Form 990 Pf

What is the Form 990-PF?

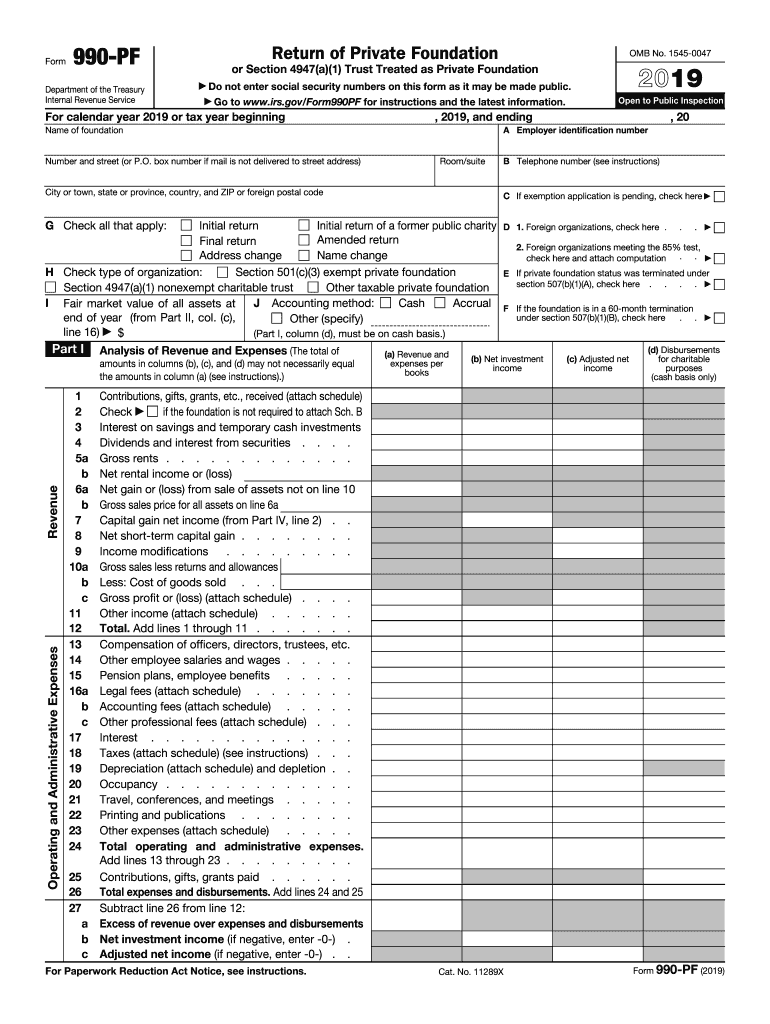

The Form 990-PF is an annual information return that private foundations in the United States must file with the IRS. This form provides a detailed overview of a foundation's financial activities, including its income, expenses, and distributions to charitable organizations. It is essential for ensuring transparency and compliance with federal tax regulations. The 2019 version of the form includes specific sections that require information about the foundation’s assets, liabilities, and the grants it has made during the year. By completing the Form 990-PF, foundations demonstrate their commitment to fulfilling their charitable purposes and adhering to legal requirements.

How to use the Form 990-PF

Using the Form 990-PF involves several key steps to ensure accurate reporting of a foundation's financial activities. First, gather all necessary financial documents, including bank statements, receipts, and records of grants made. Next, download the 2019 form from the IRS website, ensuring you have the correct version. Once you have the form, carefully fill out each section, providing accurate figures and descriptions. Pay special attention to the sections that require detailed information about grants and distributions. After completing the form, review it for accuracy before submitting it to the IRS by the appropriate deadline.

Steps to complete the Form 990-PF

Completing the Form 990-PF involves a systematic approach to ensure compliance and accuracy. Follow these steps:

- Gather financial records, including income statements, balance sheets, and grant records.

- Download the 2019 Form 990-PF from the IRS website.

- Fill out the form, starting with basic information about the foundation, including its name, address, and Employer Identification Number (EIN).

- Detail the foundation's financial activities, including total revenue, expenses, and assets.

- Provide information on grants made during the year, including recipient names and amounts.

- Review the form for accuracy and completeness, ensuring all required sections are filled out.

- Submit the completed form to the IRS by the specified deadline.

Legal use of the Form 990-PF

The Form 990-PF is legally binding and must be completed accurately to comply with IRS regulations. Foundations are required to file this form annually, and failure to do so can result in penalties or loss of tax-exempt status. The information provided on the form is used by the IRS to ensure that private foundations are operating in accordance with their charitable purposes. It is essential for foundations to maintain accurate records and to file the Form 990-PF on time to avoid any legal issues or financial penalties.

Filing Deadlines / Important Dates

The filing deadline for the Form 990-PF is typically the 15th day of the fifth month after the end of the foundation's fiscal year. For foundations that operate on a calendar year, this means the form is due by May 15 of the following year. If the deadline falls on a weekend or holiday, the due date is extended to the next business day. It is important for foundations to be aware of these deadlines to ensure timely submission and compliance with IRS regulations.

Required Documents

To complete the Form 990-PF, several documents are necessary to provide accurate and comprehensive information. These include:

- Financial statements, including income statements and balance sheets.

- Records of all grants made during the fiscal year, including recipient details and amounts.

- Documentation of any investments held by the foundation.

- Previous year’s Form 990-PF for reference and consistency.

Having these documents readily available will facilitate a smoother completion process and ensure compliance with reporting requirements.

Quick guide on how to complete private foundation internal revenue service

Effortlessly Prepare Form 990 Pf on Any Device

Managing documents online has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed papers, enabling you to find the correct form and securely store it online. airSlate SignNow provides all the tools necessary to quickly create, edit, and eSign your documents without delays. Handle Form 990 Pf on any device using airSlate SignNow's Android or iOS applications and enhance any document-related process today.

The Easiest Way to Edit and eSign Form 990 Pf Seamlessly

- Locate Form 990 Pf and click Get Form to begin.

- Utilize the tools we offer to complete your document.

- Emphasize important sections of the documents or obscure sensitive information with tools that airSlate SignNow provides specifically for this purpose.

- Generate your signature using the Sign tool, which takes mere seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Done button to save your modifications.

- Select your preferred method of sending your form, whether by email, SMS, invitation link, or downloading it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Edit and eSign Form 990 Pf and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the private foundation internal revenue service

How to create an eSignature for the Private Foundation Internal Revenue Service online

How to create an eSignature for your Private Foundation Internal Revenue Service in Chrome

How to create an electronic signature for putting it on the Private Foundation Internal Revenue Service in Gmail

How to create an electronic signature for the Private Foundation Internal Revenue Service right from your mobile device

How to create an eSignature for the Private Foundation Internal Revenue Service on iOS

How to create an electronic signature for the Private Foundation Internal Revenue Service on Android OS

People also ask

-

Where can I find tax forms 2019 printable?

You can easily find tax forms 2019 printable on the IRS website or through official state tax websites. Additionally, airSlate SignNow provides functionality to upload and fill out these forms digitally, facilitating smoother tax filing.

-

How does airSlate SignNow help me with tax forms 2019 printable?

airSlate SignNow allows you to upload, sign, and send tax forms 2019 printable with ease. Our platform provides an intuitive interface and electronic signature capabilities that streamline the process of managing your tax documents.

-

Are there any costs associated with using airSlate SignNow for tax forms 2019 printable?

airSlate SignNow offers flexible pricing plans that are cost-effective for businesses of all sizes. Utilizing our service to manage tax forms 2019 printable can save you time and potential errors, making it a worthwhile investment.

-

Can I integrate airSlate SignNow with my existing accounting software for tax forms 2019 printable?

Yes, airSlate SignNow easily integrates with several popular accounting software solutions. This will enable you to manage tax forms 2019 printable alongside your financial records seamlessly.

-

What features does airSlate SignNow offer for handling tax forms 2019 printable?

airSlate SignNow provides a variety of features for managing tax forms 2019 printable, including eSigning, document templates, and secure storage. These features enhance productivity and ensure your tax documents are processed efficiently.

-

Is it safe to use airSlate SignNow for tax forms 2019 printable?

Absolutely! airSlate SignNow employs robust security measures, including encryption and secure access controls, to protect your sensitive tax forms 2019 printable. You can trust our platform to keep your data safe and confidential.

-

Can I access tax forms 2019 printable from my mobile device using airSlate SignNow?

Yes, airSlate SignNow offers a mobile-friendly platform, allowing you to access and manage your tax forms 2019 printable on the go. You can easily sign and send documents directly from your smartphone or tablet.

Get more for Form 990 Pf

Find out other Form 990 Pf

- How Do I Electronic signature Iowa Construction Document

- How Can I Electronic signature South Carolina Charity PDF

- How Can I Electronic signature Oklahoma Doctors Document

- How Can I Electronic signature Alabama Finance & Tax Accounting Document

- How To Electronic signature Delaware Government Document

- Help Me With Electronic signature Indiana Education PDF

- How To Electronic signature Connecticut Government Document

- How To Electronic signature Georgia Government PDF

- Can I Electronic signature Iowa Education Form

- How To Electronic signature Idaho Government Presentation

- Help Me With Electronic signature Hawaii Finance & Tax Accounting Document

- How Can I Electronic signature Indiana Government PDF

- How Can I Electronic signature Illinois Finance & Tax Accounting PPT

- How To Electronic signature Maine Government Document

- How To Electronic signature Louisiana Education Presentation

- How Can I Electronic signature Massachusetts Government PDF

- How Do I Electronic signature Montana Government Document

- Help Me With Electronic signature Louisiana Finance & Tax Accounting Word

- How To Electronic signature Pennsylvania Government Document

- Can I Electronic signature Texas Government PPT