3300 9 1980-2026

What is the 3300 9

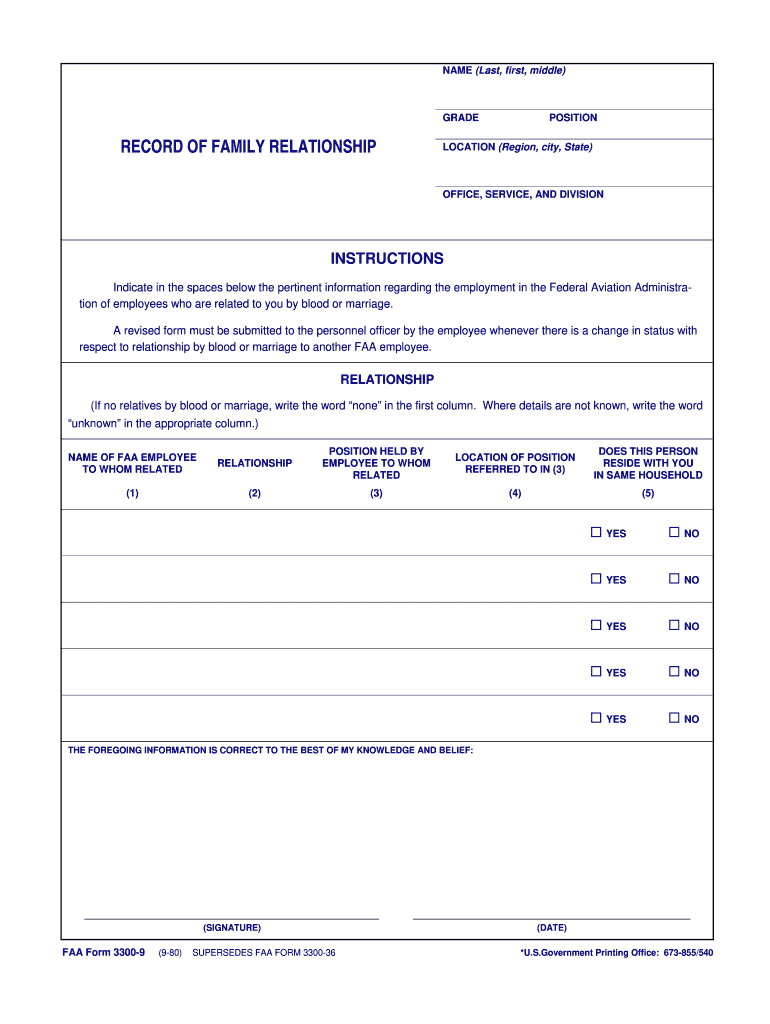

The 3300 9 form, also known as the FAA Form 3300-9, is a document used within the aviation industry, primarily for reporting family relationships in the context of FAA regulations. This form is essential for individuals seeking to establish or clarify familial connections related to aviation credentials, ensuring compliance with federal requirements. Understanding this form is crucial for those involved in the aviation sector, as it plays a significant role in maintaining accurate records and fulfilling legal obligations.

How to use the 3300 9

Using the 3300 9 form involves several straightforward steps. First, ensure you have the most recent version of the form, as outdated documents may not be accepted. Next, fill out the required fields with accurate information regarding family relationships. This may include names, dates of birth, and relevant identification numbers. After completing the form, review it carefully to ensure all information is correct before submission. It is important to follow the specific guidelines provided by the FAA to avoid delays or rejections.

Steps to complete the 3300 9

Completing the 3300 9 form requires attention to detail. Here are the steps to follow:

- Obtain the latest version of the form from a reliable source.

- Provide personal information, including your name and contact details.

- Detail the family relationships being reported, ensuring all names and relationships are accurately described.

- Double-check all entries for accuracy and completeness.

- Sign and date the form where required.

- Submit the completed form according to the instructions provided by the FAA.

Legal use of the 3300 9

The legal use of the 3300 9 form is critical in ensuring compliance with FAA regulations. This form serves as an official document that verifies family relationships, which can impact various aviation-related applications, such as pilot certifications or aircraft ownership. It is essential to use this form correctly to avoid potential legal issues or complications in the processing of aviation credentials. Familiarizing oneself with the legal implications of this form can help individuals navigate the regulatory landscape more effectively.

Who Issues the Form

The 3300 9 form is issued by the Federal Aviation Administration (FAA), the governing body responsible for regulating civil aviation in the United States. The FAA provides guidelines and resources for individuals needing to complete this form, ensuring that users have access to the necessary information for compliance. Understanding the role of the FAA in issuing this form can help users appreciate the importance of accurate and timely submissions.

Required Documents

When completing the 3300 9 form, certain documents may be required to support the information provided. These documents can include:

- Proof of identity, such as a driver's license or passport.

- Birth certificates or other official documents that establish family relationships.

- Any previous FAA correspondence related to the individual’s aviation credentials.

Gathering these documents in advance can streamline the completion process and ensure all necessary information is readily available.

Quick guide on how to complete 3300 9 form

Discover the simplest method to complete and sign your 3300 9

Are you still spending time preparing your official paperwork on paper instead of doing it electronically? airSlate SignNow provides a superior way to finish and sign your 3300 9 and associated forms for public services. Our intelligent eSignature solution equips you with everything required to manage documents swiftly and in compliance with official standards - robust PDF editing, handling, securing, signing, and sharing tools all readily available within an intuitive interface.

Only a few steps are necessary to fill out and sign your 3300 9:

- Upload the editable template to the editor using the Get Form button.

- Review what details you need to enter in your 3300 9.

- Move between the fields using the Next option to ensure nothing is missed.

- Utilize Text, Check, and Cross tools to fill in the sections with your details.

- Modify the content with Text boxes or Images from the top toolbar.

- Emphasize what is important or Obscure sections that are no longer relevant.

- Click on Sign to generate a legally binding eSignature using any method you prefer.

- Include the Date beside your signature and finish your task with the Done button.

Store your finalized 3300 9 in the Documents folder within your account, download it, or transfer it to your chosen cloud storage. Our solution also offers versatile form sharing. There’s no need to print your forms when you need to send them to the appropriate public office - do it via email, fax, or by requesting a USPS “snail mail” delivery from your account. Try it out today!

Create this form in 5 minutes or less

FAQs

-

How do I fill a W-9 Tax Form out?

Download a blank Form W-9To get started, download the latest Form W-9 from the IRS website at https://www.irs.gov/pub/irs-pdf/.... Check the date in the top left corner of the form as it is updated occasionally by the IRS. The current revision should read (Rev. December 2014). Click anywhere on the form and a menu appears at the top that will allow you to either print or save the document. If the browser you are using doesn’t allow you to type directly into the W-9 then save the form to your desktop and reopen using signNow Reader.General purposeThe general purpose of Form W-9 is to provide your correct taxpayer identification number (TIN) to an individual or entity (typically a company) that is required to submit an “information return” to the IRS to report an amount paid to you, or other reportable amount.U.S. personForm W-9 should only be completed by what the IRS calls a “U.S. person”. Some examples of U.S. persons include an individual who is a U.S. citizen or a U.S. resident alien. Partnerships, corporations, companies, or associations created or organized in the United States or under the laws of the United States are also U.S. persons.If you are not a U.S. person you should not use this form. You will likely need to provide Form W-8.Enter your informationLine 1 – Name: This line should match the name on your income tax return.Line 2 – Business name: This line is optional and would include your business name, trade name, DBA name, or disregarded entity name if you have any of these. You only need to complete this line if your name here is different from the name on line 1. See our related blog, What is a disregarded entity?Line 3 – Federal tax classification: Check ONE box for your U.S. federal tax classification. This should be the tax classification of the person or entity name that is entered on line 1. See our related blog, What is the difference between an individual and a sole proprietor?Limited Liability Company (LLC). If the name on line 1 is an LLC treated as a partnership for U.S. federal tax purposes, check the “Limited liability company” box and enter “P” in the space provided. If the LLC has filed Form 8832 or 2553 to be taxed as a corporation, check the “Limited liability company” box and in the space provided enter “C” for C corporation or “S” for S corporation. If it is a single-member LLC that is a disregarded entity, do not check the “Limited liability company” box; instead check the first box in line 3 “Individual/sole proprietor or single-member LLC.” See our related blog, What tax classification should an LLC select?Other (see instructions) – This line should be used for classifications that are not listed such as nonprofits, governmental entities, etc.Line 4 – Exemptions: If you are exempt from backup withholding enter your exempt payee code in the first space. If you are exempt from FATCA reporting enter your exemption from FATCA reporting code in the second space. Generally, individuals (including sole proprietors) are not exempt from backup withholding. See the “Specific Instructions” for line 4 shown with Form W-9 for more detailed information on exemptions.Line 5 – Address: Enter your address (number, street, and apartment or suite number). This is where the requester of the Form W-9 will mail your information returns.Line 6 – City, state and ZIP: Enter your city, state and ZIP code.Line 7 – Account numbers: This is an optional field to list your account number(s) with the company requesting your W-9 such as a bank, brokerage or vendor. We recommend that you do not list any account numbers as you may have to provide additional W-9 forms for accounts you do not include.Requester’s name and address: This is an optional section you can use to record the requester’s name and address you sent your W-9 to.Part I – Taxpayer Identification Number (TIN): Enter in your taxpayer identification number here. This is typically a social security number for an individual or sole proprietor and an employer identification number for a company. See our blog, What is a TIN number?Part II – Certification: Sign and date your form.For additional information visit w9manager.com.

-

Why did my employer give me a W-9 Form to fill out instead of a W-4 Form?

I wrote about the independent-contractor-vs-employee issue last year, see http://nctaxpro.wordpress.com/20...Broadly speaking, you are an employee when someone else - AKA the employer - has control over when and where you work and the processes by which you perform the work that you do for that individual. A DJ or bartender under some circumstances, I suppose, might qualify as an independent contractor at a restaurant, but the waitstaff, bus help, hosts, kitchen aides, etc. almost certainly would not.There's always risk in confronting an employer when faced with a situation like yours - my experience is that most employers know full well that they are violating the law when they treat employees as independent contractors, and for that reason they don't tolerate questions about that policy very well - so you definitely should tread cautiously if you want to keep this position. Nonetheless, I think you owe it to yourself to ask whether or not the restaurant intends to withhold federal taxes from your checks - if for no other reason than you don't want to get caught short when it comes to filing your own return, even if you don't intend to challenge the policy.

-

I received my late husband's W-9 form to fill out for what I believe were our stocks. How am I supposed to fill this out or am I even supposed to?

You do not sound as a person who handles intricasies of finances on daily basis, this is why you should redirect the qustion to your family’s tax professional who does hte filings for you.The form itself, W-9 form, is a form created and approved by the IRS, if that’s your only inquiry.Whether the form applies to you or to your husband’s estate - that’s something only a person familiar with the situation would tell you about; there is no generic answer to this.

-

Why does my property management ask me to fill out a W-9 form?

To collect data on you in case they want to sue you and enforce a judgment.If the management co is required to pay inerest on security deposits then they need to account to ou for that interest income.If you are in a coop or condo they may apportion tax benefits or capital costs to you for tax purposes.

-

Do I need to fill out Form W-9 (US non-resident alien with an LLC in the US)?

A single-member LLC is by default a disregarded entity. Assuming you have not made a “check-the-box” election to have it treated as a corporation, this means for tax purposes, you are a sole proprietor.As a non-resident alien, you would not complete form W-9. You would likely provide form W-8ECI; possibly W-8BEN.

Create this form in 5 minutes!

How to create an eSignature for the 3300 9 form

How to generate an eSignature for the 3300 9 Form in the online mode

How to generate an electronic signature for the 3300 9 Form in Google Chrome

How to create an eSignature for signing the 3300 9 Form in Gmail

How to generate an eSignature for the 3300 9 Form straight from your smart phone

How to create an electronic signature for the 3300 9 Form on iOS

How to create an eSignature for the 3300 9 Form on Android OS

People also ask

-

What is the 3300 9 plan offered by airSlate SignNow?

The 3300 9 plan by airSlate SignNow is a comprehensive eSignature solution designed for businesses seeking efficiency and cost-effectiveness. It includes features such as unlimited document signing, templates, and advanced integrations, making it ideal for teams of various sizes. With the 3300 9 plan, users can streamline their document workflows effortlessly.

-

How much does the 3300 9 plan cost?

The pricing for the 3300 9 plan is competitive and tailored to suit the needs of businesses looking for an affordable eSignature solution. For detailed pricing information, it's best to visit the airSlate SignNow website or contact their sales team for a personalized quote. This ensures that you receive the best value tailored to your specific requirements.

-

What features are included in the 3300 9 plan?

The 3300 9 plan offers a variety of powerful features, including unlimited document signings, customizable templates, and robust security measures. Additionally, users can benefit from real-time tracking and notifications, making it easier to manage document workflows. This plan is designed to enhance productivity and simplify the signing process for businesses.

-

Can I integrate the 3300 9 plan with other software?

Yes, the 3300 9 plan allows for seamless integration with various popular business applications such as Salesforce, Google Workspace, and Zapier. This flexibility enables businesses to streamline their workflows by automating processes and ensuring that all tools work together efficiently. The integration capabilities are one of the key benefits of choosing the 3300 9 plan.

-

What are the benefits of using the 3300 9 plan for my business?

Utilizing the 3300 9 plan can signNowly enhance your business operations by reducing the time spent on document management. It empowers teams to send and eSign documents quickly and securely, leading to faster transaction times and improved customer satisfaction. Moreover, the cost-effective nature of this plan makes it an excellent choice for businesses seeking to optimize their resources.

-

Is the 3300 9 plan suitable for small businesses?

Absolutely! The 3300 9 plan is designed to cater to businesses of all sizes, including small enterprises. Its user-friendly interface and affordable pricing make it an ideal choice for small businesses looking to improve their document signing processes without incurring high costs. This plan can help streamline operations while maintaining professionalism.

-

How secure is the 3300 9 plan for document signing?

The 3300 9 plan prioritizes security with features such as encryption, secure cloud storage, and compliance with major regulations like GDPR and HIPAA. airSlate SignNow ensures that your documents are protected throughout the signing process, giving you peace of mind when handling sensitive information. The platform is built to keep your data safe and secure.

Get more for 3300 9

- Form 9423 2010

- What is new dection about 212a3b form

- Ndot ms4 nv0023329 2010 permit form

- Death certificate format in hindi

- Admission form for examination of pharmacy technician supplementary

- Rula smart form

- Bereavement leave claim form for reimbursement from fringe reserve cfao

- Jury duty claim form for reimbursement fom fringe reserve

Find out other 3300 9

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer

- Electronic signature Colorado Charity Promissory Note Template Simple

- Electronic signature Alabama Construction Quitclaim Deed Free

- Electronic signature Alaska Construction Lease Agreement Template Simple

- Electronic signature Construction Form Arizona Safe

- Electronic signature Kentucky Charity Living Will Safe

- Electronic signature Construction Form California Fast

- Help Me With Electronic signature Colorado Construction Rental Application

- Electronic signature Connecticut Construction Business Plan Template Fast

- Electronic signature Delaware Construction Business Letter Template Safe

- Electronic signature Oklahoma Business Operations Stock Certificate Mobile