Mw506 Form PDF

What is the MW506 Form PDF?

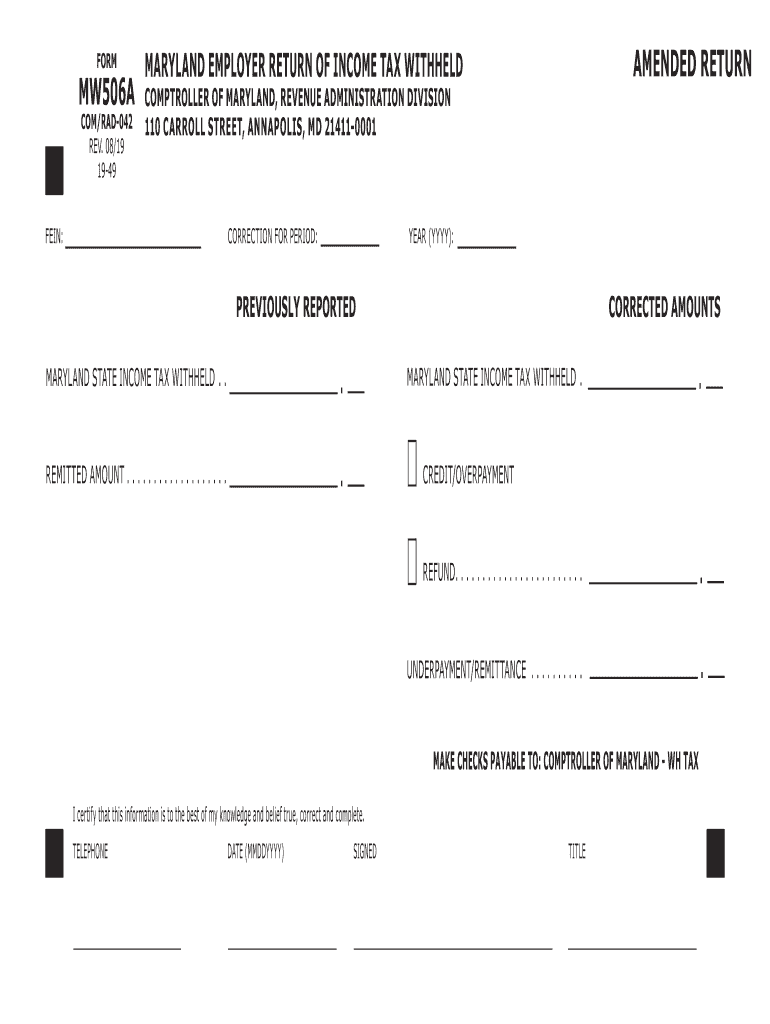

The MW506 form is a Maryland tax document used for reporting and remitting withholding tax for employees. This form is essential for employers who withhold state income tax from their employees' wages. The MW506 form PDF is the electronic version of this document, allowing for easier completion and submission. It includes various sections that require specific information about the employer, the employees, and the amounts withheld. Understanding the MW506 form is crucial for compliance with Maryland tax laws.

Steps to Complete the MW506 Form PDF

Completing the MW506 form PDF involves several key steps:

- Download the MW506 form PDF from the official Maryland Comptroller's website.

- Fill in the employer's information, including the name, address, and federal employer identification number (FEIN).

- Enter details for each employee, including their names, social security numbers, and the total amount of state income tax withheld.

- Calculate the total withholding amounts and ensure accuracy in your entries.

- Review the completed form for any errors before submission.

Legal Use of the MW506 Form PDF

The MW506 form PDF is legally binding when filled out correctly and submitted to the Maryland Comptroller's office. It must be completed in accordance with Maryland state tax laws to ensure compliance. Employers are required to maintain accurate records and submit this form to report withholding amounts accurately. Failure to submit the MW506 form can result in penalties and interest on unpaid taxes.

Filing Deadlines / Important Dates

Employers must be aware of the filing deadlines associated with the MW506 form. Typically, the form is due on or before the 15th day of the month following the end of the quarter. For example, for the first quarter ending March 31, the MW506 form must be submitted by April 15. It is essential to stay updated on any changes to these deadlines to avoid penalties.

Form Submission Methods (Online / Mail / In-Person)

The MW506 form PDF can be submitted through various methods. Employers have the option to file online via the Maryland Comptroller's eServices portal, which offers a streamlined process for electronic submission. Alternatively, the completed form can be mailed to the appropriate address provided by the Comptroller's office. In-person submissions are also accepted at designated locations, allowing employers to receive immediate assistance if needed.

Key Elements of the MW506 Form PDF

Several key elements must be included in the MW506 form PDF to ensure its validity:

- Employer identification information, including name and FEIN.

- Employee details, such as names and social security numbers.

- Total amount of state income tax withheld for each employee.

- Signature of the person authorized to submit the form.

Quick guide on how to complete ty 2019 mw506apdf tax year 2019 mw506a

Complete Mw506 Form Pdf effortlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal eco-friendly alternative to traditional printed and signed documents, allowing you to find the necessary form and securely store it online. airSlate SignNow equips you with all the resources required to create, modify, and eSign your documents quickly without delays. Manage Mw506 Form Pdf on any platform with airSlate SignNow Android or iOS applications and streamline any document-related workflow today.

The easiest way to edit and eSign Mw506 Form Pdf without any hassle

- Obtain Mw506 Form Pdf and then click Get Form to begin.

- Use the features we provide to fill out your form.

- Emphasize signNow sections of your documents or conceal sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature using the Sign tool, which takes moments and carries the same legal validity as a conventional wet ink signature.

- Review the information and then click the Done button to save your changes.

- Select your preferred method to submit your form, whether by email, SMS, invite link, or download it to your computer.

Eliminate concerns about lost or misplaced files, tedious form searches, or mistakes that require reprinting document copies. airSlate SignNow meets your document management needs with just a few clicks from any device you choose. Edit and eSign Mw506 Form Pdf and guarantee excellent communication at any stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the ty 2019 mw506apdf tax year 2019 mw506a

How to create an electronic signature for the Ty 2019 Mw506apdf Tax Year 2019 Mw506a in the online mode

How to create an eSignature for the Ty 2019 Mw506apdf Tax Year 2019 Mw506a in Chrome

How to create an electronic signature for signing the Ty 2019 Mw506apdf Tax Year 2019 Mw506a in Gmail

How to create an eSignature for the Ty 2019 Mw506apdf Tax Year 2019 Mw506a from your smartphone

How to make an electronic signature for the Ty 2019 Mw506apdf Tax Year 2019 Mw506a on iOS devices

How to create an electronic signature for the Ty 2019 Mw506apdf Tax Year 2019 Mw506a on Android

People also ask

-

What is the process for creating an amended Maryland withheld form using airSlate SignNow?

Creating an amended Maryland withheld form with airSlate SignNow is straightforward. Simply upload your document, make necessary amendments using our intuitive interface, and then utilize our eSignature feature to finalize the process. This ensures that your amended Maryland withheld form complies with state requirements efficiently.

-

How does airSlate SignNow ensure the security of my amended Maryland withheld documents?

AirSlate SignNow prioritizes the security of your amended Maryland withheld documents by implementing strong encryption protocols and secure data storage solutions. Our platform is compliant with industry standards, providing you peace of mind that your sensitive information is protected during eSigning and throughout the document lifecycle.

-

Is airSlate SignNow suitable for both individuals and businesses needing amended Maryland withheld forms?

Yes, airSlate SignNow caters to both individuals and businesses who need amended Maryland withheld forms. Whether you are an independent freelancer or part of a large corporation, our platform offers flexible plans that allow you to customize your document management needs. This makes airSlate SignNow a versatile solution for all users.

-

What features does airSlate SignNow offer for managing amended Maryland withheld forms?

AirSlate SignNow provides a range of features specifically for managing amended Maryland withheld forms, including customizable templates, advanced tagging options, and seamless collaboration tools. These features streamline the document preparation process, making it easy for users to track changes and obtain necessary approvals.

-

Can I integrate airSlate SignNow with other tools for handling amended Maryland withheld documents?

Absolutely! AirSlate SignNow offers integrations with popular tools such as Google Drive, Dropbox, and CRM systems to enhance your workflow. This means you can easily manage your amended Maryland withheld documents alongside other applications, improving efficiency and productivity across your organization.

-

What is the pricing structure for using airSlate SignNow for amended Maryland withheld documents?

AirSlate SignNow offers a competitive pricing structure that is flexible according to your needs. You can choose from various plans that cater to individuals and businesses, allowing you to only pay for what's necessary. This ensures you get an affordable and effective solution for handling your amended Maryland withheld documents.

-

Are there any limits on the number of amended Maryland withheld forms I can sign or send?

With airSlate SignNow, you can sign and send an unlimited number of amended Maryland withheld forms, depending on your chosen plan. This flexibility allows you to manage all your documents without the worry of exceeding monthly limitations. Our aim is to provide a hassle-free experience for document management.

Get more for Mw506 Form Pdf

Find out other Mw506 Form Pdf

- Help Me With Electronic signature Hawaii Debt Settlement Agreement Template

- Electronic signature Oregon Stock Purchase Agreement Template Later

- Electronic signature Mississippi Debt Settlement Agreement Template Later

- Electronic signature Vermont Stock Purchase Agreement Template Safe

- Electronic signature California Stock Transfer Form Template Mobile

- How To Electronic signature Colorado Stock Transfer Form Template

- Electronic signature Georgia Stock Transfer Form Template Fast

- Electronic signature Michigan Stock Transfer Form Template Myself

- Electronic signature Montana Stock Transfer Form Template Computer

- Help Me With Electronic signature Texas Debt Settlement Agreement Template

- How Do I Electronic signature Nevada Stock Transfer Form Template

- Electronic signature Virginia Stock Transfer Form Template Secure

- How Do I Electronic signature Colorado Promissory Note Template

- Can I Electronic signature Florida Promissory Note Template

- How To Electronic signature Hawaii Promissory Note Template

- Electronic signature Indiana Promissory Note Template Now

- Electronic signature Kansas Promissory Note Template Online

- Can I Electronic signature Louisiana Promissory Note Template

- Electronic signature Rhode Island Promissory Note Template Safe

- How To Electronic signature Texas Promissory Note Template