Schedule Eic Form

What is the Schedule EIC Form

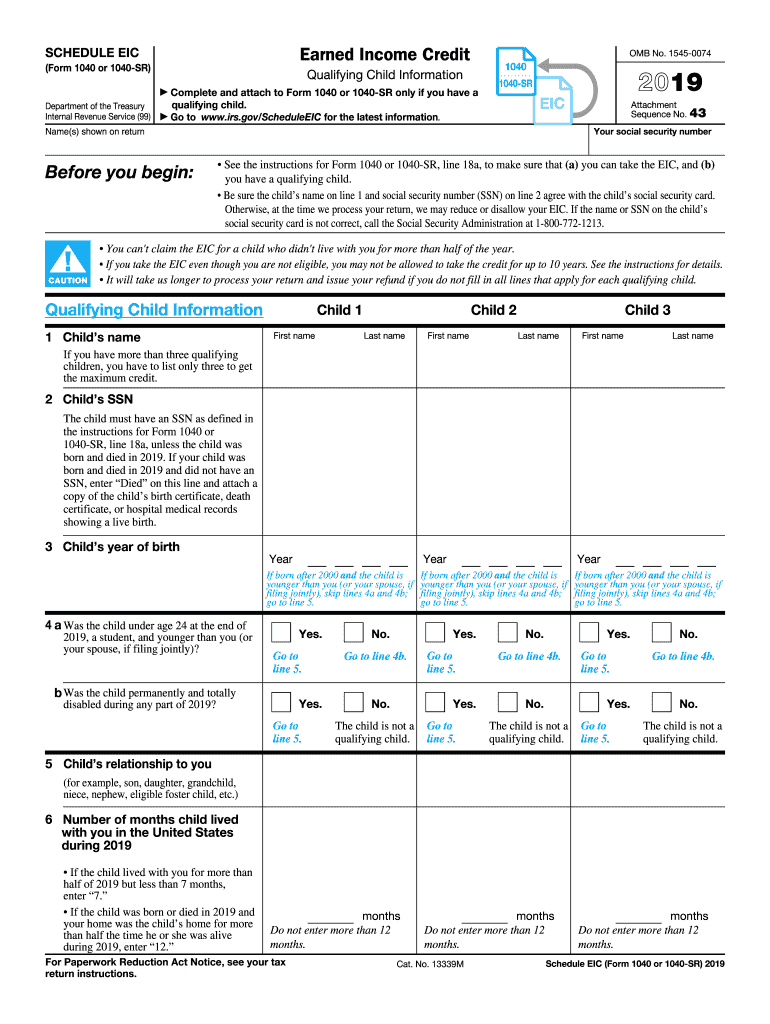

The Schedule EIC form is a crucial document used by taxpayers in the United States to claim the Earned Income Credit (EIC). This credit is designed to assist low to moderate-income working individuals and families by reducing their tax liability. The form provides a structured way for eligible taxpayers to report their income and determine their eligibility for the credit. Understanding the Schedule EIC form is essential for maximizing potential tax refunds and ensuring compliance with IRS regulations.

How to Use the Schedule EIC Form

Using the Schedule EIC form involves several steps. First, taxpayers must gather necessary financial documents, including W-2 forms and any other income statements. Next, they should complete the form by accurately reporting their income, filing status, and number of qualifying children, if applicable. The form must be attached to the taxpayer's Form 1040 or 1040A when filing their federal income tax return. It is important to follow the instructions carefully to ensure that all information is correct and that the claim for the Earned Income Credit is valid.

Steps to Complete the Schedule EIC Form

Completing the Schedule EIC form requires careful attention to detail. Here are the key steps:

- Gather all relevant income documentation, such as W-2s and 1099s.

- Determine your filing status and the number of qualifying children.

- Fill out the income section, ensuring that all amounts are accurate.

- Follow the worksheet provided on the form to calculate your credit amount.

- Attach the completed Schedule EIC to your Form 1040 or 1040A before submission.

Eligibility Criteria

To qualify for the Earned Income Credit using the Schedule EIC form, taxpayers must meet specific eligibility criteria. These include:

- Having earned income from employment or self-employment.

- Meeting income limits based on filing status and number of qualifying children.

- Having a valid Social Security number.

- Filing a tax return, even if no tax is owed.

- Being a U.S. citizen or resident alien for the entire tax year.

IRS Guidelines

The IRS provides detailed guidelines for completing the Schedule EIC form. These guidelines include eligibility requirements, income limits, and instructions for filling out the form accurately. Taxpayers should refer to the IRS website or the instructions included with the form to ensure compliance with all regulations. Adhering to these guidelines helps prevent errors that could lead to delays in processing or potential audits.

Required Documents

When completing the Schedule EIC form, certain documents are necessary to substantiate the information provided. Required documents typically include:

- W-2 forms from all employers.

- 1099 forms for any additional income.

- Proof of residency for qualifying children, if applicable.

- Any other documentation that supports income claims or eligibility.

Quick guide on how to complete schedule eic earned income credit form an llc or

Set Up Schedule Eic Form Effortlessly on Any Device

Managing documents online has become increasingly popular among both businesses and individuals. It serves as an ideal environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it on the internet. airSlate SignNow provides all the tools you need to create, edit, and electronically sign your documents promptly without any hold-ups. Handle Schedule Eic Form on any device using the airSlate SignNow Android or iOS applications and simplify any documentation process today.

The Easiest Way to Edit and Electronically Sign Schedule Eic Form with Ease

- Obtain Schedule Eic Form and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Forge your electronic signature with the Sign tool, which takes only seconds and carries the same legal significance as a traditional handwritten signature.

- Review the information and click on the Done button to save your modifications.

- Select your preferred method to send your form, whether by email, text message (SMS), or invitation link, or download it directly to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that require reprinting new copies. airSlate SignNow fulfills your document management needs in just a few clicks from any device you choose. Edit and electronically sign Schedule Eic Form and ensure excellent communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the schedule eic earned income credit form an llc or

How to generate an electronic signature for the Schedule Eic Earned Income Credit Form An Llc Or online

How to make an electronic signature for the Schedule Eic Earned Income Credit Form An Llc Or in Chrome

How to create an electronic signature for signing the Schedule Eic Earned Income Credit Form An Llc Or in Gmail

How to create an eSignature for the Schedule Eic Earned Income Credit Form An Llc Or straight from your smart phone

How to make an electronic signature for the Schedule Eic Earned Income Credit Form An Llc Or on iOS

How to generate an electronic signature for the Schedule Eic Earned Income Credit Form An Llc Or on Android devices

People also ask

-

What is the earned income credit table 2019 and how does it work?

The earned income credit table 2019 provides a guideline for calculating the earned income tax credit (EITC) based on earned income and the number of qualifying children. This tax benefit helps reduce the tax burden for low-to-moderate income working individuals and families. Understanding this table can maximize your tax savings when preparing your tax return.

-

How does airSlate SignNow help in managing documents related to the earned income credit table 2019?

AirSlate SignNow simplifies the process of managing documents required for tax-related activities, including those associated with the earned income credit table 2019. With secure eSigning and document tracking features, users can ensure that their paperwork is completed on time, which can be crucial during tax season.

-

Are there any costs associated with accessing templates for the earned income credit table 2019?

AirSlate SignNow offers various pricing plans designed to accommodate different business needs, with a free trial available. While accessing templates related to the earned income credit table 2019 may be included in certain subscription plans, check the specific features of each plan to understand any associated costs.

-

What features does airSlate SignNow provide for eSigning tax documents related to the earned income credit table 2019?

AirSlate SignNow includes intuitive eSigning features that allow users to easily sign tax documents linked to the earned income credit table 2019. Users can create templates, manage document workflows, and securely store signed documents, ensuring compliance and convenience.

-

What benefits does airSlate SignNow offer for businesses handling the earned income credit table 2019 documentation?

By utilizing airSlate SignNow, businesses benefit from faster document turnaround times and reduced administrative burdens. The platform's ease of use, combined with features tailored for tax documents related to the earned income credit table 2019, allows for efficient collaboration among team members.

-

Can airSlate SignNow integrate with other tax preparation software for managing the earned income credit table 2019?

Yes, airSlate SignNow can seamlessly integrate with various tax preparation software, allowing users to import and export documents related to the earned income credit table 2019 easily. This integration feature enhances workflow efficiency and helps maintain organized records for tax filing.

-

How can I ensure the security of my documents related to the earned income credit table 2019 when using airSlate SignNow?

AirSlate SignNow employs state-of-the-art security measures, including encryption and secure storage, to protect your documents related to the earned income credit table 2019. Users can have peace of mind knowing that their sensitive tax information is kept safe and confidential.

Get more for Schedule Eic Form

- Towards translingual information access using portable information

- Forms of business ownership 1 sole proprietorship one score

- Theme liquidating a sole proprietorship form

- Responses to questions provided to the office of inspector form

- Msp client onboarding form

- Nanny self employed contract template form

- Narration contract template form

- Nasw supervision contract template form

Find out other Schedule Eic Form

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe

- eSignature Florida Real Estate Quitclaim Deed Online

- eSignature Arizona Sports Moving Checklist Now

- eSignature South Dakota Plumbing Emergency Contact Form Mobile

- eSignature South Dakota Plumbing Emergency Contact Form Safe

- Can I eSignature South Dakota Plumbing Emergency Contact Form

- eSignature Georgia Real Estate Affidavit Of Heirship Later

- eSignature Hawaii Real Estate Operating Agreement Online