4952 Form

What is the 4952

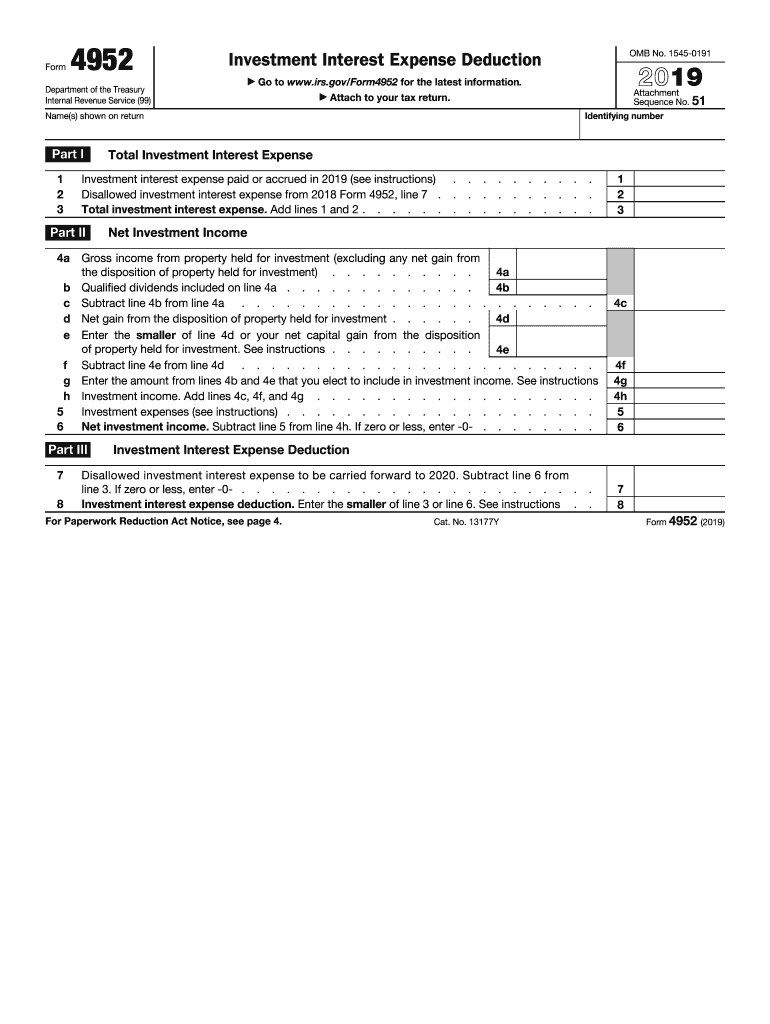

The IRS Form 4952, also known as the Investment Interest Expense Deduction, is a tax form used by individuals to calculate and report the amount of investment interest expense they can deduct on their tax returns. This form is essential for taxpayers who have incurred interest expenses related to investments, such as margin loans, and wish to claim these expenses on their tax returns. The 2019 version of this form outlines specific guidelines and calculations to determine the allowable deduction, ensuring compliance with IRS regulations.

How to use the 4952

To effectively use the 2019 Form 4952, taxpayers must first gather all relevant financial information regarding their investment interest expenses. This includes details about the investments generating the interest and the total amount of interest paid during the tax year. The form requires taxpayers to complete various sections, including the calculation of net investment income, which is crucial for determining the deductible amount. Once completed, the form should be attached to the taxpayer's Form 1040 when filing their annual tax return.

Steps to complete the 4952

Completing the 2019 Form 4952 involves several key steps:

- Gather necessary documentation, including records of investment interest expenses and income.

- Calculate your net investment income, which includes interest and dividends from investments.

- Fill out the form, ensuring all sections are completed accurately, including the calculation of allowable deductions.

- Review the completed form for accuracy and compliance with IRS guidelines.

- Attach the form to your Form 1040 and submit it by the tax filing deadline.

Legal use of the 4952

The legal use of the 2019 Form 4952 is governed by IRS regulations, which stipulate the conditions under which investment interest expenses can be deducted. Taxpayers must ensure that their claims are substantiated by proper documentation and that they adhere to the guidelines provided by the IRS. Failure to comply with these regulations may result in penalties or disallowance of the deduction, emphasizing the importance of understanding the legal framework surrounding this form.

IRS Guidelines

The IRS provides specific guidelines for completing the 2019 Form 4952, which include instructions on calculating net investment income and allowable deductions. Taxpayers should refer to the IRS instructions accompanying the form to ensure they are following the most current regulations. This includes understanding what qualifies as investment interest and how to report it accurately on the tax return. Staying informed about IRS updates is crucial for maintaining compliance and maximizing deductions.

Filing Deadlines / Important Dates

Taxpayers must be aware of the filing deadlines associated with the 2019 Form 4952. Typically, individual tax returns, including Form 1040 and any attached forms, are due on April 15 of the following year. If this date falls on a weekend or holiday, the deadline may be extended. It is essential to file the form on time to avoid penalties and interest on any unpaid taxes. Taxpayers should also consider any extensions that may apply if they need additional time to prepare their returns.

Required Documents

When preparing to complete the 2019 Form 4952, several documents are required to ensure accurate reporting. These include:

- Statements from financial institutions detailing interest paid on investment loans.

- Records of investment income, such as dividends and interest from stocks or bonds.

- Any relevant tax documents that support the claims made on the form.

Having these documents readily available will facilitate a smoother completion process and help ensure compliance with IRS requirements.

Quick guide on how to complete irs f4952 fill online printable fillable blank

Complete 4952 effortlessly on any device

Digital document management has gained traction among businesses and individuals. It serves as an ideal eco-friendly alternative to conventional printed and signed files, as you can easily locate the appropriate form and securely store it online. airSlate SignNow equips you with all the necessary tools to generate, modify, and electronically sign your documents quickly and without interruptions. Handle 4952 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven procedure today.

The easiest way to alter and electronically sign 4952 with minimal effort

- Find 4952 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Emphasize pertinent sections of the documents or obscure sensitive information using tools that airSlate SignNow offers specifically for that purpose.

- Create your signature with the Sign feature, which takes mere seconds and carries the same legal validity as a traditional handwritten signature.

- Review the details and click on the Done button to save your modifications.

- Select your preferred method to share your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about lost or misplaced documents, tedious form searches, or mistakes that require printing new copies. airSlate SignNow fulfills all your document management requirements in just a few clicks from any device you choose. Modify and electronically sign 4952 and ensure excellent communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the irs f4952 fill online printable fillable blank

How to make an electronic signature for your Irs F4952 Fill Online Printable Fillable Blank in the online mode

How to make an eSignature for your Irs F4952 Fill Online Printable Fillable Blank in Google Chrome

How to generate an eSignature for putting it on the Irs F4952 Fill Online Printable Fillable Blank in Gmail

How to make an electronic signature for the Irs F4952 Fill Online Printable Fillable Blank from your smartphone

How to create an electronic signature for the Irs F4952 Fill Online Printable Fillable Blank on iOS

How to generate an electronic signature for the Irs F4952 Fill Online Printable Fillable Blank on Android devices

People also ask

-

What is the 2019 IRS 4952 form and why is it important?

The 2019 IRS 4952 form is crucial for taxpayers claiming expenses related to investment interest. Understanding this form helps ensure compliance and minimizes tax liabilities, making it essential for effective financial management.

-

How can airSlate SignNow help with the 2019 IRS 4952 form?

AirSlate SignNow provides an efficient solution to prepare, send, and eSign the 2019 IRS 4952 form securely. This simplifies the submission process, ensuring you meet deadlines while maintaining compliance.

-

Is there a cost associated with using airSlate SignNow for the 2019 IRS 4952?

Yes, airSlate SignNow offers a cost-effective subscription model that can suit various business sizes. The pricing is designed to be competitive while providing valuable features that facilitate the signing and management of documents like the 2019 IRS 4952.

-

What features does airSlate SignNow offer for handling the 2019 IRS 4952 form?

AirSlate SignNow offers features such as customizable templates, real-time tracking, and secure cloud storage to streamline the process of managing your 2019 IRS 4952 form. These features enhance your workflow, making document handling more efficient.

-

Can I integrate airSlate SignNow with other software for the 2019 IRS 4952?

Absolutely! AirSlate SignNow integrates seamlessly with various applications such as CRM and accounting software, allowing for a smooth workflow when preparing the 2019 IRS 4952. This integration helps manage your documents efficiently.

-

What are the benefits of using airSlate SignNow for tax-related documents?

Using airSlate SignNow for tax-related documents, including the 2019 IRS 4952, offers numerous benefits like reducing paperwork, enhancing security, and saving time. The platform also ensures that your documents are signed and sent quickly, minimizing delays.

-

How secure is airSlate SignNow when dealing with sensitive documents like the 2019 IRS 4952?

AirSlate SignNow prioritizes security and employs industry-standard encryption to protect sensitive documents, including the 2019 IRS 4952. You can rest assured that your information is safeguarded throughout the signing process.

Get more for 4952

Find out other 4952

- Electronic signature North Carolina Plumbing Business Letter Template Easy

- Electronic signature Kansas Real Estate Residential Lease Agreement Simple

- How Can I Electronic signature North Carolina Plumbing Promissory Note Template

- Electronic signature North Dakota Plumbing Emergency Contact Form Mobile

- Electronic signature North Dakota Plumbing Emergency Contact Form Easy

- Electronic signature Rhode Island Plumbing Business Plan Template Later

- Electronic signature Louisiana Real Estate Quitclaim Deed Now

- Electronic signature Louisiana Real Estate Quitclaim Deed Secure

- How Can I Electronic signature South Dakota Plumbing Emergency Contact Form

- Electronic signature South Dakota Plumbing Emergency Contact Form Myself

- Electronic signature Maryland Real Estate LLC Operating Agreement Free

- Electronic signature Texas Plumbing Quitclaim Deed Secure

- Electronic signature Utah Plumbing Last Will And Testament Free

- Electronic signature Washington Plumbing Business Plan Template Safe

- Can I Electronic signature Vermont Plumbing Affidavit Of Heirship

- Electronic signature Michigan Real Estate LLC Operating Agreement Easy

- Electronic signature West Virginia Plumbing Memorandum Of Understanding Simple

- Electronic signature Sports PDF Alaska Fast

- Electronic signature Mississippi Real Estate Contract Online

- Can I Electronic signature Missouri Real Estate Quitclaim Deed