1099 Form

What is the 1099 Form

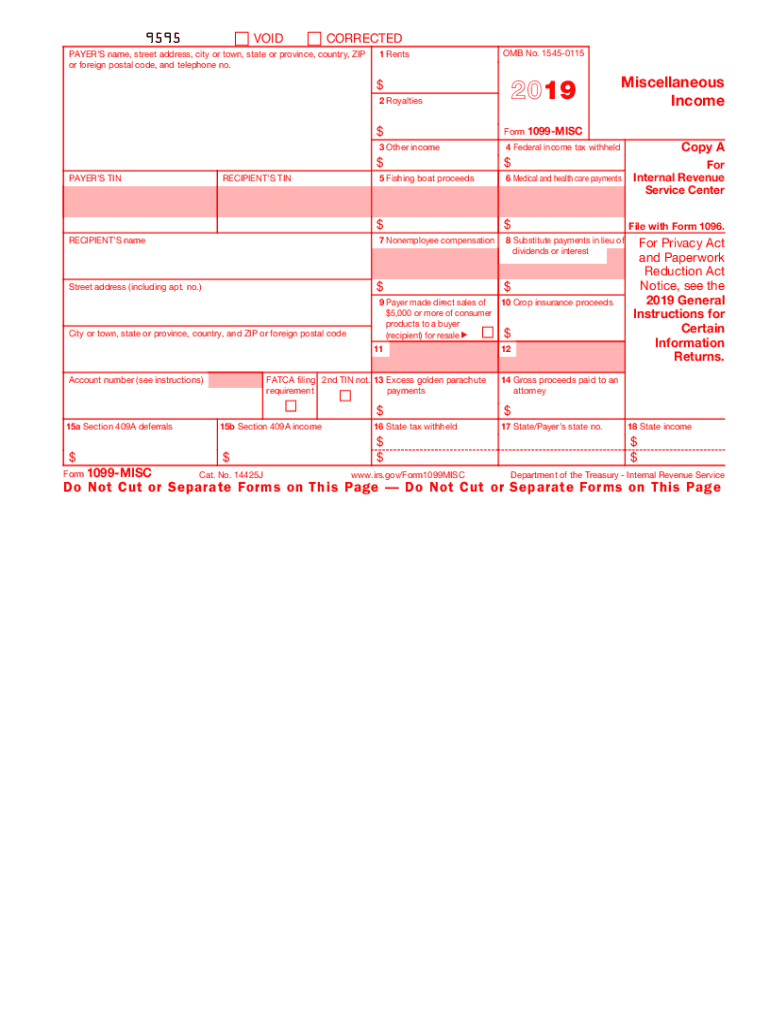

The 1099 form is a series of documents used in the United States to report various types of income other than wages, salaries, and tips. The 2019 Form 1099-NEC specifically reports non-employee compensation, which is crucial for freelancers, independent contractors, and other self-employed individuals. This form ensures that the Internal Revenue Service (IRS) is informed about income received by individuals who are not on a company’s payroll. Understanding the purpose of the 1099 form is essential for accurate tax filing and compliance.

How to use the 1099 Form

To use the 1099 form effectively, individuals and businesses must first determine if they need to issue it. If a business pays an independent contractor or freelancer $600 or more in a calendar year, it is required to issue a 1099-NEC form. The payer must fill out the form with the recipient's name, address, and taxpayer identification number, along with the total amount paid during the year. Once completed, the form must be sent to the recipient and filed with the IRS by the designated deadline.

Steps to complete the 1099 Form

Completing the 2019 Form 1099-NEC involves several key steps:

- Gather necessary information: Collect the recipient's name, address, and taxpayer identification number (TIN).

- Fill out the form: Enter the payer's information, the recipient's details, and the total amount paid in Box 1.

- Review for accuracy: Ensure all information is correct to avoid penalties.

- Provide copies: Send Copy B to the recipient and file Copy A with the IRS.

- Keep records: Maintain a copy for your records for future reference.

Filing Deadlines / Important Dates

Filing deadlines for the 2019 Form 1099-NEC are critical for compliance. The form must be provided to recipients by January 31 of the year following the tax year. Additionally, the IRS requires that the form be filed by January 31 as well, whether filing electronically or by mail. Missing these deadlines can result in penalties, so it is important to stay organized and ensure timely submission.

Legal use of the 1099 Form

The legal use of the 1099 form is governed by IRS regulations. It is essential for businesses to issue the form accurately to report non-employee compensation. Failure to provide the correct information can lead to penalties and an audit by the IRS. Moreover, recipients must report the income listed on the 1099-NEC on their tax returns, making it a crucial document for both payers and payees in maintaining compliance with tax laws.

Who Issues the Form

The 1099 form is typically issued by businesses or individuals who have paid non-employee compensation during the tax year. This includes corporations, partnerships, and sole proprietors. It's important for the issuer to have accurate records of payments made to contractors or freelancers to ensure proper reporting. The responsibility lies with the payer to issue the form to the recipient and file it with the IRS.

Quick guide on how to complete 2019 form 1099 misc irsgov

Effortlessly Prepare 1099 Form on Any Device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, as you can access the necessary form and securely store it online. airSlate SignNow equips you with all the resources you need to create, edit, and eSign your documents swiftly without delays. Manage 1099 Form on any platform using airSlate SignNow Android or iOS applications and streamline any document-related processes today.

How to Edit and eSign 1099 Form with Ease

- Obtain 1099 Form and click on Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Emphasize important sections of the documents or redact sensitive information with the features that airSlate SignNow provides specifically for this purpose.

- Create your signature using the Sign tool, which takes seconds and holds the same legal validity as a conventional wet ink signature.

- Review the information and click on the Done button to save your changes.

- Choose how you prefer to send your form: by email, SMS, invite link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searches, or mistakes that necessitate the printing of new document copies. airSlate SignNow meets your document management needs in just a few clicks from a device of your choice. Modify and eSign 1099 Form to ensure seamless communication at every step of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 misc irsgov

How to make an electronic signature for the 2019 Form 1099 Misc Irsgov online

How to generate an eSignature for the 2019 Form 1099 Misc Irsgov in Chrome

How to generate an eSignature for signing the 2019 Form 1099 Misc Irsgov in Gmail

How to create an electronic signature for the 2019 Form 1099 Misc Irsgov straight from your smart phone

How to generate an electronic signature for the 2019 Form 1099 Misc Irsgov on iOS devices

How to make an electronic signature for the 2019 Form 1099 Misc Irsgov on Android

People also ask

-

What is a 1099 Form and why do I need it?

A 1099 Form is a tax document used to report income received from non-employment sources, such as freelance work or contract labor. If you’re a business owner or freelancer, you need this form to ensure accurate income reporting and compliance with IRS regulations. Using airSlate SignNow, you can easily eSign and send 1099 Forms to streamline your tax reporting process.

-

How does airSlate SignNow simplify the process of sending 1099 Forms?

airSlate SignNow simplifies the process of sending 1099 Forms by providing an intuitive platform that allows users to create, eSign, and send documents quickly. With its user-friendly interface, you can upload your 1099 Form, add recipients, and send it out for signatures in just a few clicks. This efficiency saves you time and ensures that your documents are securely handled.

-

Can I integrate airSlate SignNow with my accounting software for 1099 Forms?

Yes, airSlate SignNow offers seamless integrations with popular accounting software, making it easy to manage your 1099 Forms. By integrating with tools like QuickBooks or Xero, you can automatically generate and send 1099 Forms to your contractors and freelancers, ensuring accurate record-keeping and compliance. This integration helps streamline your financial workflows.

-

What is the pricing structure for sending 1099 Forms with airSlate SignNow?

airSlate SignNow offers a variety of pricing plans that cater to different business needs, including options for sending 1099 Forms. Whether you’re a small business or a large enterprise, you can choose a plan that fits your budget while providing access to essential features for managing your documents. Visit our pricing page to find the plan that’s right for you.

-

Is it safe to eSign 1099 Forms using airSlate SignNow?

Absolutely! airSlate SignNow prioritizes security, ensuring that all eSignatures and 1099 Forms are protected with industry-leading encryption. Your sensitive information is kept confidential, and our platform complies with legal standards for electronic signatures, giving you peace of mind when signing and sending important tax documents.

-

Can I track the status of my 1099 Forms sent through airSlate SignNow?

Yes, airSlate SignNow provides tracking features that allow you to monitor the status of your 1099 Forms in real-time. You can see when the form has been sent, viewed, and signed, ensuring that you stay informed throughout the process. This visibility helps you manage your documentation efficiently.

-

What features does airSlate SignNow offer for managing 1099 Forms?

airSlate SignNow offers a range of features designed to make managing 1099 Forms straightforward. You can easily create templates, automate workflows, and set reminders for sending out forms, ensuring you never miss a deadline. With these tools, you can enhance your document management process signNowly.

Get more for 1099 Form

Find out other 1099 Form

- Sign Ohio Police Promissory Note Template Easy

- Sign Alabama Courts Affidavit Of Heirship Simple

- How To Sign Arizona Courts Residential Lease Agreement

- How Do I Sign Arizona Courts Residential Lease Agreement

- Help Me With Sign Arizona Courts Residential Lease Agreement

- How Can I Sign Arizona Courts Residential Lease Agreement

- Sign Colorado Courts LLC Operating Agreement Mobile

- Sign Connecticut Courts Living Will Computer

- How Do I Sign Connecticut Courts Quitclaim Deed

- eSign Colorado Banking Rental Application Online

- Can I eSign Colorado Banking Medical History

- eSign Connecticut Banking Quitclaim Deed Free

- eSign Connecticut Banking Business Associate Agreement Secure

- Sign Georgia Courts Moving Checklist Simple

- Sign Georgia Courts IOU Mobile

- How Can I Sign Georgia Courts Lease Termination Letter

- eSign Hawaii Banking Agreement Simple

- eSign Hawaii Banking Rental Application Computer

- eSign Hawaii Banking Agreement Easy

- eSign Hawaii Banking LLC Operating Agreement Fast