2106 Form

What is the 2106

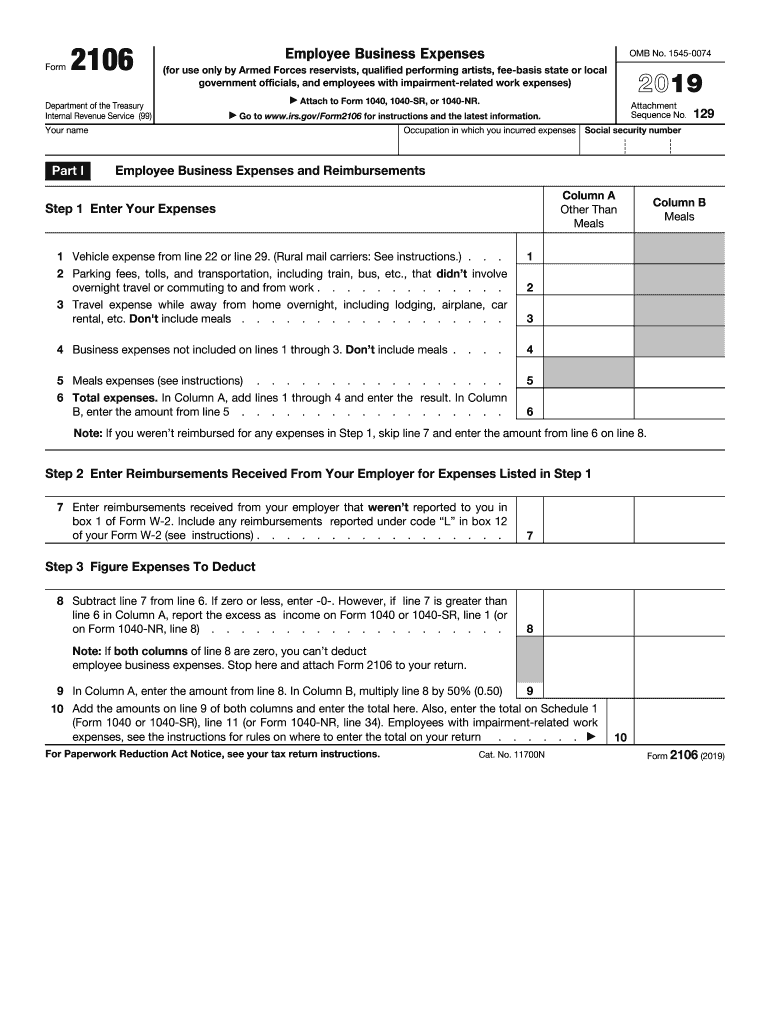

The 2106 form, also known as the Employee Business Expenses form, is used by employees to report unreimbursed business expenses. This form is particularly relevant for employees who incur costs while performing their job duties. The 2106 allows taxpayers to deduct certain expenses on their federal income tax return, which can help reduce their overall tax liability. Understanding the purpose of this form is essential for employees looking to maximize their deductions.

How to use the 2106

To effectively use the 2106 form, employees should first gather all relevant documentation of their business expenses. This includes receipts, invoices, and any other proof of payment. Once the necessary documents are collected, employees can fill out the form by detailing their expenses, categorizing them into sections such as travel, meals, and entertainment. It is important to adhere to IRS guidelines to ensure that all reported expenses are legitimate and properly categorized.

Steps to complete the 2106

Completing the 2106 form involves several key steps:

- Gather all receipts and documentation for business-related expenses.

- Fill in your personal information, including your name and Social Security number.

- Detail your expenses in the appropriate sections of the form.

- Calculate the total amount of deductible expenses.

- Sign and date the form before submitting it with your tax return.

Following these steps ensures that you accurately report your business expenses and take full advantage of available deductions.

IRS Guidelines

The IRS provides specific guidelines regarding what qualifies as a deductible business expense on the 2106 form. Generally, expenses must be ordinary and necessary for your job. This includes costs related to travel, meals, and supplies. It is crucial to maintain accurate records and only claim expenses that meet IRS criteria to avoid potential audits or penalties.

Filing Deadlines / Important Dates

When filing the 2106 form, it is important to be aware of key deadlines. Typically, the deadline for submitting your federal income tax return, including the 2106, is April fifteenth. If you require additional time, you may file for an extension, but any taxes owed must still be paid by the original deadline to avoid penalties. Keeping track of these dates can help ensure timely and accurate tax filing.

Required Documents

To complete the 2106 form, you will need several documents:

- Receipts for all business-related expenses.

- Records of mileage if claiming vehicle expenses.

- Any employer reimbursement documentation, if applicable.

- Previous year’s tax return for reference, if needed.

Having these documents ready will streamline the process and help ensure that your deductions are accurate and substantiated.

Quick guide on how to complete tax reform employee business expense form 2106

Complete 2106 effortlessly on any device

Web-based document management has become increasingly favored by companies and individuals alike. It offers an ideal eco-conscious substitute for traditional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow equips you with all the necessary tools to create, modify, and electronically sign your documents swiftly without issues. Handle 2106 on any device using airSlate SignNow's Android or iOS applications and simplify your document-related tasks today.

The easiest method to edit and electronically sign 2106 with ease

- Find 2106 and then click Get Form to initiate.

- Utilize the features we offer to finalize your document.

- Select important sections of your documents or obscure sensitive details with tools specifically provided by airSlate SignNow for that purpose.

- Create your signature using the Sign tool, which takes moments and holds the same legal validity as a standard wet ink signature.

- Review the details and then click on the Done button to save your changes.

- Choose how you wish to share your form, via email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misfiled documents, laborious form searches, or errors that necessitate printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device you prefer. Modify and electronically sign 2106 to ensure outstanding communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the tax reform employee business expense form 2106

How to make an eSignature for the Tax Reform Employee Business Expense Form 2106 online

How to make an eSignature for your Tax Reform Employee Business Expense Form 2106 in Google Chrome

How to create an electronic signature for putting it on the Tax Reform Employee Business Expense Form 2106 in Gmail

How to generate an electronic signature for the Tax Reform Employee Business Expense Form 2106 straight from your smart phone

How to generate an electronic signature for the Tax Reform Employee Business Expense Form 2106 on iOS

How to generate an eSignature for the Tax Reform Employee Business Expense Form 2106 on Android

People also ask

-

What is airSlate SignNow and how does it benefit my 2019 business?

airSlate SignNow is an intuitive eSignature solution that empowers your 2019 business to send and sign documents digitally. By streamlining your document workflows, you'll save time and reduce paper usage, enhancing your operational efficiency. This leads to faster transactions and improved customer satisfaction.

-

How much does airSlate SignNow cost for a 2019 business?

Pricing for airSlate SignNow varies based on the features you choose for your 2019 business. We offer flexible plans, including a free trial, so you can evaluate the service before committing. This allows businesses of all sizes to adopt a cost-effective digital signing solution.

-

What features does airSlate SignNow offer for my 2019 business?

airSlate SignNow offers a comprehensive set of features including template creation, team collaboration tools, and robust security measures. Additionally, the platform supports multiple file formats, making it easy to integrate into your existing processes. These features enhance workflow efficiency for your 2019 business.

-

Can airSlate SignNow integrate with other tools for my 2019 business?

Yes, airSlate SignNow seamlessly integrates with various applications your 2019 business may already be using. Compatibility with tools like Google Workspace, Salesforce, and Microsoft Office allows you to synchronize your workflows effortlessly. This helps you maintain productivity while using eSignature capabilities.

-

Is airSlate SignNow secure for sensitive documents in my 2019 business?

Absolutely, airSlate SignNow prioritizes security to ensure that your sensitive documents are protected. The platform employs bank-grade encryption and complies with global security standards, making it a reliable choice for your 2019 business. You can confidently manage all your important documents with peace of mind.

-

How can airSlate SignNow improve customer experience for my 2019 business?

By using airSlate SignNow, your 2019 business can provide customers with a fast and convenient signing experience. This means no more printing, scanning, or mailing documents, which can be time-consuming. A smoother process helps to enhance satisfaction, encouraging repeat business and positive referrals.

-

What support is available for airSlate SignNow users in a 2019 business?

airSlate SignNow provides extensive support for users in a 2019 business, including a robust knowledge base, live chat, and email support. Our dedicated customer service team is available to assist with any questions or issues that may arise. This ensures a smooth experience as you integrate eSignature into your operations.

Get more for 2106

Find out other 2106

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself

- eSignature Louisiana Plumbing Rental Application Secure

- eSignature Maine Plumbing Business Plan Template Simple

- Can I eSignature Massachusetts Plumbing Business Plan Template

- eSignature Mississippi Plumbing Emergency Contact Form Later

- eSignature Plumbing Form Nebraska Free

- How Do I eSignature Alaska Real Estate Last Will And Testament

- Can I eSignature Alaska Real Estate Rental Lease Agreement

- eSignature New Jersey Plumbing Business Plan Template Fast

- Can I eSignature California Real Estate Contract

- eSignature Oklahoma Plumbing Rental Application Secure

- How Can I eSignature Connecticut Real Estate Quitclaim Deed

- eSignature Pennsylvania Plumbing Business Plan Template Safe