Irs Tax Form

What is the IRS Tax Form?

The IRS tax form is a document that taxpayers in the United States use to report their income, calculate their tax liability, and claim any applicable deductions or credits. The most common form for individual taxpayers is the Form 1040, which allows for a comprehensive overview of a taxpayer's financial situation. Other forms, such as the W-2, are used by employers to report wages paid to employees. Each form serves a specific purpose in the tax filing process, ensuring compliance with federal tax laws.

How to Obtain the IRS Tax Form

To obtain the IRS tax forms for 2019, individuals can visit the official IRS website, where forms are available for download in PDF format. Alternatively, taxpayers can request paper copies to be mailed to their address. Many tax preparation offices and libraries also provide physical copies of these forms. It is essential to ensure that the correct version of the form is used, as forms may vary from year to year.

Steps to Complete the IRS Tax Form

Completing the IRS tax form involves several key steps:

- Gather necessary documents, including W-2s, 1099s, and any other income statements.

- Choose the appropriate form based on your filing status and income level.

- Fill out personal information, such as your name, address, and Social Security number.

- Report all sources of income accurately.

- Claim deductions and credits you qualify for, which can reduce your taxable income.

- Calculate your total tax liability and determine if you owe money or will receive a refund.

Legal Use of the IRS Tax Form

The IRS tax form must be completed accurately and submitted by the designated deadline to ensure compliance with federal tax laws. Legal use of these forms includes providing truthful information, maintaining records of submitted forms, and adhering to guidelines set forth by the IRS. Failure to comply can result in penalties or audits, emphasizing the importance of careful and honest reporting.

Filing Deadlines / Important Dates

Taxpayers should be aware of important deadlines related to the IRS tax forms. For the 2019 tax year, the typical deadline for filing individual tax returns is April 15, 2020. If this date falls on a weekend or holiday, the deadline may be extended. Additionally, taxpayers can file for an extension, which typically grants an additional six months to submit their forms, although any taxes owed must still be paid by the original deadline to avoid penalties.

Form Submission Methods

IRS tax forms can be submitted in several ways, including:

- Electronically through e-filing services, which can expedite processing and refunds.

- By mailing a paper form to the appropriate IRS address, which varies based on the taxpayer's location and whether a payment is included.

- In-person at designated IRS offices, though this option may require an appointment.

Required Documents

When completing the IRS tax form, certain documents are essential for accurate reporting. These include:

- W-2 forms from employers, detailing annual wages and taxes withheld.

- 1099 forms for any freelance or contract work, showing income received.

- Receipts for deductible expenses, such as medical costs or charitable contributions.

- Any other relevant financial documents that support claims made on the tax form.

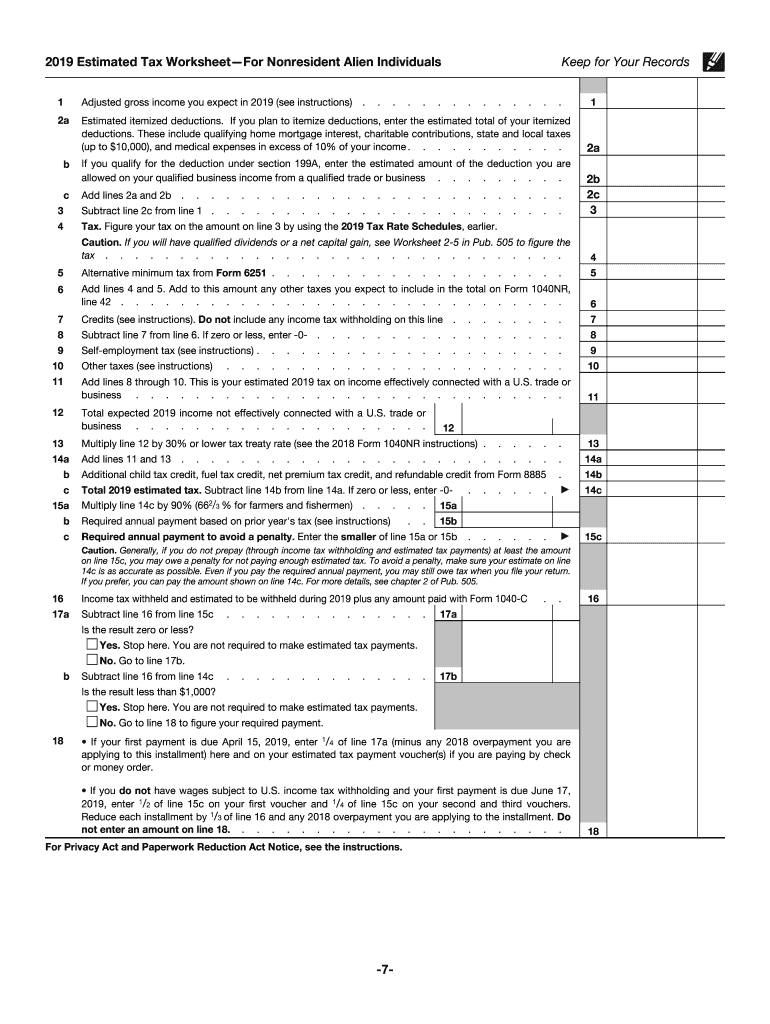

Quick guide on how to complete 2019 form 1040 es nr form 1040 es nr us estimated tax for nonresident alien individuals

Fill out Irs Tax Form effortlessly on any device

Digital document management has gained traction among businesses and individuals. It offers an ideal environmentally friendly option to traditional printed and signed documents, allowing you to obtain the right form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents swiftly without any delays. Handle Irs Tax Form on any device with airSlate SignNow Android or iOS applications and streamline any document-related tasks today.

How to modify and eSign Irs Tax Form with ease

- Find Irs Tax Form and then click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight pertinent sections of your documents or obscure confidential information with tools specifically provided by airSlate SignNow for that purpose.

- Create your eSignature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Verify all the details and then click on the Done button to save your modifications.

- Select your preferred method to submit your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate reprinting new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Edit and eSign Irs Tax Form to ensure effective communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1040 es nr form 1040 es nr us estimated tax for nonresident alien individuals

How to create an eSignature for the 2019 Form 1040 Es Nr Form 1040 Es Nr Us Estimated Tax For Nonresident Alien Individuals in the online mode

How to create an electronic signature for the 2019 Form 1040 Es Nr Form 1040 Es Nr Us Estimated Tax For Nonresident Alien Individuals in Chrome

How to make an eSignature for putting it on the 2019 Form 1040 Es Nr Form 1040 Es Nr Us Estimated Tax For Nonresident Alien Individuals in Gmail

How to generate an eSignature for the 2019 Form 1040 Es Nr Form 1040 Es Nr Us Estimated Tax For Nonresident Alien Individuals from your mobile device

How to generate an electronic signature for the 2019 Form 1040 Es Nr Form 1040 Es Nr Us Estimated Tax For Nonresident Alien Individuals on iOS

How to generate an electronic signature for the 2019 Form 1040 Es Nr Form 1040 Es Nr Us Estimated Tax For Nonresident Alien Individuals on Android

People also ask

-

Where can I find tax forms for 2019?

You can find tax forms for 2019 on the IRS website, where they offer a comprehensive list of downloadable forms. Additionally, many online tax software platforms, including airSlate SignNow, provide access to necessary tax forms to help streamline your filing process.

-

How much does airSlate SignNow cost for accessing tax forms?

airSlate SignNow offers competitive pricing, starting with basic plans that are ideal for individuals needing to access tax forms for 2019. Our pricing is transparent, and you can choose from various plans that suit your needs for sending and signing documents.

-

What features does airSlate SignNow offer for managing tax documents?

airSlate SignNow provides a user-friendly interface that allows you to upload, eSign, and store your tax documents securely. This makes it easier to locate essential forms, including where to get tax forms for 2019 and manage all your tax-related paperwork efficiently.

-

Can I integrate airSlate SignNow with other applications to access tax forms?

Yes, airSlate SignNow offers integrations with various applications such as Google Drive, Dropbox, and accounting software. This allows you to easily access and send tax forms for 2019, ensuring seamless document management.

-

Is my data secure when using airSlate SignNow for tax forms?

Absolutely! airSlate SignNow prioritizes the security of your data, employing advanced encryption methods and security protocols. When looking for where to get tax forms for 2019, you can trust that your information is safe.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for your tax-related documents allows for faster processing and eliminates the hassle of printing and mailing forms. With features dedicated to eSigning and document tracking, it simplifies the entire process of managing where to get tax forms for 2019.

-

Can I use airSlate SignNow on mobile devices to access tax forms?

Yes, airSlate SignNow has a mobile-friendly application that allows you to access tax forms for 2019 on-the-go. This flexibility enables you to manage your documents from anywhere, ensuring you never miss a filing deadline.

Get more for Irs Tax Form

Find out other Irs Tax Form

- How To eSign Arizona Agreement contract template

- eSign Texas Agreement contract template Fast

- eSign Massachusetts Basic rental agreement or residential lease Now

- How To eSign Delaware Business partnership agreement

- How Do I eSign Massachusetts Business partnership agreement

- Can I eSign Georgia Business purchase agreement

- How Can I eSign Idaho Business purchase agreement

- How To eSign Hawaii Employee confidentiality agreement

- eSign Idaho Generic lease agreement Online

- eSign Pennsylvania Generic lease agreement Free

- eSign Kentucky Home rental agreement Free

- How Can I eSign Iowa House rental lease agreement

- eSign Florida Land lease agreement Fast

- eSign Louisiana Land lease agreement Secure

- How Do I eSign Mississippi Land lease agreement

- eSign Connecticut Landlord tenant lease agreement Now

- eSign Georgia Landlord tenant lease agreement Safe

- Can I eSign Utah Landlord lease agreement

- How Do I eSign Kansas Landlord tenant lease agreement

- How Can I eSign Massachusetts Landlord tenant lease agreement