Schedule F Form

What is the Schedule F

The Schedule F is a tax form used by farmers in the United States to report income and expenses related to farming activities. It is part of the IRS Form 1040 series and is specifically designed for individuals who operate a farm as a sole proprietorship. This form helps farmers calculate their net profit or loss from farming operations, which is then reported on their individual income tax return. The Schedule F includes sections for reporting income from various farming activities, as well as deductions for expenses such as feed, seed, and equipment depreciation.

How to use the Schedule F

Using the Schedule F involves several steps to ensure accurate reporting of farming income and expenses. First, gather all relevant financial records, including receipts and invoices for farm-related purchases. Next, report all income earned from farming activities in the designated section of the form. This includes sales of crops, livestock, and any other farm products. After reporting income, list all allowable expenses, such as costs for supplies, labor, and maintenance. Finally, calculate the net profit or loss by subtracting total expenses from total income. This figure will be transferred to your Form 1040.

Steps to complete the Schedule F

Completing the Schedule F requires careful attention to detail. Follow these steps:

- Begin by entering your name and Social Security number at the top of the form.

- In Part I, report your farming income, including sales of livestock, produce, and other products.

- In Part II, list your farming expenses. Common expenses include feed, fertilizer, and repairs.

- Calculate your total income and total expenses at the bottom of each part.

- Subtract total expenses from total income to determine your net profit or loss.

- Transfer the net profit or loss to your Form 1040.

IRS Guidelines

The IRS provides specific guidelines for completing the Schedule F. It is important to refer to the latest IRS instructions for Schedule F to ensure compliance with current tax laws. These guidelines detail what constitutes allowable expenses, how to report income accurately, and any special considerations for different types of farming operations. Additionally, the IRS outlines the record-keeping requirements that farmers must adhere to, ensuring that all reported figures can be substantiated with proper documentation.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule F typically align with the general tax return deadlines. For most taxpayers, the deadline to file Form 1040, including the Schedule F, is April 15 of each year. However, if you are unable to meet this deadline, you may file for an extension, which grants you an additional six months. It is essential to be aware of these dates to avoid penalties and ensure timely submission of your tax documents.

Penalties for Non-Compliance

Failure to file the Schedule F or inaccuracies in reporting can result in penalties from the IRS. Common penalties include fines for late filing, as well as interest on any unpaid taxes. Additionally, if the IRS determines that there was intentional disregard of the rules, more severe penalties may apply. It is crucial for farmers to maintain accurate records and file their forms correctly to avoid these consequences.

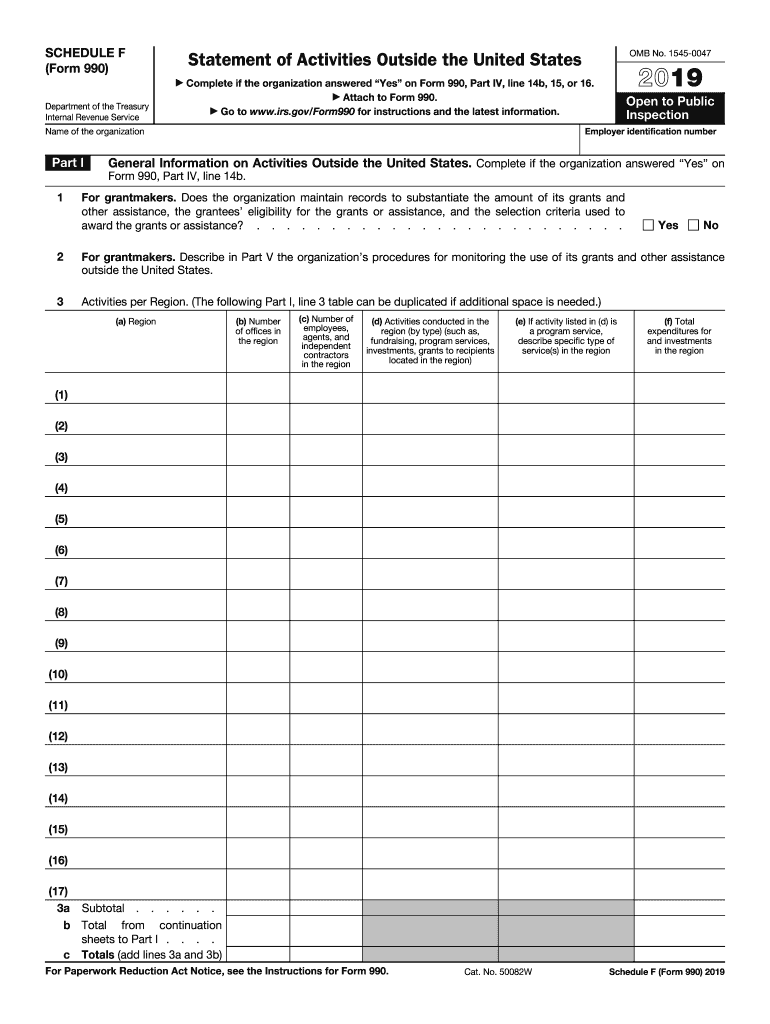

Quick guide on how to complete 2019 schedule f form 990 statement of activities outside the united states

Handle Schedule F effortlessly on any device

Online document management has gained increased traction among businesses and individuals. It serves as a perfect environmentally friendly alternative to conventional printed and signed documents, allowing you to locate the necessary form and securely store it online. airSlate SignNow provides all the tools you need to create, modify, and eSign your documents swiftly without any delays. Manage Schedule F on any platform using airSlate SignNow's Android or iOS applications and simplify any document-related process today.

How to alter and eSign Schedule F with ease

- Obtain Schedule F and then click Get Form to begin.

- Employ the tools we offer to complete your form.

- Emphasize important sections of your documents or obscure sensitive details using the tools that airSlate SignNow provides specifically for that purpose.

- Generate your eSignature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Verify the details and then click on the Done button to save your changes.

- Select your preferred method for sending your form, whether by email, SMS, or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from your chosen device. Revise and eSign Schedule F and guarantee effective communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 schedule f form 990 statement of activities outside the united states

How to make an eSignature for your 2019 Schedule F Form 990 Statement Of Activities Outside The United States in the online mode

How to make an eSignature for your 2019 Schedule F Form 990 Statement Of Activities Outside The United States in Chrome

How to make an electronic signature for signing the 2019 Schedule F Form 990 Statement Of Activities Outside The United States in Gmail

How to make an eSignature for the 2019 Schedule F Form 990 Statement Of Activities Outside The United States straight from your smartphone

How to generate an eSignature for the 2019 Schedule F Form 990 Statement Of Activities Outside The United States on iOS devices

How to make an electronic signature for the 2019 Schedule F Form 990 Statement Of Activities Outside The United States on Android OS

People also ask

-

What is the purpose of the 2019 IRS Schedule F?

The 2019 IRS Schedule F is specifically designed for farmers to report their farming income and expenses. It helps you calculate the net profit or loss from farming, which is essential for your overall tax obligations. Understanding how to accurately fill out this form can signNowly impact your tax return.

-

How can airSlate SignNow assist with the management of documents related to the 2019 IRS Schedule F?

airSlate SignNow provides an easy-to-use platform for sending and eSigning documents related to your 2019 IRS Schedule F. By utilizing our service, you can streamline your workflow, ensuring that vital documents are signed promptly and securely. This efficiency can help you manage your tax obligations with ease.

-

What features does airSlate SignNow offer for small business owners dealing with the 2019 IRS Schedule F?

With airSlate SignNow, small business owners can enjoy features like templates for tax documents, secure electronic signatures, and easy tracking of document status. These features specifically assist in managing the paperwork associated with the 2019 IRS Schedule F, ensuring you never miss a signing deadline crucial for taxes.

-

Are there any integrations available with airSlate SignNow for managing 2019 IRS Schedule F documents?

Yes, airSlate SignNow offers various integrations with popular accounting and tax software that can help you manage your 2019 IRS Schedule F documents. By integrating seamlessly with tools you already use, we help make your tax preparation more efficient and organized. This connectivity is essential for maintaining an accurate financial overview.

-

What are the benefits of using airSlate SignNow for eSigning my 2019 IRS Schedule F?

Using airSlate SignNow for eSigning your 2019 IRS Schedule F offers several benefits, including faster turnaround times and enhanced security features. Our platform ensures that your documents are protected and received instantly, which can be crucial as tax deadlines approach. Additionally, our user-friendly interface makes it easy for you and your stakeholders to get documents signed on time.

-

Is airSlate SignNow a cost-effective solution for businesses handling the 2019 IRS Schedule F?

Absolutely! airSlate SignNow is designed to be a cost-effective solution for any business dealing with the 2019 IRS Schedule F. Our pricing plans are flexible and cater to different business sizes, allowing you to save time and resources while ensuring compliance with tax regulations.

-

Can airSlate SignNow support multiple users for handling the 2019 IRS Schedule F?

Yes, airSlate SignNow supports multi-user access, making it easy for teams to collaborate on documents related to the 2019 IRS Schedule F. You can assign roles and permissions to ensure the right people have access to crucial tax documents. This feature helps streamline teamwork and improves accountability within your organization.

Get more for Schedule F

Find out other Schedule F

- How To Sign Iowa Charity LLC Operating Agreement

- Sign Kentucky Charity Quitclaim Deed Myself

- Sign Michigan Charity Rental Application Later

- How To Sign Minnesota Charity Purchase Order Template

- Sign Mississippi Charity Affidavit Of Heirship Now

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed