Form Gift Tax

What is the Form Gift Tax

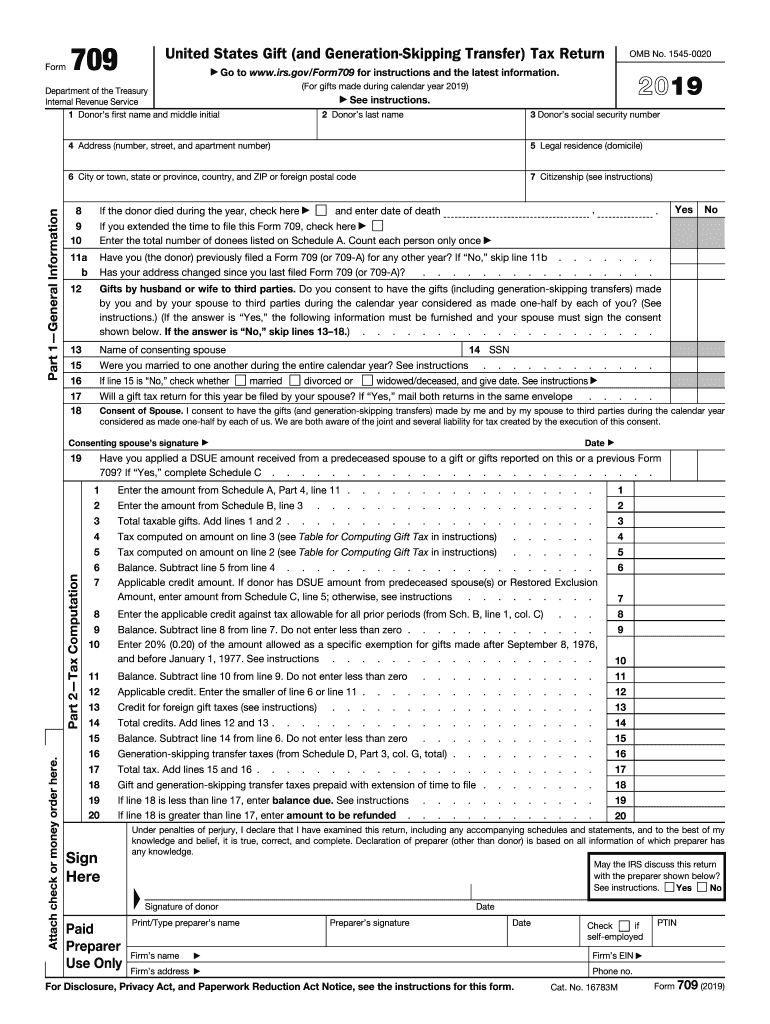

The Form 709, also known as the Gift Tax Return, is a tax document used in the United States to report gifts made during the tax year. This form is essential for individuals who give gifts exceeding the annual exclusion amount, which was fifteen thousand dollars for the year 2019. By filing Form 709, taxpayers can declare their taxable gifts and potentially utilize the lifetime gift tax exemption, which was eleven million four hundred thousand dollars for 2019. Understanding the purpose of this form is crucial for compliance with IRS regulations and to avoid any potential penalties.

Steps to Complete the Form Gift Tax

Completing the Form 709 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including the recipient's details and the value of the gifts given.

- Determine if the gifts exceed the annual exclusion amount for the year.

- Fill out the form, starting with your personal information, followed by details of the gifts.

- Calculate the total gifts and any applicable deductions.

- Sign and date the form to certify its accuracy.

It is advisable to review the completed form thoroughly to ensure all information is accurate before submission.

Legal Use of the Form Gift Tax

The legal use of Form 709 is governed by IRS regulations, which stipulate that it must be filed for any gifts exceeding the annual exclusion limit. Failure to report taxable gifts can result in penalties and interest on unpaid taxes. The form serves as a record of gifts that may affect the donor's lifetime gift tax exemption. It is important to maintain accurate records of all gifts and to file the form timely to comply with federal tax laws.

Filing Deadlines / Important Dates

The deadline for filing Form 709 is typically April fifteenth of the year following the tax year in which the gifts were made. If you are unable to meet this deadline, you may file for an extension, which generally allows for an additional six months. However, any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates is essential for ensuring compliance with IRS requirements.

Required Documents

To complete Form 709, you will need several documents and pieces of information, including:

- Personal identification information, such as your Social Security number.

- Details of the recipient(s) of the gifts, including their names and addresses.

- Valuation of the gifts given, including appraisals if necessary.

- Any documentation supporting the calculation of the annual exclusion and lifetime exemption.

Having these documents ready will facilitate a smoother filing process.

Examples of Using the Form Gift Tax

Form 709 is commonly used in various scenarios, such as:

- Gifting a property valued at two hundred thousand dollars to a child, which exceeds the annual exclusion.

- Making multiple gifts to different recipients throughout the year, each exceeding the exclusion limit.

- Utilizing the lifetime gift tax exemption for larger gifts, such as funding a trust.

These examples illustrate the importance of accurately reporting gifts to ensure compliance with tax obligations.

Quick guide on how to complete form 709 united states gift and generation skipping

Effortlessly Prepare Form Gift Tax on Any Device

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute to traditional printed and signed papers, as you can obtain the appropriate form and securely store it online. airSlate SignNow equips you with all the resources necessary to produce, modify, and electronically sign your documents swiftly without any holdups. Manage Form Gift Tax on any device with airSlate SignNow's Android or iOS applications and simplify any document-related process today.

The Easiest Way to Modify and Electronically Sign Form Gift Tax Effortlessly

- Locate Form Gift Tax and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your electronic signature using the Sign feature, which takes only seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you would like to send your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you select. Edit and electronically sign Form Gift Tax to guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 709 united states gift and generation skipping

How to generate an electronic signature for your Form 709 United States Gift And Generation Skipping online

How to make an electronic signature for your Form 709 United States Gift And Generation Skipping in Chrome

How to create an electronic signature for signing the Form 709 United States Gift And Generation Skipping in Gmail

How to generate an electronic signature for the Form 709 United States Gift And Generation Skipping from your smart phone

How to make an eSignature for the Form 709 United States Gift And Generation Skipping on iOS

How to create an electronic signature for the Form 709 United States Gift And Generation Skipping on Android OS

People also ask

-

What is the gift tax 2019 limit for individual gifts?

In 2019, the annual exclusion for the gift tax is set at $15,000 per recipient. This means individuals can gift up to $15,000 to any number of people without being subject to gift tax. Understanding these limits is crucial for effective estate planning.

-

How does the gift tax 2019 impact estate planning?

The gift tax 2019 implications are signNow for estate planning, as gifting assets during your lifetime can reduce the taxable estate upon death. By utilizing the annual exclusion, individuals can strategically transfer wealth while minimizing tax liabilities. It's advisable to consult a tax professional for personalized strategies.

-

Are there any exemptions to the gift tax 2019?

Yes, certain gifts may be exempt from the gift tax 2019, such as those made for educational or medical expenses. Payments made directly to educational institutions or medical providers do not count against the gift tax exclusion. Being aware of these exemptions can help you maximize your gifting strategy.

-

What are the penalties for not filing a gift tax return in 2019?

Failing to file a gift tax return when necessary in 2019 can lead to signNow penalties, including a tardiness fee of up to 5% of the gift tax owed for each month late. Additionally, it may result in increased scrutiny from the IRS in future transactions. It's important to stay compliant to avoid such repercussions.

-

How can airSlate SignNow help with gift tax documentation in 2019?

airSlate SignNow allows users to easily create and manage documents related to gift transactions, ensuring all necessary records are efficiently stored and signed. With customizable templates and eSigning capabilities, it simplifies the process of documenting gifts for 2019. Streamlining these tasks helps maintain transparency and compliance.

-

What features does airSlate SignNow offer for managing gift tax documents?

airSlate SignNow provides a user-friendly platform for drafting, signing, and storing important documents related to the gift tax 2019. Key features include customizable templates, secure storage, and multi-party signing options, which facilitate a hassle-free process for users. This efficiency can save both time and money during tax season.

-

Can airSlate SignNow integrate with financial software for gift tax records in 2019?

Yes, airSlate SignNow easily integrates with various financial and accounting software, allowing for seamless import and export of gift tax data. This integration supports accurate record-keeping and efficient management of your tax-related documents for 2019. It's a great way to ensure all financial records are synchronized and organized.

Get more for Form Gift Tax

Find out other Form Gift Tax

- How To eSignature Utah Real estate forms

- How Do I eSignature Washington Real estate investment proposal template

- Can I eSignature Kentucky Performance Contract

- eSignature Nevada Performance Contract Safe

- eSignature California Franchise Contract Secure

- How To eSignature Colorado Sponsorship Proposal Template

- eSignature Alabama Distributor Agreement Template Secure

- eSignature California Distributor Agreement Template Later

- eSignature Vermont General Power of Attorney Template Easy

- eSignature Michigan Startup Cost Estimate Simple

- eSignature New Hampshire Invoice for Services (Standard Format) Computer

- eSignature Arkansas Non-Compete Agreement Later

- Can I eSignature Arizona Non-Compete Agreement

- How Do I eSignature New Jersey Non-Compete Agreement

- eSignature Tennessee Non-Compete Agreement Myself

- How To eSignature Colorado LLC Operating Agreement

- Help Me With eSignature North Carolina LLC Operating Agreement

- eSignature Oregon LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Online

- eSignature Wyoming LLC Operating Agreement Computer