Schedule H Form

What is the Schedule H

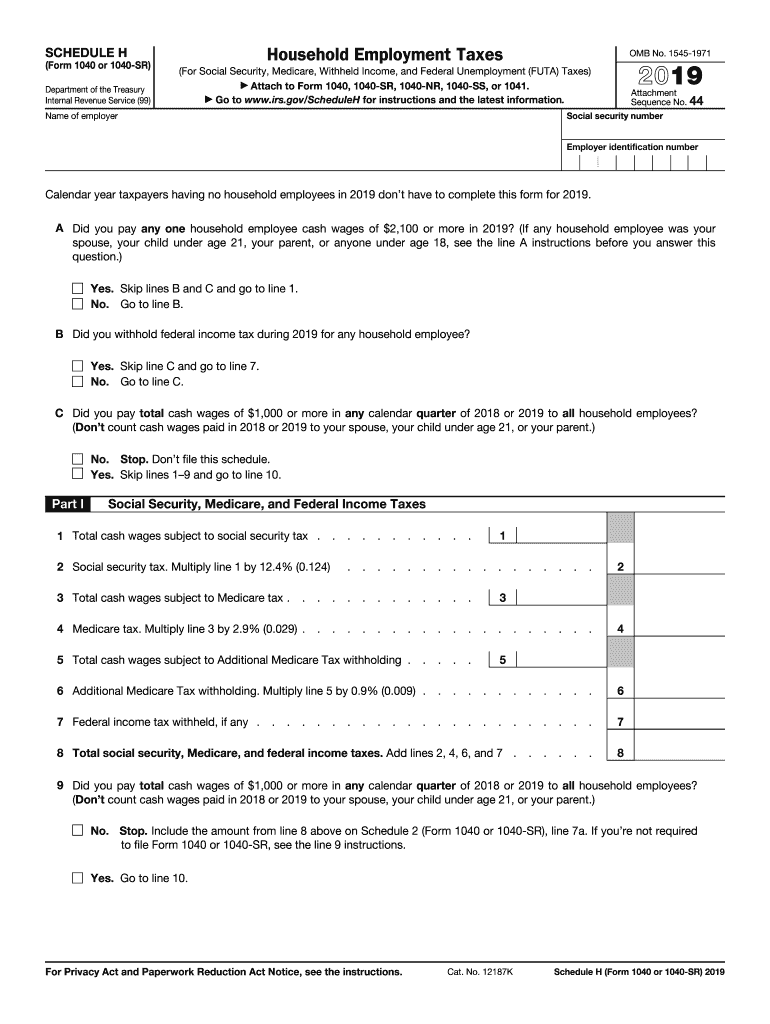

The Schedule H is a federal tax form used by employers to report household employment taxes. It is specifically designed for individuals who hire household employees, such as nannies, housekeepers, or caregivers, and need to report wages paid and taxes withheld. This form is filed as part of the Form 1040, allowing taxpayers to calculate and pay Social Security, Medicare, and federal unemployment taxes for their household workers. Understanding the Schedule H is essential for compliance with IRS regulations regarding household employment.

How to use the Schedule H

To use the Schedule H effectively, taxpayers must first determine if they have household employees. If an individual pays a worker $2,400 or more in a calendar year, they must complete this form. The form requires detailed information about the employee, including their name, Social Security number, and total wages paid. Taxpayers must also calculate the appropriate taxes based on the wages reported. Once completed, the Schedule H is submitted with the individual’s Form 1040 during tax filing season.

Steps to complete the Schedule H

Completing the Schedule H involves several key steps:

- Gather necessary information about your household employee, including their Social Security number and total wages paid for the year.

- Calculate the total amount of Social Security and Medicare taxes owed based on the wages paid.

- Complete the relevant sections of the Schedule H, including employee details and tax calculations.

- Attach the completed Schedule H to your Form 1040 when filing your federal tax return.

Legal use of the Schedule H

The legal use of the Schedule H is governed by IRS guidelines, which require accurate reporting of household employment taxes. Failing to report wages or pay the necessary taxes can result in penalties. It is important for taxpayers to maintain proper records of payments made to household employees and to ensure compliance with federal tax laws. Using a reliable digital tool can help streamline the completion and submission process, ensuring that all legal requirements are met.

Filing Deadlines / Important Dates

Filing deadlines for the Schedule H align with the general tax filing deadlines for Form 1040. Typically, taxpayers must submit their forms by April 15 of the following year. If the deadline falls on a weekend or holiday, it is extended to the next business day. Additionally, if you are unable to file by the deadline, you may apply for an extension, which typically gives you until October 15 to file your return. However, any taxes owed must still be paid by the original deadline to avoid penalties.

Required Documents

To complete the Schedule H, several documents are necessary:

- Wage records for household employees, including total payments made throughout the year.

- Employee identification information, such as Social Security numbers.

- Any previous tax forms related to household employment, if applicable.

Having these documents ready will facilitate a smoother filing process and ensure compliance with IRS requirements.

Quick guide on how to complete about schedule h form 1040 household employment taxes

Prepare Schedule H seamlessly on any device

Digital document management has become increasingly popular among businesses and individuals. It presents an ideal eco-friendly alternative to conventional printed and signed documents, as you can easily locate the necessary form and securely store it online. airSlate SignNow provides all the resources you need to create, alter, and eSign your documents quickly without complications. Manage Schedule H on any device with airSlate SignNow Android or iOS applications and streamline any document-based task today.

The easiest way to modify and eSign Schedule H effortlessly

- Obtain Schedule H and click Get Form to begin.

- Utilize the tools we offer to complete your form.

- Highlight important sections of your documents or redact sensitive information with tools specifically provided by airSlate SignNow for this purpose.

- Generate your eSignature using the Sign tool, which takes just seconds and holds the same legal validity as a traditional wet ink signature.

- Review the details and click on the Done button to save your changes.

- Decide how you wish to send your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate worries about lost or misplaced documents, tedious form searching, or mistakes that necessitate printing new copies of documents. airSlate SignNow meets all your document management requirements with just a few clicks from any device you choose. Edit and eSign Schedule H to ensure clear communication at every stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the about schedule h form 1040 household employment taxes

How to generate an electronic signature for your About Schedule H Form 1040 Household Employment Taxes online

How to create an electronic signature for the About Schedule H Form 1040 Household Employment Taxes in Chrome

How to create an electronic signature for putting it on the About Schedule H Form 1040 Household Employment Taxes in Gmail

How to create an electronic signature for the About Schedule H Form 1040 Household Employment Taxes straight from your mobile device

How to create an electronic signature for the About Schedule H Form 1040 Household Employment Taxes on iOS devices

How to generate an electronic signature for the About Schedule H Form 1040 Household Employment Taxes on Android OS

People also ask

-

What is airSlate SignNow and how does it relate to h 2019?

AirSlate SignNow is a powerful eSignature solution that enhances document workflows for businesses. In h 2019, it became a key player in providing an easy-to-use platform for secure document signing, enabling teams to streamline their processes efficiently.

-

What features does airSlate SignNow offer that's relevant to h 2019?

In h 2019, airSlate SignNow introduced several features including customizable templates, advanced security protocols, and mobile support. These features empower users to not only manage but also maximize the efficiency of their document workflows seamlessly.

-

How does airSlate SignNow's pricing compare to other eSignature solutions in h 2019?

AirSlate SignNow offers competitive pricing plans tailored to fit the needs of various businesses in h 2019. With affordable subscription options, users can access a robust set of features without overspending, making it a cost-effective choice for eSigning documents.

-

What are the benefits of using airSlate SignNow in h 2019?

The benefits of using airSlate SignNow in h 2019 include increased efficiency in document management and improved compliance with legal standards. Businesses can easily send, track, and store signed documents, reducing turnaround time signNowly.

-

Can airSlate SignNow integrate with other platforms as of h 2019?

Yes, airSlate SignNow supports numerous integrations with popular platforms as of h 2019. Whether it's CRM systems, cloud storage solutions, or workflow automation tools, you can streamline your processes and maintain data consistency.

-

Is airSlate SignNow user-friendly for beginners in h 2019?

Absolutely! In h 2019, airSlate SignNow was designed with user-friendliness in mind. Beginners can easily navigate its intuitive interface to send and sign documents without needing extensive training or technical support.

-

What security measures does airSlate SignNow offer in h 2019?

In h 2019, airSlate SignNow implemented robust security measures including encryption, multi-factor authentication, and compliance with GDPR and HIPAA. These features ensure that your documents are always safe and secure while being processed.

Get more for Schedule H

- Form 13715 volunteer site information sheet oct 2015

- Planilla para la declaracin de la contribucin federal sobre el trabajo por cuenta propia incluyendo el crdito tributario form

- 940pr 2003 form

- Formulario 940 pr 1998

- Customs form 4790

- Myanmar arrival card form

- Fiduciary declaration of estimated tax pay online form

- Sc1040 individual income tax form and instructions 794910796

Find out other Schedule H

- Electronic signature California Car Lease Agreement Template Free

- How Can I Electronic signature Florida Car Lease Agreement Template

- Electronic signature Kentucky Car Lease Agreement Template Myself

- Electronic signature Texas Car Lease Agreement Template Easy

- Electronic signature New Mexico Articles of Incorporation Template Free

- Electronic signature New Mexico Articles of Incorporation Template Easy

- Electronic signature Oregon Articles of Incorporation Template Simple

- eSignature Montana Direct Deposit Enrollment Form Easy

- How To Electronic signature Nevada Acknowledgement Letter

- Electronic signature New Jersey Acknowledgement Letter Free

- Can I eSignature Oregon Direct Deposit Enrollment Form

- Electronic signature Colorado Attorney Approval Later

- How To Electronic signature Alabama Unlimited Power of Attorney

- Electronic signature Arizona Unlimited Power of Attorney Easy

- Can I Electronic signature California Retainer Agreement Template

- How Can I Electronic signature Missouri Unlimited Power of Attorney

- Electronic signature Montana Unlimited Power of Attorney Secure

- Electronic signature Missouri Unlimited Power of Attorney Fast

- Electronic signature Ohio Unlimited Power of Attorney Easy

- How Can I Electronic signature Oklahoma Unlimited Power of Attorney