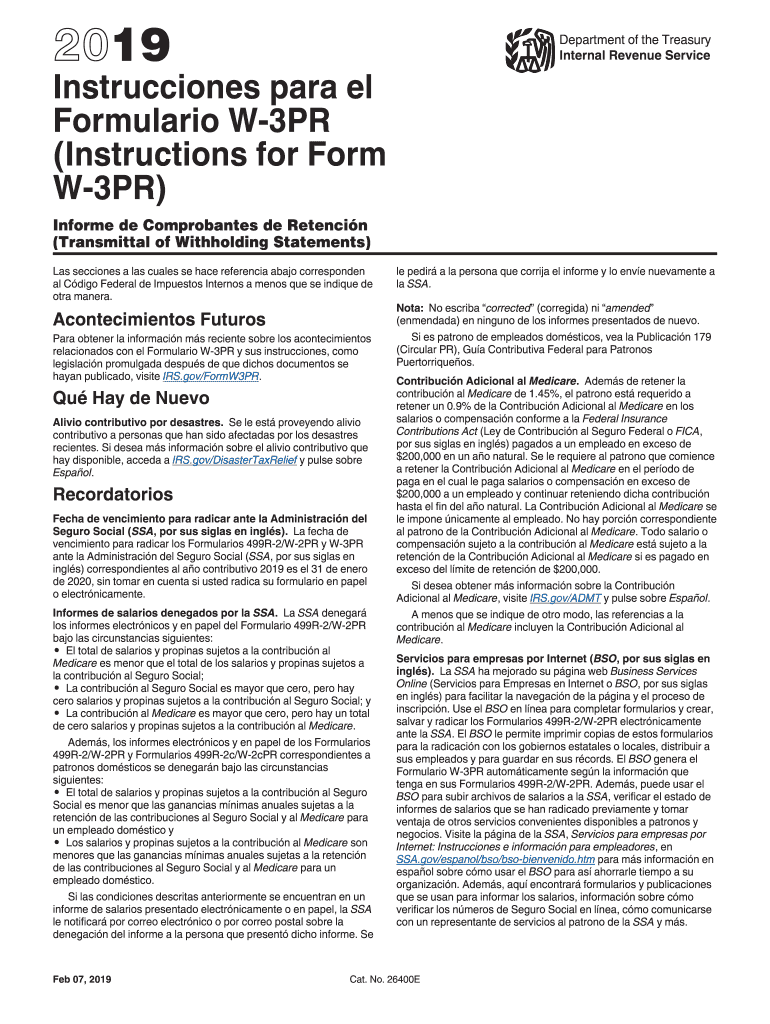

W3pr Form

What is the W3pr?

The W3pr 2019 form is a tax document used in the United States, primarily for reporting income and tax information related to certain business entities. It is essential for ensuring compliance with federal tax regulations. This form serves as a means for businesses to provide necessary data to the Internal Revenue Service (IRS), which may include details about income, deductions, and other financial information. Understanding the purpose and requirements of the W3pr is crucial for businesses to maintain accurate records and fulfill their tax obligations.

How to use the W3pr

Using the W3pr 2019 form involves several steps to ensure accurate completion and submission. First, gather all relevant financial documents and records that pertain to the tax year in question. Next, fill out the form with precise information, including business details and income figures. It is important to review the form for accuracy before submission. Once completed, the W3pr can be submitted electronically or via mail, depending on the preferred method of the business. Familiarity with the form's requirements and guidelines will aid in its effective use.

Steps to complete the W3pr

Completing the W3pr 2019 form requires careful attention to detail. Follow these steps:

- Gather all necessary documentation, including income statements and expense records.

- Fill in the business name, address, and taxpayer identification number accurately.

- Report all income received during the tax year, ensuring that figures are consistent with other financial records.

- Include any applicable deductions or credits that the business qualifies for.

- Review the form for completeness and accuracy before submission.

Legal use of the W3pr

The legal use of the W3pr 2019 form is governed by IRS regulations. To be considered valid, the form must be completed accurately and submitted within the designated filing deadlines. It is important to ensure that all information provided is truthful and substantiated by supporting documents. Failure to comply with these legal requirements may result in penalties or audits. Understanding the legal implications of the W3pr is essential for businesses to avoid potential issues with the IRS.

Filing Deadlines / Important Dates

Filing deadlines for the W3pr 2019 form are critical for compliance. Businesses must submit the form by the IRS deadline, which typically falls on the last day of the tax filing season. It is advisable to check the IRS website for specific dates and any updates regarding extensions or changes in filing requirements. Keeping track of these important dates helps ensure that businesses remain in good standing with tax authorities.

Required Documents

To complete the W3pr 2019 form accurately, certain documents are required. These may include:

- Income statements, such as 1099 forms or other earnings reports.

- Expense records that provide evidence of deductions claimed.

- Previous tax returns for reference and consistency.

- Any additional documentation that supports the information reported on the form.

Quick guide on how to complete 2019 instrucciones para elformulario w 3pr instructions for form w 3pr instrucciones para elformulario w 3pr instructions for

Finish W3pr smoothly on any gadget

Online document administration has become increasingly popular among businesses and individuals. It offers a perfect eco-friendly substitute for conventional printed and signed files, as you can easily locate the necessary form and securely keep it online. airSlate SignNow equips you with all the resources needed to create, modify, and electronically sign your documents promptly without delays. Manage W3pr on any device with airSlate SignNow Android or iOS applications and simplify any document-related process today.

The easiest way to modify and electronically sign W3pr effortlessly

- Find W3pr and click Get Form to begin.

- Use the tools we provide to complete your document.

- Emphasize important sections of the documents or obscure confidential information with tools specifically provided by airSlate SignNow for that function.

- Generate your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a regular wet ink signature.

- Review all the details and click the Done button to preserve your modifications.

- Select your preferred method to send your form, via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tiring form searches, or errors that necessitate printing additional document copies. airSlate SignNow addresses your document management requirements in just a few clicks from any device of your choice. Adjust and electronically sign W3pr while ensuring effective communication at every stage of the form creation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instrucciones para elformulario w 3pr instructions for form w 3pr instrucciones para elformulario w 3pr instructions for

How to generate an eSignature for your 2019 Instrucciones Para Elformulario W 3pr Instructions For Form W 3pr Instrucciones Para Elformulario W 3pr Instructions For online

How to create an electronic signature for your 2019 Instrucciones Para Elformulario W 3pr Instructions For Form W 3pr Instrucciones Para Elformulario W 3pr Instructions For in Google Chrome

How to make an electronic signature for signing the 2019 Instrucciones Para Elformulario W 3pr Instructions For Form W 3pr Instrucciones Para Elformulario W 3pr Instructions For in Gmail

How to create an electronic signature for the 2019 Instrucciones Para Elformulario W 3pr Instructions For Form W 3pr Instrucciones Para Elformulario W 3pr Instructions For straight from your smartphone

How to generate an eSignature for the 2019 Instrucciones Para Elformulario W 3pr Instructions For Form W 3pr Instrucciones Para Elformulario W 3pr Instructions For on iOS

How to create an electronic signature for the 2019 Instrucciones Para Elformulario W 3pr Instructions For Form W 3pr Instrucciones Para Elformulario W 3pr Instructions For on Android devices

People also ask

-

What is the w3pr 2019 form and why is it important?

The w3pr 2019 form is a crucial document for reporting your annual income to the IRS. It consolidates information from multiple W-2 forms, ensuring accurate tax reporting. Using airSlate SignNow, you can easily eSign and manage your w3pr 2019 form securely and efficiently.

-

How can airSlate SignNow help with the w3pr 2019 form?

airSlate SignNow offers an intuitive platform to create, send, and eSign your w3pr 2019 form effortlessly. With features like templates and automated workflows, you can streamline the entire process of handling important tax documents in a secure environment.

-

Is there a cost associated with using airSlate SignNow for the w3pr 2019 form?

Yes, while airSlate SignNow offers various pricing plans, the cost is often offset by the time and resources saved in managing your w3pr 2019 form. The platform provides great value with features tailored specifically for efficient document handling, making it a cost-effective solution.

-

What features does airSlate SignNow offer for eSigning the w3pr 2019 form?

airSlate SignNow includes features like customizable templates, automatic reminders, and multi-user collaboration, making it ideal for eSigning the w3pr 2019 form. These functionalities ensure that you can complete and send your documents quickly while maintaining professionalism.

-

Can I integrate airSlate SignNow with other applications for the w3pr 2019 form?

Absolutely! airSlate SignNow seamlessly integrates with various applications such as Google Drive, Dropbox, and various accounting software. This allows for easy access and management of your w3pr 2019 form, enhancing your overall workflow.

-

How secure is airSlate SignNow when handling the w3pr 2019 form?

Security is a top priority at airSlate SignNow. The platform employs advanced encryption and secure cloud storage, ensuring that your w3pr 2019 form is protected from unauthorized access, so you can focus on what matters most.

-

Can I access my w3pr 2019 form from multiple devices?

Yes, airSlate SignNow is designed for accessibility across all devices. You can access and manage your w3pr 2019 form from your desktop, tablet, or mobile phone, making it convenient to work on your documents anytime, anywhere.

Get more for W3pr

Find out other W3pr

- How Do I eSignature Nevada Articles of Incorporation Template

- How Do I eSignature New Mexico Articles of Incorporation Template

- How To Electronic signature Georgia Home lease agreement

- Can I Electronic signature South Carolina Home lease agreement

- Can I Electronic signature Wisconsin Home lease agreement

- How To Electronic signature Rhode Island Generic lease agreement

- How Can I eSignature Florida Car Lease Agreement Template

- How To eSignature Indiana Car Lease Agreement Template

- How Can I eSignature Wisconsin Car Lease Agreement Template

- Electronic signature Tennessee House rent agreement format Myself

- How To Electronic signature Florida House rental agreement

- eSignature Connecticut Retainer Agreement Template Myself

- How To Electronic signature Alaska House rental lease agreement

- eSignature Illinois Retainer Agreement Template Free

- How Do I Electronic signature Idaho Land lease agreement

- Electronic signature Illinois Land lease agreement Fast

- eSignature Minnesota Retainer Agreement Template Fast

- Electronic signature Louisiana Land lease agreement Fast

- How Do I eSignature Arizona Attorney Approval

- How Can I eSignature North Carolina Retainer Agreement Template