Form 8843

What is the Form 8843

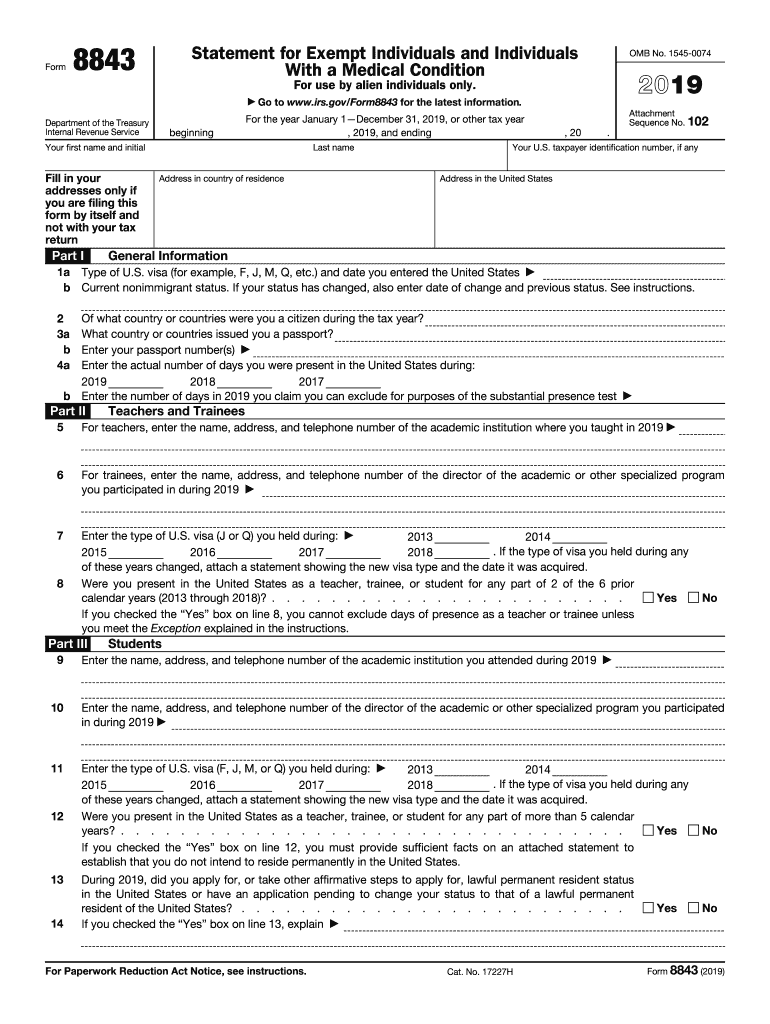

The Form 8843 is a statement for exempt individuals and individuals with a medical condition, primarily used for tax purposes in the United States. It is essential for non-resident aliens who are in the U.S. under specific visa categories, such as students or teachers, to claim their exempt status. This form helps individuals clarify their residency status for tax purposes and ensures compliance with IRS regulations. It is particularly relevant for those who may be eligible for a dependent exemption or other tax benefits.

How to use the Form 8843

Using the Form 8843 involves several key steps. First, individuals must determine their eligibility based on their visa type and duration of stay in the U.S. Once confirmed, the form must be filled out accurately, providing details such as personal information, visa status, and the number of days present in the United States. After completing the form, it should be submitted alongside any required tax returns or documents to the IRS, ensuring that all information is accurate to avoid potential penalties.

Steps to complete the Form 8843

Completing the Form 8843 requires careful attention to detail. Here are the steps to follow:

- Gather necessary information, including your visa type, entry and exit dates, and personal identification details.

- Fill out the form, ensuring that all sections are completed accurately, particularly those related to your residency status.

- Review the form for any errors or omissions to ensure compliance with IRS guidelines.

- Submit the completed form to the IRS along with any other required tax documentation.

Legal use of the Form 8843

The legal use of the Form 8843 is essential for maintaining compliance with U.S. tax laws. It serves as a declaration that the individual qualifies for tax exemptions based on their residency status. To be legally binding, the form must be filled out truthfully and submitted within the specified deadlines. Failure to comply with these requirements can result in penalties or loss of exempt status, making it crucial for individuals to understand their obligations under U.S. tax law.

Filing Deadlines / Important Dates

Filing deadlines for the Form 8843 are critical for compliance. Generally, the form must be submitted by the tax filing deadline, which is typically April fifteenth for most taxpayers. However, individuals who are non-resident aliens may have different deadlines based on their specific circumstances. It is important to verify the exact dates each year, as they can vary, especially in cases of extensions or special circumstances related to the individual's residency status.

Required Documents

When completing the Form 8843, certain documents may be required to support your claims. These can include:

- Passport and visa information

- Form I-20 or DS-2019, if applicable

- Records of days present in the U.S.

- Any prior tax forms or documentation relevant to your residency status

Having these documents ready will facilitate the completion of the form and ensure that all claims are substantiated.

Quick guide on how to complete 2019 form 8843 statement for exempt individuals and individuals with a medical condition

Complete Form 8843 seamlessly on any device

Digital document management has gained traction among businesses and individuals. It offers a wonderful eco-friendly substitute for conventional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the resources needed to create, edit, and eSign your files quickly without interruptions. Handle Form 8843 on any device with airSlate SignNow's Android or iOS applications and enhance any document-centric task today.

The simplest way to edit and eSign Form 8843 effortlessly

- Obtain Form 8843 and click on Get Form to begin.

- Utilize the features we offer to finalize your document.

- Emphasize relevant parts of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for that purpose.

- Create your eSignature using the Sign feature, which takes moments and holds the same legal significance as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Choose how you’d like to send your form – via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced files, time-consuming document searches, or errors that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 8843 and guarantee effective communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8843 statement for exempt individuals and individuals with a medical condition

How to make an electronic signature for the 2019 Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition in the online mode

How to create an electronic signature for the 2019 Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition in Chrome

How to make an electronic signature for signing the 2019 Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition in Gmail

How to generate an eSignature for the 2019 Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition straight from your smartphone

How to generate an electronic signature for the 2019 Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition on iOS

How to create an electronic signature for the 2019 Form 8843 Statement For Exempt Individuals And Individuals With A Medical Condition on Android

People also ask

-

What is Form 8843 2019?

Form 8843 2019 is a tax form used by non-residents in the United States to explain their status and claim a tax treaty benefit. Completing this form properly is important to ensure you're in compliance with IRS regulations. airSlate SignNow simplifies the signing process for this form, making it easier for users to manage and submit their tax documents.

-

How can airSlate SignNow help with completing Form 8843 2019?

airSlate SignNow provides an intuitive platform for easily filling out and eSigning Form 8843 2019. With our user-friendly interface, you can quickly input your personal information and securely send it for signatures, which streamlines the entire process. Our solution ensures that you stay organized and compliant with IRS requirements.

-

Is there a cost associated with using airSlate SignNow for Form 8843 2019?

Yes, airSlate SignNow offers a variety of pricing plans to fit different budgets for using our platform, including for purposes like handling Form 8843 2019. We provide a cost-effective solution that ensures you have access to all essential features without breaking the bank. You can explore our enterprise solutions for more advanced needs.

-

What features does airSlate SignNow offer for handling tax documents like Form 8843 2019?

Our platform offers multiple features beneficial for managing Form 8843 2019, including real-time collaboration, templates for recurring use, and secure document storage. You can also track who has signed the document and when, ensuring complete transparency throughout the process. These features help streamline your tax document management efficiently.

-

Can I integrate airSlate SignNow with other software to manage Form 8843 2019?

Yes, airSlate SignNow seamlessly integrates with various software applications, enhancing your ability to manage Form 8843 2019 alongside other critical business processes. This flexibility allows you to sync documents, access data, and send forms directly from your existing systems. Integration saves time and boosts productivity for users.

-

What are the benefits of using airSlate SignNow for Form 8843 2019?

Using airSlate SignNow for Form 8843 2019 allows you to ensure a streamlined and compliant signing process. Unlimited eSigning, real-time collaboration, and secure cloud storage of your documents are several advantages. You will have peace of mind knowing that your tax documents are handled efficiently and securely.

-

Can multiple people sign Form 8843 2019 using airSlate SignNow?

Absolutely! airSlate SignNow allows for multiple signers, making it ideal for situations where more than one signature is required on Form 8843 2019. You can easily send the document to multiple parties for eSigning, ensuring everyone’s participation is documented and legally binding at the same time.

Get more for Form 8843

Find out other Form 8843

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA

- eSign Georgia Finance & Tax Accounting POA Fast

- eSign Georgia Finance & Tax Accounting POA Simple

- How To eSign Oregon Education LLC Operating Agreement

- eSign Illinois Finance & Tax Accounting Resignation Letter Now

- eSign Texas Construction POA Mobile

- eSign Kansas Finance & Tax Accounting Stock Certificate Now

- eSign Tennessee Education Warranty Deed Online

- eSign Tennessee Education Warranty Deed Now

- eSign Texas Education LLC Operating Agreement Fast

- eSign Utah Education Warranty Deed Online

- eSign Utah Education Warranty Deed Later

- eSign West Virginia Construction Lease Agreement Online

- How To eSign West Virginia Construction Job Offer

- eSign West Virginia Construction Letter Of Intent Online

- eSign West Virginia Construction Arbitration Agreement Myself

- eSign West Virginia Education Resignation Letter Secure

- eSign Education PDF Wyoming Mobile

- Can I eSign Nebraska Finance & Tax Accounting Business Plan Template