Form 4797

What is the Form 4797

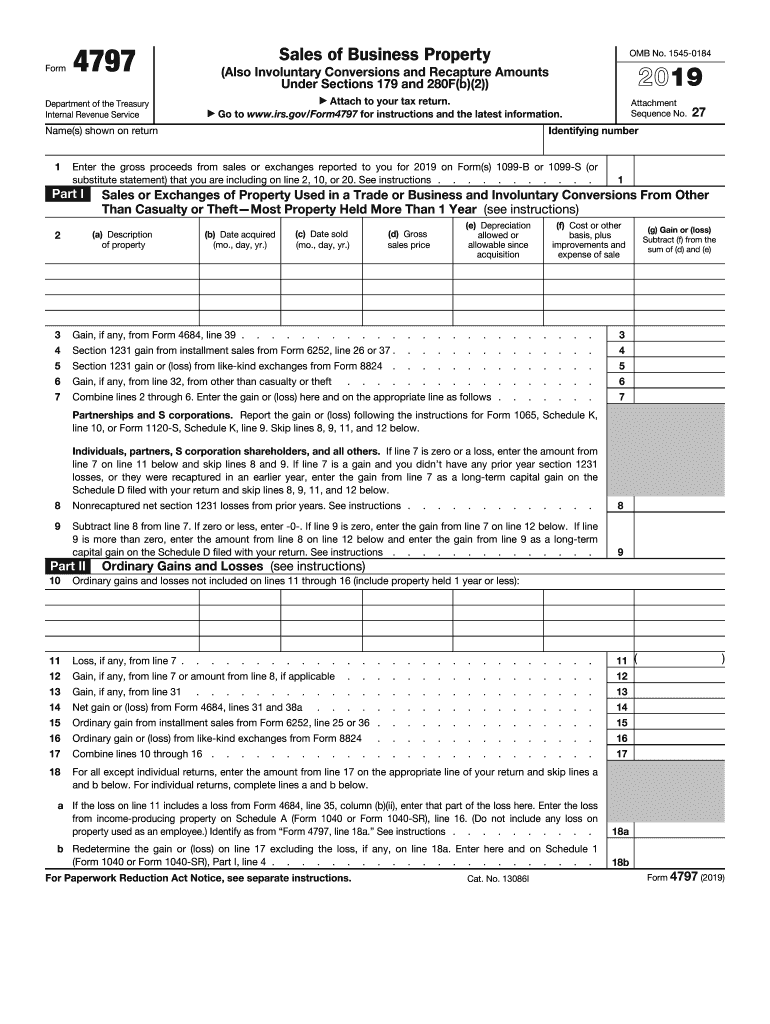

The 2019 Form 4797, officially known as the "Sales of Business Property," is a tax form used by taxpayers in the United States to report the sale or exchange of business property. This form is essential for individuals and businesses that have disposed of assets used in a trade or business, including real estate and personal property. The information reported on this form helps the IRS determine the amount of gain or loss from the sale, which is crucial for calculating tax liability.

How to use the Form 4797

To effectively use the 2019 IRS Form 4797, you need to gather all relevant information regarding the property sold or exchanged. This includes the date of acquisition, date of sale, selling price, and any expenses associated with the sale. The form is divided into sections that require you to report different types of transactions, such as sales of depreciable property and involuntary conversions. Properly completing this form ensures accurate reporting of gains or losses, which affects your overall tax return.

Steps to complete the Form 4797

Completing the 2019 Form 4797 involves several key steps:

- Begin by entering your name, address, and taxpayer identification number at the top of the form.

- Identify the type of property sold and provide details such as the acquisition date and selling price.

- Calculate the adjusted basis of the property, which includes the original cost plus any improvements made.

- Determine the gain or loss by subtracting the adjusted basis from the selling price.

- Complete the relevant sections based on the type of transaction, ensuring all calculations are accurate.

- Review the form for completeness and accuracy before submission.

Legal use of the Form 4797

The legal use of the 2019 Form 4797 is governed by IRS regulations, which stipulate that taxpayers must accurately report any gains or losses from the sale of business property. Failure to comply with these regulations can result in penalties or audits. It is essential to keep thorough records of all transactions and supporting documents, as these may be required for verification by the IRS. Using the form correctly helps ensure compliance with tax laws and reduces the risk of legal issues.

Filing Deadlines / Important Dates

The filing deadline for the 2019 Form 4797 typically aligns with the due date for your annual tax return. For most individual taxpayers, this date is April 15 of the following year. If you are filing for a business entity, the deadline may vary. It is crucial to be aware of these deadlines to avoid late fees and penalties. Additionally, if you require an extension, ensure that you file the necessary forms to extend your tax return deadline.

Form Submission Methods (Online / Mail / In-Person)

The 2019 Form 4797 can be submitted through various methods, depending on your preference and circumstances. Taxpayers have the option to file electronically using IRS-approved e-filing software, which often simplifies the process and reduces errors. Alternatively, you can mail a paper copy of the form to the appropriate IRS address based on your location. In-person submissions are generally not available for this form, as the IRS encourages electronic filing for efficiency and security.

Quick guide on how to complete department of the treasuryinternal revenue service form us

Effortlessly prepare Form 4797 on any device

Digital document management has gained popularity among businesses and individuals alike. It offers an ideal environmentally friendly substitute for conventional printed and signed documents, as you can obtain the necessary form and securely maintain it online. airSlate SignNow provides you with all the features you require to create, edit, and electronically sign your documents swiftly and without holdups. Manage Form 4797 on any device using airSlate SignNow's Android or iOS applications and enhance any document-driven task today.

The easiest way to modify and electronically sign Form 4797 effortlessly

- Locate Form 4797 and then click Get Form to begin.

- Utilize the tools available to complete your form.

- Highlight important sections of the documents or obscure sensitive details with the tools that airSlate SignNow specifically provides for this purpose.

- Create your signature using the Sign tool, which takes only seconds and carries the same legal validity as a traditional handwritten signature.

- Review all the information and then click on the Done button to save your updates.

- Choose your preferred method to send your form—by email, text message (SMS), or share a link, or download it directly to your PC.

Eliminate concerns about lost or misplace documents, tedious form navigation, or errors that require printing new document copies. airSlate SignNow efficiently addresses your document management needs with just a few clicks from any device you prefer. Modify and electronically sign Form 4797 to ensure effective communication throughout every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the department of the treasuryinternal revenue service form us

How to make an eSignature for your Department Of The Treasuryinternal Revenue Service Form Us in the online mode

How to create an electronic signature for the Department Of The Treasuryinternal Revenue Service Form Us in Chrome

How to make an electronic signature for signing the Department Of The Treasuryinternal Revenue Service Form Us in Gmail

How to generate an eSignature for the Department Of The Treasuryinternal Revenue Service Form Us right from your smart phone

How to generate an eSignature for the Department Of The Treasuryinternal Revenue Service Form Us on iOS

How to generate an electronic signature for the Department Of The Treasuryinternal Revenue Service Form Us on Android devices

People also ask

-

What are the key features of airSlate SignNow related to form 4797 instructions 2019?

airSlate SignNow provides a seamless platform for managing form 4797 instructions 2019. With features like document editing, eSigning, and template creation, users can efficiently complete their tax forms. This digital solution ensures that businesses can handle their forms with accuracy and speed.

-

How can airSlate SignNow help with completing form 4797 instructions 2019?

Using airSlate SignNow, users can easily navigate through the requirements of form 4797 instructions 2019. The platform allows for intuitive filling and eSigning of documents, ensuring compliance with tax regulations. This helps streamline the overall process for businesses.

-

Is there a mobile app for airSlate SignNow to assist with form 4797 instructions 2019?

Yes, airSlate SignNow offers a mobile app that facilitates access to form 4797 instructions 2019 on the go. This mobile solution ensures that users can manage their document signing and form filling anytime and anywhere. The user-friendly interface enhances the experience for mobile users.

-

What are the pricing options for airSlate SignNow regarding form 4797 instructions 2019?

airSlate SignNow offers competitive pricing plans that cater to a variety of business needs when dealing with form 4797 instructions 2019. Users can choose from different tiers that provide varying features and capabilities. This flexibility allows businesses to select a plan that fits their budget and requirements.

-

Does airSlate SignNow integrate with other tools for handling form 4797 instructions 2019?

Absolutely! airSlate SignNow integrates with a multitude of applications to enhance the handling of form 4797 instructions 2019. With integrations available for popular tools like Google Drive, Dropbox, and Microsoft Office, users can streamline their workflows effectively. This integration capability maximizes productivity.

-

What security measures are in place on airSlate SignNow when dealing with form 4797 instructions 2019?

airSlate SignNow takes the security of your data seriously, especially when it comes to sensitive documents like form 4797 instructions 2019. The platform utilizes robust encryption and secure cloud storage to protect your information. This focus on security helps instill confidence in users while handling important tax documents.

-

Can I use airSlate SignNow for team collaboration on form 4797 instructions 2019?

Yes, airSlate SignNow accommodates team collaboration for form 4797 instructions 2019. Team members can share, edit, and sign documents collaboratively to ensure everyone is on the same page. This collaborative feature streamlines the completion of essential tax forms.

Get more for Form 4797

Find out other Form 4797

- eSignature New York Non-Profit LLC Operating Agreement Mobile

- How Can I eSignature Colorado Orthodontists LLC Operating Agreement

- eSignature North Carolina Non-Profit RFP Secure

- eSignature North Carolina Non-Profit Credit Memo Secure

- eSignature North Dakota Non-Profit Quitclaim Deed Later

- eSignature Florida Orthodontists Business Plan Template Easy

- eSignature Georgia Orthodontists RFP Secure

- eSignature Ohio Non-Profit LLC Operating Agreement Later

- eSignature Ohio Non-Profit LLC Operating Agreement Easy

- How Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Ohio Lawers Lease Termination Letter

- Can I eSignature Oregon Non-Profit Last Will And Testament

- Can I eSignature Oregon Orthodontists LLC Operating Agreement

- How To eSignature Rhode Island Orthodontists LLC Operating Agreement

- Can I eSignature West Virginia Lawers Cease And Desist Letter

- eSignature Alabama Plumbing Confidentiality Agreement Later

- How Can I eSignature Wyoming Lawers Quitclaim Deed

- eSignature California Plumbing Profit And Loss Statement Easy

- How To eSignature California Plumbing Business Letter Template

- eSignature Kansas Plumbing Lease Agreement Template Myself