Form 6252

What is the Form 6252

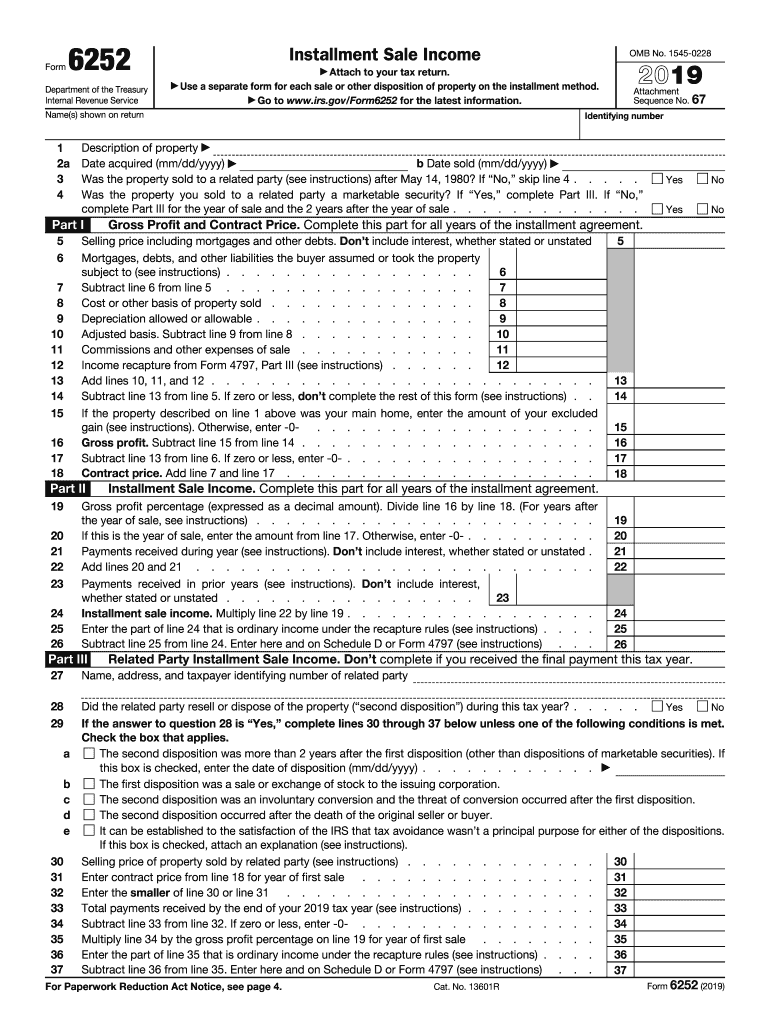

The Form 6252, also known as the Installment Sale Income form, is a tax form used by taxpayers in the United States to report income from the sale of property when the payment is received in installments. This form is particularly relevant for individuals and businesses that sell property and receive payments over time rather than in a lump sum. The form allows sellers to report their income in a way that aligns with the actual cash flow they receive, which can be beneficial for tax planning purposes.

How to use the Form 6252

Using the Form 6252 involves several steps to ensure accurate reporting of installment sale income. Taxpayers must first determine if their sale qualifies as an installment sale under IRS rules. If it does, they will need to gather relevant information, including the selling price, the cost basis of the property, and the amount of payments received during the tax year. The form requires details about the property sold, the buyer, and the terms of the sale. Once completed, the form should be filed with the taxpayer's annual income tax return.

Steps to complete the Form 6252

Completing the Form 6252 involves a structured process:

- Gather Information: Collect all necessary details about the sale, including the selling price, cost basis, and payment terms.

- Fill Out the Form: Enter the required information in the appropriate sections of the form, ensuring accuracy to avoid issues with the IRS.

- Calculate Income: Determine the amount of income to report based on the payments received and the gross profit percentage.

- Review and Submit: Double-check all entries for accuracy before submitting the form with your tax return.

Legal use of the Form 6252

The legal use of the Form 6252 is governed by IRS regulations regarding installment sales. To be considered valid, the sale must meet specific criteria, such as being a sale of property and involving payments made over time. Properly completing and filing this form ensures compliance with tax laws and helps avoid potential penalties. Taxpayers should maintain records of the sale and payments received to substantiate the information reported on the form.

Filing Deadlines / Important Dates

Filing deadlines for the Form 6252 align with the annual income tax return deadlines. Typically, individual taxpayers must file their federal tax returns by April fifteenth of the following year. If additional time is needed, taxpayers can file for an extension, but any tax owed must still be paid by the original deadline to avoid penalties and interest. It is essential to keep track of these dates to ensure timely compliance with IRS requirements.

Form Submission Methods (Online / Mail / In-Person)

Taxpayers can submit the Form 6252 through various methods, depending on their preference and circumstances. The form can be filed electronically using tax preparation software, which often simplifies the process and ensures accuracy. Alternatively, taxpayers can print the completed form and mail it to the appropriate IRS address. In-person submission is generally not an option for federal tax forms; however, taxpayers can seek assistance at local IRS offices if needed.

Quick guide on how to complete 2019 form 6252 installment sale income

Prepare Form 6252 effortlessly on any device

Digital document management has gained prominence among businesses and individuals alike. It offers a commendable eco-friendly substitute for conventional printed and signed documents, allowing you to locate the correct form and securely store it online. airSlate SignNow provides all the tools necessary to create, alter, and electronically sign your documents promptly without any hold-ups. Manage Form 6252 on any device using airSlate SignNow's Android or iOS applications and simplify any document-related task today.

The easiest method to modify and electronically sign Form 6252 without hassle

- Locate Form 6252 and click Get Form to begin.

- Utilize the tools we provide to complete your form.

- Mark important sections of the documents or redact sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and click the Done button to save your changes.

- Select your preferred delivery method for the form: via email, SMS, invitation link, or download it to your computer.

Say goodbye to misplaced or lost files, tedious form searches, or mistakes that necessitate printing new document copies. airSlate SignNow fulfills all your document management needs in just a few clicks from any device you choose. Edit and electronically sign Form 6252 to ensure outstanding communication throughout the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 6252 installment sale income

How to generate an electronic signature for the 2019 Form 6252 Installment Sale Income in the online mode

How to generate an eSignature for your 2019 Form 6252 Installment Sale Income in Google Chrome

How to make an electronic signature for signing the 2019 Form 6252 Installment Sale Income in Gmail

How to make an eSignature for the 2019 Form 6252 Installment Sale Income right from your mobile device

How to generate an electronic signature for the 2019 Form 6252 Installment Sale Income on iOS

How to make an eSignature for the 2019 Form 6252 Installment Sale Income on Android OS

People also ask

-

What are the benefits of using airSlate SignNow for managing 2019 installment income?

Using airSlate SignNow helps you efficiently manage your 2019 installment income by streamlining the document signing process. It ensures that all agreements related to your installment income are securely signed and easily accessible, promoting better organization and compliance.

-

How does airSlate SignNow assist in tracking 2019 installment income payments?

airSlate SignNow offers features that allow you to set reminders and track all your 2019 installment income payments. With integrated status updates and notifications, you'll never miss a payment due date, thereby enhancing your financial management.

-

Is airSlate SignNow cost-effective for businesses managing 2019 installment income?

Yes, airSlate SignNow is designed to be a cost-effective solution for businesses handling 2019 installment income. With flexible pricing plans, you can choose an option that fits your budget while benefiting from comprehensive eSigning features.

-

What features does airSlate SignNow offer for processing documents related to 2019 installment income?

airSlate SignNow provides numerous features for processing documents like custom templates, automated workflows, and secure storage. These tools specifically streamline the management of contracts tied to your 2019 installment income, ensuring a smooth process.

-

Can airSlate SignNow integrate with other software for managing 2019 installment income?

Absolutely! airSlate SignNow seamlessly integrates with a variety of software applications, including CRMs and accounting tools. This interoperability allows you to effectively track and manage your 2019 installment income within your existing business systems.

-

How can airSlate SignNow improve the workflow for documents related to 2019 installment income?

airSlate SignNow enhances workflow by providing an efficient platform for sending, signing, and storing documents tied to 2019 installment income. The user-friendly interface reduces the time spent on paperwork, allowing your team to focus on core business activities.

-

What security measures does airSlate SignNow implement for handling 2019 installment income documents?

Security is paramount at airSlate SignNow, especially when dealing with sensitive 2019 installment income documents. The platform employs encryption, secure signatures, and compliance with legal standards to ensure your information is protected at all times.

Get more for Form 6252

Find out other Form 6252

- Help Me With eSign Idaho Plumbing Profit And Loss Statement

- eSign Illinois Plumbing Letter Of Intent Now

- eSign Massachusetts Orthodontists Last Will And Testament Now

- eSign Illinois Plumbing Permission Slip Free

- eSign Kansas Plumbing LLC Operating Agreement Secure

- eSign Kentucky Plumbing Quitclaim Deed Free

- eSign Legal Word West Virginia Online

- Can I eSign Wisconsin Legal Warranty Deed

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template