Wheel Tax Exemption Form City of Omaha Cityofomaha

What is the Wheel Tax Exemption Form City Of Omaha Cityofomaha

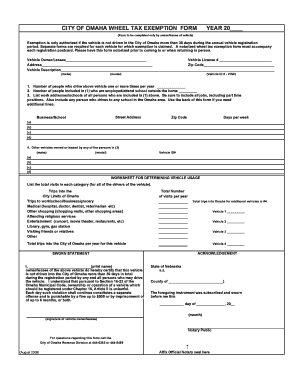

The Wheel Tax Exemption Form is a specific document used by residents of Omaha to apply for an exemption from wheel tax fees imposed by the city. This exemption is typically available for certain categories of vehicles, such as those owned by non-profit organizations or government entities. The form is designed to streamline the process of requesting this exemption, ensuring that eligible applicants can benefit from reduced financial burdens associated with vehicle ownership in Omaha.

How to obtain the Wheel Tax Exemption Form City Of Omaha Cityofomaha

To obtain the Wheel Tax Exemption Form, individuals can visit the official City of Omaha website, where the form is usually available for download. Additionally, residents may request a physical copy by contacting the city's finance department directly. It is important to ensure that you have the most current version of the form, as outdated forms may not be accepted.

Steps to complete the Wheel Tax Exemption Form City Of Omaha Cityofomaha

Completing the Wheel Tax Exemption Form involves several key steps:

- Download or obtain the form from the City of Omaha's official website or finance department.

- Fill out the required personal information, including your name, address, and vehicle details.

- Indicate the reason for the exemption, ensuring that it aligns with the eligibility criteria.

- Attach any necessary supporting documents, such as proof of non-profit status if applicable.

- Review the completed form for accuracy before submission.

Eligibility Criteria

Eligibility for the Wheel Tax Exemption typically includes specific conditions that applicants must meet. Common criteria may involve:

- Ownership of the vehicle by a non-profit organization or government entity.

- Vehicles that are not used for commercial purposes.

- Compliance with any additional local regulations set forth by the City of Omaha.

Form Submission Methods

Once the Wheel Tax Exemption Form is completed, applicants can submit it through various methods:

- Online Submission: If available, applicants may submit the form electronically through the City of Omaha's online portal.

- Mail: The completed form can be mailed to the designated city department, ensuring it is sent to the correct address.

- In-Person: Applicants may also choose to deliver the form in person at the city finance department during business hours.

Required Documents

To successfully complete the Wheel Tax Exemption Form, applicants may need to provide certain documents. Commonly required documents include:

- Proof of vehicle ownership, such as a title or registration.

- Documentation supporting the exemption claim, like a letter of determination from the IRS for non-profits.

- Any additional forms or information requested by the City of Omaha to verify eligibility.

Quick guide on how to complete wheel tax exemption form city of omaha cityofomaha

Complete Wheel Tax Exemption Form City Of Omaha Cityofomaha effortlessly on any device

Online document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for traditional printed and signed documents, as you can find the necessary form and securely save it online. airSlate SignNow equips you with all the resources you need to create, modify, and eSign your documents swiftly without delays. Manage Wheel Tax Exemption Form City Of Omaha Cityofomaha on any platform with airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to modify and eSign Wheel Tax Exemption Form City Of Omaha Cityofomaha with ease

- Obtain Wheel Tax Exemption Form City Of Omaha Cityofomaha and click on Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize signNow sections of the documents or redact sensitive information with features that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal authority as a conventional wet ink signature.

- Review all the details and click on the Done button to save your modifications.

- Choose how you'd like to send your form, whether by email, text message (SMS), or invitation link, or download it to your PC.

Eliminate concerns about lost or misplaced documents, tedious form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs with just a few clicks from your chosen device. Modify and eSign Wheel Tax Exemption Form City Of Omaha Cityofomaha and guarantee effective communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the wheel tax exemption form city of omaha cityofomaha

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Wheel Tax Exemption Form City Of Omaha Cityofomaha?

The Wheel Tax Exemption Form City Of Omaha Cityofomaha is a document that allows eligible residents to apply for an exemption from the wheel tax imposed by the city. This form is essential for those who qualify and wish to save on vehicle registration fees. Completing this form accurately ensures compliance with local regulations.

-

How can I obtain the Wheel Tax Exemption Form City Of Omaha Cityofomaha?

You can easily obtain the Wheel Tax Exemption Form City Of Omaha Cityofomaha by visiting the official City of Omaha website or through local government offices. Additionally, airSlate SignNow provides a streamlined process to access and fill out this form digitally, making it convenient for users.

-

What are the benefits of using airSlate SignNow for the Wheel Tax Exemption Form City Of Omaha Cityofomaha?

Using airSlate SignNow for the Wheel Tax Exemption Form City Of Omaha Cityofomaha offers several benefits, including easy document management and secure eSigning capabilities. Our platform simplifies the submission process, ensuring that your form is completed and sent quickly. This efficiency can save you time and reduce the hassle of paperwork.

-

Is there a cost associated with the Wheel Tax Exemption Form City Of Omaha Cityofomaha?

While the Wheel Tax Exemption Form City Of Omaha Cityofomaha itself is free to obtain, there may be associated costs depending on your vehicle and local regulations. However, using airSlate SignNow to complete and submit the form is a cost-effective solution that can help you manage your documents without additional fees.

-

Can I track the status of my Wheel Tax Exemption Form City Of Omaha Cityofomaha submission?

Yes, airSlate SignNow allows you to track the status of your Wheel Tax Exemption Form City Of Omaha Cityofomaha submission. You will receive notifications and updates regarding your form's progress, ensuring you stay informed throughout the process. This feature enhances transparency and peace of mind.

-

What features does airSlate SignNow offer for the Wheel Tax Exemption Form City Of Omaha Cityofomaha?

airSlate SignNow offers a variety of features for the Wheel Tax Exemption Form City Of Omaha Cityofomaha, including customizable templates, secure eSigning, and cloud storage. These features make it easy to manage your documents efficiently and securely. Additionally, our user-friendly interface ensures a smooth experience for all users.

-

Are there any integrations available with airSlate SignNow for the Wheel Tax Exemption Form City Of Omaha Cityofomaha?

Yes, airSlate SignNow integrates with various applications and platforms to enhance your experience with the Wheel Tax Exemption Form City Of Omaha Cityofomaha. These integrations allow for seamless document sharing and collaboration, making it easier to manage your forms alongside other business processes.

Get more for Wheel Tax Exemption Form City Of Omaha Cityofomaha

- Us import textile checklist 210790442 form

- Express scripts prior authorization form pdf

- Cape consumers form

- Sum and difference formulas worksheet

- Code of conduct agreement form

- Residential aged care property details for services australia and 772058593 form

- Business rental contract template form

- Build rental contract template form

Find out other Wheel Tax Exemption Form City Of Omaha Cityofomaha

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online

- eSignature Alabama Insurance Forbearance Agreement Safe

- How Can I eSignature Arkansas Insurance LLC Operating Agreement

- Help Me With eSignature Michigan High Tech Emergency Contact Form

- eSignature Louisiana Insurance Rental Application Later

- eSignature Maryland Insurance Contract Safe

- eSignature Massachusetts Insurance Lease Termination Letter Free

- eSignature Nebraska High Tech Rental Application Now

- How Do I eSignature Mississippi Insurance Separation Agreement

- Help Me With eSignature Missouri Insurance Profit And Loss Statement