Form 990

What is the Form 990

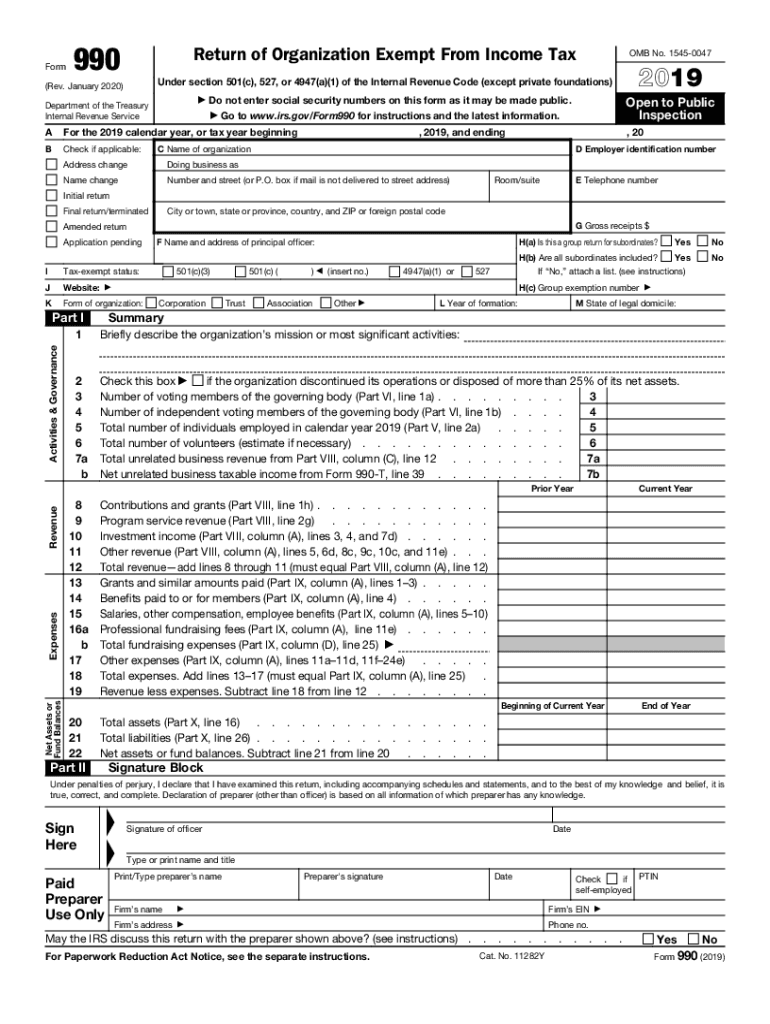

The Form 990 is a crucial document that tax-exempt organizations in the United States must file annually with the Internal Revenue Service (IRS). This form provides transparency about an organization’s financial status, governance, and activities. It includes detailed information about revenue, expenses, and compensation for the highest-paid employees. The IRS uses this data to ensure compliance with tax laws and to maintain the integrity of tax-exempt status.

How to use the Form 990

Organizations utilize the Form 990 to report their financial activities and to demonstrate compliance with federal regulations. This form is essential for maintaining tax-exempt status and for informing donors and the public about the organization’s operations. Users should carefully review the instructions provided by the IRS to ensure accurate reporting. The form can also serve as a tool for organizations to assess their financial health and operational effectiveness.

Steps to complete the Form 990

Completing the Form 990 involves several key steps:

- Gather financial records, including income statements, balance sheets, and expense reports.

- Review the IRS guidelines to understand the specific requirements for your organization type.

- Fill out the form, ensuring all sections are completed accurately, including revenue, expenses, and governance information.

- Review the completed form for accuracy and compliance with IRS regulations.

- Submit the form electronically or via mail by the designated filing deadline.

Legal use of the Form 990

To be considered legally valid, the Form 990 must be completed in accordance with IRS guidelines. This includes providing accurate financial information and ensuring that all required sections are filled out. Organizations must also maintain records that support the information provided in the form. Failure to comply with these legal requirements can result in penalties, including the loss of tax-exempt status.

Filing Deadlines / Important Dates

Organizations must be aware of the filing deadlines for the Form 990 to avoid penalties. Generally, the form is due on the fifteenth day of the fifth month after the end of the organization’s fiscal year. For example, if the fiscal year ends on December 31, the Form 990 is due on May 15 of the following year. Organizations can apply for an extension, but they must file the extension request before the original due date.

Form Submission Methods (Online / Mail / In-Person)

The Form 990 can be submitted through various methods. Most organizations opt for electronic filing, which is often faster and more efficient. The IRS provides a designated online portal for this purpose. Alternatively, organizations can mail a paper copy of the form to the appropriate IRS address. In-person submissions are generally not accepted, and it is essential to ensure that the submission method chosen complies with IRS regulations.

Quick guide on how to complete 2019 form 990 return of organization exempt from income tax

Prepare Form 990 effortlessly on any device

Digital document management has gained traction among companies and individuals. It serves as a perfect eco-friendly alternative to traditional printed and signed documents, as you can locate the right form and securely store it online. airSlate SignNow equips you with all the tools necessary to create, edit, and eSign your documents promptly without delays. Manage Form 990 on any platform using airSlate SignNow's Android or iOS applications and streamline any document-related task today.

The easiest way to alter and eSign Form 990 with ease

- Locate Form 990 and then click Get Form to begin.

- Make use of the tools we provide to fill out your document.

- Select pertinent sections of the documents or conceal sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a conventional handwritten signature.

- Review all the details and then click on the Done button to save your modifications.

- Choose how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Say goodbye to lost or misplaced documents, tedious form searches, or mistakes that necessitate printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device of your choice. Modify and eSign Form 990 and ensure seamless communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 990 return of organization exempt from income tax

How to make an electronic signature for the 2019 Form 990 Return Of Organization Exempt From Income Tax in the online mode

How to make an electronic signature for the 2019 Form 990 Return Of Organization Exempt From Income Tax in Google Chrome

How to make an eSignature for putting it on the 2019 Form 990 Return Of Organization Exempt From Income Tax in Gmail

How to generate an electronic signature for the 2019 Form 990 Return Of Organization Exempt From Income Tax from your smart phone

How to make an electronic signature for the 2019 Form 990 Return Of Organization Exempt From Income Tax on iOS devices

How to make an eSignature for the 2019 Form 990 Return Of Organization Exempt From Income Tax on Android devices

People also ask

-

What is the IRS Form 990 PF 2019, and why is it important?

The IRS Form 990 PF 2019 is a crucial tax document for private foundations that provides detailed financial information to the IRS and the public. It helps ensure transparency and accountability in nonprofit operations, making it essential for compliance.

-

How can airSlate SignNow assist with the filing of IRS Form 990 PF 2019?

AirSlate SignNow simplifies the process of signing and submitting IRS Form 990 PF 2019 by providing a fast and secure eSigning solution. Our platform allows users to easily upload, sign, and send the document without the need for printing or scanning.

-

What features does airSlate SignNow offer for managing IRS Form 990 PF 2019?

AirSlate SignNow offers features like document templates, customizable signing workflows, and in-app chat support, making it easier to manage IRS Form 990 PF 2019. These tools help streamline the filing process and ensure quick turnaround times.

-

Is there a free trial available for airSlate SignNow to manage IRS Form 990 PF 2019?

Yes, airSlate SignNow offers a free trial so you can test the platform’s capabilities in managing IRS Form 990 PF 2019. This allows prospective customers to explore the features and benefits without any financial commitment.

-

What are the pricing options for using airSlate SignNow for IRS Form 990 PF 2019?

AirSlate SignNow provides flexible pricing plans that cater to different business needs, making it an affordable choice for managing IRS Form 990 PF 2019. Users can select from monthly or annual subscription options to fit their budget.

-

Can I integrate airSlate SignNow with other software for IRS Form 990 PF 2019?

Absolutely! AirSlate SignNow integrates seamlessly with various applications, allowing you to streamline workflows related to IRS Form 990 PF 2019. This integration capability enhances productivity by connecting with accounting and document management tools.

-

What are the security measures in place for handling IRS Form 990 PF 2019 on airSlate SignNow?

AirSlate SignNow prioritizes security with encrypted document storage and secure eSigning protocols for IRS Form 990 PF 2019. Our platform is designed to protect sensitive information and maintain the confidentiality of your filings.

Get more for Form 990

Find out other Form 990

- Help Me With eSignature Kentucky Charity Form

- How Do I eSignature Michigan Charity Presentation

- How Do I eSignature Pennsylvania Car Dealer Document

- How To eSignature Pennsylvania Charity Presentation

- Can I eSignature Utah Charity Document

- How Do I eSignature Utah Car Dealer Presentation

- Help Me With eSignature Wyoming Charity Presentation

- How To eSignature Wyoming Car Dealer PPT

- How To eSignature Colorado Construction PPT

- How To eSignature New Jersey Construction PDF

- How To eSignature New York Construction Presentation

- How To eSignature Wisconsin Construction Document

- Help Me With eSignature Arkansas Education Form

- Can I eSignature Louisiana Education Document

- Can I eSignature Massachusetts Education Document

- Help Me With eSignature Montana Education Word

- How To eSignature Maryland Doctors Word

- Help Me With eSignature South Dakota Education Form

- How Can I eSignature Virginia Education PDF

- How To eSignature Massachusetts Government Form