Form 8949 Instructions

What is the Form 8949 Instructions

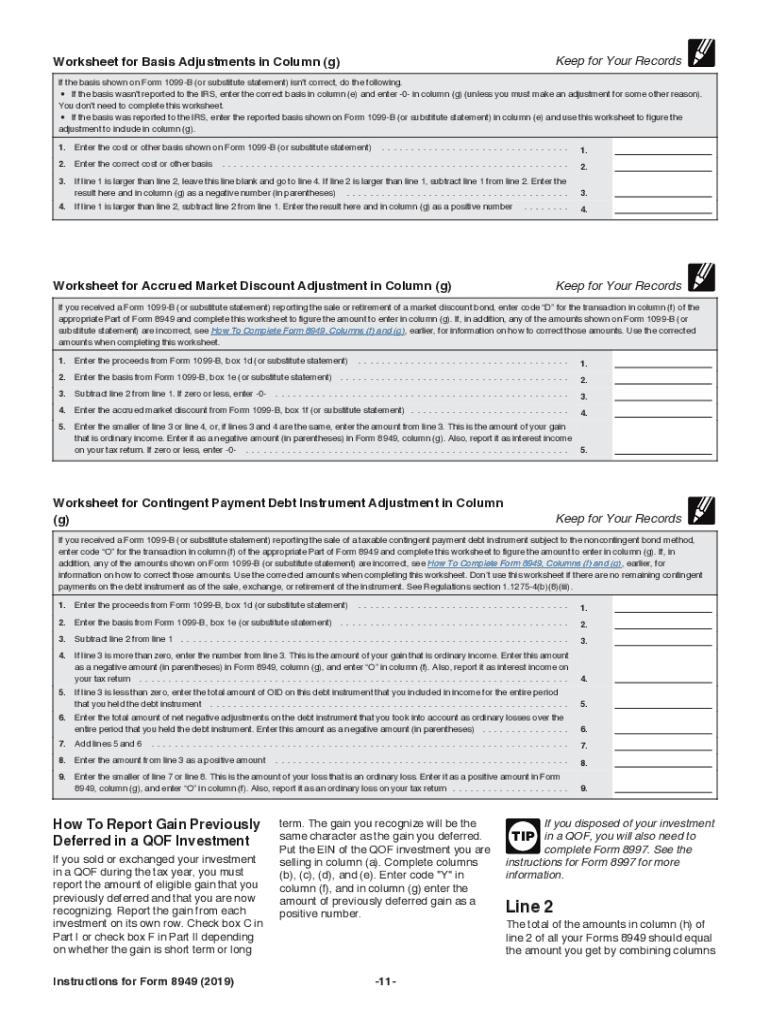

The Form 8949 instructions provide detailed guidance on how to report capital gains and losses from the sale of assets. This form is essential for taxpayers who need to report transactions involving stocks, bonds, and other capital assets. Understanding the instructions ensures that individuals accurately complete the form, which is crucial for compliance with IRS regulations. The instructions outline the necessary steps to fill out the form correctly, including how to categorize transactions and calculate gains or losses.

Steps to Complete the Form 8949 Instructions

Completing the Form 8949 involves several key steps that ensure accuracy and compliance. First, gather all necessary documentation related to your capital asset transactions, such as purchase and sale records. Next, categorize each transaction as either short-term or long-term based on the holding period. Then, enter the details of each transaction, including the date acquired, date sold, proceeds, and cost basis. Finally, calculate the total gain or loss for each category and transfer the totals to your tax return. Following these steps carefully will help you avoid errors and potential penalties.

Legal Use of the Form 8949 Instructions

The legal use of the Form 8949 instructions is vital for ensuring that taxpayers comply with federal tax laws. The IRS requires accurate reporting of capital gains and losses, and the instructions provide the framework for doing so. By adhering to these guidelines, taxpayers can avoid issues such as audits or penalties for non-compliance. Additionally, electronic filing options are available, which can streamline the submission process while maintaining compliance with IRS regulations.

Examples of Using the Form 8949 Instructions

Examples of using the Form 8949 instructions can clarify how to report different types of transactions. For instance, if a taxpayer sells stocks purchased at different prices, they must report each sale separately, indicating the specific purchase price and sale price for accurate gain or loss calculations. Another example includes reporting transactions involving cryptocurrency, where the same principles apply. These examples illustrate the practical application of the instructions, helping taxpayers navigate complex scenarios effectively.

Filing Deadlines / Important Dates

Filing deadlines for Form 8949 are crucial for taxpayers to keep in mind. Generally, the form must be submitted by the tax filing deadline, which is typically April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Taxpayers should also be aware of any changes in deadlines due to special circumstances, such as federal extensions or specific disaster relief provisions.

Required Documents

To accurately complete the Form 8949, several documents are required. Taxpayers should gather transaction records, including brokerage statements, purchase receipts, and sale confirmations. These documents provide the necessary details for reporting gains or losses accurately. Additionally, any relevant tax documents from previous years may be helpful, especially if they relate to carryover losses or gains.

Form Submission Methods (Online / Mail / In-Person)

Form 8949 can be submitted using various methods, including online, by mail, or in person. Online submission is often the most efficient option, allowing for electronic filing through tax software or the IRS e-file system. Taxpayers may also choose to print the completed form and mail it to the appropriate IRS address. In-person submission is less common but can be done at designated IRS offices. Each method has its own set of guidelines and timelines that taxpayers should follow to ensure proper processing.

Quick guide on how to complete f8949 example form 8949 department of the treasury internal

Effortlessly Prepare Form 8949 Instructions on Any Device

Digital document management has gained popularity among businesses and individuals. It offers an excellent eco-friendly alternative to traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents quickly and efficiently. Manage Form 8949 Instructions on any device using airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Modify and Electronically Sign Form 8949 Instructions with Ease

- Find Form 8949 Instructions and click Get Form to begin.

- Make use of the tools we provide to complete your document.

- Emphasize important sections of your documents or redact sensitive information using tools specifically designed for that purpose by airSlate SignNow.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review all the details and then click on the Done button to finalize your changes.

- Select your preferred method for sharing your form, whether by email, SMS, invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that require printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device of your choice. Modify and electronically sign Form 8949 Instructions to ensure effective communication at every step of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the f8949 example form 8949 department of the treasury internal

How to make an eSignature for your F8949 Example Form 8949 Department Of The Treasury Internal online

How to create an eSignature for the F8949 Example Form 8949 Department Of The Treasury Internal in Google Chrome

How to make an electronic signature for putting it on the F8949 Example Form 8949 Department Of The Treasury Internal in Gmail

How to make an electronic signature for the F8949 Example Form 8949 Department Of The Treasury Internal right from your mobile device

How to create an eSignature for the F8949 Example Form 8949 Department Of The Treasury Internal on iOS devices

How to make an electronic signature for the F8949 Example Form 8949 Department Of The Treasury Internal on Android

People also ask

-

What is the f8949 and how does it relate to airSlate SignNow?

The f8949 is a tax form used by individuals to report capital gains and losses in the United States. AirSlate SignNow offers a streamlined solution for electronically signing and managing the f8949 form, making it easier to complete and submit. With airSlate SignNow, users can ensure their f8949 forms are signed quickly and securely.

-

How does airSlate SignNow simplify the process of sending f8949 forms?

AirSlate SignNow simplifies the process by allowing users to upload their f8949 forms and send them for electronic signatures with just a few clicks. This means no more printing or scanning documents, saving time and ensuring a seamless experience. The platform’s user-friendly interface enhances efficiency for managing the f8949 and other important documents.

-

What are the pricing options for using airSlate SignNow to manage f8949 forms?

AirSlate SignNow offers various pricing plans that cater to different business needs, including a free trial for first-time users to explore the platform. Pricing tiers are designed to provide flexibility, allowing users to find a plan that best fits their budget while efficiently managing their f8949 forms. You can visit the airSlate SignNow website for detailed pricing information.

-

Can I integrate airSlate SignNow with other tools to handle f8949 forms?

Yes, airSlate SignNow offers seamless integrations with various tools and software, allowing users to manage their f8949 forms alongside their existing workflows. Integrating with CRM systems, cloud storage, and other applications maximizes efficiency and eliminates unnecessary steps. This makes handling the f8949 and other documents much more streamlined.

-

What benefits does airSlate SignNow provide for handling sensitive information on the f8949?

AirSlate SignNow prioritizes security with advanced encryption and authentication measures to protect sensitive information, such as that found on the f8949 form. Users can trust that their data is safe during the signing process. This level of security is crucial, especially when dealing with financial documents like the f8949.

-

Is it easy to track the status of my f8949 forms with airSlate SignNow?

Yes, airSlate SignNow provides real-time tracking for all documents sent for eSignature, including your f8949 forms. Users can easily monitor who has signed and who needs to sign, streamlining communication and ensuring no critical steps are missed. This feature helps maintain transparency throughout the signing process.

-

Does airSlate SignNow offer templates for the f8949?

AirSlate SignNow offers customizable templates that can be used for various documents, including the f8949 form. Users can quickly create, modify, and save templates, enhancing efficiency during tax season. This feature simplifies recurring tasks associated with the f8949, making it easy to replicate formats for future use.

Get more for Form 8949 Instructions

Find out other Form 8949 Instructions

- Sign California Government Job Offer Now

- How Do I Sign Colorado Government Cease And Desist Letter

- How To Sign Connecticut Government LLC Operating Agreement

- How Can I Sign Delaware Government Residential Lease Agreement

- Sign Florida Government Cease And Desist Letter Online

- Sign Georgia Government Separation Agreement Simple

- Sign Kansas Government LLC Operating Agreement Secure

- How Can I Sign Indiana Government POA

- Sign Maryland Government Quitclaim Deed Safe

- Sign Louisiana Government Warranty Deed Easy

- Sign Government Presentation Massachusetts Secure

- How Can I Sign Louisiana Government Quitclaim Deed

- Help Me With Sign Michigan Government LLC Operating Agreement

- How Do I Sign Minnesota Government Quitclaim Deed

- Sign Minnesota Government Affidavit Of Heirship Simple

- Sign Missouri Government Promissory Note Template Fast

- Can I Sign Missouri Government Promissory Note Template

- Sign Nevada Government Promissory Note Template Simple

- How To Sign New Mexico Government Warranty Deed

- Help Me With Sign North Dakota Government Quitclaim Deed