Tax Code Declaration 2024

What is the Tax Code Declaration

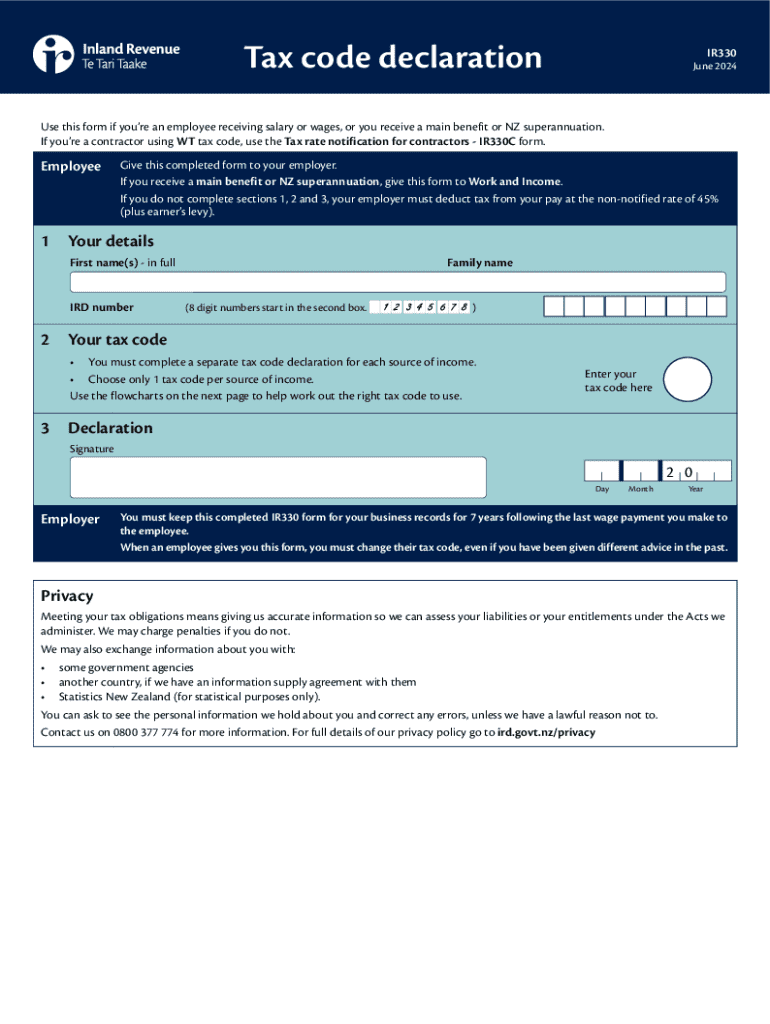

The Tax Code Declaration, specifically the IR330 form, is an essential document used in the United States for tax purposes. It allows individuals to declare their tax code to their employer, which in turn helps in determining the correct amount of tax to withhold from their paychecks. This form is particularly important for ensuring compliance with tax regulations and avoiding underpayment or overpayment of taxes.

How to obtain the Tax Code Declaration

To obtain the IR330 form, individuals can visit the official website of the Internal Revenue Service (IRS) or other authorized tax agencies. The form is typically available for download in PDF format, allowing users to print it for completion. Additionally, many employers may provide the form directly to their employees, ensuring easy access.

Steps to complete the Tax Code Declaration

Completing the IR330 form involves several straightforward steps:

- Begin by entering your personal information, including your name, address, and Social Security number.

- Select the appropriate tax code that applies to your situation. This may vary based on your employment status and other factors.

- Review the information for accuracy to ensure that it reflects your current tax situation.

- Sign and date the form to validate your declaration.

- Submit the completed form to your employer, who will use it to adjust your tax withholding accordingly.

Key elements of the Tax Code Declaration

The IR330 form includes several key elements that are crucial for accurate tax reporting:

- Personal Information: This section requires basic details about the taxpayer, such as name and Social Security number.

- Tax Code Selection: Taxpayers must choose the correct tax code that corresponds to their financial situation.

- Signature: A signature is necessary to confirm the accuracy of the information provided.

Form Submission Methods

The IR330 form can be submitted through various methods, depending on the employer's preferences:

- Online Submission: Some employers may allow electronic submission of the form through their payroll systems.

- Mail: Taxpayers can print the form and send it via postal mail to their employer's payroll department.

- In-Person: Individuals may also choose to deliver the completed form directly to their employer.

Legal use of the Tax Code Declaration

The IR330 form is legally binding, and its proper use is essential for compliance with tax laws. Employers are required to maintain accurate records of tax code declarations to ensure correct tax withholding. Failure to submit the form or providing false information can lead to penalties, including fines or audits by tax authorities.

Handy tips for filling out Tax Code Declaration online

Quick steps to complete and e-sign Tax Code Declaration online:

- Use Get Form or simply click on the template preview to open it in the editor.

- Start completing the fillable fields and carefully type in required information.

- Use the Cross or Check marks in the top toolbar to select your answers in the list boxes.

- Utilize the Circle icon for other Yes/No questions.

- Look through the document several times and make sure that all fields are completed with the correct information.

- Insert the current Date with the corresponding icon.

- Add a legally-binding e-signature. Go to Sign -> Add New Signature and select the option you prefer: type, draw, or upload an image of your handwritten signature and place it where you need it.

- Finish filling out the form with the Done button.

- Download your copy, save it to the cloud, print it, or share it right from the editor.

- Check the Help section and contact our Support team if you run into any troubles when using the editor.

We understand how straining completing forms could be. Get access to a HIPAA and GDPR compliant service for maximum simplicity. Use signNow to electronically sign and send out Tax Code Declaration for e-signing.

Create this form in 5 minutes or less

Find and fill out the correct tax code declaration

Create this form in 5 minutes!

How to create an eSignature for the tax code declaration

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the ir330 form and why is it important?

The ir330 form is a tax declaration form used in New Zealand for employees to provide their tax code to their employer. It is important because it ensures that the correct amount of tax is withheld from your salary, preventing any tax liabilities at the end of the financial year.

-

How can airSlate SignNow help with the ir330 form?

airSlate SignNow simplifies the process of completing and signing the ir330 form by providing an easy-to-use platform for electronic signatures. This ensures that your ir330 form is processed quickly and securely, allowing you to focus on your work without delays.

-

Is there a cost associated with using airSlate SignNow for the ir330 form?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Each plan provides access to features that streamline the completion and signing of documents like the ir330 form, making it a cost-effective solution for businesses.

-

What features does airSlate SignNow offer for managing the ir330 form?

airSlate SignNow offers features such as customizable templates, secure electronic signatures, and document tracking, which are essential for managing the ir330 form. These features enhance efficiency and ensure compliance with tax regulations.

-

Can I integrate airSlate SignNow with other software for the ir330 form?

Yes, airSlate SignNow integrates seamlessly with various software applications, allowing you to manage the ir330 form alongside your existing tools. This integration helps streamline your workflow and enhances productivity.

-

What are the benefits of using airSlate SignNow for the ir330 form?

Using airSlate SignNow for the ir330 form offers numerous benefits, including faster processing times, reduced paperwork, and enhanced security. These advantages help businesses maintain compliance while improving overall efficiency.

-

How secure is the airSlate SignNow platform for handling the ir330 form?

The airSlate SignNow platform employs advanced security measures, including encryption and secure access controls, to protect sensitive information like the ir330 form. This ensures that your data remains confidential and secure throughout the signing process.

Get more for Tax Code Declaration

- South carolina warranty deed 497325589 form

- Sc quitclaim deed form

- General warranty deed from an individual to two individuals with a retained life estate in grantor south carolina form

- Timeshare 497325592 form

- Notice of commencement corporation or llc south carolina form

- Quitclaim deed from individual to two individuals in joint tenancy south carolina form

- Renunciation and disclaimer of property from will by testate south carolina form

- Sc notice form

Find out other Tax Code Declaration

- Can I eSign Texas Plumbing Cease And Desist Letter

- eSign Utah Plumbing Notice To Quit Secure

- eSign Alabama Real Estate Quitclaim Deed Mobile

- eSign Alabama Real Estate Affidavit Of Heirship Simple

- eSign California Real Estate Business Plan Template Free

- How Can I eSign Arkansas Real Estate Promissory Note Template

- eSign Connecticut Real Estate LLC Operating Agreement Later

- eSign Connecticut Real Estate LLC Operating Agreement Free

- eSign Real Estate Document Florida Online

- eSign Delaware Real Estate Quitclaim Deed Easy

- eSign Hawaii Real Estate Agreement Online

- Help Me With eSign Hawaii Real Estate Letter Of Intent

- eSign Florida Real Estate Residential Lease Agreement Simple

- eSign Florida Real Estate Limited Power Of Attorney Online

- eSign Hawaii Sports RFP Safe

- eSign Hawaii Sports Warranty Deed Myself

- eSign Louisiana Real Estate Last Will And Testament Easy

- eSign Louisiana Real Estate Work Order Now

- eSign Maine Real Estate LLC Operating Agreement Simple

- eSign Maine Real Estate Memorandum Of Understanding Mobile