What is Key Person Insurance Form

What is Key Person Insurance

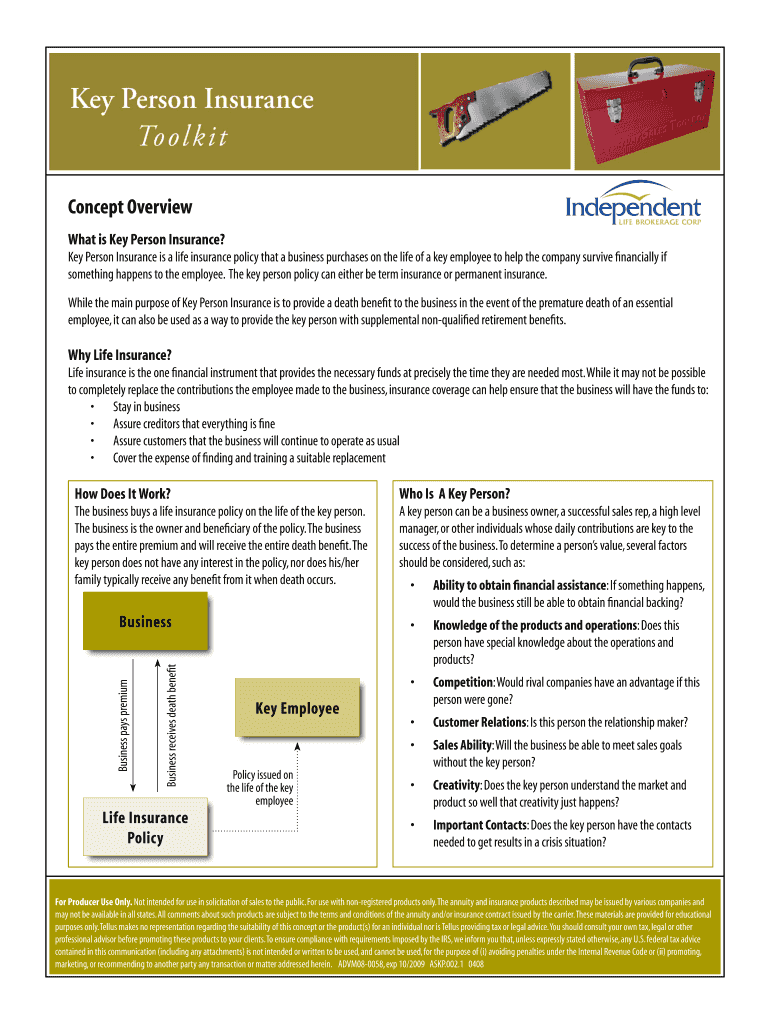

Key person insurance is a type of life insurance policy that a business purchases on the life of an essential employee, often referred to as a key person. This insurance is designed to protect the company from financial losses that may occur due to the unexpected death or disability of that individual. The coverage amount is typically based on the key person's value to the business, which may include their skills, experience, and relationships with clients or suppliers.

Key elements of Key Person Insurance

Several critical components define key person insurance. These include:

- Coverage Amount: This is determined by assessing the financial impact of losing the key person, including lost revenue and the costs associated with hiring and training a replacement.

- Policy Ownership: The business is the policy owner and beneficiary, ensuring that the funds are available for operational continuity.

- Premium Payments: Premiums can vary based on the key person's age, health, and the amount of coverage needed.

- Tax Implications: Generally, the death benefit is received tax-free by the business, but premiums are not tax-deductible.

How to obtain Key Person Insurance

Obtaining key person insurance involves several steps:

- Identify Key Individuals: Determine which employees are critical to your business operations.

- Assess Coverage Needs: Evaluate the potential financial impact of losing each key person to establish the appropriate coverage amount.

- Choose an Insurance Provider: Research and select a reputable insurance company that offers key person insurance policies.

- Complete the Application: Fill out the necessary application forms, providing information about the key person and the business.

- Undergo Medical Underwriting: The insurance company may require a medical examination or health questionnaire for the key person.

Legal use of Key Person Insurance

Key person insurance is legally recognized in the United States as a legitimate business expense. Companies must ensure that they have the consent of the insured individual before purchasing a policy. Additionally, businesses should maintain clear documentation regarding the purpose of the insurance and the assessment of the key person's value. This helps in compliance with tax regulations and ensures transparency in financial reporting.

Examples of using Key Person Insurance

Key person insurance can be beneficial in various scenarios. For instance:

- A small business that relies heavily on a founder for client relationships may use this insurance to cover the costs of hiring a replacement if the founder passes away.

- A tech startup may insure a lead developer whose expertise is crucial for ongoing projects, ensuring the company can sustain operations during a transition period.

- A law firm may take out a policy on a senior partner to protect against the financial impact of losing that individual, which could affect client retention and revenue.

Eligibility Criteria

Eligibility for key person insurance typically requires the following:

- The key person must be an employee of the business, and their role should be integral to the company's success.

- The business must demonstrate a clear financial interest in the key person's continued employment.

- The insured individual must provide consent for the policy to be issued.

Quick guide on how to complete what is key person insurance

Easily Prepare What Is Key Person Insurance on Any Device

Digital document management has become widely embraced by businesses and individuals alike. It offers an ideal environmentally friendly alternative to traditional printed and signed paperwork, enabling you to locate the necessary form and store it securely online. airSlate SignNow provides all the tools needed to create, edit, and eSign your documents rapidly without delays. Manage What Is Key Person Insurance on any device using airSlate SignNow's Android or iOS applications and streamline any document-related process today.

Effortlessly Modify and eSign What Is Key Person Insurance

- Find What Is Key Person Insurance and click Get Form to begin.

- Utilize the tools we offer to fill out your form.

- Highlight important parts of your documents or obscure sensitive information with the tools specifically provided by airSlate SignNow.

- Create your signature with the Sign tool, which takes mere seconds and holds the same legal validity as a conventional ink signature.

- Review all details and click the Done button to save your updates.

- Select how you wish to send your form, whether via email, text message (SMS), or invitation link, or download it to your computer.

Forget about lost or misplaced documents, tedious form searching, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from the device of your choice. Modify and eSign What Is Key Person Insurance to ensure effective communication at every stage of your form preparation with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the what is key person insurance

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What Is Key Person Insurance?

What Is Key Person Insurance is a type of life insurance that protects a business from financial loss due to the death or disability of a key employee. This insurance helps ensure that the company can continue to operate smoothly and cover any financial obligations that may arise. It is essential for businesses that rely heavily on specific individuals for their success.

-

How does Key Person Insurance benefit my business?

What Is Key Person Insurance provides financial security to your business by covering the costs associated with losing a key employee. This can include hiring a replacement, training new staff, and addressing any potential loss of revenue. By having this insurance, you can safeguard your business's future and maintain stability during challenging times.

-

What factors determine the cost of Key Person Insurance?

The cost of What Is Key Person Insurance varies based on several factors, including the age and health of the key person, the amount of coverage needed, and the type of policy chosen. Generally, younger and healthier individuals will have lower premiums. It's important to assess your business's specific needs to determine the right coverage and pricing.

-

Can I customize my Key Person Insurance policy?

Yes, What Is Key Person Insurance can often be customized to fit the unique needs of your business. You can choose the coverage amount, policy duration, and additional riders that may enhance your protection. Working with an insurance advisor can help you tailor a policy that aligns with your business goals.

-

How do I file a claim for Key Person Insurance?

Filing a claim for What Is Key Person Insurance typically involves notifying the insurance provider and submitting necessary documentation, such as a death certificate or proof of disability. The insurer will then review the claim and determine the payout based on the policy terms. It's advisable to keep all relevant documents organized to streamline the process.

-

Is Key Person Insurance tax-deductible?

Generally, premiums paid for What Is Key Person Insurance are not tax-deductible for the business. However, the death benefit received by the company is usually tax-free. It's essential to consult with a tax professional to understand the specific tax implications for your business.

-

How does Key Person Insurance integrate with other business insurance policies?

What Is Key Person Insurance can complement other business insurance policies, such as general liability or property insurance, by providing additional financial protection. Integrating these policies can create a comprehensive risk management strategy for your business. Consulting with an insurance expert can help you understand how to best combine these coverages.

Get more for What Is Key Person Insurance

- Form 14157 a rev 5 2012 tax return preparer fraud or misconduct affidavit

- Form 433 b oic dor mo

- 2013 943 fillable form pdf

- 2015 instructions for schedule m 3 form 1065 instructions for schedule m 3 form 1065 net income loss reconciliation for certain

- Notice 1036 rev december 2016 early release copies of the 2017 percentage method tables for income tax withholding irs form

- Publication 974 rev march 2015 irs form

- Joining instructions for form five students 2011

- W 3 ss 2015 form

Find out other What Is Key Person Insurance

- eSign New Hampshire Sports IOU Safe

- eSign Delaware Courts Operating Agreement Easy

- eSign Georgia Courts Bill Of Lading Online

- eSign Hawaii Courts Contract Mobile

- eSign Hawaii Courts RFP Online

- How To eSign Hawaii Courts RFP

- eSign Hawaii Courts Letter Of Intent Later

- eSign Hawaii Courts IOU Myself

- eSign Hawaii Courts IOU Safe

- Help Me With eSign Hawaii Courts Cease And Desist Letter

- How To eSign Massachusetts Police Letter Of Intent

- eSign Police Document Michigan Secure

- eSign Iowa Courts Emergency Contact Form Online

- eSign Kentucky Courts Quitclaim Deed Easy

- How To eSign Maryland Courts Medical History

- eSign Michigan Courts Lease Agreement Template Online

- eSign Minnesota Courts Cease And Desist Letter Free

- Can I eSign Montana Courts NDA

- eSign Montana Courts LLC Operating Agreement Mobile

- eSign Oklahoma Sports Rental Application Simple