Form 1040 Schedule a

What is the Form 1040 Schedule A

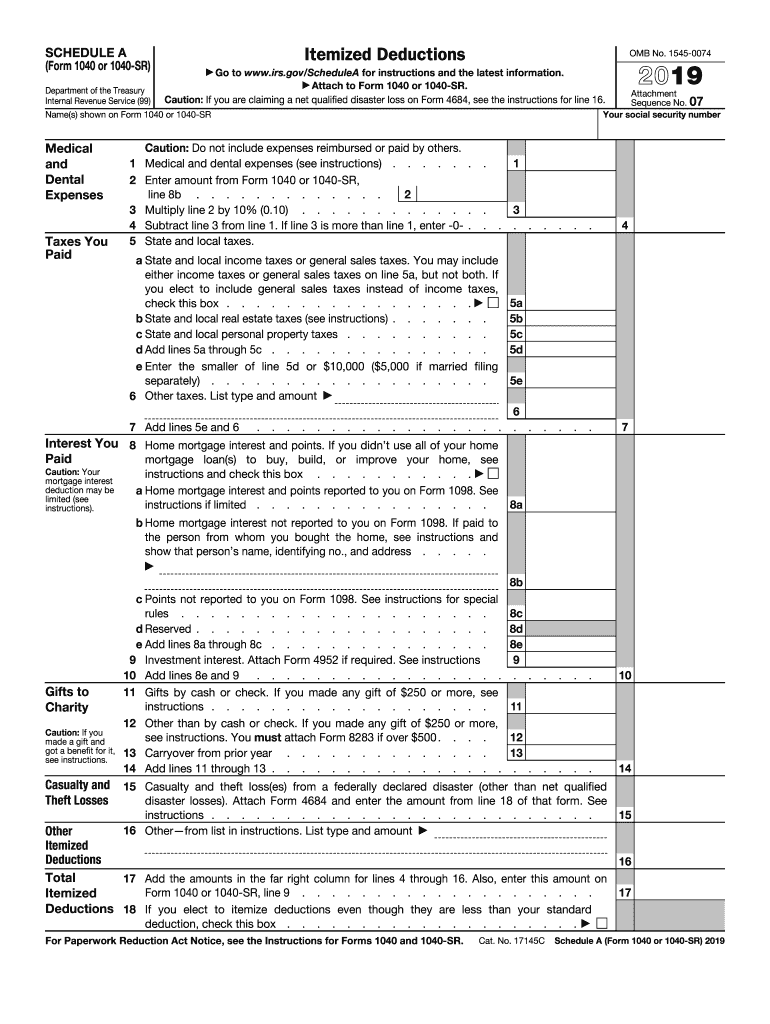

The Form 1040 Schedule A is a tax form used by taxpayers in the United States to report itemized deductions. This form allows individuals to detail specific expenses that can reduce their taxable income, potentially leading to a lower tax bill. Common itemized deductions include medical expenses, mortgage interest, state and local taxes, and charitable contributions. By using Schedule A, taxpayers can choose to itemize deductions instead of taking the standard deduction, which may be more beneficial depending on their financial situation.

How to use the Form 1040 Schedule A

To use the Form 1040 Schedule A effectively, taxpayers should gather all relevant documentation related to their itemized deductions. This includes receipts, bank statements, and any other proof of expenses. Once the information is collected, taxpayers can fill out the form by entering their deductions in the appropriate sections. It is essential to ensure that all amounts are accurate and that the necessary documentation is available in case of an audit. After completing the form, it should be attached to the main Form 1040 when filing taxes.

Steps to complete the Form 1040 Schedule A

Completing the Form 1040 Schedule A involves several key steps:

- Gather documentation for all potential itemized deductions.

- Fill out personal information at the top of the form.

- List each type of deduction in the corresponding section, including medical expenses, taxes paid, and charitable contributions.

- Calculate the total itemized deductions and enter the amount on the appropriate line.

- Review the completed form for accuracy before attaching it to Form 1040.

IRS Guidelines

The IRS provides specific guidelines for completing the Form 1040 Schedule A. Taxpayers should refer to the latest IRS instructions to ensure compliance with current tax laws. The guidelines outline eligible deductions, documentation requirements, and limitations on certain expenses. It is crucial to stay informed about any changes in tax legislation that may affect itemized deductions, as these can vary from year to year.

Required Documents

To complete the Form 1040 Schedule A, taxpayers need to gather various documents that support their itemized deductions. Essential documents include:

- Receipts for medical expenses, including prescriptions and hospital bills.

- Mortgage interest statements (Form 1098).

- Records of state and local taxes paid.

- Documentation for charitable contributions, such as donation receipts.

Having these documents readily available will facilitate a smoother filing process and help substantiate claims in case of an audit.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the Form 1040 Schedule A. Typically, the deadline for filing individual tax returns is April 15 of the following year. If April 15 falls on a weekend or holiday, the deadline may be extended to the next business day. It is advisable to file early to avoid any last-minute issues and to ensure that all forms, including Schedule A, are submitted on time.

Quick guide on how to complete deductions form 1040 itemized internal revenue service

Complete Form 1040 Schedule A effortlessly on any device

Digital document management has gained immense popularity among organizations and individuals. It serves as an ideal environmentally friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the necessary tools to create, modify, and eSign your documents quickly without any holdups. Handle Form 1040 Schedule A on any device with the airSlate SignNow Android or iOS applications and simplify any document-related process today.

How to modify and eSign Form 1040 Schedule A with ease

- Obtain Form 1040 Schedule A and then click Get Form to begin.

- Use the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes just seconds and carries the same legal significance as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Select how you wish to share your form, via email, text message (SMS), invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets all your document management needs within a few clicks from any device of your choice. Edit and eSign Form 1040 Schedule A and ensure excellent communication at every stage of the form completion process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the deductions form 1040 itemized internal revenue service

How to create an eSignature for your Deductions Form 1040 Itemized Internal Revenue Service online

How to make an electronic signature for your Deductions Form 1040 Itemized Internal Revenue Service in Chrome

How to make an electronic signature for putting it on the Deductions Form 1040 Itemized Internal Revenue Service in Gmail

How to create an electronic signature for the Deductions Form 1040 Itemized Internal Revenue Service from your smartphone

How to generate an electronic signature for the Deductions Form 1040 Itemized Internal Revenue Service on iOS devices

How to create an eSignature for the Deductions Form 1040 Itemized Internal Revenue Service on Android devices

People also ask

-

What is the process to schedule a form 1040 using airSlate SignNow?

To schedule a form 1040 with airSlate SignNow, you can simply upload your document, add the necessary signers, and specify a schedule for signing. The platform will send reminders to all parties involved, ensuring that the form is signed and submitted on time. This easy-to-use solution streamlines the entire process, making tax season less stressful.

-

Is there a cost associated with scheduling a form 1040 through airSlate SignNow?

Yes, airSlate SignNow offers various pricing plans that cater to different business needs. Depending on the features required for your document scheduling, signing, and management, you can choose a plan that best fits your budget. This cost-effective solution delivers value when you need to schedule a form 1040 efficiently.

-

What features does airSlate SignNow offer for scheduling a form 1040?

airSlate SignNow provides features such as automated reminders, templates for forms, and a user-friendly interface that makes it easy to schedule a form 1040. Additionally, you can track the status of your document in real-time, ensuring that all signers are up to date. These features enhance productivity and accuracy in your tax filing process.

-

Can airSlate SignNow integrate with other software when scheduling a form 1040?

Absolutely! airSlate SignNow supports integrations with a variety of applications, including popular accounting software like QuickBooks and tax preparation tools. This seamless integration allows you to easily schedule a form 1040 while keeping your business's workflow streamlined. Check out our integration directory for more options.

-

What are the benefits of using airSlate SignNow to schedule a form 1040?

Using airSlate SignNow to schedule a form 1040 offers numerous advantages, including reduced paper usage, increased efficiency, and improved compliance. The electronic signing process ensures that documents are securely signed and stored, while automated notifications keep everyone informed. Overall, it simplifies the tax preparation process for businesses of all sizes.

-

Is it safe to schedule a form 1040 with airSlate SignNow?

Yes, airSlate SignNow prioritizes security to protect your sensitive information when you schedule a form 1040. The platform uses advanced encryption methods and complies with industry regulations to ensure that your documents are kept confidential and secure. You can confidently manage and sign your tax documents without worrying about privacy concerns.

-

How can I get support when scheduling a form 1040 using airSlate SignNow?

airSlate SignNow provides dedicated customer support to assist you in scheduling a form 1040 and addressing any questions you might have. You can access help through live chat, email support, or a comprehensive knowledge base filled with guides and FAQs. Our support team is committed to ensuring you have a smooth eSigning experience.

Get more for Form 1040 Schedule A

- Searching for philosophy university of evansville faculty evansville form

- Compact form of sv40 viral minichromosome is resistant to

- Incoming direct rollover county employees retirement fund form

- Empower retirement 401k rollover form

- Government statement of work contract template form

- Grad contract template form

- Grade contract template form

- Grain contract template form

Find out other Form 1040 Schedule A

- eSignature North Dakota Government Quitclaim Deed Free

- eSignature Kansas Finance & Tax Accounting Business Letter Template Free

- eSignature Washington Government Arbitration Agreement Simple

- Can I eSignature Massachusetts Finance & Tax Accounting Business Plan Template

- Help Me With eSignature Massachusetts Finance & Tax Accounting Work Order

- eSignature Delaware Healthcare / Medical NDA Secure

- eSignature Florida Healthcare / Medical Rental Lease Agreement Safe

- eSignature Nebraska Finance & Tax Accounting Business Letter Template Online

- Help Me With eSignature Indiana Healthcare / Medical Notice To Quit

- eSignature New Jersey Healthcare / Medical Credit Memo Myself

- eSignature North Dakota Healthcare / Medical Medical History Simple

- Help Me With eSignature Arkansas High Tech Arbitration Agreement

- eSignature Ohio Healthcare / Medical Operating Agreement Simple

- eSignature Oregon Healthcare / Medical Limited Power Of Attorney Computer

- eSignature Pennsylvania Healthcare / Medical Warranty Deed Computer

- eSignature Texas Healthcare / Medical Bill Of Lading Simple

- eSignature Virginia Healthcare / Medical Living Will Computer

- eSignature West Virginia Healthcare / Medical Claim Free

- How To eSignature Kansas High Tech Business Plan Template

- eSignature Kansas High Tech Lease Agreement Template Online