M 3 Form

What is the M-3?

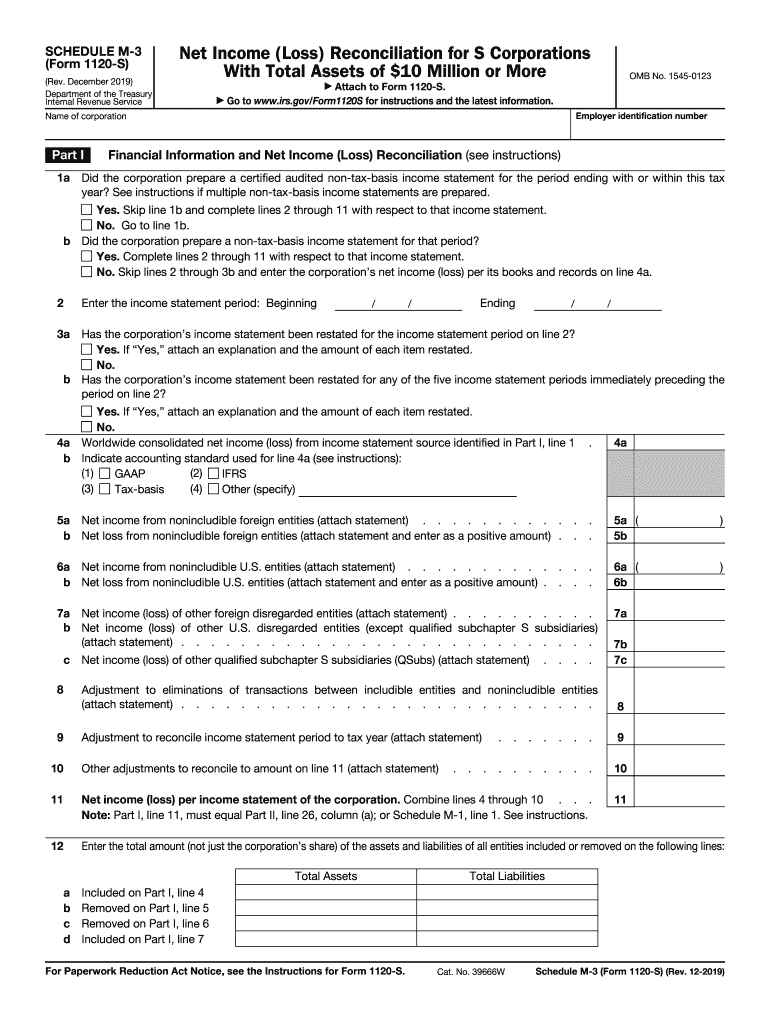

The M-3, or Schedule M-3, is a form used by corporations to report their financial information to the Internal Revenue Service (IRS). Specifically designed for C corporations, the M-3 provides a detailed breakdown of income, deductions, and other relevant financial data. This form is essential for accurately calculating the corporation's taxable income and ensures compliance with federal tax regulations. Unlike simpler forms, the M-3 offers a comprehensive view of a corporation's financial activities, making it crucial for tax reporting.

How to Use the M-3

To effectively use the M-3, corporations must first gather all necessary financial documents, including income statements and balance sheets. The form requires detailed entries about various income sources and deductions. Each section of the M-3 corresponds to specific financial data, such as adjusted total assets and other adjustments. It is vital to complete each section accurately to avoid discrepancies that could lead to audits or penalties. Corporations should also ensure they are familiar with the IRS guidelines regarding the M-3 to facilitate proper completion.

Steps to Complete the M-3

Completing the M-3 involves several key steps:

- Gather financial statements, including income and balance sheets.

- Review IRS instructions for the M-3 to understand required information.

- Fill out the form, ensuring all sections are completed accurately.

- Double-check entries for accuracy, particularly in income and deductions.

- Submit the completed M-3 along with the corporate tax return.

Following these steps helps ensure compliance and reduces the risk of errors that could lead to penalties.

Filing Deadlines / Important Dates

The filing deadline for the M-3 typically aligns with the corporate tax return due date. For most corporations, this is the fifteenth day of the fourth month following the end of the tax year. For example, if a corporation's tax year ends on December 31, the M-3 must be filed by April 15 of the following year. It is essential for corporations to be aware of these deadlines to avoid late fees and ensure timely compliance with IRS regulations.

IRS Guidelines

The IRS provides specific guidelines for completing and submitting the M-3. These guidelines include detailed instructions on what information is required, how to report various types of income and deductions, and the importance of accuracy in reporting. Corporations should refer to the latest IRS publications related to the M-3 for updates and changes in reporting requirements. Adhering to these guidelines is crucial for maintaining compliance and avoiding potential audits.

Legal Use of the M-3

The M-3 is legally required for corporations that meet specific criteria, such as those with total assets exceeding a certain threshold. Using the M-3 correctly ensures that corporations fulfill their legal obligations to report financial information accurately. Failure to file the M-3 or submitting inaccurate information can result in penalties, including fines and interest on unpaid taxes. Therefore, understanding the legal implications of the M-3 is essential for corporate compliance.

Quick guide on how to complete about schedule m 3 form 1120 s net income loss

Easily Prepare M 3 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It serves as an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to access the correct form and safely store it online. airSlate SignNow provides all the necessary tools to create, edit, and electronically sign your documents swiftly without unnecessary delays. Handle M 3 on any device using airSlate SignNow's Android or iOS applications and enhance your document-related processes today.

How to Edit and Electronically Sign M 3 Effortlessly

- Locate M 3 and click on Get Form to begin.

- Utilize the tools we provide to fill out your document.

- Mark essential sections of your documents or obscure sensitive details with tools specifically designed by airSlate SignNow for that purpose.

- Create your signature using the Sign feature, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Verify the details and click on the Done button to save your changes.

- Select your preferred method for delivering your form, whether via email, text message (SMS), invitation link, or download it to your computer.

Eliminate the worries of lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your chosen device. Edit and electronically sign M 3 and ensure seamless communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about schedule m 3 form 1120 s net income loss

How to generate an electronic signature for your About Schedule M 3 Form 1120 S Net Income Loss in the online mode

How to generate an electronic signature for your About Schedule M 3 Form 1120 S Net Income Loss in Chrome

How to generate an eSignature for putting it on the About Schedule M 3 Form 1120 S Net Income Loss in Gmail

How to generate an eSignature for the About Schedule M 3 Form 1120 S Net Income Loss straight from your smart phone

How to make an electronic signature for the About Schedule M 3 Form 1120 S Net Income Loss on iOS devices

How to create an electronic signature for the About Schedule M 3 Form 1120 S Net Income Loss on Android OS

People also ask

-

What is the 1120S Schedule M-3, and why is it important?

The 1120S Schedule M-3 is a form used by S corporations to report their financial information to the IRS. It is essential because it provides transparency around the differences between financial accounting income and taxable income. By accurately completing the 1120S Schedule M-3, businesses ensure compliance with tax regulations.

-

How can airSlate SignNow assist with filing the 1120S Schedule M-3?

airSlate SignNow simplifies the process of preparing documents like the 1120S Schedule M-3 by offering a user-friendly platform for eSigning and document management. With SignNow, you can easily collaborate on important tax documents, ensuring that all necessary parties can review and sign them promptly. This streamlines your workflow and helps you meet critical deadlines.

-

What features does airSlate SignNow offer for handling tax documents?

airSlate SignNow includes features such as customizable templates, in-app integrations, and secure eSigning capabilities specifically for tax documentation like the 1120S Schedule M-3. Users can automate repetitive tasks, track document status, and ensure compliance with legal requirements. This functionality saves time and reduces the risk of errors in filing.

-

Is there a cost associated with using airSlate SignNow for filing the 1120S Schedule M-3?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. The pricing is competitive, and the platform provides excellent value by streamlining document operations like the 1120S Schedule M-3. You can choose a plan that aligns with your company size and the volume of documents you handle.

-

Can I integrate airSlate SignNow with other software for managing my tax documents?

Absolutely! airSlate SignNow offers seamless integrations with popular accounting and tax management software. These integrations support efficient data transfer and make it easier to access the information needed to complete your 1120S Schedule M-3. Using integrated tools enhances your overall productivity.

-

What are the benefits of using airSlate SignNow for tax document management?

Using airSlate SignNow for tax document management, including the 1120S Schedule M-3, allows for faster turnaround times, improved accuracy, and enhanced security. The platform's automation features minimize human error, while its secure eSigning ensures that sensitive information remains protected. Overall, it simplifies the workflow for businesses.

-

Is airSlate SignNow suitable for small businesses filing the 1120S Schedule M-3?

Yes, airSlate SignNow is particularly beneficial for small businesses needing an affordable and efficient solution for filing the 1120S Schedule M-3. The platform's user-friendly interface enables small enterprises to manage tax-related documents without the need for extensive training. It helps to streamline workflow and reduce administrative burdens.

Get more for M 3

Find out other M 3

- Sign Georgia Education Business Plan Template Now

- Sign Louisiana Education Business Plan Template Mobile

- Sign Kansas Education Rental Lease Agreement Easy

- Sign Maine Education Residential Lease Agreement Later

- How To Sign Michigan Education LLC Operating Agreement

- Sign Mississippi Education Business Plan Template Free

- Help Me With Sign Minnesota Education Residential Lease Agreement

- Sign Nevada Education LLC Operating Agreement Now

- Sign New York Education Business Plan Template Free

- Sign Education Form North Carolina Safe

- Sign North Carolina Education Purchase Order Template Safe

- Sign North Dakota Education Promissory Note Template Now

- Help Me With Sign North Carolina Education Lease Template

- Sign Oregon Education Living Will Easy

- How To Sign Texas Education Profit And Loss Statement

- Sign Vermont Education Residential Lease Agreement Secure

- How Can I Sign Washington Education NDA

- Sign Wisconsin Education LLC Operating Agreement Computer

- Sign Alaska Finance & Tax Accounting Purchase Order Template Computer

- Sign Alaska Finance & Tax Accounting Lease Termination Letter Free