either electronically or via mail, depending on the specific requirements set by tax authorities.

Steps to Complete The Income Tax Act, 1962 Form No 30

Completing The Income Tax Act, 1962 Form No 30 involves a systematic approach:

- Gather all relevant financial documents, such as income statements, receipts for deductions, and previous tax returns.

- Carefully read the instructions provided with the form to understand the requirements for each section.

- Fill in personal details, including name, address, and taxpayer identification number.

- Report income from various sources accurately, ensuring all figures are correct and verifiable.

- Claim eligible deductions and credits, providing necessary documentation as required.

- Review the completed form for accuracy and completeness before submission.

Legal Use of The Income Tax Act, 1962 Form No 30

The legal use of The Income Tax Act, 1962 Form No 30 is essential for compliance with tax laws. This form serves as an official declaration of income and deductions, which can be subject to review by tax authorities. Proper use of the form helps prevent legal issues, such as audits or penalties for non-compliance. It is important for taxpayers to understand their rights and responsibilities when using this form to ensure they are protected under tax laws.

Required Documents for The Income Tax Act, 1962 Form No 30

When preparing to complete The Income Tax Act, 1962 Form No 30, several documents are typically required:

- Income statements from employers or other sources of income.

- Receipts and records for any deductions being claimed.

- Previous tax returns for reference and consistency.

- Any additional documentation that supports income or deductions, such as investment statements.

Form Submission Methods for The Income Tax Act, 1962 Form No 30

The Income Tax Act, 1962 Form No 30 can be submitted through various methods, accommodating different preferences and needs:

- Online submission via authorized tax software or platforms, which often provide guided assistance.

- Mailing a physical copy of the completed form to the appropriate tax authority.

- In-person submission at designated tax offices, if applicable.

Quick guide on how to complete the income tax act 1962 form no 30 think legal

Complete [SKS] effortlessly on any gadget

Digital document administration has gained traction with organizations and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed papers, allowing you to locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents promptly, eliminating delays. Handle [SKS] on any device using the airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

The simplest method to alter and electronically sign [SKS] without hassle

- Obtain [SKS] and click Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize pertinent sections of your documents or redact sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Generate your signature with the Sign feature, which takes just seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you would like to share your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form hunting, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choosing. Edit and electronically sign [SKS] to ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Related searches to The Income Tax Act, 1962 Form No 30 Think Legal

Create this form in 5 minutes!

How to create an eSignature for the the income tax act 1962 form no 30 think legal

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is The Income Tax Act, 1962 Form No 30 Think Legal?

The Income Tax Act, 1962 Form No 30 Think Legal is a specific form used for tax purposes in India. It is essential for individuals and businesses to comply with tax regulations. Understanding this form can help ensure accurate tax filings and avoid penalties.

-

How can airSlate SignNow assist with The Income Tax Act, 1962 Form No 30 Think Legal?

airSlate SignNow provides a streamlined platform for eSigning and sending The Income Tax Act, 1962 Form No 30 Think Legal. Our solution simplifies document management, making it easier to complete and submit tax forms efficiently. This ensures compliance and saves valuable time.

-

What are the pricing options for using airSlate SignNow for The Income Tax Act, 1962 Form No 30 Think Legal?

airSlate SignNow offers flexible pricing plans tailored to different business needs. Whether you are a small business or a large enterprise, you can find a plan that fits your budget while ensuring you can manage The Income Tax Act, 1962 Form No 30 Think Legal effectively.

-

What features does airSlate SignNow offer for managing The Income Tax Act, 1962 Form No 30 Think Legal?

Our platform includes features such as customizable templates, secure eSigning, and document tracking. These tools enhance your ability to manage The Income Tax Act, 1962 Form No 30 Think Legal efficiently. Additionally, our user-friendly interface makes it easy for anyone to navigate.

-

What are the benefits of using airSlate SignNow for The Income Tax Act, 1962 Form No 30 Think Legal?

Using airSlate SignNow for The Income Tax Act, 1962 Form No 30 Think Legal offers numerous benefits, including increased efficiency and reduced paperwork. Our solution helps you stay organized and compliant with tax regulations, ultimately saving you time and resources.

-

Can airSlate SignNow integrate with other software for The Income Tax Act, 1962 Form No 30 Think Legal?

Yes, airSlate SignNow seamlessly integrates with various software applications to enhance your workflow. This integration capability allows you to manage The Income Tax Act, 1962 Form No 30 Think Legal alongside your existing tools, improving overall productivity.

-

Is airSlate SignNow secure for handling The Income Tax Act, 1962 Form No 30 Think Legal?

Absolutely! airSlate SignNow prioritizes security and compliance, ensuring that your documents, including The Income Tax Act, 1962 Form No 30 Think Legal, are protected. We utilize advanced encryption and security protocols to safeguard your sensitive information.

Get more for The Income Tax Act, 1962 Form No 30 Think Legal

- Electrical contractor package washington form

- Sheetrock drywall contractor package washington form

- Flooring contractor package washington form

- Trim carpentry contractor package washington form

- Fencing contractor package washington form

- Hvac contractor package washington form

- Landscaping contractor package washington form

- Commercial contractor package washington form

Find out other The Income Tax Act, 1962 Form No 30 Think Legal

- How To eSign Hawaii Time Off Policy

- How Do I eSign Hawaii Time Off Policy

- Help Me With eSign Hawaii Time Off Policy

- How To eSign Hawaii Addressing Harassement

- How To eSign Arkansas Company Bonus Letter

- eSign Hawaii Promotion Announcement Secure

- eSign Alaska Worksheet Strengths and Weaknesses Myself

- How To eSign Rhode Island Overtime Authorization Form

- eSign Florida Payroll Deduction Authorization Safe

- eSign Delaware Termination of Employment Worksheet Safe

- Can I eSign New Jersey Job Description Form

- Can I eSign Hawaii Reference Checking Form

- Help Me With eSign Hawaii Acknowledgement Letter

- eSign Rhode Island Deed of Indemnity Template Secure

- eSign Illinois Car Lease Agreement Template Fast

- eSign Delaware Retainer Agreement Template Later

- eSign Arkansas Attorney Approval Simple

- eSign Maine Car Lease Agreement Template Later

- eSign Oregon Limited Power of Attorney Secure

- How Can I eSign Arizona Assignment of Shares