Form it 633 Economic Transformation and Facility Redevelopment Program Tax Credit Tax Year 2024-2026

What is the Form IT-633 Economic Transformation and Facility Redevelopment Program Tax Credit?

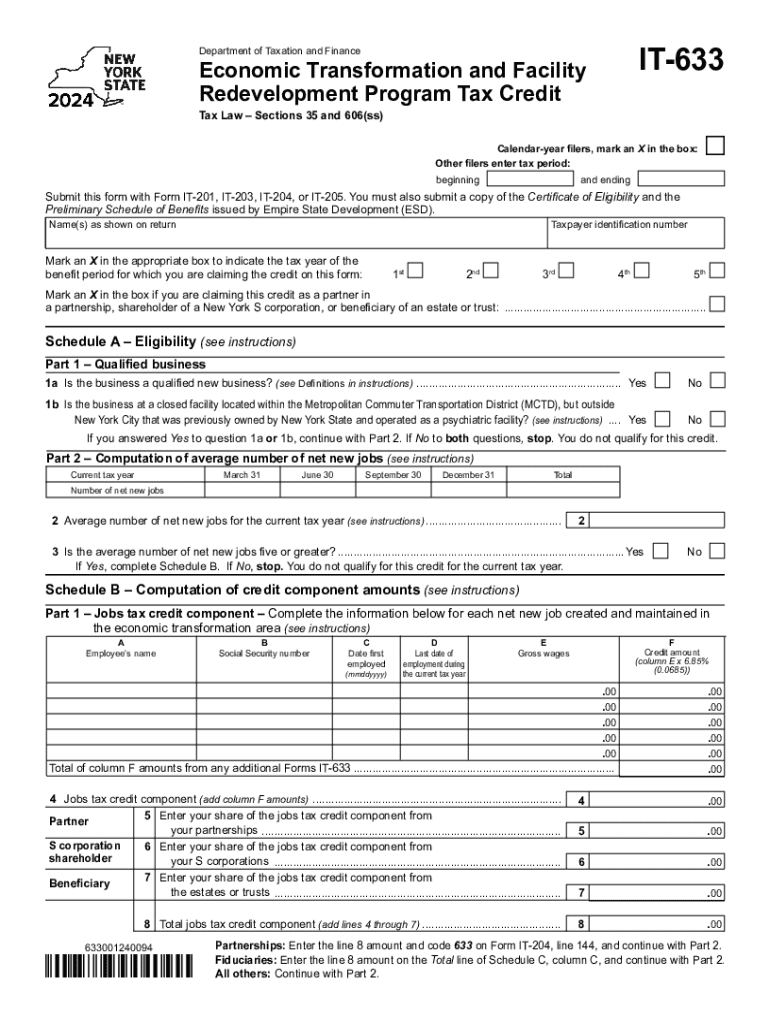

The Form IT-633 is a tax credit application related to the Economic Transformation and Facility Redevelopment Program in New York. This program aims to incentivize businesses to invest in the redevelopment of underutilized properties, thereby stimulating economic growth and revitalizing communities. The tax credit is designed for businesses that meet specific criteria, including making significant investments in redevelopment projects that enhance local economies.

Eligibility Criteria for the Form IT-633

To qualify for the tax credit under the Form IT-633, businesses must meet several eligibility requirements. These include:

- Location within designated redevelopment zones.

- Commitment to a minimum investment threshold in facility improvements.

- Creation or retention of a specified number of jobs within a defined period.

- Compliance with local zoning and environmental regulations.

Meeting these criteria is essential for businesses to benefit from the tax incentives offered through this program.

Steps to Complete the Form IT-633

Completing the Form IT-633 requires careful attention to detail. Here are the steps to follow:

- Gather necessary documentation, including proof of investment and job creation.

- Fill out the form with accurate information regarding the business and the redevelopment project.

- Attach supporting documents, such as financial statements and project plans.

- Review the form for completeness and accuracy before submission.

- Submit the form by the specified deadline, either online or via mail.

Following these steps can help ensure a smooth application process for the tax credit.

Filing Deadlines for the Form IT-633

Filing deadlines for the Form IT-633 are crucial for businesses seeking to benefit from the tax credit. Typically, applications must be submitted by a specific date each tax year. It is essential to stay informed about these deadlines to avoid missing out on potential tax savings. Businesses should check the official guidelines for the exact dates relevant to the current tax year.

Required Documents for the Form IT-633

When applying for the Form IT-633, businesses must provide various documents to support their application. Required documents may include:

- Proof of investment in redevelopment activities.

- Evidence of job creation or retention.

- Financial statements demonstrating the business's economic impact.

- Project plans and timelines for the redevelopment efforts.

Having these documents ready can streamline the application process and improve the chances of approval.

Legal Use of the Form IT-633

The Form IT-633 is legally binding and must be completed in accordance with state regulations. Businesses should ensure that all information provided is truthful and accurate, as any discrepancies may lead to penalties or disqualification from the tax credit program. Understanding the legal implications of the application process is essential for compliance and successful participation in the program.

Create this form in 5 minutes or less

Find and fill out the correct form it 633 economic transformation and facility redevelopment program tax credit tax year

Create this form in 5 minutes!

How to create an eSignature for the form it 633 economic transformation and facility redevelopment program tax credit tax year

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is airSlate SignNow's approach to document redevelopment?

airSlate SignNow focuses on the redevelopment of document workflows by providing an intuitive platform that simplifies the eSigning process. This allows businesses to streamline their operations and enhance productivity. With features designed for easy integration, users can redevelop their document management systems efficiently.

-

How does airSlate SignNow support the redevelopment of business processes?

The platform supports the redevelopment of business processes by offering customizable templates and automation tools. These features enable organizations to tailor their document workflows to meet specific needs, ensuring a seamless transition to a more efficient system. This redevelopment ultimately leads to improved turnaround times and reduced operational costs.

-

What are the pricing options for airSlate SignNow's redevelopment features?

airSlate SignNow offers flexible pricing plans that cater to various business sizes and needs, making the redevelopment of document processes accessible to all. Each plan includes essential features for eSigning and document management, allowing businesses to choose the best fit for their redevelopment goals. Additionally, there are options for scaling as your business grows.

-

Can airSlate SignNow integrate with other tools for document redevelopment?

Yes, airSlate SignNow seamlessly integrates with a variety of third-party applications, enhancing the redevelopment of your document workflows. This integration capability allows businesses to connect their existing tools, ensuring a smooth transition and improved efficiency. By leveraging these integrations, users can maximize the potential of their document management systems.

-

What benefits does airSlate SignNow provide for document redevelopment?

The primary benefits of using airSlate SignNow for document redevelopment include increased efficiency, reduced errors, and enhanced collaboration. By automating the eSigning process, businesses can save time and resources, allowing teams to focus on more strategic tasks. This leads to a more agile and responsive organization overall.

-

Is airSlate SignNow suitable for small businesses looking to redevelop their document processes?

Absolutely! airSlate SignNow is designed to be user-friendly and cost-effective, making it an ideal choice for small businesses aiming to redevelop their document processes. The platform provides essential features without overwhelming users, ensuring that even those with limited technical expertise can benefit from its capabilities. This empowers small businesses to compete effectively in their markets.

-

How secure is airSlate SignNow for document redevelopment?

Security is a top priority for airSlate SignNow, especially during the redevelopment of document workflows. The platform employs advanced encryption and compliance with industry standards to protect sensitive information. This commitment to security ensures that businesses can confidently manage their documents without compromising data integrity.

Get more for Form IT 633 Economic Transformation And Facility Redevelopment Program Tax Credit Tax Year

- Application to renew public insurance adjuster license lic 448 29c insurance ca form

- Form 442 39a

- Jfes 10 weekly job search log sample ctdol state ct form

- Ct apprenticeship completion form

- Mvr certificate form

- Georgia prevailing 2008 2019 form

- Georgia lottery application form

- Ga application barber form

Find out other Form IT 633 Economic Transformation And Facility Redevelopment Program Tax Credit Tax Year

- eSign North Dakota Real Estate Business Letter Template Computer

- eSign North Dakota Real Estate Quitclaim Deed Myself

- eSign Maine Sports Quitclaim Deed Easy

- eSign Ohio Real Estate LLC Operating Agreement Now

- eSign Ohio Real Estate Promissory Note Template Online

- How To eSign Ohio Real Estate Residential Lease Agreement

- Help Me With eSign Arkansas Police Cease And Desist Letter

- How Can I eSign Rhode Island Real Estate Rental Lease Agreement

- How Do I eSign California Police Living Will

- Can I eSign South Dakota Real Estate Quitclaim Deed

- How To eSign Tennessee Real Estate Business Associate Agreement

- eSign Michigan Sports Cease And Desist Letter Free

- How To eSign Wisconsin Real Estate Contract

- How To eSign West Virginia Real Estate Quitclaim Deed

- eSign Hawaii Police Permission Slip Online

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online