Irs Form 944

What is the IRS Form 944?

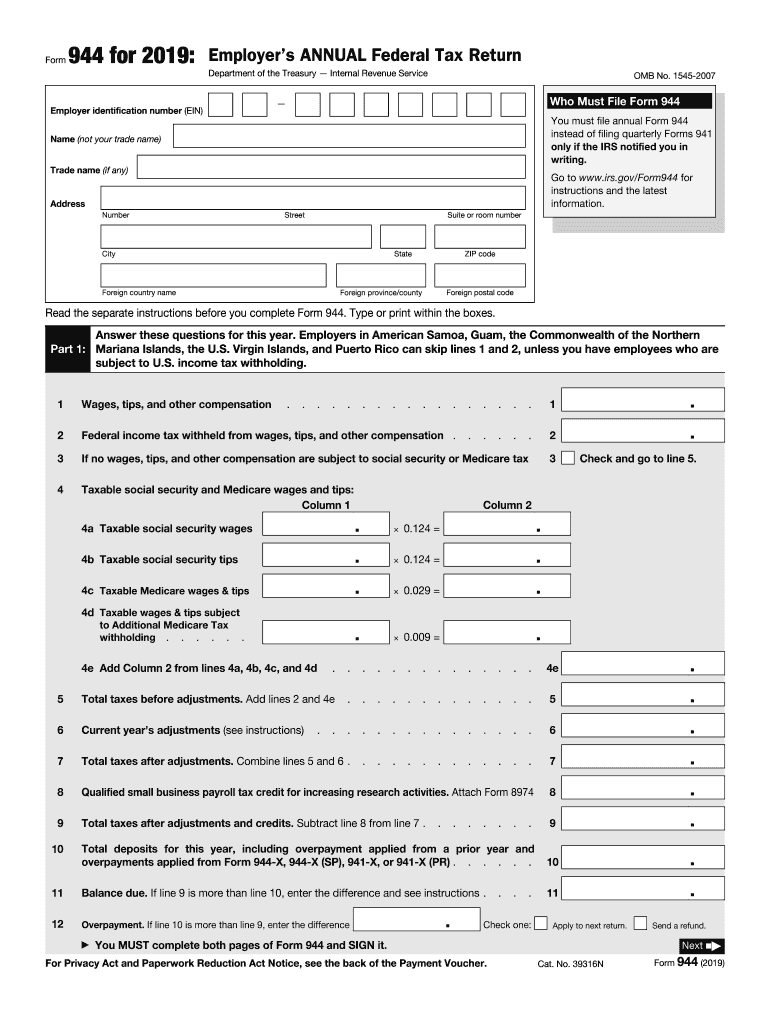

The IRS Form 944 is a federal tax return specifically designed for small employers to report their annual payroll taxes. This form is beneficial for businesses that owe less than a certain amount in payroll taxes each year, allowing them to file just once a year instead of quarterly. The form includes information about the total wages paid to employees, the amount of federal income tax withheld, and the employer's share of Social Security and Medicare taxes. This simplifies the reporting process for small businesses, making tax compliance more manageable.

Steps to Complete the IRS Form 944

Completing the IRS Form 944 involves several key steps:

- Gather necessary information: Collect all relevant payroll records, including employee wages and tax withholdings.

- Fill out the form: Enter the required information accurately, including the total wages paid and taxes withheld.

- Review for accuracy: Double-check all entries to ensure there are no mistakes that could lead to penalties.

- Sign and date the form: Ensure that the form is signed by an authorized individual within the business.

- Submit the form: Choose your preferred submission method, whether online or via mail.

Filing Deadlines / Important Dates

For the IRS Form 944, the filing deadline is typically January 31 of the year following the tax year being reported. If January 31 falls on a weekend or holiday, the deadline may be extended to the next business day. It is crucial for employers to adhere to this deadline to avoid penalties and interest on unpaid taxes. Additionally, employers should be aware of any changes in deadlines that may occur due to IRS updates or specific circumstances.

Required Documents

To complete the IRS Form 944 accurately, certain documents are needed:

- Payroll records, including employee names, Social Security numbers, and wages paid.

- Records of federal income tax withheld from employee paychecks.

- Documentation of Social Security and Medicare taxes owed.

- Any prior year tax returns for reference, if applicable.

Form Submission Methods

The IRS Form 944 can be submitted in several ways:

- Online: Employers can file electronically through the IRS e-file system or authorized e-file providers.

- By Mail: The completed form can be mailed to the appropriate IRS address, which can vary based on the employer's location.

- In-Person: While less common, some employers may choose to deliver the form in person at their local IRS office.

Penalties for Non-Compliance

Failing to file the IRS Form 944 on time or inaccurately reporting information can result in significant penalties. The IRS may impose fines based on the amount of tax owed and the length of time the return is late. Additionally, interest may accrue on any unpaid taxes. It is essential for employers to understand these penalties to ensure timely and accurate compliance with federal tax laws.

Quick guide on how to complete about form 944 employers annual federal tax return

Prepare Irs Form 944 effortlessly on any gadget

Online document management has gained traction with businesses and individuals. It offers an ideal eco-friendly substitute for conventional printed and signed documents, allowing you to locate the appropriate form and securely save it online. airSlate SignNow equips you with all the resources necessary to create, alter, and eSign your papers quickly without any delays. Manage Irs Form 944 on any device with airSlate SignNow Android or iOS applications and enhance any document-driven process today.

The easiest way to alter and eSign Irs Form 944 without hassle

- Obtain Irs Form 944 and click Access Form to begin.

- Utilize the tools we provide to finalize your document.

- Emphasize signNow sections of your documents or redact sensitive information with tools that airSlate SignNow has specifically designed for that purpose.

- Create your signature using the Signature tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review all the details and click the Complete button to save your modifications.

- Select your preferred method to send your form, via email, text message (SMS), or invite link, or download it to your computer.

Say goodbye to lost or misplaced documents, tiresome form searching, or errors that require new document copies to be printed. airSlate SignNow addresses your document management needs in just a few clicks from a device of your choosing. Alter and eSign Irs Form 944 and ensure excellent communication at every step of the form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about form 944 employers annual federal tax return

How to make an electronic signature for the About Form 944 Employers Annual Federal Tax Return online

How to make an electronic signature for your About Form 944 Employers Annual Federal Tax Return in Google Chrome

How to create an eSignature for putting it on the About Form 944 Employers Annual Federal Tax Return in Gmail

How to generate an electronic signature for the About Form 944 Employers Annual Federal Tax Return right from your mobile device

How to make an eSignature for the About Form 944 Employers Annual Federal Tax Return on iOS devices

How to generate an eSignature for the About Form 944 Employers Annual Federal Tax Return on Android devices

People also ask

-

What is the significance of filing an income tax return 2019?

Filing your income tax return 2019 is essential for ensuring compliance with IRS regulations. It allows you to report your income, claim deductions, and potentially receive a refund if you overpaid your taxes. Understanding the significance of your return can help you maximize your financial benefits.

-

How can airSlate SignNow help with my income tax return 2019?

airSlate SignNow simplifies the process of sending and eSigning your income tax return 2019. Our platform allows you to securely manage documents online, making it easier to gather signatures and ensure timely filings. Enjoy a streamlined workflow that increases productivity while maintaining compliance.

-

What are the pricing options for using airSlate SignNow for my income tax return 2019?

airSlate SignNow offers various pricing plans to accommodate businesses of all sizes while handling documents like your income tax return 2019. Plans include features such as unlimited templates and cloud storage, ensuring you find a solution that fits your needs and budget. Explore our pricing page to find the perfect plan for managing your tax documents.

-

Is airSlate SignNow secure for handling sensitive documents like an income tax return 2019?

Absolutely! airSlate SignNow employs robust encryption and security protocols to protect your sensitive documents, including your income tax return 2019. You can trust that your data is safe as you use our platform to eSign and manage your tax documents.

-

Can I integrate airSlate SignNow with other software for my income tax return 2019?

Yes, airSlate SignNow offers integration capabilities with various software platforms that can assist in the management of your income tax return 2019. Whether you’re using accounting software or CRM systems, our integration features enhance your workflow. Check our integrations list to see all compatible applications.

-

What features does airSlate SignNow offer for preparing an income tax return 2019?

With airSlate SignNow, you get features such as easy document creation, eSigning, and tracking for your income tax return 2019. Our user-friendly interface ensures that document preparation is quick and efficient. Focus on your taxes while we take care of the paperwork.

-

What benefits can I expect from using airSlate SignNow for my income tax return 2019?

Using airSlate SignNow for your income tax return 2019 presents numerous benefits, including reduced processing time, improved accuracy, and enhanced collaboration. You can easily share documents with your accountant or tax advisor, ensuring everyone is on the same page. Our platform helps you manage your tax-related tasks more effectively.

Get more for Irs Form 944

Find out other Irs Form 944

- How To eSign Missouri Construction Contract

- eSign Missouri Construction Rental Lease Agreement Easy

- How To eSign Washington Doctors Confidentiality Agreement

- Help Me With eSign Kansas Education LLC Operating Agreement

- Help Me With eSign West Virginia Doctors Lease Agreement Template

- eSign Wyoming Doctors Living Will Mobile

- eSign Wyoming Doctors Quitclaim Deed Free

- How To eSign New Hampshire Construction Rental Lease Agreement

- eSign Massachusetts Education Rental Lease Agreement Easy

- eSign New York Construction Lease Agreement Online

- Help Me With eSign North Carolina Construction LLC Operating Agreement

- eSign Education Presentation Montana Easy

- How To eSign Missouri Education Permission Slip

- How To eSign New Mexico Education Promissory Note Template

- eSign New Mexico Education Affidavit Of Heirship Online

- eSign California Finance & Tax Accounting IOU Free

- How To eSign North Dakota Education Rental Application

- How To eSign South Dakota Construction Promissory Note Template

- eSign Education Word Oregon Secure

- How Do I eSign Hawaii Finance & Tax Accounting NDA