Schedule E Form

What is the Schedule E

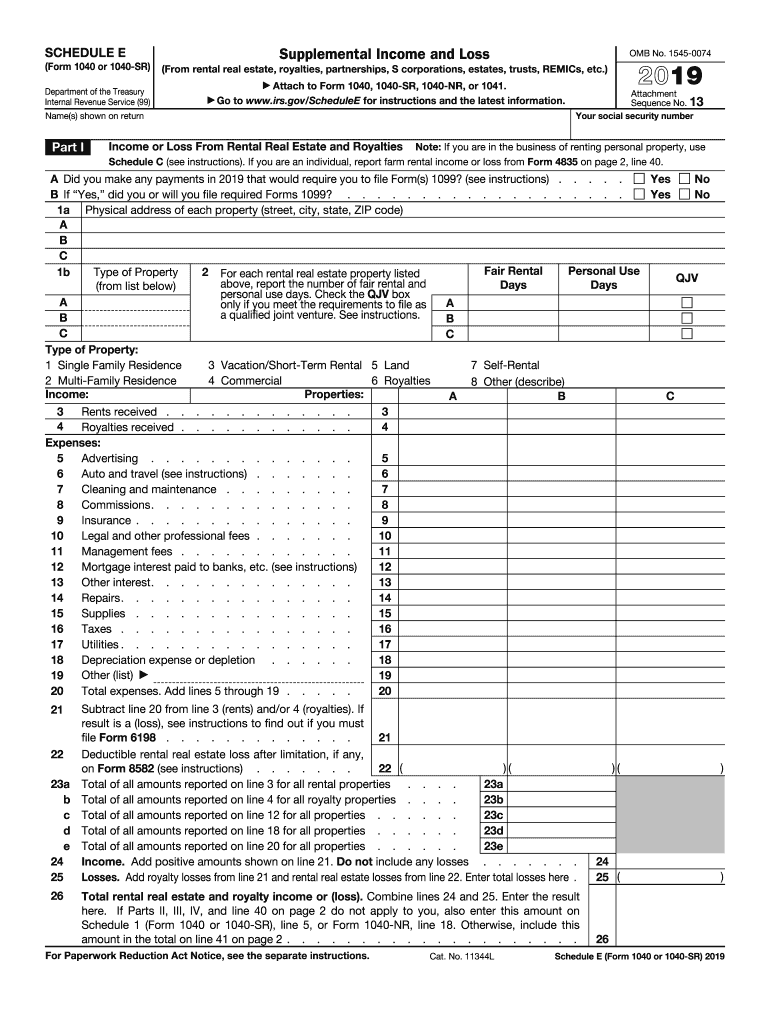

The Schedule E is a tax form used by individuals to report income or loss from rental real estate, partnerships, S corporations, estates, trusts, and other sources. This form is an attachment to the Form 1040, which is the standard individual income tax return in the United States. The Schedule E allows taxpayers to detail their income from various sources, ensuring that all earnings are accurately reported to the Internal Revenue Service (IRS).

It is essential for individuals who own rental properties or have income from pass-through entities to complete this form correctly. The information provided on the Schedule E helps determine the taxpayer's overall tax liability and can affect their eligibility for certain deductions and credits.

How to use the Schedule E

Using the Schedule E involves several steps to ensure that all relevant income and expenses are reported accurately. Taxpayers should start by gathering all necessary documentation related to their rental properties or other income sources. This includes records of rental income received, expenses incurred, and any depreciation claimed on properties.

Once the information is collected, taxpayers can fill out the Schedule E by entering income on the appropriate lines. They should also list any deductible expenses, such as mortgage interest, property taxes, and repairs. After completing the form, it should be attached to the Form 1040 when filing taxes.

Steps to complete the Schedule E

Completing the Schedule E involves a systematic approach to ensure accuracy. Here are the key steps:

- Gather all necessary documentation related to rental income and expenses.

- Fill out Part I for income or loss from rental real estate, detailing each property separately.

- Complete Part II for income or loss from partnerships and S corporations, listing each entity.

- Enter any applicable deductions in the appropriate sections, including depreciation and expenses.

- Review the completed form for accuracy and ensure all figures are correctly calculated.

- Attach the Schedule E to the Form 1040 and submit it to the IRS.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule E to ensure compliance with tax laws. Taxpayers should refer to the IRS instructions for the Schedule E, which detail how to report various types of income and expenses. These guidelines also outline eligibility criteria for deductions and any special considerations for different types of income sources.

It is important to follow these guidelines closely to avoid errors that could lead to penalties or audits. Taxpayers should keep records of all income and expenses for at least three years in case of an IRS inquiry.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule E coincide with the standard tax return deadlines. Typically, individual taxpayers must file their Form 1040 and attached Schedule E by April 15 of the following tax year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day.

Taxpayers can request an extension to file their taxes, which typically extends the deadline by six months. However, it is important to note that an extension to file is not an extension to pay any taxes owed. Payments must still be made by the original deadline to avoid penalties and interest.

Key elements of the Schedule E

The Schedule E includes several key elements that taxpayers must understand to complete the form accurately. These elements include:

- Part I: Used for reporting income or loss from rental real estate.

- Part II: Used for reporting income or loss from partnerships and S corporations.

- Income Reporting: Taxpayers must report all rental income received, including advance rent and any payments for services.

- Expense Deductions: Common deductible expenses include mortgage interest, property taxes, repairs, and management fees.

- Depreciation: Taxpayers can claim depreciation on rental properties, which reduces taxable income.

Quick guide on how to complete 2019 schedule e form 1040 or 1040 sr internal revenue

Effortlessly Prepare Schedule E on Any Device

Digital document management has gained traction among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed paperwork, enabling you to access the necessary forms and securely store them online. airSlate SignNow equips you with all the resources required to create, modify, and electronically sign your documents swiftly and without hindrance. Manage Schedule E on any platform using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

How to Alter and Electronically Sign Schedule E with Ease

- Find Schedule E and then click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools specifically designed by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes mere seconds and carries the same legal significance as a conventional wet ink signature.

- Review the information and then click on the Done button to save your modifications.

- Select your preferred delivery method for your form: via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, cumbersome form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets all your document management requirements in just a few clicks from your chosen device. Modify and electronically sign Schedule E to ensure excellent communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule e form 1040 or 1040 sr internal revenue

How to make an electronic signature for the 2019 Schedule E Form 1040 Or 1040 Sr Internal Revenue in the online mode

How to generate an eSignature for your 2019 Schedule E Form 1040 Or 1040 Sr Internal Revenue in Google Chrome

How to generate an electronic signature for putting it on the 2019 Schedule E Form 1040 Or 1040 Sr Internal Revenue in Gmail

How to create an eSignature for the 2019 Schedule E Form 1040 Or 1040 Sr Internal Revenue right from your mobile device

How to make an eSignature for the 2019 Schedule E Form 1040 Or 1040 Sr Internal Revenue on iOS devices

How to create an electronic signature for the 2019 Schedule E Form 1040 Or 1040 Sr Internal Revenue on Android devices

People also ask

-

What is the 2019 schedule e and how can it benefit my business?

The 2019 schedule e is a specific tax form businesses use to report income from various passive activities. By efficiently managing your 2019 schedule e with airSlate SignNow, you can easily send and eSign documents, streamlining the filing process and ensuring compliance.

-

How much does airSlate SignNow cost for managing the 2019 schedule e?

airSlate SignNow offers competitive pricing plans that cater to businesses of all sizes. Depending on your needs for handling documents like the 2019 schedule e, you can choose a plan that provides the right balance of features and cost-effectiveness.

-

Can I integrate airSlate SignNow with other accounting software to assist with my 2019 schedule e?

Yes, airSlate SignNow can seamlessly integrate with a variety of accounting software tools. This integration helps users manage documents related to their 2019 schedule e efficiently, ensuring all forms are accessible and easy to eSign.

-

What security measures does airSlate SignNow implement for my 2019 schedule e documents?

airSlate SignNow prioritizes your document security by employing advanced encryption protocols and secure data storage. When handling sensitive documents like your 2019 schedule e, rest assured that your information is protected from unauthorized access.

-

Are there any features specifically designed for handling the 2019 schedule e in airSlate SignNow?

Yes, airSlate SignNow includes user-friendly features that facilitate document creation, sharing, and eSigning, specifically for tax forms like the 2019 schedule e. These features help ensure that you can manage and complete your forms quickly and accurately.

-

How does airSlate SignNow simplify the eSigning process for the 2019 schedule e?

airSlate SignNow simplifies the eSigning process by allowing users to electronically sign their 2019 schedule e documents from any device. This convenience enables faster turnaround times and ensures that your forms are submitted promptly.

-

Can I track the progress of my 2019 schedule e documents with airSlate SignNow?

Yes, airSlate SignNow includes tracking features that allow you to monitor the progress of your 2019 schedule e documents. You can receive notifications when a document is viewed or signed, keeping you informed throughout the eSigning process.

Get more for Schedule E

- Physical aspects of quality form

- Form of no objection certificate

- Form tm22 notice to surrender a registration

- Sis 10w revised form

- Non emergency medical transportation contract template form

- Non executive director contract template form

- Non liability contract template form

- Non profit board of directors contract template form

Find out other Schedule E

- How Do I Sign Colorado Medical Power of Attorney Template

- How To Sign Louisiana Medical Power of Attorney Template

- How Do I Sign Louisiana Medical Power of Attorney Template

- Can I Sign Florida Memorandum of Agreement Template

- How Do I Sign Hawaii Memorandum of Agreement Template

- Sign Kentucky Accident Medical Claim Form Fast

- Sign Texas Memorandum of Agreement Template Computer

- How Do I Sign Utah Deed of Trust Template

- Sign Minnesota Declaration of Trust Template Simple

- Sign Texas Shareholder Agreement Template Now

- Sign Wisconsin Shareholder Agreement Template Simple

- Sign Nebraska Strategic Alliance Agreement Easy

- Sign Nevada Strategic Alliance Agreement Online

- How To Sign Alabama Home Repair Contract

- Sign Delaware Equipment Rental Agreement Template Fast

- Sign Nevada Home Repair Contract Easy

- Sign Oregon Construction Contract Template Online

- Sign Wisconsin Construction Contract Template Simple

- Sign Arkansas Business Insurance Quotation Form Now

- Sign Arkansas Car Insurance Quotation Form Online