8814 Form

What is the 8814 Form

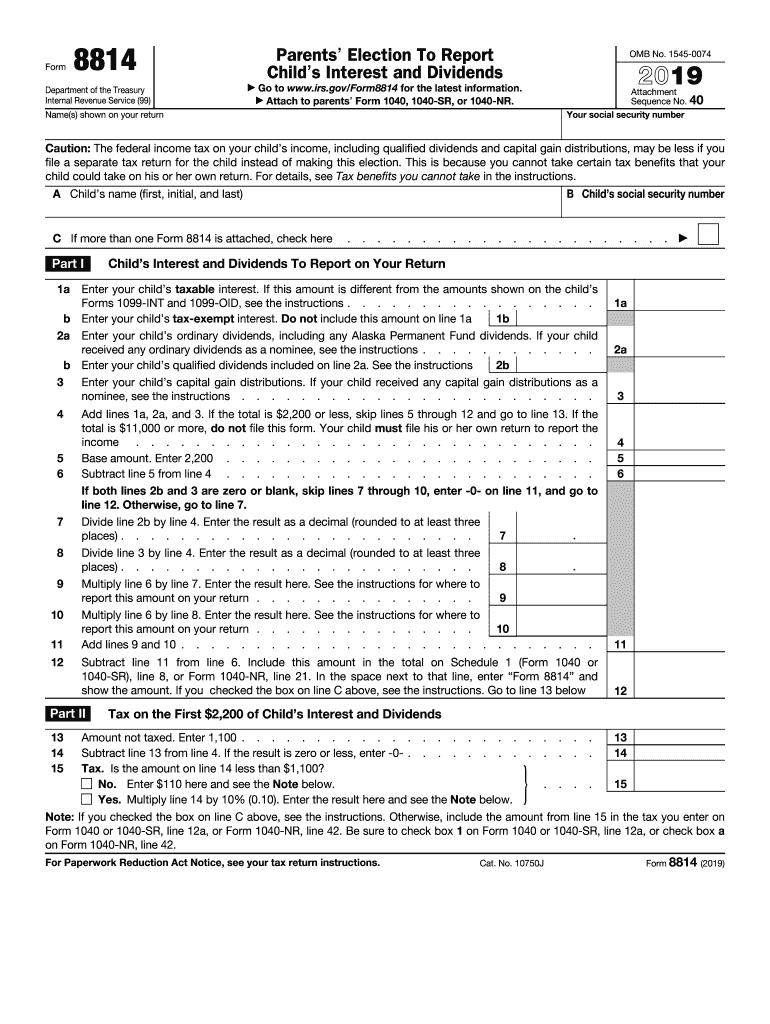

The 8814 Form, officially known as IRS Form 8814, is a tax document used by parents to report their child's unearned income on their tax return. This form is particularly relevant for children under the age of 19 or full-time students under the age of 24 who have unearned income exceeding a specific threshold. The form allows parents to include their child's income on their own tax return, simplifying the process and potentially reducing the overall tax liability.

How to use the 8814 Form

Using the 8814 Form involves several key steps. First, parents must gather information about their child's unearned income, which may include interest, dividends, or capital gains. Next, they will need to complete the form by entering the child's income details and other required information. Once completed, the form should be attached to the parent's tax return when filing. It is important to ensure that all information is accurate to avoid potential issues with the IRS.

Steps to complete the 8814 Form

Completing the 8814 Form requires careful attention to detail. Here are the steps to follow:

- Gather all necessary financial documents related to your child's unearned income.

- Fill in the child's name, Social Security number, and other identifying information at the top of the form.

- Report the total amount of unearned income in the appropriate sections.

- Calculate any applicable tax using the provided instructions.

- Sign and date the form before submitting it with your tax return.

IRS Guidelines

The IRS provides specific guidelines for using Form 8814. These guidelines outline eligibility criteria, income thresholds, and instructions for completing the form. It is essential to review these guidelines to ensure compliance with tax regulations. Understanding these rules can help prevent errors and ensure that the form is processed smoothly by the IRS.

Filing Deadlines / Important Dates

Filing deadlines for Form 8814 align with the general tax filing deadlines set by the IRS. Typically, individual tax returns are due on April 15 of each year. However, if this date falls on a weekend or holiday, the deadline may be extended. It is crucial to stay informed about these dates to avoid penalties and ensure timely submission of the tax return and the 8814 Form.

Key elements of the 8814 Form

Key elements of the 8814 Form include sections for reporting the child's income, calculating taxes owed, and providing necessary personal information. The form also includes instructions for determining eligibility and specific income thresholds. Understanding these elements is vital for accurate completion and compliance with IRS requirements.

Quick guide on how to complete 2019 form 8814 parents election to report childs interest and dividends

Effortlessly manage 8814 Form on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed documents, allowing you to locate the correct form and safely store it online. airSlate SignNow provides all the tools necessary to quickly create, edit, and eSign your documents without delays. Manage 8814 Form on any device with airSlate SignNow's Android or iOS applications and streamline any document-related workflow today.

How to edit and eSign 8814 Form with ease

- Locate 8814 Form and click on Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or redact sensitive information using tools specifically provided by airSlate SignNow for that purpose.

- Generate your eSignature with the Sign tool, which takes just seconds and has the same legal validity as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious document searches, or mistakes that necessitate reprinting new copies. airSlate SignNow addresses all your document management needs within a few clicks from any device you prefer. Modify and eSign 8814 Form and ensure clear communication throughout the document preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8814 parents election to report childs interest and dividends

How to make an electronic signature for your 2019 Form 8814 Parents Election To Report Childs Interest And Dividends online

How to create an eSignature for your 2019 Form 8814 Parents Election To Report Childs Interest And Dividends in Google Chrome

How to create an electronic signature for signing the 2019 Form 8814 Parents Election To Report Childs Interest And Dividends in Gmail

How to make an electronic signature for the 2019 Form 8814 Parents Election To Report Childs Interest And Dividends straight from your mobile device

How to generate an eSignature for the 2019 Form 8814 Parents Election To Report Childs Interest And Dividends on iOS

How to make an electronic signature for the 2019 Form 8814 Parents Election To Report Childs Interest And Dividends on Android devices

People also ask

-

What is the 8814 Form and how can airSlate SignNow help?

The 8814 Form is used by parents to report the income of their child on their tax return. With airSlate SignNow, you can easily create, send, and eSign the 8814 Form, making the process simple and efficient. Our platform streamlines document management, ensuring that your tax paperwork is handled securely and quickly.

-

Is there a cost associated with using airSlate SignNow for the 8814 Form?

Yes, airSlate SignNow offers various pricing plans to accommodate your needs, even for tasks like filling out the 8814 Form. Our plans are designed to be cost-effective, providing you with the tools you need for seamless document signing and management. You can choose a plan that fits your budget and requirements.

-

What features does airSlate SignNow offer for the 8814 Form?

airSlate SignNow provides a range of features for the 8814 Form, including customizable templates, eSignature capabilities, and secure cloud storage. These features ensure that you can efficiently complete and manage your tax documents while maintaining compliance and security. Plus, you can track the status of your forms in real-time.

-

How does airSlate SignNow ensure the security of the 8814 Form?

Security is a priority for airSlate SignNow when handling the 8814 Form and all sensitive documents. We use advanced encryption methods and secure servers to protect your information. Additionally, our platform complies with industry standards to ensure your data remains confidential and safe throughout the signing process.

-

Can I integrate airSlate SignNow with other software for handling the 8814 Form?

Absolutely! airSlate SignNow offers integrations with various business applications, making it easy to incorporate the 8814 Form into your existing workflows. Whether you use CRM systems, cloud storage, or productivity tools, our platform can connect seamlessly to enhance your document management experience.

-

What are the benefits of using airSlate SignNow for tax forms like the 8814 Form?

Using airSlate SignNow to handle the 8814 Form offers several benefits, including time savings, improved accuracy, and enhanced collaboration. The ability to eSign documents eliminates the hassle of printing and mailing, allowing for quicker processing. Additionally, our platform helps reduce errors by providing guided templates and automatic form filling.

-

Is airSlate SignNow user-friendly for completing the 8814 Form?

Yes, airSlate SignNow is designed to be user-friendly, making it easy for anyone to complete the 8814 Form without prior experience. Our intuitive interface guides users through the process, ensuring that you can efficiently fill out and eSign your documents. You’ll find all the tools you need at your fingertips.

Get more for 8814 Form

Find out other 8814 Form

- Help Me With eSignature Tennessee Banking PDF

- How Can I eSignature Virginia Banking PPT

- How Can I eSignature Virginia Banking PPT

- Can I eSignature Washington Banking Word

- Can I eSignature Mississippi Business Operations Document

- How To eSignature Missouri Car Dealer Document

- How Can I eSignature Missouri Business Operations PPT

- How Can I eSignature Montana Car Dealer Document

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document