Lease Agreement Form

What is the Lease Agreement

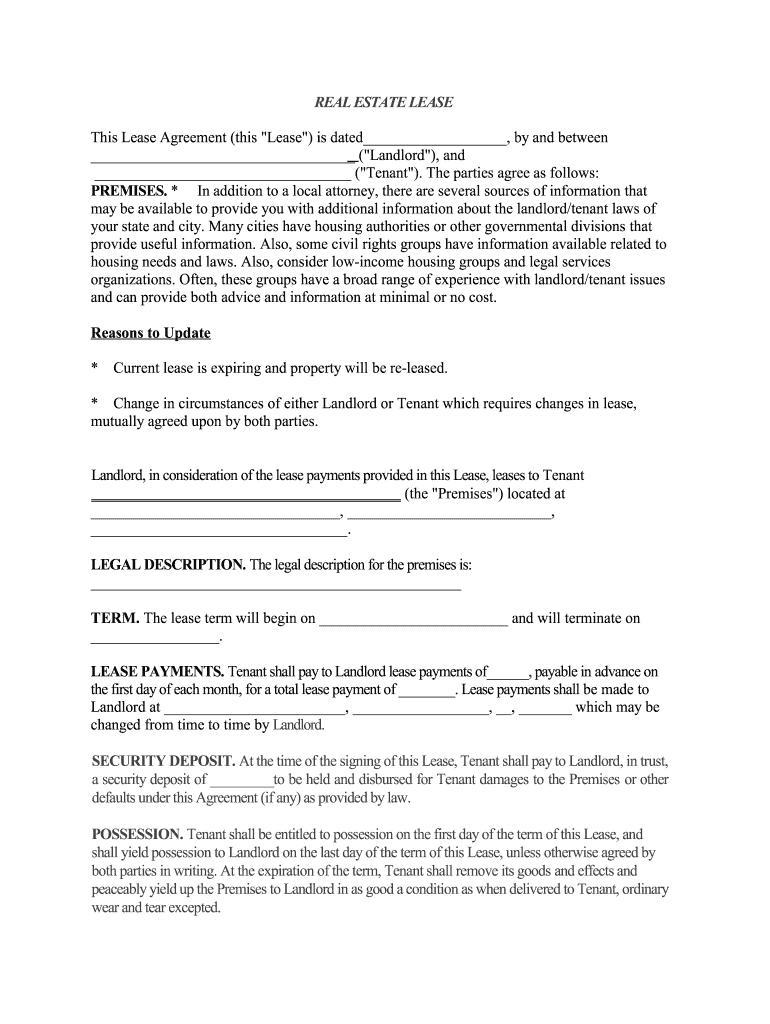

A residential estate lease is a legally binding contract between a landlord and a tenant, outlining the terms under which a tenant may occupy a rental property. This agreement typically includes details such as the rental amount, lease duration, security deposit requirements, and responsibilities of both parties. Understanding the lease agreement is crucial for both landlords and tenants to ensure clear expectations and compliance with local laws.

Key elements of the Lease Agreement

Several key elements are essential in a residential estate lease. These include:

- Parties involved: Identification of the landlord and tenant.

- Property description: Detailed address and description of the rental property.

- Lease term: Duration of the lease, including start and end dates.

- Rent payment details: Amount due, payment methods, and due dates.

- Security deposit: Amount required and conditions for its return.

- Maintenance responsibilities: Duties of the landlord and tenant regarding property upkeep.

- Termination conditions: Procedures for ending the lease early or upon expiration.

Steps to complete the Lease Agreement

Completing a residential estate lease involves several important steps:

- Choose the correct form: Select a lease agreement template that complies with state laws.

- Fill in the details: Enter information about the landlord, tenant, and property.

- Specify terms: Clearly outline the rental terms, including rent amount and lease duration.

- Review the agreement: Both parties should carefully read the document to ensure all terms are accurate.

- Sign the lease: Both landlord and tenant should sign the lease, ideally in the presence of a witness.

Legal use of the Lease Agreement

For a residential estate lease to be legally binding, it must comply with local and state laws. This includes adhering to regulations regarding fair housing, security deposits, and eviction processes. It is important for both landlords and tenants to understand their rights and obligations as outlined in the lease agreement to prevent legal disputes.

State-specific rules for the Lease Agreement

Each state in the U.S. has specific laws governing residential leases. These rules can affect various aspects of the lease agreement, including:

- Maximum allowable security deposits

- Notice periods for eviction

- Requirements for lease renewals

Landlords and tenants should familiarize themselves with their state’s regulations to ensure compliance and protect their rights.

How to use the Lease Agreement

Using a residential estate lease effectively requires understanding its purpose and proper execution. The lease serves as a reference point for both parties throughout the rental term. It is advisable to keep a signed copy accessible for any disputes or clarifications that may arise. Additionally, both parties should communicate openly about any issues related to the lease to maintain a positive landlord-tenant relationship.

Quick guide on how to complete residential real estate lease form

The optimal method to obtain and sign Lease Agreement

On a company-wide scale, ineffective procedures related to paper approval can take up a signNow amount of productive time. Signing documents like Lease Agreement is an inherent aspect of operations in any organization, which is why the effectiveness of each agreement’s lifecycle is crucial to the overall performance of the business. With airSlate SignNow, signing your Lease Agreement can be as straightforward and quick as possible. This platform provides you with the latest version of nearly any document. Even better, you can sign it instantly without needing to install any external software on your computer or printing hard copies.

Steps to obtain and sign your Lease Agreement

- Browse our library by category or use the search box to locate the document you require.

- Click on Learn more to preview the document and verify it is the correct one.

- Select Get form to begin editing immediately.

- Fill out your document and provide any necessary information using the toolbar.

- Once complete, click the Sign tool to sign your Lease Agreement.

- Select the signature method that is most suitable for you: Draw, Generate initials, or upload an image of your handwritten signature.

- Click Done to finalize your edits and move on to document-sharing options as needed.

With airSlate SignNow, you possess everything necessary to manage your documentation effectively. You can find, complete, modify, and even send your Lease Agreement in a single tab without any trouble. Enhance your workflows with a single, intelligent eSignature solution.

Create this form in 5 minutes or less

FAQs

-

How does commercial real estate differ from residential real estate?

There are many definitions base on different realms.Legal. Different state has different definition between Residential and Commercial. In New York, any (besides Condo and Co-op) dwellings that are more than 4 units are considered Commercial. The legal definition is use to govern taxes, licensing law, zoning, etc.Brokerage/Investment. In the Brokerage or Investment world, it means Property Type:Residential 1 - 4 Family, Condo, Co-opCommercial Multi-Family (5 and up) Office Industrial Retail Shopping Center Land Hotel Etc.In this realm, it usually means separation of duties, Residential brokers/agents do Residential sales/rental, Commercial brokers/agents do Commercial sales/leasing.It has NOTHING to do with:Own-Use or Investment. Someone can buy a 3-Family property for his own use because one family for self, one for brother, and one for parents. Or conversely, someone can buy a Single Family (1-Family) property for investment, renting it out to collect rent. Buying a bunch of 1-Family for investment purpose doesn't make you a "Commercial Investor". Conversely, buying a retail building for you own use (because you want to house your own business in it) doesn't make you a non-commercial buyer, in the eyes of the law and broker, you are buying a Commercial property.

-

How could residential real estate be disrupted?

At the root of any disruption is being able to affect the bottom line and the bottom line in real estate is the $100B + in commissions real estate brokerages and agents make annually. If you could create a system/brokerage that could scale nationally and cut that number by 2/3rds then you can say you have successfully disrupted the residential real estate market. Until that happens everything else is irrelevant no matter how sophisticated and technical it is. This is a service industry unlike other service industries that have gone by the wayside and have become obsolete like renting a DVD (blockbuster), buying a plane ticket (travel agents) or getting a taxi (medallion owners). This service industry requires human interaction on many levels all coordinated by the r.e. agent. Who is the only one in the whole transaction who only gets paid if there is a closing. R.E. are responsible for the whole transaction (which none are alike) on a commission only payment structure. Not only is the r.e. agent a conductor in the orchestra that is a real estate transaction but he is also a mediator and on many levels a psychologist of sorts for both the sellers and the buyers, these are only a few of the roles and kills needed to close most deals by the way. You cannot put all those skills and services into an app / website. Just like Uber cannot with current tech do with out an actual Uber driver. Not until autonomous cars are a viable alternative. Which for Uber it will be an option sooner rather than later like it is for the real estate industry. To do away with real estate agents completely would mean AI would have to be a reality, and we are light years away from that, some would say.So, if agents cant be done away with, that means commission will remain high?No, IMO that's where the innovation can be found - look at Europe, agents only charge 2%-3% max. The disruptor that can scale this business model on a national level here is the US will win the game. Because they would have effectively put back $60-$70B back into the homeowners pockets / economy. Think of Uber - they cut traditional taxi ride prices by 30-40% and made it a much better transaction. They transformed the like of the taxi driver and of the consumer/passenger. The only negatively impacted group in the taxi industry, where the medallion owners not the taxi drivers or the consumers/passengers. Everyone wants to apply their new innovative business model / app / website / startup and change the real estate industry over night. They forget this is an industry that has resisted change for over 100 years and has had 10's of billions invested at disrupting it and none have succeeded. Any real disruptor will creep up slowly, merging tech with real live real estate services, all which is built on the #1 cornerstone, the only cornerstone on which to build the Uber of real estate, which is a lower commission fee to the homeowner.Uber would be nowhere if they didn't offer a cheaper and better alternative to a traditional taxi. In real estate, likewise will the "Uber of Real Estate" have to do. Who will raise the ten's of millions necessary to do this? Can't wait to find out!This is why I don't bother worrying about the next cool app / website cutting out the agent or offering an awesome platform for buyers to shop at. Because the one to monopolize the industry has to be a brokerage capturing all the listings at 2 or 3% max, they will also require a massive agent base. An agent base that is on commission only to start and then as said monopoly captures more listings, it can begin to transition it's agents into a non fiduciary roll and more of that of a transaction coordinator paid on a salary. Redfin and others at least have that part right, salaried agents, but they are ahead of their time. First you lower commissions, take over enough market share and then transition agents rolls and pay structure... and finally you can lower commissions even more as tech and users/customers advance in to a world where they no longer need as much hand holding and such. This requires time and planning - not simply rolling out an app and a version of real estate platforms that are way to far into the future. The average seller is in their 50's, so stop innovating as if they where in their 20's and 30's. Sellers will adapt to apps and platforms that are tech heavy in 15-20 years when today's buyers are sellers. Until then the roll of the agent will remain mostly unchanged and so will the industry unless someone tackles the $100B in commissions paid by homeowners, not buyers!Sorry - I got an F in 4th grade for spelling, I am sure it shows but I hope I made my point. #theuberofrealestate

-

Why don't residential real estate leases have confidentiality clauses?

From the owner’s/investor’s perspectives, especially if there’s buy/sell transaction involved, the buyer would want to assess the risk profile of the tenants and the stability of the tenant’s income capabilities whether they would deliver a steady income flow, etc therefore when the law enables transparency, it allows and info from tenancy schedule, clauses and conditions it allows a fair assessment and enable decisions. This protects the owner/buyer/seller rights of ownership and their liability as the owner should there be any damages to the property. The list could go on.

-

What’s different about a commercial real estate lease versus residential?

That’s a great question and I hope my reply helps :real estate can be defined as simple ownership rules and complicated ownership rulesBuying a house is simple, the odds of getting a sour house is rather difficult if you follow common sense.Buying commercial property is always complicated ( even when it’s easy ) … so let’s break down a tiny bitapartment complex typeindustrial sites and plantsstorefronts and mallsin any of these transactions, the due diligence is going to take a while ( ever look at 80 leases for a rental apartment building ?)On an apartment building, you are inspecting every unit, and looking for where the seller deferred maintenance, some places, you’ll even discovered that beams are missing. I was in a building once with a team of inspectors, someone blew a whistle and an airhorn, everyone ( inspectors) quickly got off the site. they discovered a wooden support beam rotted completely that was painted over and ready to fail. the inspector call the city, boy was that seller pissed that we backed out of the offer.on industrial sites you have to do a chemical analysis of the land just to make sure it’s not toxic ( toxic sites can have a history and cost you a fortune in insurance clean up cost ). then zoning issues and then all other issues.on storefront, office space, and malls… zoning regulation and permits and traffic counts and a load of other shit.You can do a deal that closes in 30 days, but the chance of that happening are rarecommissions : seller usually has a commision to his agent only and that agent does not co-broke. Buyer has his team and their agent gets paid by the buyer.Commercial sellers always try to take your commissions, that is why the transaction must happen in escrow, and all claims must happen with the funds still in escrow, in fact there are legal firms that have a small but steady business niche in this field.

-

What is the best way to purchase NYC residential real estate in order to rent it out?

There's actually 3 parts to getting this right: (1) getting educated on the NYC market, (2) finding the real estate, and (3) hiring the right person to manage the real estate.Part 1: Getting Educated on the NYC Real Estate Markethttp://AddressReport.com (for deep building data, renovation histories, crime reports, subway access, local amenities, area pricing)BrickUnderground (chock-full of NYC real estate guides)http://NY.Curbed.Com (to get a sense for what's "trending")Part 2: Finding the Real Estate Listingshttp://StreetEasy.com - the king of NYC sales listings aggregatorsNYTimes real estate section - still reliablehttp://HomeCanvasr.com - for off-market listingsPart 3: Managing (Renting Out) the Real EstateGo back to StreetEasy and locate properties that seem similar to the one place you've bought and note the names of 6-8 brokers who have made high volumes of (and/or very recent) sales (NOT rentals) in those properties. (The broker who just sold you the unit will likely be on that list, but shouldn't be the only name.)Confirm on AddressReport that these properties share similar qualities, subway access, and neighborhood amenities with the one you purchasedWith these "property comps" in hand, contact each broker on your list and ask if they interview them to determine which would be a good steward of your rental property; things to check for include an understanding of going rental prices for properties such as yours, the process they use to advertise your property and vet applicants; and whom they can refer as a maintenance contact for when things inevitably go wrong and you're not around to fix it (since you don't live in NYC or just don't want to deal with it).

-

Is it more profitable to buy commercial real estate to rent out or is residential real estate a better option?

The rental yields on commercial real estate is generally higher than the rental yield on residential real estate.But in either case, the rent will not cover the EMI on the loans taken, even if you take only 80% of the value of the property as Loan.However, your yield is a combination of current value of the(a) future rentplus(b) appreciation of the propertyLess(d) Interest and other expenses incurred on the property.The current value of tax benefits should also be factored, to find the actual profit from the transaction. At this stage, it could be either or both or neither the Commercial Real Estate nor the Residential real Estate that can be profitable, depending on the entry and exit level, holding period etc.

-

Real Estate Rentals: Can a tenant lease a residential property through their corporation?

Yes, it is actually being done by many corporations. Corporations tend to send out representatives to a certain area for whatever purpose, and instead of letting them book more expensive hotel-style accommodations that will turn out more expensive because they charge on a daily basis, they look to lease vacation homes or rental apartments with the corporation named as tenant. As the landlord, simply make sure that you are always informed of the turnover schedules, the names and profiles of the actual tenants, and the number of occupants one should expect at any given time.

-

How competitive is commercial real estate compared to residential?

Not sure if you mean investing in or working as an agent. From a former agent’s perspective commercial has relatively less agents than residential. Anyone can get a license and start selling homes right away. Commercial has a higher level of specialized knowledge required to do well. Higher level of training needed for commercial to begin. Commercial has fewer properties that exchange hands during a given period of time than residential. There are still a lot depending on the area. No type of real eatate sales is “easy” and both types have their own challenges. If you are deciding a career path to take choose the product type that interests you the most because you will live and breath it 7 days a week. Find a brokerage that deals in that type of real estate and hang your livense there. A good brokerage will help pair you with an experienced mentor. If you are investing then its easier to start in residential (unless money is no object) so start there. Sc

Create this form in 5 minutes!

How to create an eSignature for the residential real estate lease form

How to generate an eSignature for your Residential Real Estate Lease Form online

How to generate an electronic signature for your Residential Real Estate Lease Form in Chrome

How to create an electronic signature for signing the Residential Real Estate Lease Form in Gmail

How to create an eSignature for the Residential Real Estate Lease Form straight from your smart phone

How to make an electronic signature for the Residential Real Estate Lease Form on iOS

How to make an electronic signature for the Residential Real Estate Lease Form on Android devices

People also ask

-

What is a Lease Agreement?

A Lease Agreement is a legally binding contract between a landlord and a tenant that outlines the terms and conditions of renting a property. It includes details such as rent amount, lease duration, and responsibilities of both parties. Using airSlate SignNow, you can easily create, send, and eSign your Lease Agreement to ensure all terms are clearly documented.

-

How can airSlate SignNow help with my Lease Agreement?

airSlate SignNow simplifies the process of managing your Lease Agreement by allowing you to create customizable templates, send them for eSignature, and securely store completed documents. This streamlined process saves time and reduces paperwork, making it easier to handle leasing transactions efficiently.

-

What is the pricing for airSlate SignNow when creating a Lease Agreement?

airSlate SignNow offers flexible pricing plans tailored to your needs, starting with a free trial that allows you to create and eSign a Lease Agreement without any commitment. As you explore the features, you can choose from various subscription plans that provide additional functionalities, ensuring you get the best value for your business.

-

Can I customize my Lease Agreement template with airSlate SignNow?

Yes, with airSlate SignNow, you can fully customize your Lease Agreement template to fit your specific requirements. You can add clauses, modify terms, and include your branding elements to ensure your agreement meets your business needs and complies with local laws.

-

Is it easy to eSign a Lease Agreement with airSlate SignNow?

Absolutely! airSlate SignNow provides a user-friendly interface that makes eSigning your Lease Agreement quick and easy. Recipients can sign the document from any device, ensuring a seamless experience that accelerates the leasing process and reduces delays.

-

What security measures does airSlate SignNow implement for Lease Agreements?

airSlate SignNow prioritizes security with features like encryption, audit trails, and secure cloud storage for your Lease Agreements. This ensures that your sensitive information is protected, and you can track document activity to maintain compliance and transparency.

-

Can airSlate SignNow integrate with other tools for managing Lease Agreements?

Yes, airSlate SignNow integrates seamlessly with various applications, including CRM systems and document management tools. This integration allows you to streamline your workflow and manage your Lease Agreements more effectively within your existing business processes.

Get more for Lease Agreement

Find out other Lease Agreement

- How To Sign Wyoming Legal Quitclaim Deed

- Sign Wisconsin Insurance Living Will Now

- Sign Wyoming Insurance LLC Operating Agreement Simple

- Sign Kentucky Life Sciences Profit And Loss Statement Now

- How To Sign Arizona Non-Profit Cease And Desist Letter

- Can I Sign Arkansas Non-Profit LLC Operating Agreement

- Sign Arkansas Non-Profit LLC Operating Agreement Free

- Sign California Non-Profit Living Will Easy

- Sign California Non-Profit IOU Myself

- Sign California Non-Profit Lease Agreement Template Free

- Sign Maryland Life Sciences Residential Lease Agreement Later

- Sign Delaware Non-Profit Warranty Deed Fast

- Sign Florida Non-Profit LLC Operating Agreement Free

- Sign Florida Non-Profit Cease And Desist Letter Simple

- Sign Florida Non-Profit Affidavit Of Heirship Online

- Sign Hawaii Non-Profit Limited Power Of Attorney Myself

- Sign Hawaii Non-Profit Limited Power Of Attorney Free

- Sign Idaho Non-Profit Lease Agreement Template Safe

- Help Me With Sign Illinois Non-Profit Business Plan Template

- Sign Maryland Non-Profit Business Plan Template Fast