1040x Instructions Form

What is the 1040x Instructions

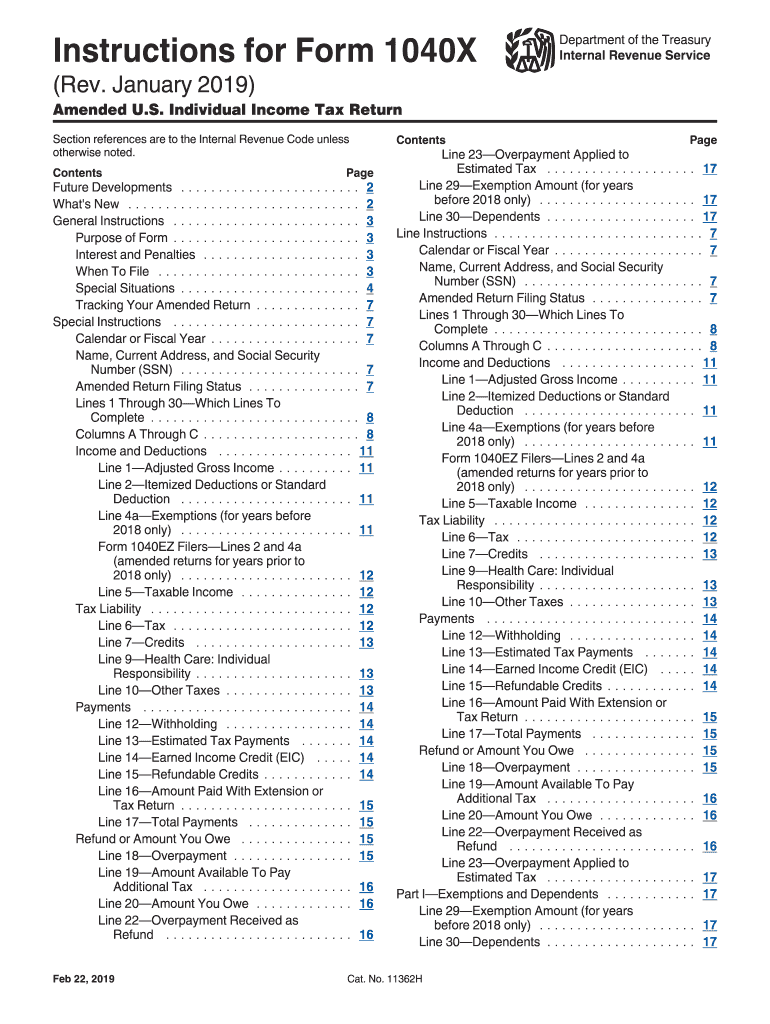

The 1040x Instructions provide essential guidelines for taxpayers who need to amend their federal income tax return. This form is specifically designed for individuals who have already filed a 1040, 1040A, or 1040EZ and need to correct errors or make changes to their reported income, deductions, or credits. Understanding these instructions is crucial for ensuring that any amendments are processed correctly and efficiently.

How to use the 1040x Instructions

To effectively use the 1040x Instructions, taxpayers should first obtain the form from the IRS website or other reliable sources. Once the form is in hand, carefully read through the instructions to identify the specific sections that apply to your situation. It is important to follow the step-by-step guidance provided, including how to fill out each line accurately. This ensures that all necessary information is included, which can help avoid delays in processing your amendment.

Steps to complete the 1040x Instructions

Completing the 1040x Instructions involves several key steps:

- Gather all relevant documents, including your original tax return and any supporting documents for the changes.

- Fill out the 1040x form, ensuring that you indicate the correct tax year being amended.

- Clearly explain the reason for each change in the designated section of the form.

- Review the completed form for accuracy before submission.

- Submit the form according to the provided guidelines, either by mail or electronically if applicable.

Legal use of the 1040x Instructions

The legal use of the 1040x Instructions is governed by IRS regulations, which stipulate that taxpayers must file an amended return to correct errors on their original tax filings. Compliance with these instructions is essential to avoid potential penalties or legal issues. It is advisable to keep a copy of the amended return and any correspondence with the IRS for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the 1040x Instructions are critical to ensure compliance with IRS regulations. Generally, taxpayers have up to three years from the original filing deadline to submit an amendment. However, if the amendment results in a refund, it is advisable to file as soon as possible to avoid missing the deadline. Keeping track of these dates can help prevent complications and ensure timely processing.

Required Documents

When completing the 1040x Instructions, certain documents are required to support your amendments. These may include:

- Your original tax return.

- Any W-2 forms or 1099s related to the income being amended.

- Documentation for any deductions or credits being claimed.

- Any correspondence with the IRS regarding your original return.

Quick guide on how to complete images for is it realinstructions for form 1040xdepartment of the treasury internal revenue servicerev january 2019amended us

Complete 1040x Instructions effortlessly on any gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the right form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and eSign your documents swiftly without delays. Manage 1040x Instructions on any gadget using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to alter and eSign 1040x Instructions with ease

- Locate 1040x Instructions and click on Get Form to begin.

- Utilize the tools at your disposal to complete your document.

- Highlight important sections of your documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the information and click on the Done button to preserve your changes.

- Select your preferred method to send your form, whether by email, SMS, or link invitation, or download it to your computer.

No more worrying about lost or misplaced files, cumbersome form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from your chosen device. Edit and eSign 1040x Instructions and ensure exceptional communication throughout your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the images for is it realinstructions for form 1040xdepartment of the treasury internal revenue servicerev january 2019amended us

How to create an electronic signature for the Images For Is It Realinstructions For Form 1040xdepartment Of The Treasury Internal Revenue Servicerev January 2019amended Us in the online mode

How to make an electronic signature for your Images For Is It Realinstructions For Form 1040xdepartment Of The Treasury Internal Revenue Servicerev January 2019amended Us in Chrome

How to make an eSignature for signing the Images For Is It Realinstructions For Form 1040xdepartment Of The Treasury Internal Revenue Servicerev January 2019amended Us in Gmail

How to generate an electronic signature for the Images For Is It Realinstructions For Form 1040xdepartment Of The Treasury Internal Revenue Servicerev January 2019amended Us from your mobile device

How to make an eSignature for the Images For Is It Realinstructions For Form 1040xdepartment Of The Treasury Internal Revenue Servicerev January 2019amended Us on iOS devices

How to make an eSignature for the Images For Is It Realinstructions For Form 1040xdepartment Of The Treasury Internal Revenue Servicerev January 2019amended Us on Android OS

People also ask

-

What is the Dr. Nowzaradan diet plan PDF?

The Dr. Nowzaradan diet plan PDF is a structured eating guide designed by Dr. Younan Nowzaradan, aimed at assisting individuals, particularly those undergoing weight loss surgery. This plan outlines the necessary dietary adjustments needed to achieve optimal health and weight management. By following the guidelines in the Dr. Nowzaradan diet plan PDF, users can expect to see signNow improvements in their overall well-being.

-

How can I get the Dr. Nowzaradan diet plan PDF?

You can obtain the Dr. Nowzaradan diet plan PDF by visiting our website and purchasing it directly. Once you complete the payment process, you will receive a download link via email. This makes accessing the Dr. Nowzaradan diet plan PDF easy and convenient.

-

What are the benefits of following the Dr. Nowzaradan diet plan PDF?

Following the Dr. Nowzaradan diet plan PDF can lead to effective weight loss, improved health markers, and a better understanding of nutrition. This plan is specifically designed to help you make sustainable changes to your diet, making it easier to maintain your weight loss goals. By adhering to the guidelines, you'll also gain insights into portion control and healthy food choices.

-

Is the Dr. Nowzaradan diet plan PDF suitable for everyone?

While the Dr. Nowzaradan diet plan PDF is primarily tailored for individuals preparing for weight loss surgery, it can also benefit anyone looking to improve their diet. However, it is crucial to consult with a healthcare professional before starting any new diet plan. This ensures the plan aligns well with your individual health needs.

-

Are there any additional resources included with the Dr. Nowzaradan diet plan PDF?

Yes, along with the Dr. Nowzaradan diet plan PDF, you may also receive additional resources such as meal prep guides and tips for maintaining motivation. These extras are designed to complement the diet plan and aid in your weight loss journey. Utilizing all resources can enhance your experience and results.

-

How much does the Dr. Nowzaradan diet plan PDF cost?

The price of the Dr. Nowzaradan diet plan PDF is listed on our website, making it affordable and accessible for everyone interested in health and weight loss. We offer various payment methods to ensure a seamless transaction. Investing in this plan can lead to substantial long-term health benefits.

-

Can I track my progress while following the Dr. Nowzaradan diet plan PDF?

Absolutely! The Dr. Nowzaradan diet plan PDF encourages users to track their progress for optimal results. You can maintain a food diary, monitor your weight, and assess your health improvements over time. Keeping track of your journey can boost motivation and help identify what's working best for you.

Get more for 1040x Instructions

Find out other 1040x Instructions

- Sign Indiana Finance & Tax Accounting Confidentiality Agreement Later

- Sign Iowa Finance & Tax Accounting Last Will And Testament Mobile

- Sign Maine Finance & Tax Accounting Living Will Computer

- Sign Montana Finance & Tax Accounting LLC Operating Agreement Computer

- How Can I Sign Montana Finance & Tax Accounting Residential Lease Agreement

- Sign Montana Finance & Tax Accounting Residential Lease Agreement Safe

- How To Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Help Me With Sign Nebraska Finance & Tax Accounting Letter Of Intent

- Sign Nebraska Finance & Tax Accounting Business Letter Template Online

- Sign Rhode Island Finance & Tax Accounting Cease And Desist Letter Computer

- Sign Vermont Finance & Tax Accounting RFP Later

- Can I Sign Wyoming Finance & Tax Accounting Cease And Desist Letter

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA