Form 8867

What is the Form 8867

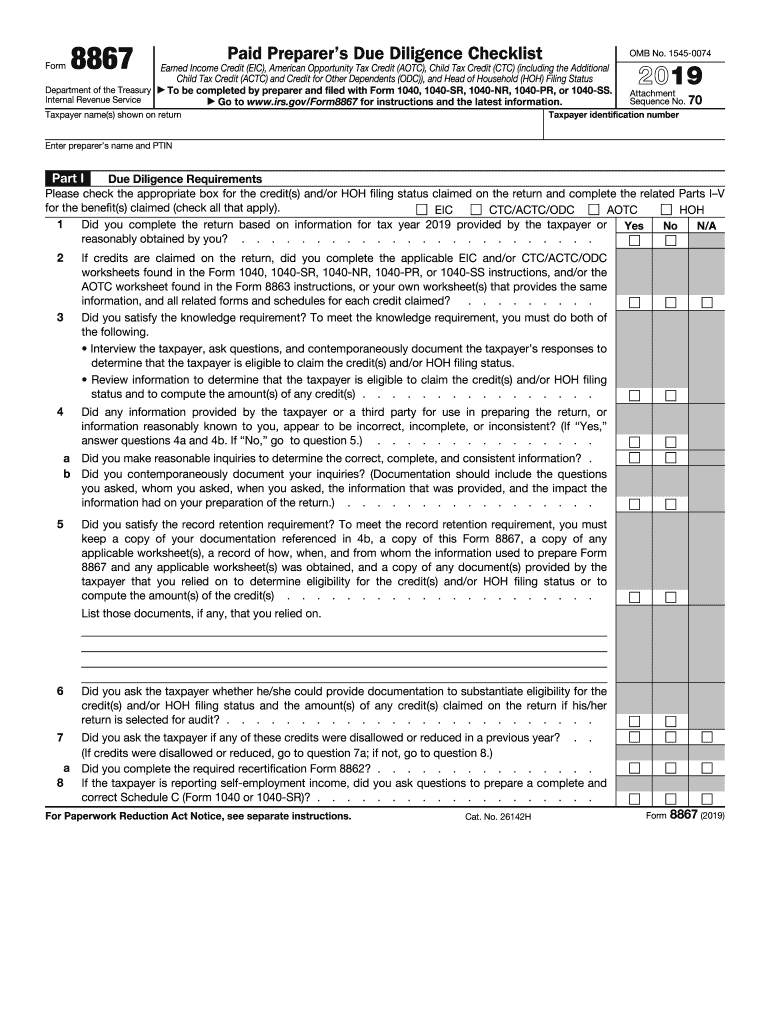

The Form 8867, also known as the Paid Preparer's Due Diligence Checklist, is a crucial document used by tax preparers to ensure compliance with the Earned Income Credit (EIC) requirements. This form is specifically designed to help preparers verify eligibility for the EIC and other related credits. By completing this form, tax professionals affirm that they have met the necessary due diligence requirements when preparing a client's tax return. The 8867 credit for 2019 is essential for ensuring that taxpayers receive the credits they are entitled to while adhering to IRS regulations.

Steps to complete the Form 8867

Completing the Form 8867 involves several key steps to ensure accuracy and compliance. First, gather all necessary documentation from the taxpayer, including income statements, Social Security numbers, and any other relevant information. Next, carefully review the eligibility criteria for the EIC and other credits. Fill out the form by answering each question accurately, ensuring that all required fields are completed. After completing the form, review it for any errors or omissions before submitting it with the tax return. This meticulous approach helps avoid potential penalties associated with non-compliance.

Key elements of the Form 8867

The Form 8867 includes several critical elements that tax preparers must address. These elements consist of questions related to the taxpayer's eligibility for the EIC, the amount of income, and the number of qualifying children. Additionally, the form requires preparers to confirm that they have reviewed the necessary documentation and that they understand the eligibility requirements. Each section of the form is designed to guide preparers through the due diligence process, ensuring that they collect and verify all pertinent information before filing the tax return.

IRS Guidelines

The IRS provides specific guidelines regarding the use of Form 8867. Tax preparers are required to complete this form for clients claiming the EIC, and failure to do so can result in penalties. The IRS outlines the due diligence requirements that preparers must follow, including maintaining records of the information used to complete the form. It is essential for preparers to stay informed about any updates to IRS guidelines to ensure compliance and avoid potential issues during audits or reviews.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the Form 8867 is critical for tax preparers. Typically, the form must be submitted along with the taxpayer's tax return by the filing deadline, which is usually April fifteenth. However, if the taxpayer is filing for an extension, the form must still be completed and submitted by the extended deadline. Being aware of these important dates helps ensure that all necessary documentation is submitted on time, reducing the risk of penalties for late filing.

Penalties for Non-Compliance

Tax preparers who fail to comply with the requirements of Form 8867 may face significant penalties. The IRS imposes fines for each failure to meet due diligence requirements, which can accumulate quickly. Additionally, if a taxpayer claims the EIC without proper documentation, they may be subject to audits and potential disallowance of the credit. It is vital for preparers to understand these risks and take the necessary steps to ensure compliance when using the Form 8867.

Quick guide on how to complete 2019 form 8867 paid preparers due diligence checklist

Complete Form 8867 effortlessly on any device

Online document management has gained popularity among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can access the correct form and securely keep it online. airSlate SignNow equips you with all the tools necessary to create, modify, and eSign your files quickly and without delays. Manage Form 8867 on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign Form 8867 smoothly

- Locate Form 8867 and click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize pertinent sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the details and click on the Done button to save your modifications.

- Select how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your PC.

Eliminate the concerns of lost or misfiled documents, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management needs in just a few clicks from any device you choose. Modify and eSign Form 8867 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 8867 paid preparers due diligence checklist

How to make an eSignature for the 2019 Form 8867 Paid Preparers Due Diligence Checklist in the online mode

How to create an electronic signature for your 2019 Form 8867 Paid Preparers Due Diligence Checklist in Google Chrome

How to create an eSignature for putting it on the 2019 Form 8867 Paid Preparers Due Diligence Checklist in Gmail

How to make an eSignature for the 2019 Form 8867 Paid Preparers Due Diligence Checklist straight from your smart phone

How to create an electronic signature for the 2019 Form 8867 Paid Preparers Due Diligence Checklist on iOS devices

How to make an electronic signature for the 2019 Form 8867 Paid Preparers Due Diligence Checklist on Android

People also ask

-

What is the eic worksheet 2019 and how can I use it with airSlate SignNow?

The eic worksheet 2019 is a document designed to help businesses and individuals calculate the Earned Income Credit for tax purposes. With airSlate SignNow, you can easily upload, edit, and eSign the eic worksheet 2019, streamlining your tax filing process.

-

What are the pricing options for using airSlate SignNow with the eic worksheet 2019?

AirSlate SignNow offers flexible pricing plans that cater to different business needs. Whether you are a freelancer or a large enterprise, our plans include features that support the use of documents like the eic worksheet 2019 at a cost-effective rate.

-

Can I integrate the eic worksheet 2019 with other software using airSlate SignNow?

Yes, airSlate SignNow provides seamless integrations with various software applications, allowing you to link the eic worksheet 2019 with your preferred tools. This feature helps enhance productivity and keeps your workflow efficient.

-

What features does airSlate SignNow provide for managing the eic worksheet 2019?

AirSlate SignNow includes robust features like document editing, secure eSigning, and automated workflows specifically for managing documents including the eic worksheet 2019. These features ensure that your documents are handled efficiently and securely.

-

How secure is airSlate SignNow when handling the eic worksheet 2019?

Security is a top priority at airSlate SignNow. We use advanced encryption methods and compliance with industry standards to ensure that your documents, including the eic worksheet 2019, are protected throughout the signing process.

-

Can I track the status of my eic worksheet 2019 when using airSlate SignNow?

Absolutely! AirSlate SignNow offers real-time tracking of your documents. You can easily monitor the status of your eic worksheet 2019, receive notifications when it's opened, signed, and finalized.

-

Is airSlate SignNow user-friendly for eSigning the eic worksheet 2019?

Yes, airSlate SignNow is designed with user experience in mind. The platform is intuitive, allowing users of all technical skill levels to easily eSign the eic worksheet 2019 in just a few clicks, making it accessible for everyone.

Get more for Form 8867

Find out other Form 8867

- eSign Finance & Tax Accounting Form Texas Now

- eSign Vermont Finance & Tax Accounting Emergency Contact Form Simple

- eSign Delaware Government Stock Certificate Secure

- Can I eSign Vermont Finance & Tax Accounting Emergency Contact Form

- eSign Washington Finance & Tax Accounting Emergency Contact Form Safe

- How To eSign Georgia Government Claim

- How Do I eSign Hawaii Government Contract

- eSign Hawaii Government Contract Now

- Help Me With eSign Hawaii Government Contract

- eSign Hawaii Government Contract Later

- Help Me With eSign California Healthcare / Medical Lease Agreement

- Can I eSign California Healthcare / Medical Lease Agreement

- How To eSign Hawaii Government Bill Of Lading

- How Can I eSign Hawaii Government Bill Of Lading

- eSign Hawaii Government Promissory Note Template Now

- eSign Hawaii Government Work Order Online

- eSign Delaware Healthcare / Medical Living Will Now

- eSign Healthcare / Medical Form Florida Secure

- eSign Florida Healthcare / Medical Contract Safe

- Help Me With eSign Hawaii Healthcare / Medical Lease Termination Letter