Virginia Form 502

What is the Virginia Form 502

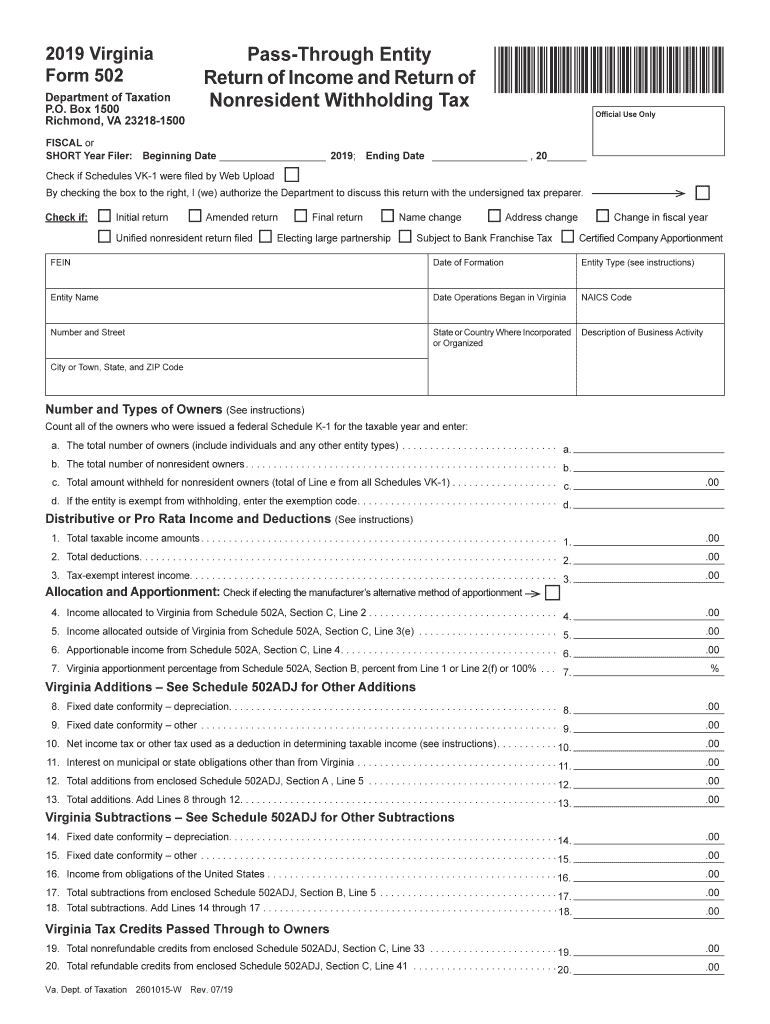

The Virginia Form 502 is the state income tax return form used by residents of Virginia to report their income and calculate their tax liability. This form is essential for individuals and couples filing their annual tax returns. It includes various sections where taxpayers provide information about their income, deductions, and credits. Understanding the purpose of this form is crucial for ensuring compliance with Virginia tax laws.

Steps to complete the Virginia Form 502

Completing the Virginia Form 502 involves several key steps:

- Gather all necessary documents, including W-2s, 1099s, and any other income statements.

- Fill out personal information, including your name, address, and Social Security number.

- Report your total income, including wages, dividends, and any other sources.

- Claim deductions and credits applicable to your situation, such as standard deductions or itemized deductions.

- Calculate your total tax liability based on the provided tax tables.

- Sign and date the form to certify that the information is accurate.

Filing Deadlines / Important Dates

For the Virginia Form 502, the filing deadline is typically May 1 of each year. If May 1 falls on a weekend or holiday, the due date is extended to the next business day. Taxpayers should be aware of this deadline to avoid penalties and interest on unpaid taxes. Additionally, extensions may be available, but they require filing a separate request.

Legal use of the Virginia Form 502

The Virginia Form 502 is legally binding when completed accurately and submitted on time. It must comply with state tax regulations to ensure that the information provided is valid. Electronic signatures are accepted, provided they meet the legal standards set forth by the state. Maintaining accurate records and documentation is essential for any claims made on the form.

How to obtain the Virginia Form 502

The Virginia Form 502 can be obtained through various channels. Taxpayers can download the form directly from the Virginia Department of Taxation's website. Additionally, physical copies may be available at local tax offices or public libraries. It is important to ensure that you are using the correct version of the form for the applicable tax year.

Key elements of the Virginia Form 502

The Virginia Form 502 includes several key elements that taxpayers must complete:

- Personal Information: Name, address, and Social Security number.

- Income Section: Total income from all sources.

- Deductions: Standard or itemized deductions.

- Tax Calculation: Total tax liability based on income and deductions.

- Signature: Certification of the accuracy of the information provided.

Quick guide on how to complete 2019 form 502 pass through entity return of income and return of nonresident withholding tax

Effortlessly Prepare Virginia Form 502 on Any Device

Managing documents online has become increasingly favored by businesses and individuals alike. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to find the correct form and securely store it online. airSlate SignNow equips you with all the tools you need to create, modify, and electronically sign your documents quickly without any holdups. Handle Virginia Form 502 on any device using airSlate SignNow's Android or iOS applications and streamline any document-based process today.

Steps to Modify and Electronically Sign Virginia Form 502 Easily

- Find Virginia Form 502 and click on Get Form to begin.

- Utilize the tools provided to complete your document.

- Emphasize important sections of the documents or redact sensitive information with the tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes just seconds and holds the same legal significance as a traditional ink signature.

- Review the details and click the Done button to finalize your changes.

- Select your preferred method to share your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate reprinting new document copies. airSlate SignNow manages all your document handling needs in just a few clicks from any device you choose. Alter and electronically sign Virginia Form 502 to ensure outstanding communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 502 pass through entity return of income and return of nonresident withholding tax

How to generate an electronic signature for your 2019 Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax online

How to create an electronic signature for the 2019 Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax in Chrome

How to create an electronic signature for signing the 2019 Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax in Gmail

How to create an eSignature for the 2019 Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax from your smart phone

How to create an eSignature for the 2019 Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax on iOS

How to make an electronic signature for the 2019 Form 502 Pass Through Entity Return Of Income And Return Of Nonresident Withholding Tax on Android

People also ask

-

What are the VA 502 instructions for using airSlate SignNow?

The VA 502 instructions guide users on how to effectively utilize the airSlate SignNow platform for document signing and management. These instructions provide step-by-step details on setting up your account, uploading documents, and ensuring secure eSignatures. Following the VA 502 instructions helps streamline your document workflows.

-

How can I integrate airSlate SignNow with other applications?

Integrating airSlate SignNow with other applications is simple and straightforward. You can follow the VA 502 instructions which include detailed integration steps with popular platforms like Google Drive, Salesforce, and more. This integration enhances your document handling, allowing for seamless workflow across different tools.

-

What pricing plans are available for airSlate SignNow?

AirSlate SignNow offers several pricing plans tailored to fit your business needs and budget. You can access the VA 502 instructions for a detailed breakdown of each plan's features and pricing. This ensures you can select the best option that aligns with your document management requirements.

-

What features does airSlate SignNow offer?

airSlate SignNow provides a variety of features such as customizable templates, automated workflows, and advanced security options. The VA 502 instructions outline these features in depth, highlighting how they can improve your document signing process. Utilizing these features can greatly enhance efficiency and reduce paperwork.

-

How does airSlate SignNow ensure the security of my documents?

Security is a top priority for airSlate SignNow, which employs encryption and secure access protocols to protect your documents. According to the VA 502 instructions, users can also set permissions and track document activity for added security. This ensures that your information remains confidential and secure throughout the signing process.

-

Can I use airSlate SignNow for remote work?

Absolutely! airSlate SignNow is designed for flexibility and efficiency, making it perfect for remote work environments. The VA 502 instructions will help you understand how to utilize the platform without being physically present, allowing you to send and eSign documents from anywhere. This is essential for modern businesses adapting to remote work.

-

What benefits does airSlate SignNow offer for businesses?

airSlate SignNow offers numerous benefits such as increased productivity, reduced turnaround time for document signing, and cost savings. Following the VA 502 instructions can help you leverage these advantages fully, enabling your business to operate more efficiently and focus on core functions. It’s a vital tool for managing documents effectively.

Get more for Virginia Form 502

Find out other Virginia Form 502

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast

- eSign Hawaii Banking Permission Slip Online

- eSign Minnesota Banking LLC Operating Agreement Online

- How Do I eSign Mississippi Banking Living Will

- eSign New Jersey Banking Claim Mobile

- eSign New York Banking Promissory Note Template Now

- eSign Ohio Banking LLC Operating Agreement Now