Form 1120 1 37

What is the Form 1120 POL?

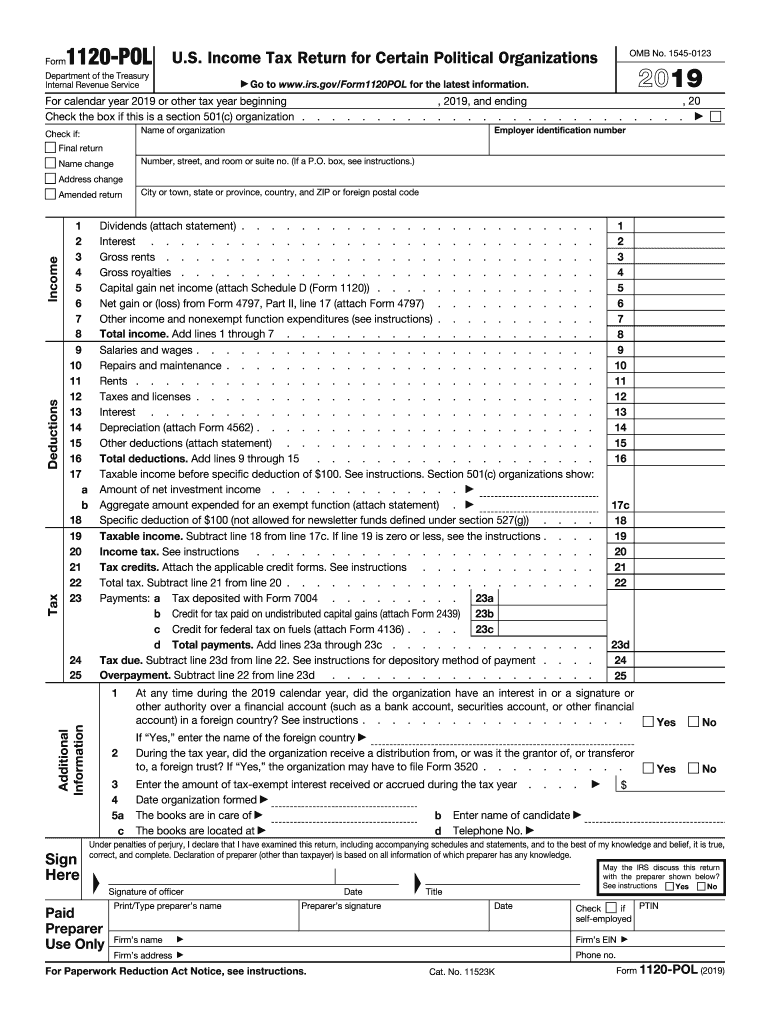

The Form 1120 POL is a tax return specifically designed for political organizations. It is used to report income, gains, losses, deductions, and credits, as well as to calculate the tax liability for these organizations. Unlike standard corporate tax returns, the 1120 POL has unique filing requirements that cater to the specific financial activities of political entities. Understanding the nuances of this form is crucial for compliance with IRS regulations.

Key Elements of the Form 1120 POL

Several key elements define the Form 1120 POL. These include:

- Income Reporting: Organizations must report all sources of income, including contributions and fundraising activities.

- Deductions: Certain deductions may apply, such as expenses related to campaigning.

- Tax Calculation: The form includes sections to calculate the tax owed based on the reported income.

- Signature Requirement: The form must be signed by an authorized individual to validate the submission.

Steps to Complete the Form 1120 POL

Completing the Form 1120 POL involves several steps:

- Gather Financial Records: Collect all relevant financial documents, including income statements and expense reports.

- Fill Out the Form: Accurately enter all required information, ensuring that income and deductions are properly reported.

- Review for Accuracy: Double-check all entries for accuracy to avoid potential penalties.

- Sign and Date the Form: Ensure that an authorized individual signs the form before submission.

- Submit the Form: File the form electronically or via mail, following IRS guidelines for submission.

Filing Deadlines / Important Dates

Timely filing of the Form 1120 POL is essential to avoid penalties. The standard due date for this form is the fifteenth day of the fifth month after the end of the organization's tax year. For organizations operating on a calendar year, this typically falls on May 15. If additional time is needed, a six-month extension can be requested, but this must be filed before the original due date.

Legal Use of the Form 1120 POL

The Form 1120 POL is legally binding and must be completed in accordance with IRS regulations. Political organizations must ensure that they comply with all reporting requirements to maintain their tax-exempt status. Failure to properly file this form can result in penalties and loss of tax-exempt status, emphasizing the importance of understanding the legal implications of its use.

Penalties for Non-Compliance

Non-compliance with the filing requirements for the Form 1120 POL can lead to significant penalties. These may include:

- Late Filing Penalties: Organizations may incur fines for failing to file by the due date.

- Accuracy-Related Penalties: Incorrect information can result in additional penalties based on the amount of tax owed.

- Loss of Tax-Exempt Status: Continued non-compliance may jeopardize an organization’s tax-exempt status, leading to further financial implications.

Quick guide on how to complete form 1120 pol internal revenue service

Effortlessly Complete Form 1120 1 37 on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly substitute for traditional printed and signed paperwork, as you can access and securely store the necessary forms online. airSlate SignNow provides you with all the tools needed to create, edit, and electronically sign your documents swiftly, without delays. Manage Form 1120 1 37 on any device using the airSlate SignNow apps for Android or iOS and streamline any document-related process today.

How to Edit and Electronically Sign Form 1120 1 37 with Ease

- Find Form 1120 1 37 and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important sections of your documents or redact sensitive information using tools that airSlate SignNow specifically provides for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, SMS, or an invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, and errors that require reprinting new document copies. airSlate SignNow addresses your document management needs in just a few clicks from your preferred device. Edit and electronically sign Form 1120 1 37 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the form 1120 pol internal revenue service

How to make an electronic signature for the Form 1120 Pol Internal Revenue Service in the online mode

How to create an eSignature for your Form 1120 Pol Internal Revenue Service in Chrome

How to generate an eSignature for putting it on the Form 1120 Pol Internal Revenue Service in Gmail

How to generate an eSignature for the Form 1120 Pol Internal Revenue Service right from your smart phone

How to make an electronic signature for the Form 1120 Pol Internal Revenue Service on iOS

How to generate an electronic signature for the Form 1120 Pol Internal Revenue Service on Android devices

People also ask

-

What features does airSlate SignNow offer for 2019 pol. users?

airSlate SignNow provides a user-friendly platform that includes eSignature capabilities, document templates, and advanced workflow automation. With 2019 pol., businesses can streamline their document processes, enhance collaboration, and ensure compliance.

-

How much does airSlate SignNow cost for 2019 pol. applications?

The pricing for airSlate SignNow varies based on the plan you choose, but it remains competitive for 2019 pol. users. We offer flexible subscription options to meet different business needs, providing great value for the features offered.

-

What are the main benefits of using airSlate SignNow for 2019 pol.?

Using airSlate SignNow for 2019 pol. can signNowly reduce the time spent on document management. The platform's streamlined eSignature process and integration capabilities make it easy to handle paperwork, thus improving overall productivity and customer satisfaction.

-

Can airSlate SignNow integrate with other tools for 2019 pol. workflows?

Yes, airSlate SignNow supports integration with a variety of applications, enhancing your 2019 pol. workflows. You can easily connect it with CRM systems, cloud storage services, and other business tools to create a seamless document management experience.

-

Is airSlate SignNow secure for handling sensitive 2019 pol. documents?

Absolutely! airSlate SignNow employs industry-leading security measures including encryption and secure storage to protect your 2019 pol. documents. This ensures that all sensitive information remains confidential, allowing you to eSign with peace of mind.

-

What type of customer support does airSlate SignNow offer for 2019 pol. users?

airSlate SignNow provides comprehensive customer support for 2019 pol. users, including live chat, email assistance, and a detailed knowledge base. Our support team is available to help you resolve any issues and maximize your use of the platform.

-

Can I customize templates for 2019 pol. documents in airSlate SignNow?

Yes, airSlate SignNow allows you to create and customize templates specifically for your 2019 pol. documents. This feature enables you to save time by reusing frequently used documents with personalized fields and settings.

Get more for Form 1120 1 37

- 3 a spouse of any person described edocket access gpo form

- Notice of intent to claim form

- Dss form 1620 jan 13dss form 1620 mar 11 qxd dss sc

- Home loan contract template form

- Home ownership contract template form

- Home purchas contract template form

- Home purchase contract template form

- Home remodel contract template form

Find out other Form 1120 1 37

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form

- How Can I eSignature Oregon Government PDF

- How Can I eSignature Oklahoma Government Document

- How To eSignature Texas Government Document

- Can I eSignature Vermont Government Form

- How Do I eSignature West Virginia Government PPT

- How Do I eSignature Maryland Healthcare / Medical PDF

- Help Me With eSignature New Mexico Healthcare / Medical Form

- How Do I eSignature New York Healthcare / Medical Presentation

- How To eSignature Oklahoma Finance & Tax Accounting PPT