Income Driven Repayment Plan Request 2024-2026

Understanding the Income Driven Repayment Plan Request

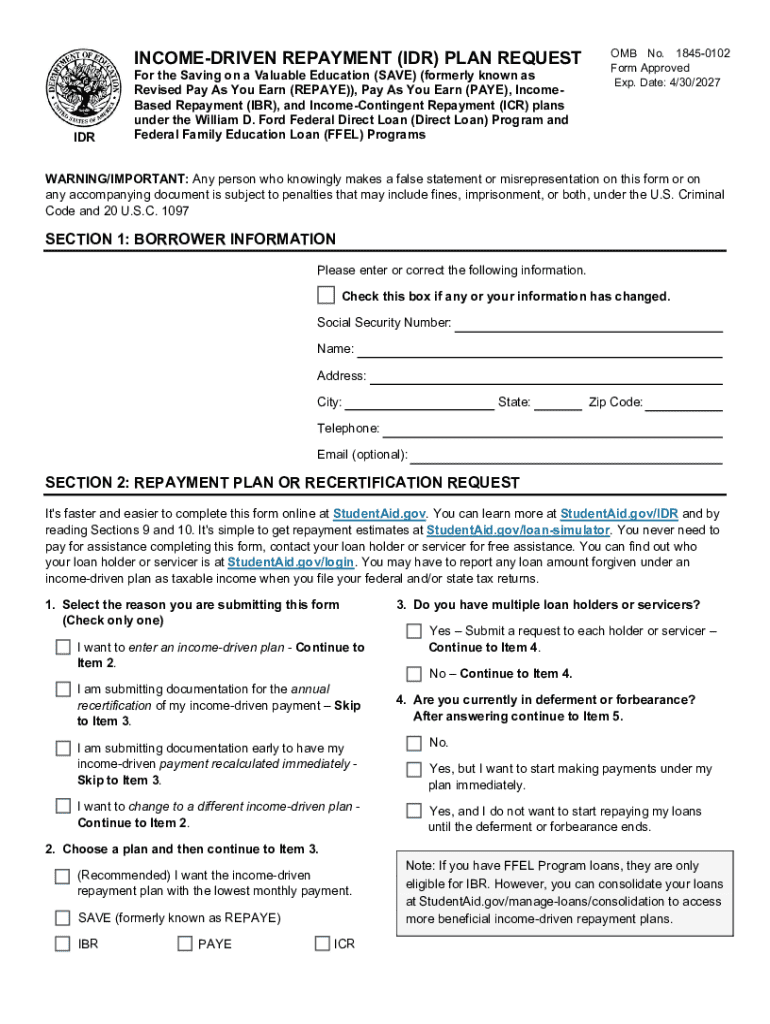

The Income Driven Repayment Plan Request is a crucial document for borrowers looking to manage their federal student loan payments based on their income. This plan allows individuals to adjust their monthly payments according to their financial situation, making it easier to stay on track with repayments. It is particularly beneficial for those experiencing financial hardship or those with lower incomes, as it ensures that payments remain affordable.

Steps to Complete the Income Driven Repayment Plan Request

Completing the Income Driven Repayment Plan Request involves several essential steps:

- Gather necessary financial documents, including your most recent tax return and proof of income.

- Fill out the Income Driven Repayment Plan Request form accurately, ensuring all information is current and complete.

- Submit the form through your loan servicer’s online portal, by mail, or in person, depending on your preference.

- Follow up with your loan servicer to confirm receipt and check the status of your application.

Eligibility Criteria for the Income Driven Repayment Plan

To qualify for the Income Driven Repayment Plan, borrowers must meet specific eligibility criteria. These include:

- Having federal student loans, as this plan does not apply to private loans.

- Demonstrating financial need, which is typically assessed through income documentation.

- Being in good standing with your loans, meaning no defaults or delinquencies.

Required Documents for the Income Driven Repayment Plan Request

When submitting the Income Driven Repayment Plan Request, it is essential to include the following documents:

- Your most recent federal tax return, which provides a comprehensive overview of your income.

- Pay stubs or other proof of income if you are not required to file taxes.

- Any additional documentation that supports your financial situation, such as unemployment benefits or Social Security statements.

Form Submission Methods

There are several methods available for submitting the Income Driven Repayment Plan Request:

- Online: Many loan servicers offer an online portal where you can complete and submit the form electronically.

- By Mail: You can print the completed form and send it via postal mail to your loan servicer.

- In-Person: Some borrowers may prefer to submit their request in person at their loan servicer's office.

Key Elements of the Income Driven Repayment Plan Request

The Income Driven Repayment Plan Request includes several key elements that borrowers should be aware of:

- Your personal information, including name, address, and Social Security number.

- Details about your federal student loans, including loan amounts and servicer information.

- Your income information, which will determine your monthly payment amount.

Quick guide on how to complete income driven repayment plan request

Accomplish Income Driven Repayment Plan Request effortlessly on any gadget

Digital document management has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for traditional printed and signed documents, allowing you to access the correct form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, revise, and electronically sign your documents quickly and without delays. Handle Income Driven Repayment Plan Request on any device with airSlate SignNow's Android or iOS applications and simplify any document-related task today.

How to modify and electronically sign Income Driven Repayment Plan Request with ease

- Locate Income Driven Repayment Plan Request and click on Get Form to initiate the process.

- Utilize the tools we provide to complete your document.

- Highlight pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds equivalent legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your modifications.

- Choose your preferred method to send your form—via email, SMS, or invite link—or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow addresses your document management needs in just a few clicks from any device you prefer. Alter and electronically sign Income Driven Repayment Plan Request to ensure outstanding communication throughout your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct income driven repayment plan request

Create this form in 5 minutes!

How to create an eSignature for the income driven repayment plan request

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is a repayment plan in the context of airSlate SignNow?

A repayment plan in the context of airSlate SignNow refers to the structured payment options available for businesses using our eSignature solutions. This allows companies to manage their expenses effectively while benefiting from our easy-to-use platform. By choosing a repayment plan, businesses can ensure they have access to essential features without a signNow upfront investment.

-

How does the pricing structure work for the repayment plan?

The pricing structure for the repayment plan at airSlate SignNow is designed to be flexible and affordable. Customers can select from various tiers based on their needs, allowing them to spread the cost over time. This approach ensures that businesses can utilize our services without financial strain, making it easier to integrate eSigning into their operations.

-

What features are included in the repayment plan?

The repayment plan includes a comprehensive suite of features such as unlimited eSignatures, document templates, and advanced security options. Users can also access integrations with popular applications, enhancing their workflow efficiency. This ensures that businesses have all the necessary tools to streamline their document signing processes.

-

What are the benefits of choosing a repayment plan with airSlate SignNow?

Choosing a repayment plan with airSlate SignNow offers several benefits, including budget-friendly payment options and access to premium features. This allows businesses to scale their eSignature needs without the burden of large upfront costs. Additionally, our platform's user-friendly interface ensures a smooth transition to digital document management.

-

Can I customize my repayment plan based on my business needs?

Yes, airSlate SignNow allows businesses to customize their repayment plan according to specific needs and usage. This flexibility ensures that you only pay for the features and services that are most relevant to your operations. Our team is available to help tailor a repayment plan that aligns with your business goals.

-

Are there any hidden fees associated with the repayment plan?

No, airSlate SignNow is committed to transparency, and there are no hidden fees associated with our repayment plan. All costs are clearly outlined during the signup process, ensuring that businesses can budget effectively. This commitment to clarity helps build trust and confidence in our services.

-

How can I integrate airSlate SignNow with other tools while on a repayment plan?

Integrating airSlate SignNow with other tools is seamless, even when using a repayment plan. Our platform supports various integrations with popular applications like CRM systems and project management tools. This capability enhances your workflow and ensures that document signing fits smoothly into your existing processes.

Get more for Income Driven Repayment Plan Request

- Identity theft by known imposter package new york form

- Ny personal form

- New york documents 497321867 form

- Essential documents for the organized traveler package with personal organizer new york form

- Postnuptial agreements package new york form

- Letters of recommendation package new york form

- New york mechanics form

- Ny lien form

Find out other Income Driven Repayment Plan Request

- How Can I Sign Idaho Charity Presentation

- How Do I Sign Nebraska Charity Form

- Help Me With Sign Nevada Charity PDF

- How To Sign North Carolina Charity PPT

- Help Me With Sign Ohio Charity Document

- How To Sign Alabama Construction PDF

- How To Sign Connecticut Construction Document

- How To Sign Iowa Construction Presentation

- How To Sign Arkansas Doctors Document

- How Do I Sign Florida Doctors Word

- Can I Sign Florida Doctors Word

- How Can I Sign Illinois Doctors PPT

- How To Sign Texas Doctors PDF

- Help Me With Sign Arizona Education PDF

- How To Sign Georgia Education Form

- How To Sign Iowa Education PDF

- Help Me With Sign Michigan Education Document

- How Can I Sign Michigan Education Document

- How Do I Sign South Carolina Education Form

- Can I Sign South Carolina Education Presentation