Irs 4868 Form

What is the IRS Form 4868?

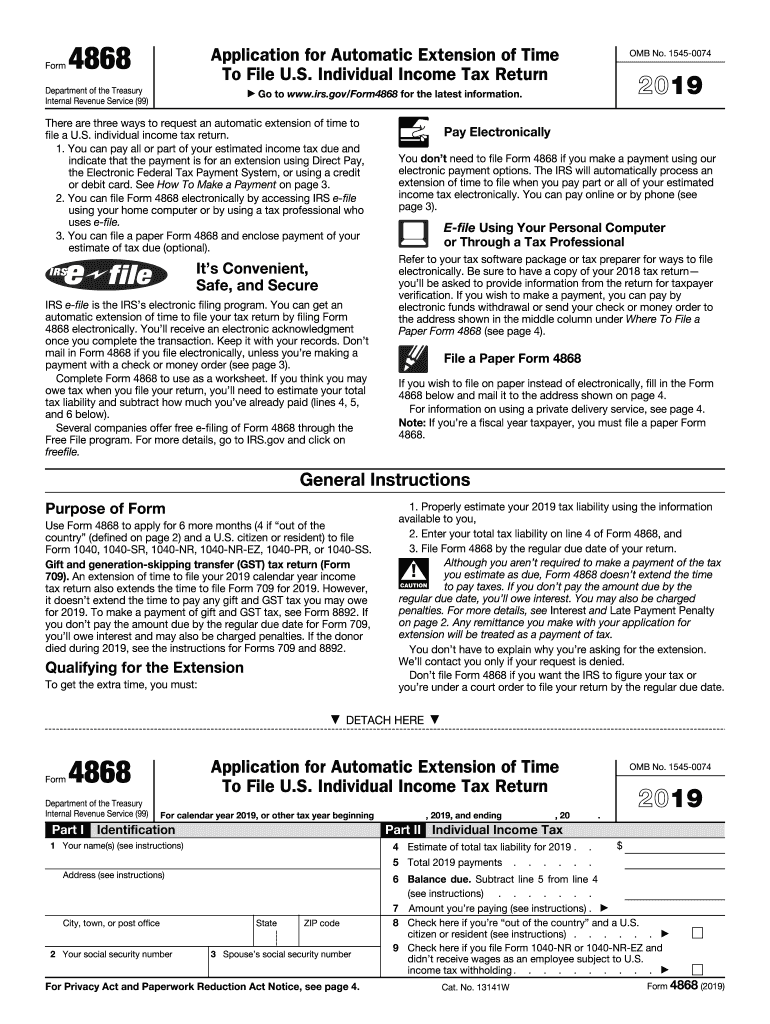

The IRS Form 4868, officially known as the Application for Automatic Extension of Time To File U.S. Individual Income Tax Return, allows taxpayers to request an automatic extension for filing their income tax returns. This form is particularly relevant for those who need additional time to prepare their 2019 income tax returns. By submitting this form, taxpayers can extend their filing deadline by six months, moving it from the typical April deadline to October. However, it is important to note that this extension only applies to filing the tax return, not to paying any taxes owed.

Steps to Complete the IRS Form 4868

Completing the IRS Form 4868 involves a few straightforward steps:

- Gather necessary information, including your name, address, Social Security number, and estimated tax liability for the 2019 income tax year.

- Fill out the form accurately, ensuring all details are correct to avoid delays.

- Calculate your estimated tax due and enter this amount on the form, as this will help determine if you need to make a payment.

- Sign and date the form to validate your request for an extension.

- Submit the completed form by the original tax return due date, either electronically or via mail.

Filing Deadlines / Important Dates

For the 2019 tax year, the original deadline for filing your income tax return was April 15, 2020. If you filed Form 4868, your new deadline to submit your 2019 tax return would be October 15, 2020. It is crucial to adhere to these dates to avoid penalties and interest on any taxes owed.

Legal Use of the IRS Form 4868

The IRS Form 4868 is legally recognized as a valid request for an extension of time to file your income tax return. To ensure compliance, taxpayers must submit the form before the original filing deadline. This form does not absolve taxpayers of their obligation to pay any taxes owed by the original deadline; thus, estimated payments should be made to avoid penalties.

Required Documents

When filing Form 4868, it is essential to have the following documents on hand:

- Your most recent tax return for reference.

- Information on any income earned during the 2019 tax year.

- Documentation of any deductions or credits you plan to claim.

- Your Social Security number or Individual Taxpayer Identification Number (ITIN).

Form Submission Methods

Taxpayers can submit the IRS Form 4868 through various methods:

- Electronically using tax preparation software that supports e-filing.

- By mail, sending the completed form to the appropriate address listed in the form instructions.

- In-person at IRS offices, though this option may be limited due to location and availability.

Eligibility Criteria

To be eligible for an extension using Form 4868, taxpayers must meet specific criteria:

- Individuals who are required to file a U.S. individual income tax return.

- Those who are unable to file by the original deadline due to various circumstances.

- Taxpayers who owe no taxes or have made sufficient estimated payments may also qualify for an extension.

Quick guide on how to complete extension of time to file internal revenue service

Complete Irs 4868 effortlessly on any device

Digital document management has become increasingly favored by businesses and individuals. It offers a fantastic eco-friendly substitute for traditional printed and signed documents, as you can obtain the necessary form and securely keep it online. airSlate SignNow equips you with all the tools you need to create, modify, and sign your documents swiftly without delays. Manage Irs 4868 on any platform with airSlate SignNow's Android or iOS applications and enhance any document-related activity today.

The easiest way to modify and sign Irs 4868 with ease

- Locate Irs 4868 and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize relevant sections of your documents or obscure sensitive information with tools that airSlate SignNow offers specifically for that purpose.

- Create your eSignature using the Sign feature, which takes seconds and has the same legal validity as a conventional ink signature.

- Review all the information and click on the Done button to save your changes.

- Select how you wish to send your form, via email, SMS, invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that require printing new document copies. airSlate SignNow meets all your document management needs in just a few clicks from any device of your choice. Modify and sign Irs 4868 and guarantee excellent communication at every phase of your form preparation journey with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the extension of time to file internal revenue service

How to make an eSignature for your Extension Of Time To File Internal Revenue Service in the online mode

How to create an eSignature for the Extension Of Time To File Internal Revenue Service in Chrome

How to make an eSignature for signing the Extension Of Time To File Internal Revenue Service in Gmail

How to make an eSignature for the Extension Of Time To File Internal Revenue Service right from your smart phone

How to make an eSignature for the Extension Of Time To File Internal Revenue Service on iOS devices

How to make an eSignature for the Extension Of Time To File Internal Revenue Service on Android

People also ask

-

What features does airSlate SignNow offer for managing 2019 income tax documents?

airSlate SignNow provides a range of features to simplify the management of 2019 income tax documents, including electronic signatures, document templates, and automated workflows. These tools help streamline the tax preparation process, allowing you to efficiently gather signatures and ensure compliance. Additionally, you can store and organize your 2019 income tax documents securely.

-

How can airSlate SignNow help simplify the filing of my 2019 income tax?

By using airSlate SignNow, you can simplify the filing of your 2019 income tax by quickly collecting signatures from multiple parties on essential documents. The platform ensures that all signed documents are securely stored and accessible when needed, reducing the hassle of managing physical paperwork. This streamlined process ultimately saves you time and reduces the risk of errors.

-

Is there a free trial available for airSlate SignNow for 2019 income tax preparation?

Yes, airSlate SignNow offers a free trial that allows you to explore its features and tools for your 2019 income tax preparation needs. During the trial, you can assess how effectively the platform facilitates eSigning and document management. This allows you to make an informed decision before committing to a subscription.

-

What is the pricing structure for airSlate SignNow services related to 2019 income tax?

airSlate SignNow offers competitive pricing plans suitable for various business needs, especially for those preparing 2019 income tax documents. Plans are available at different levels to cater to businesses of all sizes, ensuring you have access to essential features without overspending. You can choose a plan that aligns with your business needs and budget.

-

Can I integrate airSlate SignNow with other financial software for my 2019 income tax?

Yes, airSlate SignNow seamlessly integrates with various financial and accounting software to aid in the preparation of your 2019 income tax. Popular integrations include platforms like QuickBooks and Xero, making it easier to transfer information between your tax documents and financial records. This integration enhances efficiency and accuracy in your tax filing process.

-

How secure is airSlate SignNow for handling sensitive 2019 income tax information?

airSlate SignNow prioritizes security, ensuring that your sensitive 2019 income tax information is protected. The platform employs encryption and compliance with industry standards to safeguard your data. This ensures that your documents remain confidential while being easily accessible for the eSigning process.

-

What benefits does airSlate SignNow provide for small businesses filing 2019 income tax?

For small businesses, airSlate SignNow offers signNow benefits in filing 2019 income tax, such as cost-effectiveness and improved efficiency. The platform simplifies document management and eSigning, allowing small business owners to focus more on their operations rather than paperwork. Additionally, the user-friendly interface makes it easy for anyone to navigate the process.

Get more for Irs 4868

- Db 450 form

- City of los angeles claims for damages form cityclerk lacity

- Bcbs of alabama form cl 94 2009

- K12cf20110509 form

- Wage claim form iowa workforce development iowaworkforce

- Aetna student health claim form

- Carefirst health benefits claim form 2009

- Blue cross blue shield of alabama claims forms

Find out other Irs 4868

- Can I Electronic signature Arizona LLC Operating Agreement

- Electronic signature Louisiana LLC Operating Agreement Myself

- Can I Electronic signature Michigan LLC Operating Agreement

- How Can I Electronic signature Nevada LLC Operating Agreement

- Electronic signature Ohio LLC Operating Agreement Now

- Electronic signature Ohio LLC Operating Agreement Myself

- How Do I Electronic signature Tennessee LLC Operating Agreement

- Help Me With Electronic signature Utah LLC Operating Agreement

- Can I Electronic signature Virginia LLC Operating Agreement

- Electronic signature Wyoming LLC Operating Agreement Mobile

- Electronic signature New Jersey Rental Invoice Template Computer

- Electronic signature Utah Rental Invoice Template Online

- Electronic signature Louisiana Commercial Lease Agreement Template Free

- eSignature Delaware Sales Invoice Template Free

- Help Me With eSignature Oregon Sales Invoice Template

- How Can I eSignature Oregon Sales Invoice Template

- eSignature Pennsylvania Sales Invoice Template Online

- eSignature Pennsylvania Sales Invoice Template Free

- eSignature Pennsylvania Sales Invoice Template Secure

- Electronic signature California Sublease Agreement Template Myself