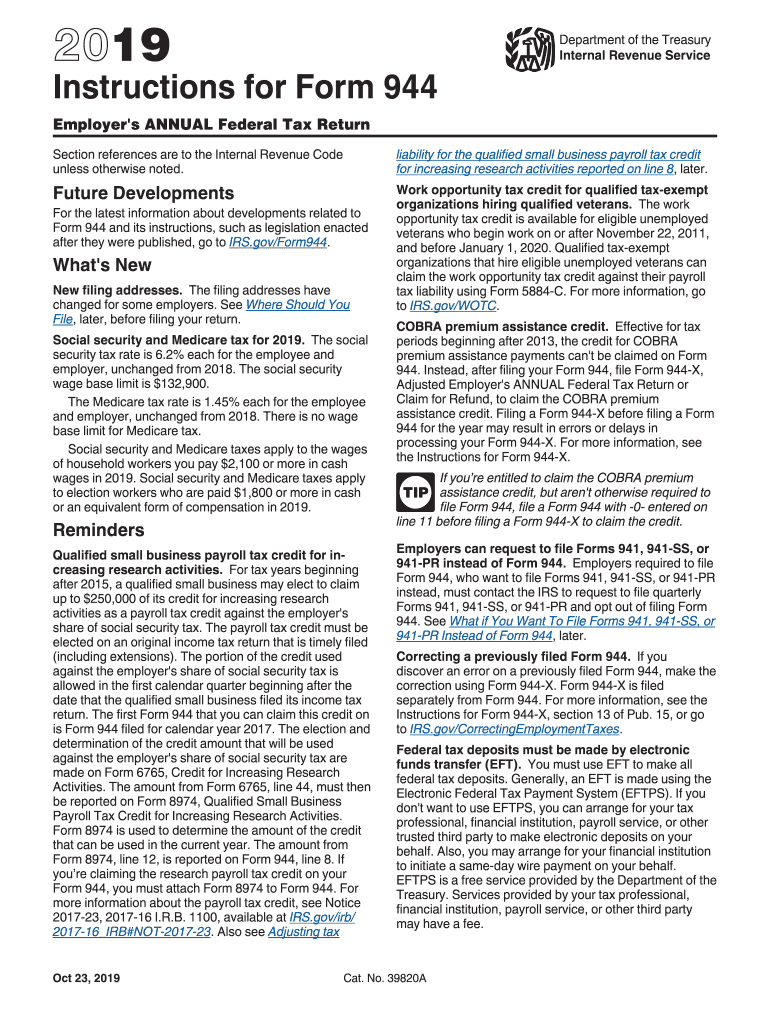

Form 944 Instructions

What is the Form 944 Instructions

The Form 944 is a simplified tax form used by small businesses to report their annual payroll taxes to the IRS. Specifically designed for employers with a low volume of payroll, it allows them to file once a year rather than quarterly. The Form 944 instructions provide detailed guidance on how to complete the form accurately, including information on reporting wages, calculating taxes, and ensuring compliance with federal regulations. Understanding these instructions is crucial for maintaining proper tax records and avoiding penalties.

Steps to complete the Form 944 Instructions

Completing the Form 944 requires careful attention to detail. Here are the essential steps:

- Gather necessary documentation, including employee wage records and previous tax filings.

- Fill out the employer identification information at the top of the form.

- Report total wages paid and taxes withheld in the appropriate sections.

- Calculate the total tax liability accurately, ensuring all calculations align with IRS guidelines.

- Sign and date the form to certify its accuracy before submission.

Following these steps will help ensure that the Form 944 is completed correctly, reducing the risk of errors that could lead to complications with the IRS.

Legal use of the Form 944 Instructions

The Form 944 instructions are legally binding, meaning that the information provided must comply with IRS regulations. This includes accurate reporting of wages and taxes, as well as adherence to deadlines. Failure to follow these instructions can result in penalties, including fines or interest charges on unpaid taxes. It is important for employers to understand their legal obligations and ensure that all filings are completed in accordance with the law.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with Form 944 to avoid penalties. The form is typically due on January 31 of the year following the tax year being reported. If the due date falls on a weekend or holiday, the deadline is extended to the next business day. Additionally, employers should be mindful of any changes in deadlines announced by the IRS, as these can vary from year to year.

IRS Guidelines

The IRS provides comprehensive guidelines for completing the Form 944. These guidelines cover various aspects, including eligibility requirements for filing the form, how to report different types of wages, and the proper method for submitting the form. Employers should consult these guidelines to ensure compliance and to understand any updates or changes that may affect their filings.

Required Documents

To complete the Form 944, employers need several key documents:

- Employee wage records for the tax year.

- Records of federal income tax withheld from employee wages.

- Documentation of any tax credits claimed.

- Previous year’s tax filings for reference.

Having these documents readily available will facilitate a smoother filing process and help ensure accuracy in reporting.

Quick guide on how to complete 2019 instructions for form 944 internal revenue service

Complete Form 944 Instructions effortlessly on any device

Web-based document management has become popular among businesses and individuals alike. It offers a perfect environmentally friendly alternative to traditional printed and signed materials, allowing you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your documents swiftly without interruptions. Manage Form 944 Instructions on any device with airSlate SignNow's Android or iOS applications and enhance any document-related operation today.

The easiest way to modify and eSign Form 944 Instructions without hassle

- Locate Form 944 Instructions and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Highlight pertinent sections of your documents or redact sensitive details with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and has the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from the device of your choice. Modify and eSign Form 944 Instructions and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 944 internal revenue service

How to generate an electronic signature for your 2019 Instructions For Form 944 Internal Revenue Service in the online mode

How to create an eSignature for your 2019 Instructions For Form 944 Internal Revenue Service in Chrome

How to generate an eSignature for putting it on the 2019 Instructions For Form 944 Internal Revenue Service in Gmail

How to make an eSignature for the 2019 Instructions For Form 944 Internal Revenue Service right from your smartphone

How to generate an eSignature for the 2019 Instructions For Form 944 Internal Revenue Service on iOS

How to generate an eSignature for the 2019 Instructions For Form 944 Internal Revenue Service on Android OS

People also ask

-

What is form 944 2019 and who needs it?

Form 944 2019 is an annual payroll tax return that smaller employers use to report their Federal Insurance Contributions Act (FICA) taxes to the IRS. Businesses that have an annual payroll tax liability of $1,000 or less are required to file this form. Understanding form 944 2019 is essential for compliance and avoiding potential penalties.

-

How can I complete form 944 2019 using airSlate SignNow?

AirSlate SignNow provides an intuitive platform where you can easily input your information to complete form 944 2019. Users can upload their data, sign, and send the document seamlessly. This eliminates the hassle of paperwork and helps ensure on-time filing.

-

Is there a cost associated with using airSlate SignNow for form 944 2019?

Yes, airSlate SignNow offers various pricing plans to suit different business needs. Depending on the plan selected, features available for managing your form 944 2019 will vary. However, the solution remains cost-effective compared to traditional methods of document handling.

-

What features does airSlate SignNow offer for managing form 944 2019?

AirSlate SignNow includes features such as eSigning, document tracking, and cloud storage, which simplify the management of form 944 2019. Users can also customize templates for easy future use. These features enhance efficiency and ensure compliance with filing requirements.

-

Can I integrate airSlate SignNow with other software for form 944 2019?

Yes, airSlate SignNow offers integration with numerous business applications, allowing users to connect their workflow for form 944 2019 efficiently. Popular integrations include Google Drive, Dropbox, and various CRM systems. This interoperability enhances productivity and ensures a streamlined process.

-

What are the benefits of using airSlate SignNow for form 944 2019?

Using airSlate SignNow for form 944 2019 streamlines the document signing and submission process, saving time and reducing errors. The platform’s user-friendly interface makes it accessible for all users, regardless of their technical expertise. Additionally, enhanced security features help protect sensitive information.

-

Is airSlate SignNow secure for filing form 944 2019?

Absolutely, airSlate SignNow prioritizes security and compliance, ensuring that your form 944 2019 is handled with the utmost care. The platform utilizes encryption and complies with industry standards to protect your information. Users can file their forms with peace of mind knowing their data is secure.

Get more for Form 944 Instructions

- From reservoirs to remediation the impact of cercla on progressivereform

- Chapter 5 a guide to determination audit cap overview form

- A restatement third of intentional form

- Report to the board of directors of the federal home loan mortgage corporation internal investigation of certain accounting form

- Are short sellers informed new evidence from short sales on

- Walmart angel treethe salvation army usa form

- Imm 1344 e form

- Novation contract template form

Find out other Form 944 Instructions

- How Can I Electronic signature Wyoming Life Sciences Word

- How To Electronic signature Utah Legal PDF

- How Do I Electronic signature Arkansas Real Estate Word

- How Do I Electronic signature Colorado Real Estate Document

- Help Me With Electronic signature Wisconsin Legal Presentation

- Can I Electronic signature Hawaii Real Estate PPT

- How Can I Electronic signature Illinois Real Estate Document

- How Do I Electronic signature Indiana Real Estate Presentation

- How Can I Electronic signature Ohio Plumbing PPT

- Can I Electronic signature Texas Plumbing Document

- How To Electronic signature Michigan Real Estate Form

- How To Electronic signature Arizona Police PDF

- Help Me With Electronic signature New Hampshire Real Estate PDF

- Can I Electronic signature New Hampshire Real Estate Form

- Can I Electronic signature New Mexico Real Estate Form

- How Can I Electronic signature Ohio Real Estate Document

- How To Electronic signature Hawaii Sports Presentation

- How To Electronic signature Massachusetts Police Form

- Can I Electronic signature South Carolina Real Estate Document

- Help Me With Electronic signature Montana Police Word