Property Tax Homestead Exemptions Georgia Department of Revenue 2023

Understanding Property Tax Homestead Exemptions

The Property Tax Homestead Exemptions offered by the Georgia Department of Revenue provide significant tax relief to homeowners. These exemptions reduce the taxable value of a home, which can lead to lower property taxes. Homeowners must meet specific criteria to qualify for these exemptions, which aim to support those who make Georgia their primary residence. The exemptions can vary based on age, disability status, and other factors, ensuring that assistance is directed to those who need it most.

Eligibility Criteria for Homestead Exemptions

To qualify for the Property Tax Homestead Exemptions in Georgia, applicants must meet several eligibility requirements. Generally, the homeowner must:

- Be the legal owner of the property.

- Use the property as their primary residence.

- Be a resident of Georgia for at least one year prior to applying.

- Provide proof of age or disability status if applying for specific exemptions.

It is essential for applicants to review the specific criteria for each type of exemption to ensure they meet all necessary requirements before applying.

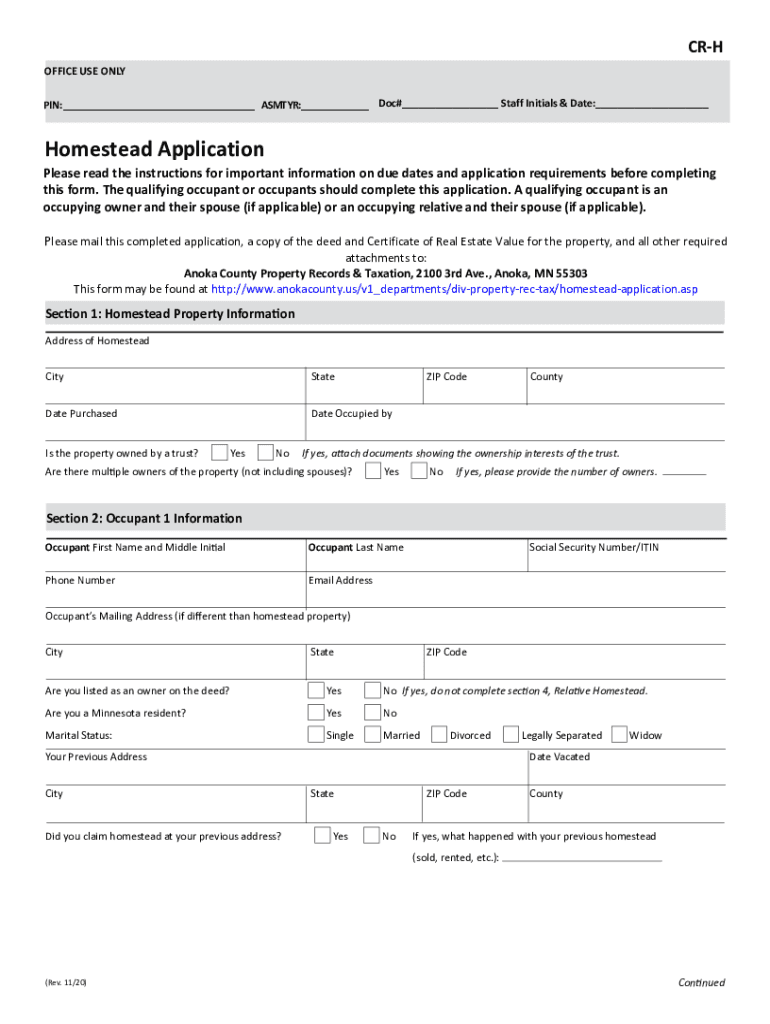

Steps to Complete the Application Process

Applying for Property Tax Homestead Exemptions involves several straightforward steps. Homeowners should follow these guidelines:

- Gather necessary documentation, such as proof of residency and identification.

- Visit the local county tax assessor's office or their website to obtain the application form.

- Complete the application form, ensuring all information is accurate and complete.

- Submit the application by the deadline, which is typically April 1 for the upcoming tax year.

- Await confirmation of approval or any further instructions from the tax office.

Completing these steps accurately can help ensure that homeowners receive the tax relief they are entitled to.

Required Documents for Application

When applying for the Property Tax Homestead Exemptions, homeowners must provide specific documents to support their application. Commonly required documents include:

- A valid Georgia driver's license or state-issued ID.

- Proof of residency, such as a utility bill or lease agreement.

- Documentation of age or disability status if applicable.

- Any prior tax exemption documentation, if applicable.

Having these documents ready can streamline the application process and help avoid delays.

Form Submission Methods

Homeowners can submit their applications for the Property Tax Homestead Exemptions through various methods. These include:

- Online submission via the county tax assessor's website, if available.

- Mailing the completed application form to the local tax assessor's office.

- In-person submission at the county tax assessor's office.

Choosing the most convenient method can help ensure that the application is submitted on time and processed efficiently.

Key Elements of the Exemption Program

The Property Tax Homestead Exemptions program includes several key elements that homeowners should be aware of. These elements encompass:

- The types of exemptions available, including those for seniors, disabled individuals, and veterans.

- The potential savings on property taxes, which can vary based on the exemption type.

- The importance of reapplying for certain exemptions annually, depending on local regulations.

Understanding these elements can help homeowners maximize their benefits and ensure compliance with local tax laws.

Quick guide on how to complete property tax homestead exemptions georgia department of revenue

Easily Prepare Property Tax Homestead Exemptions Georgia Department Of Revenue on Any Device

Managing documents online has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for traditional printed and signed documents, allowing you to access the necessary form and securely store it online. airSlate SignNow equips you with all the tools needed to create, alter, and eSign your documents promptly without delays. Manage Property Tax Homestead Exemptions Georgia Department Of Revenue on any platform with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The Simplest Method to Modify and eSign Property Tax Homestead Exemptions Georgia Department Of Revenue Effortlessly

- Obtain Property Tax Homestead Exemptions Georgia Department Of Revenue and click on Get Form to begin.

- Utilize the tools we provide to complete your form.

- Select important sections of your documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the information and click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies. airSlate SignNow addresses all your document management needs in just a few clicks from your chosen device. Edit and eSign Property Tax Homestead Exemptions Georgia Department Of Revenue while ensuring excellent communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct property tax homestead exemptions georgia department of revenue

Create this form in 5 minutes!

How to create an eSignature for the property tax homestead exemptions georgia department of revenue

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What are Property Tax Homestead Exemptions in Georgia?

Property Tax Homestead Exemptions in Georgia are tax benefits that reduce the taxable value of a primary residence, providing signNow savings for homeowners. These exemptions are administered by the Georgia Department of Revenue and can vary based on factors such as age, disability, and income. Understanding these exemptions can help homeowners maximize their savings.

-

How can I apply for Property Tax Homestead Exemptions in Georgia?

To apply for Property Tax Homestead Exemptions in Georgia, homeowners must complete an application form provided by their local county tax office. The application typically requires proof of residency and may need to be submitted by a specific deadline each year. The Georgia Department of Revenue website offers resources and guidance for the application process.

-

What documents do I need for Property Tax Homestead Exemptions in Georgia?

When applying for Property Tax Homestead Exemptions in Georgia, you will generally need to provide proof of residency, such as a driver's license or utility bill, along with the completed application form. Additional documentation may be required depending on the specific exemption type you are applying for. It's advisable to check with the Georgia Department of Revenue for detailed requirements.

-

Are there any costs associated with applying for Property Tax Homestead Exemptions in Georgia?

Applying for Property Tax Homestead Exemptions in Georgia is typically free of charge. However, homeowners should be aware that there may be fees associated with obtaining necessary documents or records. Always consult the Georgia Department of Revenue for the most accurate and up-to-date information regarding any potential costs.

-

What are the benefits of Property Tax Homestead Exemptions in Georgia?

The benefits of Property Tax Homestead Exemptions in Georgia include reduced property tax bills, which can lead to signNow savings for homeowners. These exemptions can also provide financial relief for seniors, disabled individuals, and low-income families. By taking advantage of these exemptions, homeowners can better manage their finances and invest in their properties.

-

Can I combine multiple Property Tax Homestead Exemptions in Georgia?

Yes, homeowners in Georgia may be eligible to combine multiple Property Tax Homestead Exemptions, depending on their circumstances. For instance, seniors may qualify for both the standard homestead exemption and an additional exemption for seniors. It's important to consult the Georgia Department of Revenue to understand how these exemptions can work together.

-

How often do I need to renew my Property Tax Homestead Exemptions in Georgia?

Most Property Tax Homestead Exemptions in Georgia do not require annual renewal, as long as the homeowner continues to meet the eligibility criteria. However, if there are changes in ownership or residency status, a new application may be necessary. Homeowners should stay informed through the Georgia Department of Revenue to ensure compliance.

Get more for Property Tax Homestead Exemptions Georgia Department Of Revenue

Find out other Property Tax Homestead Exemptions Georgia Department Of Revenue

- Electronic signature Massachusetts Hold Harmless (Indemnity) Agreement Myself

- Electronic signature Oklahoma Hold Harmless (Indemnity) Agreement Free

- Electronic signature Rhode Island Hold Harmless (Indemnity) Agreement Myself

- Electronic signature California Toll Manufacturing Agreement Now

- How Do I Electronic signature Kansas Toll Manufacturing Agreement

- Can I Electronic signature Arizona Warranty Deed

- How Can I Electronic signature Connecticut Warranty Deed

- How To Electronic signature Hawaii Warranty Deed

- Electronic signature Oklahoma Warranty Deed Myself

- Can I Electronic signature Texas Warranty Deed

- How To Electronic signature Arkansas Quitclaim Deed

- Electronic signature Washington Toll Manufacturing Agreement Simple

- Can I Electronic signature Delaware Quitclaim Deed

- Electronic signature Iowa Quitclaim Deed Easy

- Electronic signature Kentucky Quitclaim Deed Safe

- Electronic signature Maine Quitclaim Deed Easy

- How Can I Electronic signature Montana Quitclaim Deed

- How To Electronic signature Pennsylvania Quitclaim Deed

- Electronic signature Utah Quitclaim Deed Now

- How To Electronic signature West Virginia Quitclaim Deed