Form 1120 1 37

What is the Form 1120 POL?

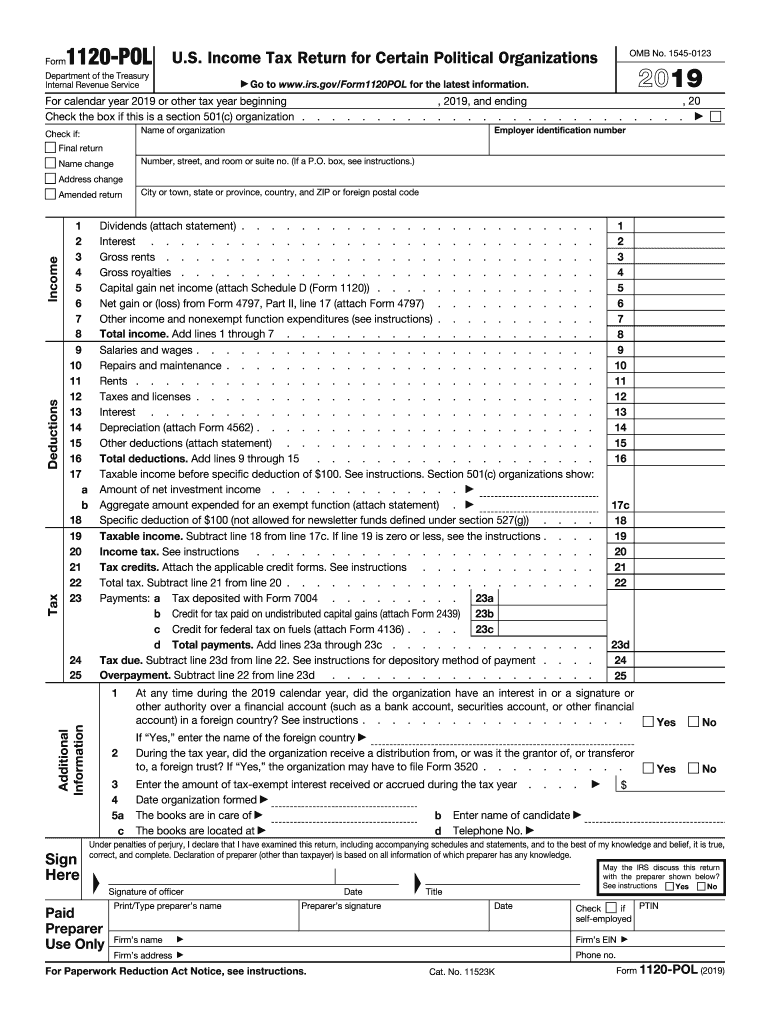

The Form 1120 POL is a tax return specifically designed for political organizations. It is used to report income, gains, losses, deductions, and credits, as well as to calculate the tax liability for these organizations. Unlike standard corporate tax returns, the 1120 POL has unique filing requirements that cater to the specific financial activities of political entities. Understanding the nuances of this form is crucial for compliance with IRS regulations.

Key Elements of the Form 1120 POL

Several key elements define the Form 1120 POL. These include:

- Income Reporting: Organizations must report all sources of income, including contributions and fundraising activities.

- Deductions: Certain deductions may apply, such as expenses related to campaigning.

- Tax Calculation: The form includes sections to calculate the tax owed based on the reported income.

- Signature Requirement: The form must be signed by an authorized individual to validate the submission.

Steps to Complete the Form 1120 POL

Completing the Form 1120 POL involves several steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements and expense reports.

- Fill Out the Form: Accurately enter all required information, ensuring that income and deductions are properly reported.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties.

- Sign and Date the Form: Ensure that an authorized individual signs the form before submission.

- Submit the Form: File the form electronically or via mail, following IRS guidelines for submission.

Filing Deadlines / Important Dates

Timely filing of the Form 1120 POL is essential to avoid penalties. The standard due date for this form is the fifteenth day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this typically falls on May 15. If additional time is needed, a six-month extension can be requested, but this must be filed before the original due date.

Legal Use of the Form 1120 POL

The Form 1120 POL is legally binding and must be completed in accordance with IRS regulations. Political organizations must ensure that they comply with all reporting requirements to maintain their tax-exempt status. Failure to properly file this form can result in penalties and loss of tax-exempt status, emphasizing the importance of understanding the legal implications of its use.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 1120 POL can lead to significant penalties. These may include:

- Late Filing Penalties: Organizations may incur fines for failing to file by the due date.

- Accuracy-Related Penalties: Incorrect information can result in additional penalties based on the amount of tax owed.

- Loss of Tax-Exempt Status: Continued non-compliance may jeopardize an organization’s tax-exempt status, leading to further financial implications.

Quick guide on how to complete form 1120 pol internal revenue service

Effortlessly Complete Form 1120 1 37 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access and securely store the necessary forms online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly, without delays. Manage Form 1120 1 37 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Form 1120 1 37 with Ease

- Find Form 1120 1 37 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 1120 1 37 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 pol internal revenue service

How to make an electronic signature for the Form 1120 Pol Internal Revenue Service in the online mode

How to create an eSignature for your Form 1120 Pol Internal Revenue Service in Chrome

How to generate an eSignature for putting it on the Form 1120 Pol Internal Revenue Service in Gmail

How to generate an eSignature for the Form 1120 Pol Internal Revenue Service right from your smart phone

How to make an electronic signature for the Form 1120 Pol Internal Revenue Service on iOS

How to generate an electronic signature for the Form 1120 Pol Internal Revenue Service on Android devices

People also ask

-

What is Form 1120 1 37 and who needs it?

Form 1120 1 37 is a tax form used by corporations to report their income, deductions, and tax liability to the IRS. Businesses, particularly C corporations, are required to file this form annually. Understanding how to complete Form 1120 1 37 accurately is crucial for compliance and can help avoid penalties.

-

How can airSlate SignNow help with Form 1120 1 37?

airSlate SignNow simplifies the process of gathering signatures and completing Form 1120 1 37 by providing a user-friendly platform for document management. With our eSignature solution, you can easily send the form to stakeholders for their signatures, ensuring a smooth and efficient filing process.

-

Is there a cost associated with using airSlate SignNow for Form 1120 1 37?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs, including those focused on handling Form 1120 1 37. Our plans are designed to be cost-effective, ensuring that you can manage your documents and signatures without breaking the bank.

-

What features does airSlate SignNow offer for managing Form 1120 1 37?

airSlate SignNow provides several features tailored for managing Form 1120 1 37, including customizable templates, audit trails, and secure cloud storage. These features ensure that your documents are handled safely and efficiently, making the filing process seamless.

-

Can I integrate airSlate SignNow with my accounting software for Form 1120 1 37?

Absolutely! airSlate SignNow integrates with a variety of accounting software solutions, allowing you to streamline the process of preparing and submitting Form 1120 1 37. This integration helps you connect your financial data directly to the form, enhancing accuracy and reducing manual entry.

-

What are the benefits of using airSlate SignNow for eSigning Form 1120 1 37?

Using airSlate SignNow for eSigning Form 1120 1 37 offers multiple benefits, including faster turnaround times, improved document tracking, and enhanced security. Our platform ensures that your signed documents are legally binding and easily accessible, which is vital for compliance.

-

Is airSlate SignNow secure for submitting sensitive documents like Form 1120 1 37?

Yes, airSlate SignNow prioritizes security with advanced encryption and secure cloud storage for sensitive documents like Form 1120 1 37. Our platform complies with industry standards, ensuring that your information remains confidential and protected throughout the signing process.

Get more for Form 1120 1 37

Find out other Form 1120 1 37

- How Can I Electronic signature North Carolina Landlord tenant lease agreement

- Can I Electronic signature Vermont lease agreement

- Can I Electronic signature Michigan Lease agreement for house

- How To Electronic signature Wisconsin Landlord tenant lease agreement

- Can I Electronic signature Nebraska Lease agreement for house

- eSignature Nebraska Limited Power of Attorney Free

- eSignature Indiana Unlimited Power of Attorney Safe

- Electronic signature Maine Lease agreement template Later

- Electronic signature Arizona Month to month lease agreement Easy

- Can I Electronic signature Hawaii Loan agreement

- Electronic signature Idaho Loan agreement Now

- Electronic signature South Carolina Loan agreement Online

- Electronic signature Colorado Non disclosure agreement sample Computer

- Can I Electronic signature Illinois Non disclosure agreement sample

- Electronic signature Kentucky Non disclosure agreement sample Myself

- Help Me With Electronic signature Louisiana Non disclosure agreement sample

- How To Electronic signature North Carolina Non disclosure agreement sample

- Electronic signature Ohio Non disclosure agreement sample Online

- How Can I Electronic signature Oklahoma Non disclosure agreement sample

- How To Electronic signature Tennessee Non disclosure agreement sample