Form 1065

What is the Form 1065

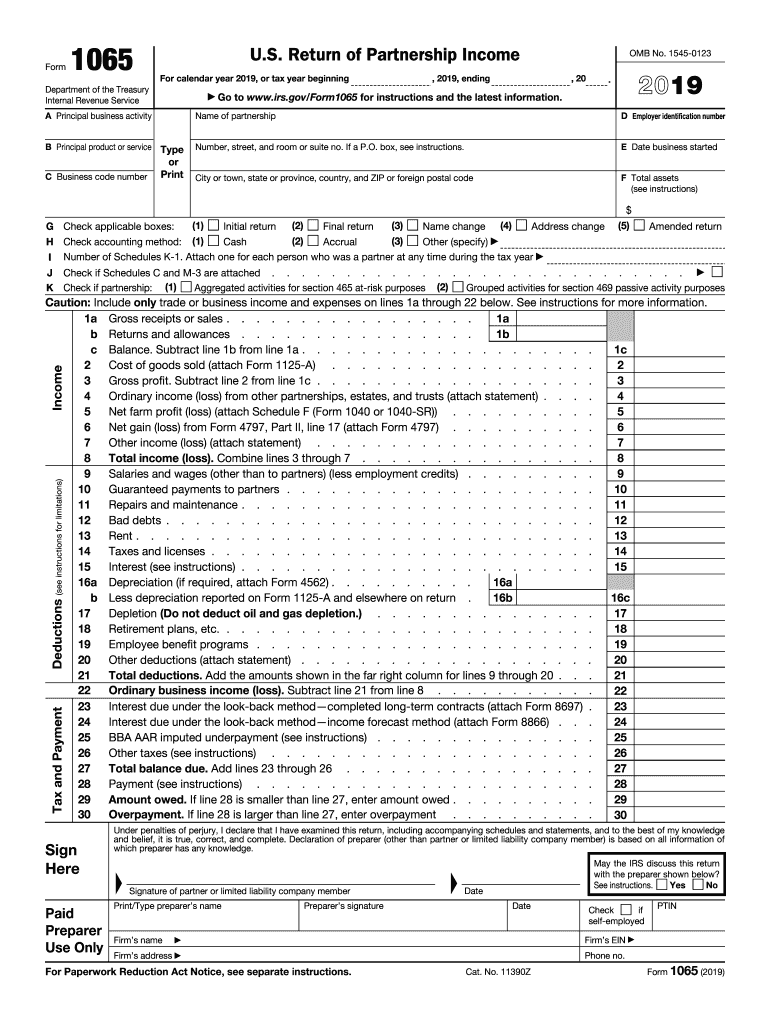

The 1065 form is a U.S. Internal Revenue Service (IRS) tax form used to report income, deductions, gains, and losses from partnerships. This form is essential for partnerships, which include two or more individuals or entities that conduct business together. The 1065 form does not calculate a tax liability, as partnerships are pass-through entities, meaning the income is passed through to the partners, who report it on their individual tax returns. Each partner receives a Schedule K-1, which details their share of the partnership's income, deductions, and credits.

Steps to complete the Form 1065

Completing the 1065 form involves several key steps:

- Gather necessary information about the partnership, including its name, address, and Employer Identification Number (EIN).

- Collect financial records, including income statements, expense reports, and any other relevant documentation.

- Fill out the form by providing details on income, deductions, and credits. Ensure that all figures are accurate and reflect the partnership's financial situation.

- Complete Schedule B, which includes questions about the partnership's operations and ownership.

- Prepare Schedule K, which summarizes the partnership's income, deductions, and credits that will be distributed to partners.

- Review the completed form for accuracy and completeness before submission.

Legal use of the Form 1065

The 1065 form is legally binding when completed accurately and submitted to the IRS. It must comply with IRS regulations regarding partnerships. To ensure its legal validity, partnerships should maintain proper documentation and records to support the information reported on the form. Additionally, electronic signatures can be used, provided they meet the requirements set forth by the ESIGN Act and UETA, ensuring that the form is legally recognized as signed.

Filing Deadlines / Important Dates

The due date for filing the 1065 form is typically March 15 of the year following the tax year being reported. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. Partnerships can request a six-month extension, pushing the deadline to September 15. It is crucial for partnerships to adhere to these deadlines to avoid penalties and interest on any taxes owed.

Form Submission Methods (Online / Mail / In-Person)

The 1065 form can be submitted in various ways:

- Online: Partnerships can e-file the 1065 form through IRS-approved software, which often provides a streamlined process and immediate confirmation of submission.

- Mail: The form can be printed and mailed to the appropriate IRS address. It is essential to use the correct address based on the partnership's location and whether a payment is included.

- In-Person: While not common, partnerships may choose to deliver the form in person to their local IRS office, though this method is generally less efficient.

Key elements of the Form 1065

The 1065 form consists of several key sections that must be accurately completed:

- Basic Information: This includes the partnership's name, address, and EIN.

- Income Section: Report all income earned by the partnership during the tax year.

- Deductions Section: Detail all allowable deductions, including business expenses and losses.

- Schedule K: Summarizes the partnership's income, deductions, and credits for distribution to partners.

- Schedule K-1: Issued to each partner, detailing their share of the partnership's income and deductions.

Quick guide on how to complete 2019 form 1065 us return of partnership income

Effortlessly Prepare Form 1065 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It serves as an ideal environmentally friendly alternative to traditional printed and signed documents, enabling you to find the necessary form and secure it online. airSlate SignNow provides all the tools required to create, modify, and electronically sign your documents swiftly without delays. Handle Form 1065 on any device using airSlate SignNow's Android or iOS applications and enhance any form-based procedure today.

How to Modify and Electronically Sign Form 1065 with Ease

- Find Form 1065 and click Get Form to begin.

- Make use of the tools available to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow provides specifically for that purpose.

- Create your electronic signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional handwritten signature.

- Review the information and then click the Done button to save your modifications.

- Choose your preferred method to send your form, whether through email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, frustrating form hunts, or errors that require reprinting new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign Form 1065 and ensure excellent communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1065 us return of partnership income

How to make an electronic signature for your 2019 Form 1065 Us Return Of Partnership Income online

How to make an eSignature for your 2019 Form 1065 Us Return Of Partnership Income in Chrome

How to generate an electronic signature for signing the 2019 Form 1065 Us Return Of Partnership Income in Gmail

How to create an eSignature for the 2019 Form 1065 Us Return Of Partnership Income straight from your mobile device

How to generate an electronic signature for the 2019 Form 1065 Us Return Of Partnership Income on iOS devices

How to generate an electronic signature for the 2019 Form 1065 Us Return Of Partnership Income on Android OS

People also ask

-

What is the 1065 form 2019, and who needs to file it?

The 1065 form 2019 is an informational tax return filed by partnerships to report income, deductions, gains, losses, etc. Businesses that operate as partnerships and need to report their financial activity to the IRS will need to file this form. Filing accurately ensures compliance with tax regulations.

-

How can airSlate SignNow help me with the 1065 form 2019?

airSlate SignNow allows users to easily fill out, send, and eSign the 1065 form 2019 digitally. Our platform streamlines the process, making it convenient for businesses to prepare and submit their tax documents securely. This enhances efficiency and reduces delays associated with traditional paper forms.

-

What features does airSlate SignNow offer for document signing related to the 1065 form 2019?

airSlate SignNow provides features such as customizable templates, secure eSignature workflows, and real-time tracking for documents like the 1065 form 2019. These features ensure that users can sign and send documents with ease and maintain a clear record of the signing process. It's all designed to simplify your tax documentation.

-

Is airSlate SignNow a cost-effective solution for filing the 1065 form 2019?

Yes, airSlate SignNow is a cost-effective solution for businesses looking to manage their documentation, including the 1065 form 2019. With competitive pricing plans and no hidden costs, users can save time and money while ensuring compliance and efficiency. Our flexible solutions cater to businesses of all sizes.

-

Can I integrate airSlate SignNow with other software for processing the 1065 form 2019?

Absolutely! airSlate SignNow offers seamless integrations with various accounting and business software platforms, making it easier to handle filings like the 1065 form 2019. These integrations allow for effortless data transfer and improved workflow management, ensuring that all your documents are streamlined in one place.

-

What are the benefits of using airSlate SignNow for the 1065 form 2019?

Using airSlate SignNow for the 1065 form 2019 provides numerous benefits, including enhanced security, faster processing, and improved efficiency. You can easily manage signatures and approvals digitally, reducing the risk of errors and delays. Our platform simplifies tax document handling for better business productivity.

-

How does airSlate SignNow ensure the security of the 1065 form 2019?

airSlate SignNow uses advanced encryption protocols and secure cloud storage to protect your 1065 form 2019 and other important documents. Additionally, our compliance with industry standards guarantees that your sensitive information remains confidential. We prioritize the security of your documents throughout the entire signing process.

Get more for Form 1065

Find out other Form 1065

- eSign Nebraska Charity LLC Operating Agreement Secure

- How Do I eSign Nevada Charity Lease Termination Letter

- eSign New Jersey Charity Resignation Letter Now

- eSign Alaska Construction Business Plan Template Mobile

- eSign Charity PPT North Carolina Now

- eSign New Mexico Charity Lease Agreement Form Secure

- eSign Charity PPT North Carolina Free

- eSign North Dakota Charity Rental Lease Agreement Now

- eSign Arkansas Construction Permission Slip Easy

- eSign Rhode Island Charity Rental Lease Agreement Secure

- eSign California Construction Promissory Note Template Easy

- eSign Colorado Construction LLC Operating Agreement Simple

- Can I eSign Washington Charity LLC Operating Agreement

- eSign Wyoming Charity Living Will Simple

- eSign Florida Construction Memorandum Of Understanding Easy

- eSign Arkansas Doctors LLC Operating Agreement Free

- eSign Hawaii Construction Lease Agreement Mobile

- Help Me With eSign Hawaii Construction LLC Operating Agreement

- eSign Hawaii Construction Work Order Myself

- eSign Delaware Doctors Quitclaim Deed Free