Schedule K Tax Form

What is the Schedule K Tax Form

The Schedule K tax form is a crucial document used by partnerships, S corporations, and certain estates and trusts to report income, deductions, and credits. This form provides a detailed overview of the entity's financial activities, which is essential for the accurate reporting of each partner's or shareholder's share of income. The Schedule K is typically filed with the IRS as part of Form 1065 for partnerships or Form 1120S for S corporations. Understanding this form is vital for ensuring compliance with tax obligations and for the proper distribution of income to partners or shareholders.

How to use the Schedule K Tax Form

Using the Schedule K tax form involves several steps to ensure accurate reporting of financial information. First, gather all necessary financial records, including income statements, expense reports, and any applicable tax credits. Next, complete the form by entering the entity's total income, deductions, and credits. Each partner or shareholder will then receive a Schedule K-1, which details their specific share of the income and deductions reported on the Schedule K. This information is essential for each individual to accurately report their income on their personal tax returns.

Steps to complete the Schedule K Tax Form

Completing the Schedule K tax form requires careful attention to detail. Follow these steps for proper completion:

- Gather Documentation: Collect all relevant financial documents, including income statements and expense records.

- Fill Out Entity Information: Enter the name, address, and taxpayer identification number of the entity.

- Report Income: List all sources of income, including ordinary business income and rental income.

- Detail Deductions: Include all applicable deductions, such as business expenses and depreciation.

- Calculate Credits: Identify any tax credits the entity is eligible for and report them accurately.

- Review and File: Double-check all entries for accuracy before submitting the form with the appropriate tax return.

Legal use of the Schedule K Tax Form

The legal use of the Schedule K tax form is governed by IRS regulations, which stipulate that it must be completed accurately and filed timely to avoid penalties. Each entity must ensure that the information reported is truthful and complete, as discrepancies can lead to audits or legal issues. Furthermore, the Schedule K must be distributed to all partners or shareholders, who rely on this information to file their personal tax returns correctly. Compliance with these legal requirements is essential for maintaining the entity's good standing with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule K tax form are critical for compliance. Generally, partnerships must file their Schedule K with Form 1065 by March 15 of the following tax year. S corporations must file their Schedule K with Form 1120S by the same date. If the deadline falls on a weekend or holiday, it is extended to the next business day. Additionally, extensions may be requested, but it is important to note that any taxes owed must still be paid by the original deadline to avoid penalties and interest.

Who Issues the Form

The Schedule K tax form is issued by the Internal Revenue Service (IRS). It is a standardized form that must be used by eligible entities, including partnerships and S corporations, to report their financial activities. The IRS provides guidelines and instructions for completing the form, ensuring that all entities adhere to the same reporting standards. It is important for entities to stay updated on any changes to the form or its requirements as issued by the IRS.

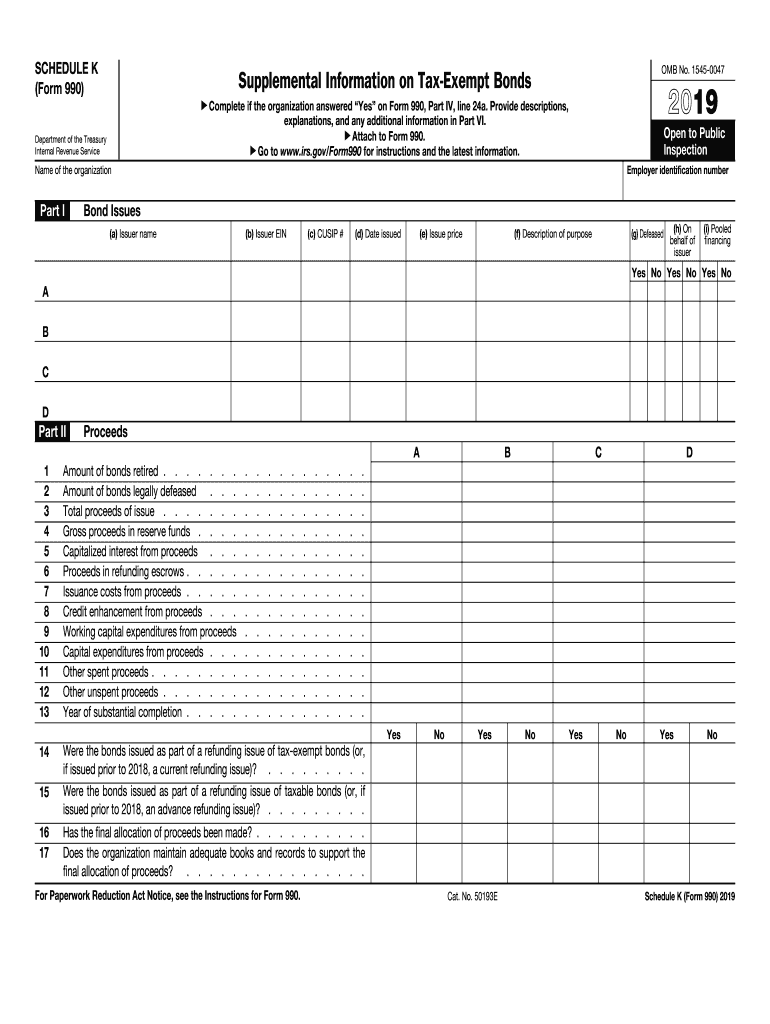

Quick guide on how to complete 2019 schedule k form 990 internal revenue service

Effortlessly Prepare Schedule K Tax Form on Any Device

Online document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without delays. Manage Schedule K Tax Form on any platform using the airSlate SignNow Android or iOS apps and streamline any document-based process today.

Easily Edit and eSign Schedule K Tax Form without Hassle

- Obtain Schedule K Tax Form and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Highlight important sections of the documents or redact sensitive information with specialized tools from airSlate SignNow.

- Formulate your eSignature using the Sign tool, which takes seconds and carries the same legal validity as a traditional signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searching, or errors that require printing new copies. airSlate SignNow fulfills your document management needs in just a few clicks from your preferred device. Modify and eSign Schedule K Tax Form while ensuring clear communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule k form 990 internal revenue service

How to generate an eSignature for the 2019 Schedule K Form 990 Internal Revenue Service in the online mode

How to generate an eSignature for the 2019 Schedule K Form 990 Internal Revenue Service in Chrome

How to generate an electronic signature for putting it on the 2019 Schedule K Form 990 Internal Revenue Service in Gmail

How to make an eSignature for the 2019 Schedule K Form 990 Internal Revenue Service right from your smart phone

How to create an eSignature for the 2019 Schedule K Form 990 Internal Revenue Service on iOS devices

How to generate an electronic signature for the 2019 Schedule K Form 990 Internal Revenue Service on Android

People also ask

-

What are 2019 supplemental bonds?

2019 supplemental bonds refer to additional bonds issued by municipalities to provide funding for various projects, typically related to infrastructure and public services. These bonds help finance important community initiatives while offering investors a reliable income stream.

-

How can airSlate SignNow help with 2019 supplemental bonds documentation?

airSlate SignNow streamlines the process of managing documents related to 2019 supplemental bonds by providing an easy-to-use eSignature platform. With its digital workflow, you can quickly send, sign, and store vital documents, ensuring compliance and expediting the financing process.

-

What are the pricing options for using airSlate SignNow for 2019 supplemental bonds?

airSlate SignNow offers flexible pricing plans that cater to different business sizes and needs. You can choose a plan that suits your budget and requirements, ensuring that managing your 2019 supplemental bonds documentation is affordable and efficient.

-

What features does airSlate SignNow offer for managing 2019 supplemental bonds?

Key features of airSlate SignNow include customizable templates, in-app document editing, and advanced security measures to protect sensitive information related to 2019 supplemental bonds. The platform also supports real-time collaboration among team members, enhancing productivity.

-

How does eSigning enhance the process of handling 2019 supplemental bonds?

eSigning with airSlate SignNow accelerates the process of formalizing 2019 supplemental bonds by reducing the time spent on paper-based workflows. Quick approvals and the ability to sign documents from anywhere enable businesses to finalize transactions efficiently.

-

Are there integrations available for managing 2019 supplemental bonds with airSlate SignNow?

Yes, airSlate SignNow offers integrations with numerous applications and software, allowing you to seamlessly manage your 2019 supplemental bonds documentation within your existing workflow. This interoperability ensures that you can easily utilize your preferred tools alongside our eSignature solution.

-

What benefits can I expect from using airSlate SignNow for 2019 supplemental bonds?

By using airSlate SignNow, you can expect enhanced efficiency, reduced costs, and improved compliance when managing 2019 supplemental bonds. The platform's user-friendly interface, combined with robust features, makes it easier to handle all your bonding documentation needs.

Get more for Schedule K Tax Form

Find out other Schedule K Tax Form

- eSign Hawaii Lawers Rental Application Fast

- eSign Hawaii Lawers Cease And Desist Letter Later

- How To eSign Hawaii Lawers Cease And Desist Letter

- How Can I eSign Hawaii Lawers Cease And Desist Letter

- eSign Hawaii Lawers Cease And Desist Letter Free

- eSign Maine Lawers Resignation Letter Easy

- eSign Louisiana Lawers Last Will And Testament Mobile

- eSign Louisiana Lawers Limited Power Of Attorney Online

- eSign Delaware Insurance Work Order Later

- eSign Delaware Insurance Credit Memo Mobile

- eSign Insurance PPT Georgia Computer

- How Do I eSign Hawaii Insurance Operating Agreement

- eSign Hawaii Insurance Stock Certificate Free

- eSign New Hampshire Lawers Promissory Note Template Computer

- Help Me With eSign Iowa Insurance Living Will

- eSign North Dakota Lawers Quitclaim Deed Easy

- eSign Ohio Lawers Agreement Computer

- eSign North Dakota Lawers Separation Agreement Online

- How To eSign North Dakota Lawers Separation Agreement

- eSign Kansas Insurance Moving Checklist Free