Form 1042

What is the Form 1042

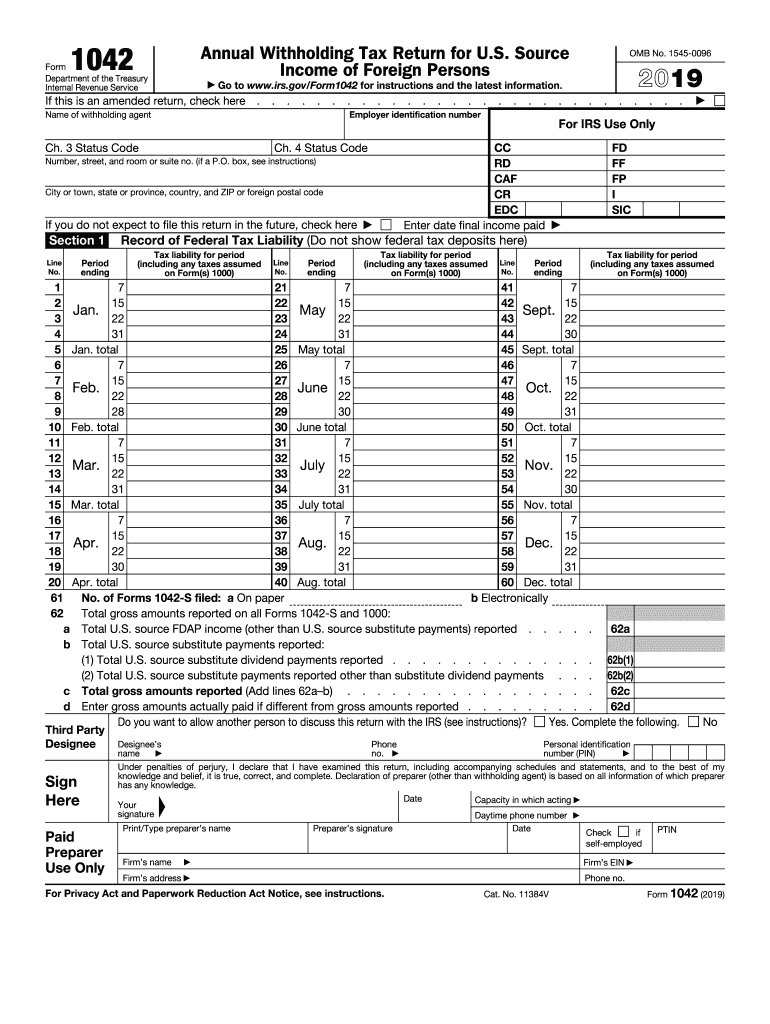

The Form 1042 is a tax document used by withholding agents to report income paid to foreign persons, including non-resident aliens and foreign entities. This form is essential for compliance with U.S. tax laws, particularly for entities making payments subject to withholding. The 1042 form is often associated with various types of income, such as interest, dividends, rents, and royalties, which may be subject to U.S. tax withholding. Understanding this form is crucial for both payers and recipients to ensure accurate reporting and compliance with IRS regulations.

How to use the Form 1042

Using the Form 1042 involves several steps that ensure proper reporting of payments made to foreign individuals or entities. First, the withholding agent must determine the type of income being paid and the corresponding withholding tax rate. Next, the agent should collect the necessary information from the payee, including their name, address, and taxpayer identification number. Once this information is gathered, the withholding agent completes the Form 1042, detailing the total amount paid, the tax withheld, and other relevant information. It is important to ensure that the form is filled out accurately to avoid penalties and ensure compliance.

Steps to complete the Form 1042

Completing the Form 1042 requires careful attention to detail. Here are the essential steps:

- Gather Information: Collect all necessary details about the payee, including their name, address, and taxpayer identification number.

- Determine Income Type: Identify the type of income being paid and the applicable withholding tax rate.

- Fill Out the Form: Complete the Form 1042 with accurate information, including total payments and taxes withheld.

- Review for Accuracy: Double-check all entries for accuracy to prevent errors that could lead to penalties.

- Submit the Form: File the completed form with the IRS by the designated deadline.

Filing Deadlines / Important Dates

Filing deadlines for the Form 1042 are critical for compliance. Typically, the form must be filed annually by March 15 of the year following the tax year in which the payments were made. Additionally, withholding agents must provide copies of the Form 1042-S to recipients by the same date. It is essential to stay informed about any changes to these deadlines, as late submissions may incur penalties.

Legal use of the Form 1042

The legal use of the Form 1042 is governed by IRS regulations, which require accurate reporting of payments to foreign persons. This form serves as a declaration of income paid and taxes withheld, ensuring that the U.S. government collects the appropriate tax revenue. Compliance with the legal requirements surrounding this form is crucial for avoiding penalties, which can include fines and interest on unpaid taxes. Understanding the legal implications of the Form 1042 helps both withholding agents and payees navigate their tax obligations effectively.

Penalties for Non-Compliance

Failure to comply with the requirements associated with the Form 1042 can result in significant penalties. These may include fines for late filing, inaccurate reporting, or failure to withhold the appropriate taxes. The IRS may impose penalties that vary based on the severity of the non-compliance, including a percentage of the unpaid tax amount. It is vital for withholding agents to understand these penalties and take proactive steps to ensure compliance with all reporting obligations.

Quick guide on how to complete 2019 instructions for form 1042 internal revenue service

Complete Form 1042 effortlessly on any device

Digital document management has become increasingly popular among organizations and individuals. It offers an ideal environmentally friendly alternative to traditional printed and signed papers, allowing you to locate the correct form and securely save it online. airSlate SignNow provides you with all the resources necessary to create, modify, and eSign your documents swiftly without delays. Manage Form 1042 on any platform with airSlate SignNow’s Android or iOS applications and simplify any document-related workflow today.

The most effective way to modify and eSign Form 1042 without stress

- Locate Form 1042 and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize important sections of the documents or redact confidential information using tools that airSlate SignNow specifically provides for that purpose.

- Generate your signature with the Sign tool, which takes mere seconds and carries the same legal validity as a conventional wet ink signature.

- Verify all the details and click on the Done button to save your modifications.

- Select your preferred method for delivering your form, whether by email, SMS, or invitation link, or download it to your computer.

Eliminate concerns about missing or lost files, tedious form searching, or mistakes that necessitate printing new document copies. airSlate SignNow meets your document management requirements in just a few clicks from any device you choose. Alter and eSign Form 1042 and ensure outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 instructions for form 1042 internal revenue service

How to make an eSignature for your 2019 Instructions For Form 1042 Internal Revenue Service in the online mode

How to generate an electronic signature for your 2019 Instructions For Form 1042 Internal Revenue Service in Chrome

How to generate an electronic signature for putting it on the 2019 Instructions For Form 1042 Internal Revenue Service in Gmail

How to create an electronic signature for the 2019 Instructions For Form 1042 Internal Revenue Service straight from your smartphone

How to create an eSignature for the 2019 Instructions For Form 1042 Internal Revenue Service on iOS devices

How to generate an electronic signature for the 2019 Instructions For Form 1042 Internal Revenue Service on Android devices

People also ask

-

What is a 2019 tax calculator and how does it work?

A 2019 tax calculator is a tool that allows individuals to estimate their tax liability or refund for the year 2019 based on their financial information. You input details such as income, deductions, and credits, and the calculator provides an estimate of what you owe or might receive as a refund. This helps in planning ahead for tax season.

-

How can a 2019 tax calculator help me maximize my tax refund?

Using a 2019 tax calculator can help you identify potential deductions and credits you may qualify for, maximizing your refund. By accurately inputting your financial data, the calculator will provide insights into your tax situation, ensuring you aren't missing out on savings. This proactive approach can lead to a more favorable tax outcome.

-

Is the airSlate SignNow 2019 tax calculator free to use?

Yes, the airSlate SignNow 2019 tax calculator is free to use, providing an accessible way for users to estimate their taxes without any cost. You can use it anytime, anywhere to quickly assess your potential tax liabilities or refunds at no charge. This makes financial planning simpler and more efficient.

-

What features should I look for in a 2019 tax calculator?

When evaluating a 2019 tax calculator, consider features like user-friendly interface, robust data security, up-to-date tax laws, and the ability to save your progress. Additionally, useful options may include integration with financial software and the ability to adjust for different filing statuses. These features enhance usability and accuracy.

-

Can I integrate the 2019 tax calculator with other financial tools?

Yes, many modern 2019 tax calculators, including those associated with airSlate SignNow, offer integrations with various financial tools. This allows you to synchronize your financial data effortlessly, streamlining your overall financial management. Integrated tools increase efficiency and accuracy in estimating your taxes.

-

What are the benefits of using a 2019 tax calculator from airSlate SignNow?

The airSlate SignNow 2019 tax calculator provides a convenient and accurate way to estimate your taxes, helping you identify deductions and credits effectively. The user-friendly interface, combined with reliable data security measures, ensures a smooth experience. Additionally, it empowers you to be more informed and prepared for tax season.

-

How do I ensure my information is secure while using the 2019 tax calculator?

When using the airSlate SignNow 2019 tax calculator, your data security is a priority. The platform employs encryption and advanced security protocols to protect your sensitive financial information. You can feel confident that your information remains confidential and secure throughout the calculation process.

Get more for Form 1042

Find out other Form 1042

- How Do I Sign South Carolina Lawers Limited Power Of Attorney

- Sign South Dakota Lawers Quitclaim Deed Fast

- Sign South Dakota Lawers Memorandum Of Understanding Free

- Sign South Dakota Lawers Limited Power Of Attorney Now

- Sign Texas Lawers Limited Power Of Attorney Safe

- Sign Tennessee Lawers Affidavit Of Heirship Free

- Sign Vermont Lawers Quitclaim Deed Simple

- Sign Vermont Lawers Cease And Desist Letter Free

- Sign Nevada Insurance Lease Agreement Mobile

- Can I Sign Washington Lawers Quitclaim Deed

- Sign West Virginia Lawers Arbitration Agreement Secure

- Sign Wyoming Lawers Lease Agreement Now

- How To Sign Alabama Legal LLC Operating Agreement

- Sign Alabama Legal Cease And Desist Letter Now

- Sign Alabama Legal Cease And Desist Letter Later

- Sign California Legal Living Will Online

- How Do I Sign Colorado Legal LLC Operating Agreement

- How Can I Sign California Legal Promissory Note Template

- How Do I Sign North Dakota Insurance Quitclaim Deed

- How To Sign Connecticut Legal Quitclaim Deed