Virginia Non Resident Tax Form

What is the Virginia Non Resident Tax

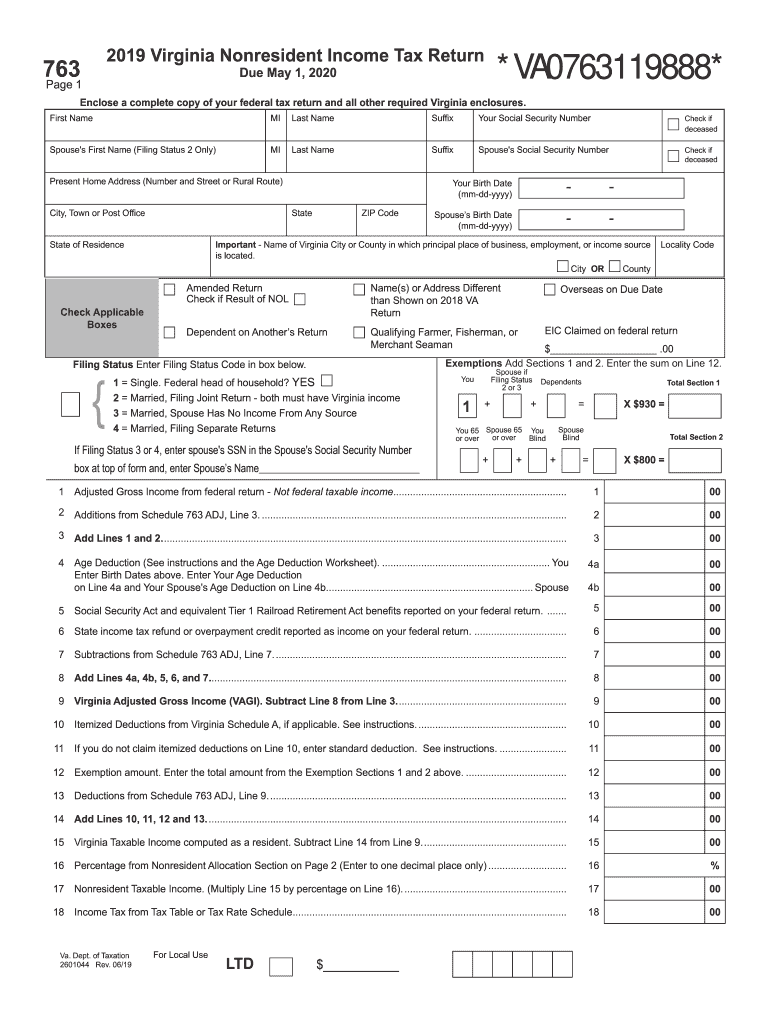

The Virginia Non Resident Tax is a tax imposed on individuals who earn income from Virginia sources but do not reside in the state. This tax applies to non-residents who have income derived from Virginia businesses, rental properties, or other taxable activities. The tax is calculated based on the income earned within Virginia, and it is essential for non-residents to understand their obligations to ensure compliance with state tax laws.

Steps to complete the Virginia Non Resident Tax

Completing the Virginia Non Resident Tax involves several key steps:

- Gather necessary financial documents, including W-2s, 1099s, and any other income statements.

- Obtain the 2019 763 form, which is the official document for reporting non-resident income.

- Fill out the form accurately, ensuring all income from Virginia sources is reported.

- Calculate the tax owed based on the income reported and the applicable Virginia tax rates.

- Review the form for accuracy before submission.

- Submit the completed form either electronically or by mail, following the guidelines provided by the Virginia Department of Taxation.

Legal use of the Virginia Non Resident Tax

The legal use of the Virginia Non Resident Tax is governed by state tax laws and regulations. Non-residents are required to file the 2019 763 form to report their Virginia-sourced income accurately. Compliance with these laws ensures that non-residents fulfill their tax obligations and avoid potential penalties. It is important to maintain accurate records and documentation to support the information reported on the form.

Filing Deadlines / Important Dates

Understanding filing deadlines is crucial for non-residents. For the 2019 tax year, the deadline to submit the Virginia Non Resident Tax is typically May 1 of the following year. If this date falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to check for any updates or changes to deadlines to ensure timely filing and avoid late fees.

Required Documents

When completing the Virginia Non Resident Tax, several documents are essential:

- W-2 forms from employers for income earned in Virginia.

- 1099 forms for any freelance or contract work performed in the state.

- Records of any other income sources related to Virginia, such as rental income.

- Documentation supporting deductions or credits claimed on the tax form.

Form Submission Methods (Online / Mail / In-Person)

Non-residents can submit the 2019 763 form through various methods:

- Online submission via the Virginia Department of Taxation's e-file system, which offers a convenient and secure way to file.

- Mailing the completed form to the appropriate address provided by the Virginia Department of Taxation.

- In-person submission at designated tax offices, although this option may vary based on location and availability.

Key elements of the Virginia Non Resident Tax

Key elements of the Virginia Non Resident Tax include:

- The tax rate, which varies based on income brackets.

- Eligibility criteria for non-residents, including the types of income that are taxable.

- Available deductions and credits that may reduce the overall tax liability.

- Compliance requirements to ensure that the tax is filed correctly and on time.

Quick guide on how to complete 2019 form 763 virginia nonresident income tax return 2019 virginia nonresident income tax return

Effortlessly Prepare Virginia Non Resident Tax on Any Gadget

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, as you can easily find the necessary template and securely save it online. airSlate SignNow provides all the resources you need to create, modify, and electronically sign your documents quickly without any delays. Manage Virginia Non Resident Tax on any gadget with airSlate SignNow's Android or iOS applications and enhance any document-focused procedure today.

How to Alter and Electronically Sign Virginia Non Resident Tax with Ease

- Obtain Virginia Non Resident Tax and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Emphasize important sections of your documents or redact sensitive information with the tools provided by airSlate SignNow specifically for that function.

- Generate your electronic signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and click the Done button to save your changes.

- Select your preferred delivery method for your form: via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, monotonous form searches, or errors that necessitate printing new document copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign Virginia Non Resident Tax to guarantee outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 763 virginia nonresident income tax return 2019 virginia nonresident income tax return

How to generate an electronic signature for your 2019 Form 763 Virginia Nonresident Income Tax Return 2019 Virginia Nonresident Income Tax Return in the online mode

How to create an eSignature for your 2019 Form 763 Virginia Nonresident Income Tax Return 2019 Virginia Nonresident Income Tax Return in Google Chrome

How to generate an eSignature for signing the 2019 Form 763 Virginia Nonresident Income Tax Return 2019 Virginia Nonresident Income Tax Return in Gmail

How to generate an eSignature for the 2019 Form 763 Virginia Nonresident Income Tax Return 2019 Virginia Nonresident Income Tax Return straight from your smart phone

How to create an eSignature for the 2019 Form 763 Virginia Nonresident Income Tax Return 2019 Virginia Nonresident Income Tax Return on iOS devices

How to create an eSignature for the 2019 Form 763 Virginia Nonresident Income Tax Return 2019 Virginia Nonresident Income Tax Return on Android OS

People also ask

-

What is the 2019 763 form and why do I need it?

The 2019 763 form is a tax document used for certain financial reporting purposes. Businesses and individuals might require this form to ensure compliance with tax regulations. Understanding this form is crucial for accurate reporting and avoiding potential penalties.

-

How does airSlate SignNow facilitate the signing of the 2019 763 form?

airSlate SignNow allows you to easily send and electronically sign the 2019 763 form online. With a user-friendly interface, you can streamline the signing process, ensuring that all parties can access the form anytime, anywhere. This efficiency signNowly reduces turnaround time for document signing.

-

Is there a cost associated with using airSlate SignNow to manage the 2019 763 form?

Yes, airSlate SignNow offers various pricing plans tailored to your business needs. Our cost-effective solutions ensure you get the best value while efficiently managing forms like the 2019 763 form. View our pricing page for specific details on each plan.

-

What features does airSlate SignNow offer for the 2019 763 form?

airSlate SignNow includes features such as customizable templates, in-app notifications, and secure cloud storage, specifically enhancing the management of documents like the 2019 763 form. Our platform makes it easy to track document status and maintain compliance with regulatory requirements.

-

Can I integrate airSlate SignNow with other software to manage the 2019 763 form?

Absolutely! airSlate SignNow offers various integrations with popular software platforms, allowing you to manage the 2019 763 form alongside your existing tools. This seamless integration helps to automate workflows and keeps your documents organized in one place.

-

What benefits does airSlate SignNow provide for handling the 2019 763 form?

Using airSlate SignNow to manage the 2019 763 form allows for faster processing and improved accuracy. The platform minimizes the risk of errors associated with manual handling of documents and provides secure digital storage for easy access and retrieval.

-

How secure is the process of signing the 2019 763 form with airSlate SignNow?

airSlate SignNow prioritizes security, ensuring that all documents, including the 2019 763 form, are encrypted and securely stored. We comply with industry standards to protect sensitive information, offering peace of mind whether you're sending or signing documents online.

Get more for Virginia Non Resident Tax

Find out other Virginia Non Resident Tax

- Sign Missouri Legal Last Will And Testament Online

- Sign Montana Legal Resignation Letter Easy

- How Do I Sign Montana Legal IOU

- How Do I Sign Montana Legal Quitclaim Deed

- Sign Missouri Legal Separation Agreement Myself

- How Do I Sign Nevada Legal Contract

- Sign New Jersey Legal Memorandum Of Understanding Online

- How To Sign New Jersey Legal Stock Certificate

- Sign New Mexico Legal Cease And Desist Letter Mobile

- Sign Texas Insurance Business Plan Template Later

- Sign Ohio Legal Last Will And Testament Mobile

- Sign Ohio Legal LLC Operating Agreement Mobile

- Sign Oklahoma Legal Cease And Desist Letter Fast

- Sign Oregon Legal LLC Operating Agreement Computer

- Sign Pennsylvania Legal Moving Checklist Easy

- Sign Pennsylvania Legal Affidavit Of Heirship Computer

- Sign Connecticut Life Sciences Rental Lease Agreement Online

- Sign Connecticut Life Sciences Affidavit Of Heirship Easy

- Sign Tennessee Legal LLC Operating Agreement Online

- How To Sign Tennessee Legal Cease And Desist Letter