FORM SP 2022

What is the FORM SP

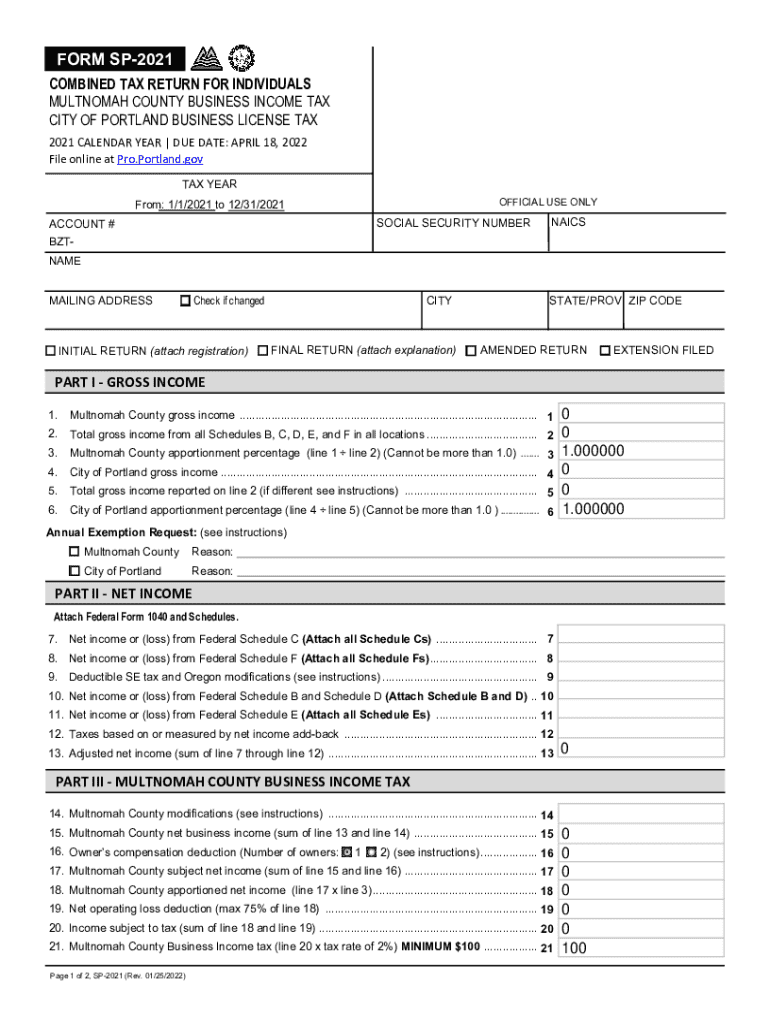

The FORM SP is a specific document used primarily for the purpose of reporting and managing certain tax-related information. This form is essential for individuals and businesses who need to disclose specific financial details to the IRS. It plays a crucial role in ensuring compliance with federal tax regulations, allowing taxpayers to accurately report their income and expenses. Understanding the purpose and requirements of the FORM SP is vital for effective tax management.

How to use the FORM SP

Using the FORM SP involves several key steps to ensure that the information provided is accurate and complete. First, gather all necessary financial documents and information that pertain to the reporting period. Next, fill out the form carefully, ensuring that all sections are completed according to the guidelines provided by the IRS. Once completed, review the form for accuracy before submitting it. Proper use of the FORM SP can help avoid potential penalties and ensure compliance with tax laws.

Steps to complete the FORM SP

Completing the FORM SP requires a systematic approach to ensure all information is accurately reported. Begin by downloading the latest version of the form from the IRS website. Follow these steps:

- Read the instructions carefully to understand the requirements.

- Fill in your personal and business information as required.

- Provide detailed financial information, including income, deductions, and credits.

- Double-check all entries for accuracy and completeness.

- Sign and date the form before submission.

Following these steps will help ensure that your FORM SP is properly completed and submitted on time.

Legal use of the FORM SP

The FORM SP is legally required for certain taxpayers to report specific financial information to the IRS. Failure to use the form when required can result in penalties or fines. It is important to understand the legal implications of submitting the FORM SP, including the necessity for accurate reporting and the potential consequences of misreporting. Taxpayers should consult with a tax professional if they have questions about their legal obligations regarding this form.

Filing Deadlines / Important Dates

Filing deadlines for the FORM SP can vary based on the type of taxpayer and the specific reporting requirements. Generally, the form must be submitted by the tax filing deadline for the year in which the income was earned. It is crucial to be aware of these deadlines to avoid late fees and penalties. Taxpayers should mark their calendars and prepare their documentation in advance to ensure timely filing.

Required Documents

To complete the FORM SP accurately, certain documents are required. These may include:

- Previous tax returns for reference.

- Documentation of income sources, such as W-2s or 1099s.

- Receipts for deductions and credits claimed.

- Any other relevant financial statements.

Having these documents on hand will facilitate a smoother completion process for the FORM SP.

Quick guide on how to complete form sp

Complete FORM SP seamlessly on any device

Digital document management has gained traction among organizations and individuals alike. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to locate the right template and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and eSign your documents swiftly and without interruptions. Manage FORM SP on any platform using airSlate SignNow apps for Android or iOS and enhance any document-related process today.

How to modify and eSign FORM SP effortlessly

- Find FORM SP and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically provides for this purpose.

- Create your signature with the Sign tool, which takes mere moments and holds the same legal validity as a traditional handwritten signature.

- Review the information and click on the Done button to confirm your changes.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs with just a few clicks from any device you prefer. Modify and eSign FORM SP and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Find and fill out the correct form sp

Create this form in 5 minutes!

How to create an eSignature for the form sp

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is FORM SP and how does it work?

FORM SP is a powerful feature of airSlate SignNow that allows users to create, send, and eSign documents seamlessly. It simplifies the document workflow by enabling users to fill out forms electronically, ensuring a faster and more efficient process. With FORM SP, businesses can streamline their operations and enhance productivity.

-

How much does airSlate SignNow with FORM SP cost?

The pricing for airSlate SignNow with FORM SP is competitive and designed to fit various business needs. We offer flexible subscription plans that cater to different user requirements, ensuring you only pay for what you need. For detailed pricing information, please visit our pricing page.

-

What are the key features of FORM SP?

FORM SP includes features such as customizable templates, real-time collaboration, and secure eSigning capabilities. Users can easily create forms that suit their specific needs and track the status of documents in real-time. These features make FORM SP an essential tool for businesses looking to enhance their document management.

-

Can FORM SP integrate with other applications?

Yes, FORM SP can seamlessly integrate with various applications, enhancing its functionality. Whether you use CRM systems, cloud storage, or other business tools, airSlate SignNow ensures that FORM SP works harmoniously with your existing software. This integration capability helps streamline your workflows.

-

What are the benefits of using FORM SP for my business?

Using FORM SP can signNowly reduce the time spent on document management and improve accuracy. It allows for quick eSigning and form completion, which can lead to faster decision-making. Additionally, FORM SP enhances security and compliance, making it a reliable choice for businesses.

-

Is FORM SP suitable for small businesses?

Absolutely! FORM SP is designed to be user-friendly and cost-effective, making it ideal for small businesses. It provides all the essential features needed for efficient document management without overwhelming users. Small businesses can leverage FORM SP to compete effectively in their markets.

-

How secure is the data when using FORM SP?

Security is a top priority for airSlate SignNow, and FORM SP is built with robust security measures. All data is encrypted, and we comply with industry standards to protect sensitive information. Users can trust that their documents and data are safe when using FORM SP.

Get more for FORM SP

Find out other FORM SP

- Electronic signature North Carolina Car Dealer Purchase Order Template Safe

- Electronic signature Kentucky Business Operations Quitclaim Deed Mobile

- Electronic signature Pennsylvania Car Dealer POA Later

- Electronic signature Louisiana Business Operations Last Will And Testament Myself

- Electronic signature South Dakota Car Dealer Quitclaim Deed Myself

- Help Me With Electronic signature South Dakota Car Dealer Quitclaim Deed

- Electronic signature South Dakota Car Dealer Affidavit Of Heirship Free

- Electronic signature Texas Car Dealer Purchase Order Template Online

- Electronic signature Texas Car Dealer Purchase Order Template Fast

- Electronic signature Maryland Business Operations NDA Myself

- Electronic signature Washington Car Dealer Letter Of Intent Computer

- Electronic signature Virginia Car Dealer IOU Fast

- How To Electronic signature Virginia Car Dealer Medical History

- Electronic signature Virginia Car Dealer Separation Agreement Simple

- Electronic signature Wisconsin Car Dealer Contract Simple

- Electronic signature Wyoming Car Dealer Lease Agreement Template Computer

- How Do I Electronic signature Mississippi Business Operations Rental Application

- Electronic signature Missouri Business Operations Business Plan Template Easy

- Electronic signature Missouri Business Operations Stock Certificate Now

- Electronic signature Alabama Charity Promissory Note Template Computer