Irs Gov Form 8453 Instructions

What is the IRS Form 8453?

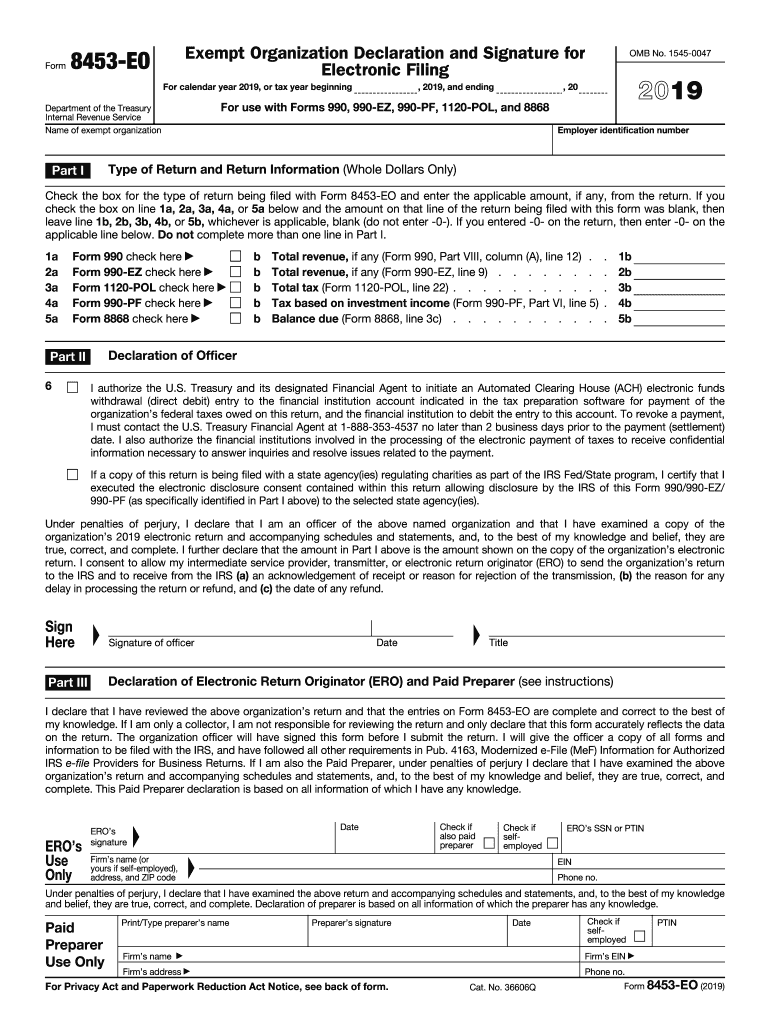

The 2019 IRS Form 8453 is a declaration form used by taxpayers to authenticate their electronic tax returns. This form allows individuals to submit their federal income tax returns electronically while providing a means to submit any necessary paper documents. It is particularly important for those who file their taxes using tax preparation software or through an online service.

Form 8453 serves as a signature document, ensuring that the taxpayer agrees to the information submitted electronically. It is essential for maintaining compliance with IRS regulations and provides a record of the taxpayer's consent.

Steps to Complete the IRS Form 8453

Filling out the 2019 IRS Form 8453 involves several key steps:

- Gather necessary information, including your name, Social Security number, and details of your electronic return.

- Complete the form by entering the required information accurately, ensuring all fields are filled in as directed.

- Review the form for any errors or omissions before proceeding.

- Sign the form electronically, which may involve using an eSignature solution that complies with IRS regulations.

- Submit the completed form along with your electronic tax return to the IRS.

Legal Use of the IRS Form 8453

The 2019 IRS Form 8453 is legally binding when filled out correctly and submitted according to IRS guidelines. It must be signed by the taxpayer or an authorized representative. The form verifies the authenticity of the electronic submission and ensures that the taxpayer agrees to the terms outlined in the return.

Compliance with eSignature laws, such as the ESIGN Act and UETA, is crucial for the legal acceptance of the form. Utilizing a trusted electronic signature platform can help ensure that the form is executed in a manner that meets legal standards.

Filing Deadlines / Important Dates

For the 2019 tax year, the deadline to file your federal income tax return is typically April 15 of the following year, unless it falls on a weekend or holiday. In such cases, the deadline may be extended to the next business day.

It is important to submit the 2019 IRS Form 8453 along with your electronic return by this deadline to avoid penalties. Taxpayers should also be aware of any state-specific deadlines that may apply.

Form Submission Methods

The 2019 IRS Form 8453 can be submitted electronically when filing your tax return through approved e-filing methods. It is essential to ensure that the electronic submission is completed through a platform that supports the form's requirements.

In some cases, if additional documents are required, you may need to mail the paper version of Form 8453 to the IRS. Always check the specific instructions provided by the IRS or your tax preparation software for guidance on submission methods.

Examples of Using the IRS Form 8453

Taxpayers may need to use the 2019 IRS Form 8453 in various scenarios, such as:

- When filing an electronic return that includes attachments, like Form 8862 or Form 8888.

- If you are a self-employed individual filing a Schedule C along with your electronic return.

- When utilizing tax software that requires the form to validate the electronic submission.

Each of these situations underscores the form's role in ensuring compliance and providing a record of agreement with the submitted tax return.

Quick guide on how to complete 8879 eo irs signature authorization form for an exempt

Easily Prepare Irs Gov Form 8453 Instructions on Any Device

The management of online documents has gained traction among businesses and individuals. It serves as an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to find the right template and securely store it online. airSlate SignNow equips you with all the tools necessary to create, modify, and electronically sign your documents quickly without delays. Manage Irs Gov Form 8453 Instructions on any device using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

Effortlessly Modify and eSign Irs Gov Form 8453 Instructions

- Find Irs Gov Form 8453 Instructions and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Mark important sections of the documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and carries the same legal validity as a traditional handwritten signature.

- Verify the details and click on the Done button to store your edits.

- Select your preferred method to share your form, whether by email, SMS, invitation link, or download it to your computer.

Put aside concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Modify and eSign Irs Gov Form 8453 Instructions to ensure effective communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 8879 eo irs signature authorization form for an exempt

How to make an electronic signature for the 8879 Eo Irs Signature Authorization Form For An Exempt in the online mode

How to generate an electronic signature for your 8879 Eo Irs Signature Authorization Form For An Exempt in Google Chrome

How to make an electronic signature for putting it on the 8879 Eo Irs Signature Authorization Form For An Exempt in Gmail

How to create an electronic signature for the 8879 Eo Irs Signature Authorization Form For An Exempt right from your smartphone

How to make an eSignature for the 8879 Eo Irs Signature Authorization Form For An Exempt on iOS devices

How to create an eSignature for the 8879 Eo Irs Signature Authorization Form For An Exempt on Android devices

People also ask

-

What is the 2019 IRS Form 8453 used for?

The 2019 IRS Form 8453 is used to authorize an e-filed tax return. It supports various electronic filing methods, enabling taxpayers to submit their returns securely. Completing and signing this form ensures compliance with IRS regulations for e-filing.

-

How can airSlate SignNow help with the 2019 IRS Form 8453?

airSlate SignNow offers a streamlined solution for preparing and eSigning the 2019 IRS Form 8453. Our platform allows you to fill out the form digitally and send it for signatures easily, ensuring a seamless e-filing process. This eliminates the hassle of printing and mailing documents.

-

Is airSlate SignNow compatible with the 2019 IRS Form 8453?

Yes, airSlate SignNow is fully compatible with the 2019 IRS Form 8453. Our platform allows users to customize and manage the form, ensuring that all necessary fields are completed correctly. Enjoy a hassle-free experience when submitting your e-filed returns.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. You can choose from monthly or annual subscriptions, which provide access to essential features, including the ability to eSign the 2019 IRS Form 8453. Visit our pricing page to explore the available options.

-

What features does airSlate SignNow offer for document signing?

airSlate SignNow offers a variety of features designed to enhance the document signing experience. This includes customizable templates for the 2019 IRS Form 8453, secure cloud storage, and real-time notifications. These capabilities ensure efficient and reliable document management.

-

How secure is the data when using airSlate SignNow to eSign Forms?

Security is a top priority at airSlate SignNow. When eSigning the 2019 IRS Form 8453, your data is encrypted and stored securely in compliance with industry standards. We implement multiple layers of security, ensuring that your sensitive information remains protected throughout the signing process.

-

Can I integrate airSlate SignNow with other software for better workflow?

Absolutely! airSlate SignNow integrates with various software solutions to enhance your workflow, including accounting software and document management systems. These integrations allow you to manage the 2019 IRS Form 8453 alongside your other business processes effortlessly.

Get more for Irs Gov Form 8453 Instructions

- Strategies for leveraging intellectual property form

- Internal administrative approval form for external grant proposals southernct

- Va form 26 6381 779308925

- Motion graphics contract template form

- Motivational speaker contract template form

- Motorcycle purchase contract template form

- Motorcycle sale contract template form

- Motorsport sponsorship contract template form

Find out other Irs Gov Form 8453 Instructions

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed