1094 C Fillable Form

What is the 1094 C Fillable

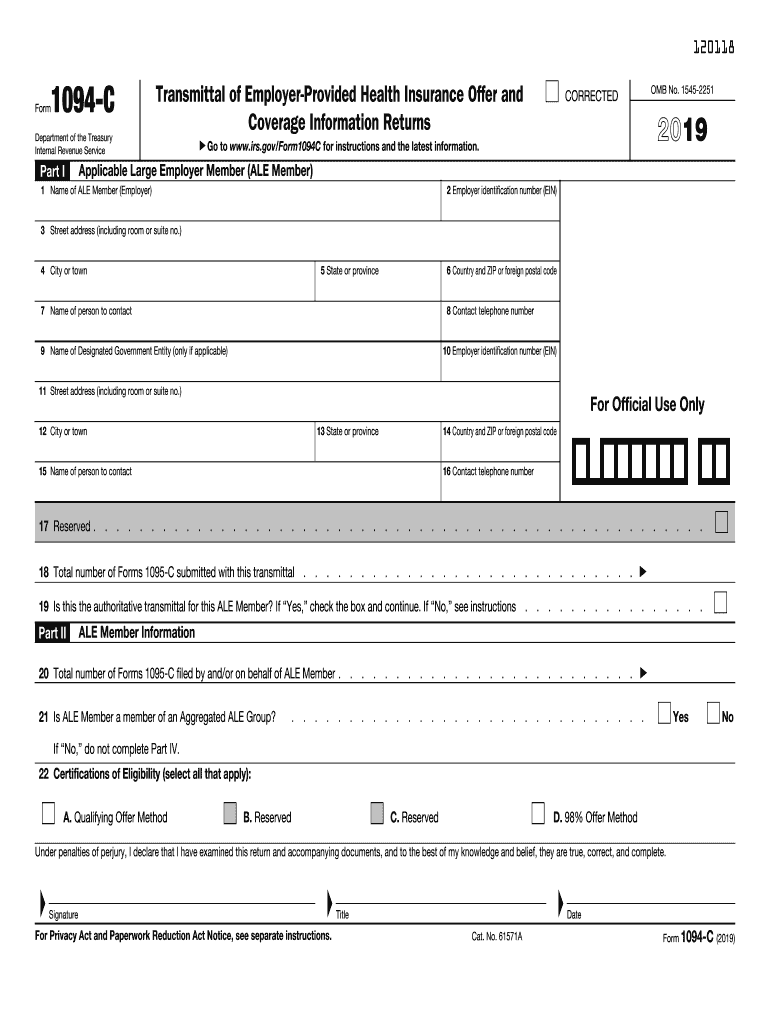

The 1094 C fillable form is a crucial document used by applicable large employers to report information about their health insurance coverage offered to employees. This form is part of the Affordable Care Act (ACA) reporting requirements and serves as a cover sheet for the 1095 C forms, which provide detailed information about each employee's health insurance coverage. The fillable version allows employers to complete the form digitally, enhancing accuracy and ease of submission.

How to use the 1094 C Fillable

Using the 1094 C fillable form involves several straightforward steps. First, access the form through a reliable platform that supports digital signatures and e-filing. Next, enter the required information, including your employer identification number (EIN), the number of full-time employees, and details regarding the health coverage provided. After filling out the form, review all entries for accuracy. Finally, save the completed form in a secure format and prepare it for submission to the IRS along with the 1095 C forms.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1094 C form is essential for compliance. For the 2019 tax year, the deadline for submitting the 1094 C and accompanying 1095 C forms to the IRS was typically March 31 of the following year if filing electronically. Employers must also provide copies of the 1095 C forms to employees by January 31. It is crucial to keep track of these dates to avoid penalties for late submissions.

Legal use of the 1094 C Fillable

The legal use of the 1094 C fillable form is governed by the requirements set forth by the IRS under the Affordable Care Act. To ensure compliance, employers must provide accurate information regarding the health coverage they offer. The fillable form must be signed and submitted according to IRS regulations, which stipulate that electronic submissions are permissible if they meet specific criteria. Ensuring that the form is filled out correctly and submitted on time helps avoid potential legal issues and penalties.

Key elements of the 1094 C Fillable

Key elements of the 1094 C fillable form include the employer's basic information, such as name, address, and EIN. Additionally, the form requires the number of full-time employees, information about the health insurance offered, and details regarding the months of coverage. Each section must be filled out accurately to ensure that the form serves its purpose in reporting compliance with the ACA. Understanding these elements is vital for proper completion and submission.

Examples of using the 1094 C Fillable

Examples of using the 1094 C fillable form can vary based on the size and structure of the employer. For instance, a corporation with multiple subsidiaries may need to consolidate information from various locations into one comprehensive report. Alternatively, a small business with fewer employees may find the process simpler, focusing on just a few entries. Regardless of the scenario, accurately filling out the form is essential to meet reporting requirements and maintain compliance.

Quick guide on how to complete about form 1095 c employer provided health insurance

Prepare 1094 C Fillable effortlessly on any device

Online document management has gained signNow traction among businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed paperwork, allowing you to obtain the necessary form and securely store it online. airSlate SignNow equips you with all the essential tools to create, alter, and eSign your documents quickly without any hitches. Manage 1094 C Fillable on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

The easiest way to alter and eSign 1094 C Fillable without any hassle

- Find 1094 C Fillable and click on Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize pertinent sections of the documents or redact sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which only takes a few seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you want to send your form, via email, SMS, or invite link, or download it to your computer.

Eliminate concerns about lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Modify and eSign 1094 C Fillable while ensuring excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 1095 c employer provided health insurance

How to generate an electronic signature for the About Form 1095 C Employer Provided Health Insurance online

How to create an electronic signature for your About Form 1095 C Employer Provided Health Insurance in Google Chrome

How to generate an electronic signature for putting it on the About Form 1095 C Employer Provided Health Insurance in Gmail

How to make an electronic signature for the About Form 1095 C Employer Provided Health Insurance right from your smart phone

How to make an eSignature for the About Form 1095 C Employer Provided Health Insurance on iOS

How to generate an electronic signature for the About Form 1095 C Employer Provided Health Insurance on Android OS

People also ask

-

What is the 1094C 2019 form and why is it important?

The 1094C 2019 form is used by applicable large employers to report health insurance coverage to the IRS. It's crucial for ensuring compliance with the Affordable Care Act (ACA). Accurate reporting with the 1094C 2019 helps avoid penalties and demonstrates your commitment to providing health coverage.

-

How can airSlate SignNow help with completing the 1094C 2019 form?

airSlate SignNow offers an intuitive platform for creating and managing the 1094C 2019 form. You can easily prepare, send, and eSign documents securely, streamlining the process and ensuring accuracy in your submissions. This eliminates errors and saves time for your HR team.

-

What features does airSlate SignNow offer for the 1094C 2019 form?

Our platform provides customizable templates, automated workflows, and real-time tracking for the 1094C 2019 form. These features simplify data collection and enhance collaboration among team members, ensuring that your submissions are timely and compliant with IRS regulations.

-

Is airSlate SignNow cost-effective for businesses handling the 1094C 2019 form?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses managing the 1094C 2019 form. Our pricing plans cater to various needs, helping organizations save money on paperwork and administrative tasks while ensuring smooth compliance with legal requirements.

-

Can I integrate airSlate SignNow with other applications for the 1094C 2019 process?

Absolutely! airSlate SignNow seamlessly integrates with various applications like Google Drive, Dropbox, and CRM systems, enhancing your overall workflow when dealing with the 1094C 2019 form. These integrations facilitate data sharing and simplify document management.

-

What are the benefits of using airSlate SignNow for the 1094C 2019 submission?

Using airSlate SignNow for the 1094C 2019 submission maximizes efficiency and reduces errors. Our platform ensures secure eSigning and document storage, allowing for easy access and retrieval, which is essential in case of audits and compliance checks.

-

How secure is the submission process for the 1094C 2019 form with airSlate SignNow?

The security of your documents is our top priority at airSlate SignNow. We employ advanced encryption and secure access controls to protect your sensitive information while submitting the 1094C 2019 form. You can trust us to keep your data confidential and safe.

Get more for 1094 C Fillable

- Hud 11702 form

- Ginnie mae help for homeowners form

- Space city seniors audition application name form

- Ventura harbor live music application ventura harbor village form

- App leg wa govrcwdefaultrcw 58 17 060 short plats and short washington form

- Wedding hall booking forms for employees of krl foundation

- Joint request to schedule an uncontested divorce hearing form

- Mi 1040d michigan adjustments of capital gains and losses mi 1040d mi 1040d michigan adjustments of capital gains and losses mi form

Find out other 1094 C Fillable

- Electronic signature New York Doctors Permission Slip Free

- Electronic signature South Dakota Construction Quitclaim Deed Easy

- Electronic signature Texas Construction Claim Safe

- Electronic signature Texas Construction Promissory Note Template Online

- How To Electronic signature Oregon Doctors Stock Certificate

- How To Electronic signature Pennsylvania Doctors Quitclaim Deed

- Electronic signature Utah Construction LLC Operating Agreement Computer

- Electronic signature Doctors Word South Dakota Safe

- Electronic signature South Dakota Doctors Confidentiality Agreement Myself

- How Do I Electronic signature Vermont Doctors NDA

- Electronic signature Utah Doctors Promissory Note Template Secure

- Electronic signature West Virginia Doctors Bill Of Lading Online

- Electronic signature West Virginia Construction Quitclaim Deed Computer

- Electronic signature Construction PDF Wisconsin Myself

- How Do I Electronic signature Wyoming Doctors Rental Lease Agreement

- Help Me With Electronic signature Wyoming Doctors Rental Lease Agreement

- How Do I Electronic signature Colorado Education RFP

- Electronic signature Colorado Education Lease Agreement Form Online

- How To Electronic signature Colorado Education Business Associate Agreement

- Can I Electronic signature California Education Cease And Desist Letter