1041 Tax Form Schedule I

What is the 1041 Tax Form Schedule I

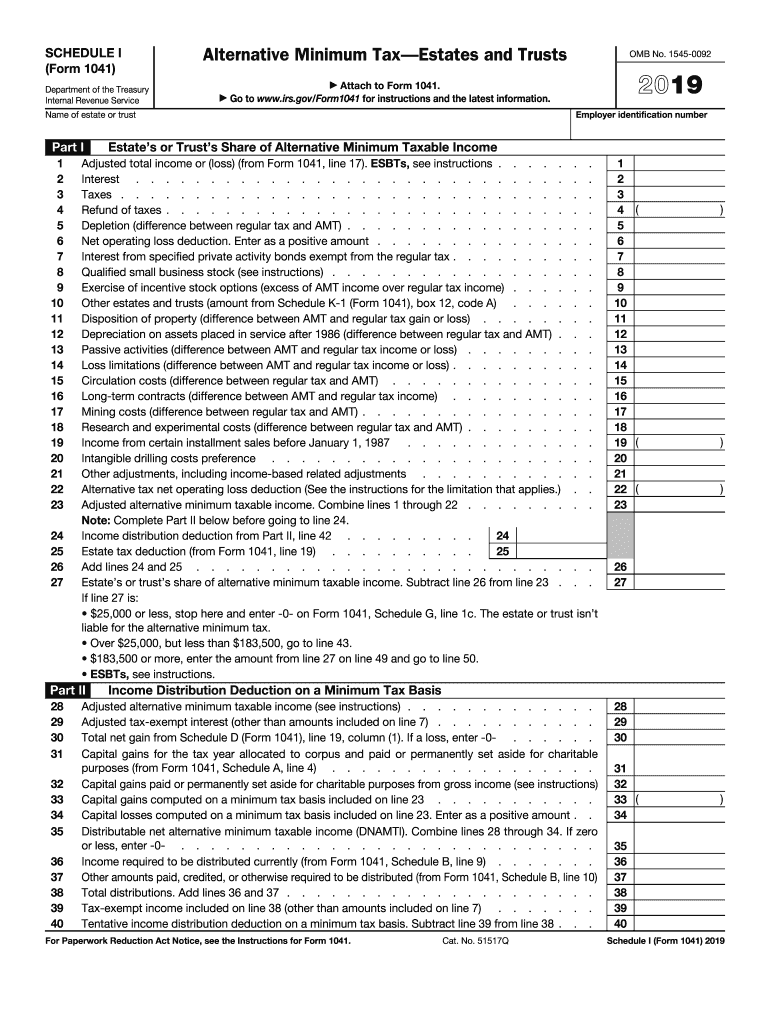

The 1041 Tax Form Schedule I is a supplemental form used by estates and trusts to report income, deductions, and credits. This form is essential for the proper calculation of income tax owed by the estate or trust. It provides detailed information about various types of income, such as interest, dividends, and capital gains, as well as deductions that can be claimed. Understanding this form is crucial for ensuring compliance with IRS regulations and for accurate tax reporting.

How to use the 1041 Tax Form Schedule I

To use the 1041 Tax Form Schedule I effectively, begin by gathering all relevant financial documents for the estate or trust. This includes income statements, investment records, and any applicable deduction information. Complete the form by accurately reporting all income sources and claiming any eligible deductions. Ensure that all calculations are correct, as errors can lead to delays or penalties. Once completed, the form should be submitted along with the main 1041 form to the IRS.

Steps to complete the 1041 Tax Form Schedule I

Completing the 1041 Tax Form Schedule I involves several key steps:

- Gather all necessary financial documents related to the estate or trust.

- Fill in the income section, detailing all sources of income received.

- List any deductions that the estate or trust is eligible to claim.

- Double-check all entries for accuracy to avoid mistakes.

- Submit the completed Schedule I with the main 1041 form by the filing deadline.

Legal use of the 1041 Tax Form Schedule I

The legal use of the 1041 Tax Form Schedule I is governed by IRS regulations. It is important to ensure that the form is filled out completely and accurately, as it serves as a formal declaration of the estate or trust's financial activities. Misrepresentation or failure to file can result in legal penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of this form is crucial for compliance.

IRS Guidelines

The IRS provides specific guidelines for completing the 1041 Tax Form Schedule I. These guidelines include detailed instructions on what income and deductions can be reported, as well as how to calculate tax liability. It is important to review these guidelines thoroughly to ensure that all information is reported correctly and in accordance with IRS requirements. Following these guidelines helps to minimize the risk of audits or penalties.

Filing Deadlines / Important Dates

Filing deadlines for the 1041 Tax Form Schedule I typically align with the main 1041 form. Generally, the form must be filed by the fifteenth day of the fourth month following the end of the estate's or trust's tax year. For estates and trusts operating on a calendar year, this means the deadline is April 15. If the deadline falls on a weekend or holiday, it may be extended to the next business day. Keeping track of these important dates is essential for timely compliance.

Form Submission Methods (Online / Mail / In-Person)

The 1041 Tax Form Schedule I can be submitted through various methods. Taxpayers have the option to file electronically using IRS-approved software, which can streamline the process and reduce errors. Alternatively, the form can be mailed directly to the IRS. In-person submissions are generally not available for this form. Regardless of the method chosen, it is important to retain copies of all submitted documents for record-keeping purposes.

Quick guide on how to complete 2019 schedule i form 1041 alternative minimum taxestates and trusts

Complete 1041 Tax Form Schedule I effortlessly on any device

Digital document management has become favored by businesses and individuals alike. It offers an ideal environmentally-friendly substitute for traditional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides you with all the resources necessary to create, adjust, and electronically sign your files promptly without delays. Manage 1041 Tax Form Schedule I on any device using the airSlate SignNow Android or iOS applications and enhance any document-centric process today.

The simplest way to adjust and electronically sign 1041 Tax Form Schedule I with ease

- Locate 1041 Tax Form Schedule I and select Get Form to begin.

- Utilize the tools we offer to complete your document.

- Underline important sections of your documents or obscure sensitive information with tools specifically provided by airSlate SignNow for that purpose.

- Generate your signature using the Sign feature, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your modifications.

- Decide how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Eliminate concerns over lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your needs in document management in just a few clicks from a device of your choice. Adjust and electronically sign 1041 Tax Form Schedule I and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule i form 1041 alternative minimum taxestates and trusts

How to generate an eSignature for your 2019 Schedule I Form 1041 Alternative Minimum Taxestates And Trusts in the online mode

How to make an electronic signature for the 2019 Schedule I Form 1041 Alternative Minimum Taxestates And Trusts in Chrome

How to generate an eSignature for putting it on the 2019 Schedule I Form 1041 Alternative Minimum Taxestates And Trusts in Gmail

How to generate an eSignature for the 2019 Schedule I Form 1041 Alternative Minimum Taxestates And Trusts from your mobile device

How to make an eSignature for the 2019 Schedule I Form 1041 Alternative Minimum Taxestates And Trusts on iOS devices

How to generate an electronic signature for the 2019 Schedule I Form 1041 Alternative Minimum Taxestates And Trusts on Android OS

People also ask

-

What is the 2018 Schedule 1 form IRS, and why do I need it?

The 2018 Schedule 1 form IRS is used to report additional income or adjustments to income that are not listed on the standard tax return. This form is essential for individuals with specific financial activities, as it helps ensure accurate reporting and compliance with tax regulations.

-

How can airSlate SignNow help me with the 2018 Schedule 1 form IRS?

With airSlate SignNow, you can easily eSign and send your 2018 Schedule 1 form IRS securely and efficiently. Our platform simplifies the process of obtaining signatures, ensuring that your tax documents are completed and submitted timely.

-

Is airSlate SignNow compatible with filing the 2018 Schedule 1 form IRS?

Yes, airSlate SignNow is fully compatible with the 2018 Schedule 1 form IRS and other tax documents. You can integrate our electronic signature solution seamlessly into your tax filing process, making it easier to ensure your forms are filed correctly.

-

What features does airSlate SignNow offer for handling the 2018 Schedule 1 form IRS?

AirSlate SignNow offers features like electronic signatures, document templates, and a secure storage solution specifically designed to manage forms like the 2018 Schedule 1 form IRS. These features streamline your paperwork, helping you focus on more important aspects of your business.

-

What are the benefits of using airSlate SignNow for my 2018 Schedule 1 form IRS?

Using airSlate SignNow for your 2018 Schedule 1 form IRS provides several benefits, including increased efficiency, reduced turnaround time, and enhanced document security. Our platform also supports collaboration, enabling multiple parties to sign and review documents effortlessly.

-

How much does it cost to use airSlate SignNow for my tax forms like the 2018 Schedule 1 form IRS?

AirSlate SignNow offers flexible pricing plans to accommodate various needs, making it a cost-effective solution for managing your 2018 Schedule 1 form IRS. You can select a plan that fits your budget while gaining access to powerful eSignature and document management features.

-

Can I integrate airSlate SignNow with my accounting software when filing the 2018 Schedule 1 form IRS?

Absolutely! AirSlate SignNow integrates seamlessly with many popular accounting software solutions, making it easy to handle your 2018 Schedule 1 form IRS within your existing workflow. This integration enhances productivity by allowing you to manage documents and signatures in one place.

Get more for 1041 Tax Form Schedule I

Find out other 1041 Tax Form Schedule I

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document