8823 Form

What is the 8823 Form

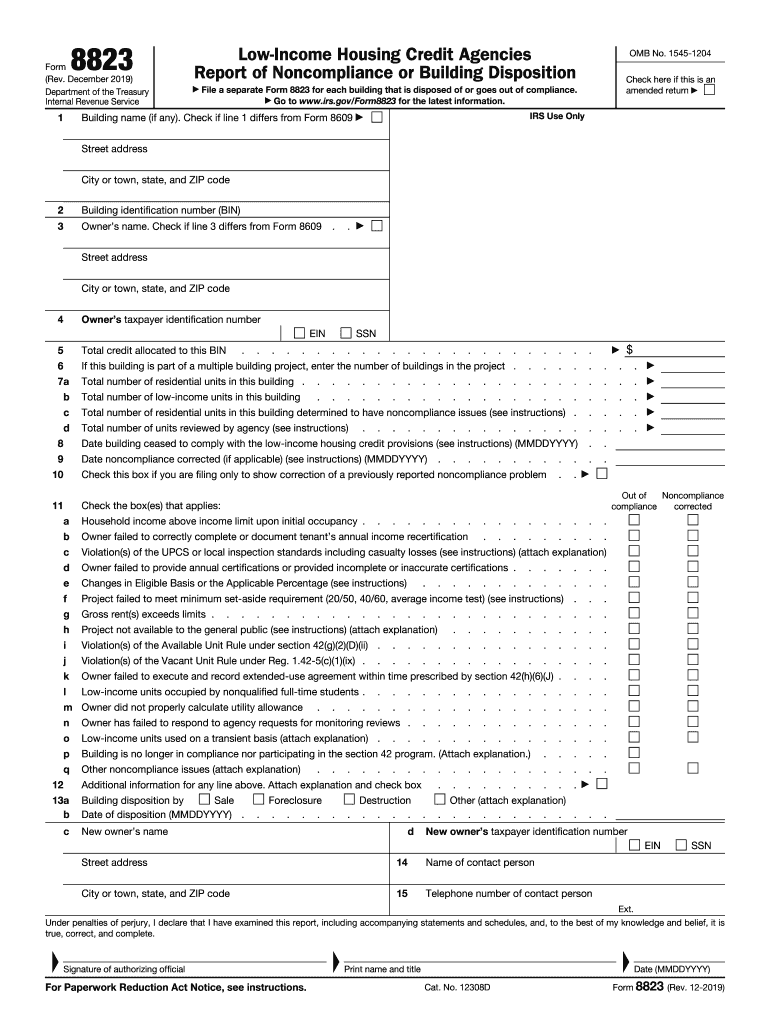

The 8823 form, officially known as the Low-Income Housing Credit Compliance Report, is used by property owners and managers to report noncompliance with the requirements of the Low-Income Housing Tax Credit (LIHTC) program. This form is essential for maintaining compliance with federal regulations and ensuring that properties continue to meet the necessary standards for low-income housing. It is primarily submitted to the Internal Revenue Service (IRS) to document any issues related to tenant income eligibility, lease agreements, and other compliance factors.

How to use the 8823 Form

Using the 8823 form involves several key steps. First, property owners must gather all relevant information regarding tenant income and occupancy status. The form requires detailed reporting of any instances of noncompliance, including tenant income exceeding limits or failure to maintain required occupancy levels. Once the necessary data is compiled, the owner or manager must complete the form accurately, ensuring all sections are filled out completely. After completing the form, it should be submitted to the appropriate IRS office, along with any supporting documentation that may be required.

Steps to complete the 8823 Form

Completing the 8823 form involves a systematic approach to ensure accuracy and compliance. Here are the steps:

- Gather documentation: Collect all relevant tenant files, including income verification and lease agreements.

- Identify noncompliance issues: Review tenant records to identify any discrepancies or issues that need reporting.

- Fill out the form: Enter all required information in the appropriate sections of the 8823 form.

- Review for accuracy: Double-check all entries for correctness and completeness.

- Submit the form: Send the completed 8823 form to the IRS, ensuring it is submitted by the required deadlines.

Penalties for Non-Compliance

Failure to comply with the requirements outlined in the 8823 form can result in significant penalties. The IRS may impose fines or revoke tax credits if noncompliance is not reported accurately or in a timely manner. Additionally, property owners may face legal repercussions, including potential audits or further scrutiny of their compliance practices. It is crucial for property owners to understand these risks and ensure that they maintain accurate records and timely submissions to avoid penalties.

IRS Guidelines

The IRS provides specific guidelines regarding the completion and submission of the 8823 form. These guidelines outline the necessary information to include, the process for reporting noncompliance, and the deadlines for submission. Property owners should familiarize themselves with these guidelines to ensure they meet all requirements and avoid any potential issues with their LIHTC compliance. Adhering to IRS guidelines not only helps in maintaining compliance but also protects the tax credits associated with low-income housing.

Eligibility Criteria

Eligibility for using the 8823 form primarily pertains to properties that have received Low-Income Housing Tax Credits. To qualify, properties must meet specific criteria, including maintaining a certain percentage of units for low-income tenants and adhering to income limits set by the IRS. Additionally, property owners must ensure that all tenants meet the eligibility requirements for low-income housing. Understanding these criteria is essential for property owners to effectively manage their compliance responsibilities.

Quick guide on how to complete the following pages refer to instructions for form 8823 low

Complete 8823 Form effortlessly on any device

Online document management has gained traction among companies and individuals. It offers an excellent environmentally friendly substitute for traditional printed and signed documents, as you can access the appropriate form and safely store it online. airSlate SignNow provides you with all the tools necessary to create, modify, and eSign your documents promptly without delays. Handle 8823 Form on any device with the airSlate SignNow Android or iOS applications and enhance any document-related process today.

The easiest way to modify and eSign 8823 Form with ease

- Locate 8823 Form and click Get Form to begin.

- Utilize the tools we provide to fill out your form.

- Emphasize important sections of your documents or obscure sensitive information with tools that airSlate SignNow specifically offers for that purpose.

- Create your eSignature with the Sign tool, which takes only seconds and holds the same legal validity as a conventional wet ink signature.

- Review all the details and then click the Done button to save your changes.

- Choose how you wish to send your form, via email, text message (SMS), or invitation link, or download it to your computer.

Say goodbye to lost or misplaced files, lengthy form searches, or mistakes that require printing new document copies. airSlate SignNow takes care of your document management needs in just a few clicks from any device of your preference. Modify and eSign 8823 Form and ensure excellent communication at any stage of your form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the the following pages refer to instructions for form 8823 low

How to make an eSignature for your The Following Pages Refer To Instructions For Form 8823 Low in the online mode

How to create an electronic signature for your The Following Pages Refer To Instructions For Form 8823 Low in Chrome

How to make an eSignature for putting it on the The Following Pages Refer To Instructions For Form 8823 Low in Gmail

How to create an eSignature for the The Following Pages Refer To Instructions For Form 8823 Low straight from your smart phone

How to create an eSignature for the The Following Pages Refer To Instructions For Form 8823 Low on iOS

How to create an eSignature for the The Following Pages Refer To Instructions For Form 8823 Low on Android OS

People also ask

-

What is 8823 noncompliance and how does it affect businesses?

8823 noncompliance refers to issues related to the IRS Form 8823, which is used to report noncompliance with housing tax credit requirements. Businesses can face penalties or lose valuable credits if they fail to report accurately. Understanding 8823 noncompliance is crucial for organizations that rely on tax credits for housing developments.

-

How can airSlate SignNow assist in managing 8823 noncompliance?

airSlate SignNow provides a streamlined process for creating, signing, and managing documents related to 8823 noncompliance. By using our service, businesses can ensure that all documents are correctly completed and stored, reducing the risk of noncompliance. The platform's user-friendly interface makes it easy to handle documentation efficiently.

-

What are the pricing options available for airSlate SignNow?

airSlate SignNow offers flexible pricing plans designed to accommodate businesses of all sizes. Pricing varies based on features and number of users, making it easy for businesses dealing with 8823 noncompliance to choose a plan that fits their budget. We also offer a free trial to help you explore our features risk-free.

-

Are there any features specifically designed for compliance management?

Yes, airSlate SignNow includes features that aid in compliance management, specifically addressing issues like 8823 noncompliance. Our template library, audit trails, and secure document storage help ensure you meet regulatory requirements. These features are essential for organizations looking to prevent compliance-related penalties.

-

Can airSlate SignNow integrate with other software solutions?

Absolutely, airSlate SignNow integrates seamlessly with numerous third-party applications, enhancing its utility for managing documents related to 8823 noncompliance. You can connect with CRM systems, project management tools, and more for a comprehensive workflow. This integration capability helps centralize your compliance documentation efficiently.

-

What benefits does airSlate SignNow provide for document management?

Using airSlate SignNow for document management offers several benefits, including increased efficiency, enhanced security, and reduction of errors associated with 8823 noncompliance. Our platform streamlines document workflows, ensuring that all necessary signatures are obtained promptly. Additionally, the electronic storage of documents makes retrieval and compliance checks much easier.

-

Is airSlate SignNow suitable for small businesses handling 8823 noncompliance?

Yes, airSlate SignNow is designed to cater to small businesses that may be navigating 8823 noncompliance. Our platform's affordability and user-friendly features make it accessible to smaller enterprises looking to manage their compliance documents effectively. We provide comprehensive support to ensure your business can operate smoothly.

Get more for 8823 Form

Find out other 8823 Form

- eSign New Hampshire Orthodontists Medical History Online

- eSign Massachusetts Plumbing Job Offer Mobile

- How To eSign Pennsylvania Orthodontists Letter Of Intent

- eSign Rhode Island Orthodontists Last Will And Testament Secure

- eSign Nevada Plumbing Business Letter Template Later

- eSign Nevada Plumbing Lease Agreement Form Myself

- eSign Plumbing PPT New Jersey Later

- eSign New York Plumbing Rental Lease Agreement Simple

- eSign North Dakota Plumbing Emergency Contact Form Mobile

- How To eSign North Dakota Plumbing Emergency Contact Form

- eSign Utah Orthodontists Credit Memo Easy

- How To eSign Oklahoma Plumbing Business Plan Template

- eSign Vermont Orthodontists Rental Application Now

- Help Me With eSign Oregon Plumbing Business Plan Template

- eSign Pennsylvania Plumbing RFP Easy

- Can I eSign Pennsylvania Plumbing RFP

- eSign Pennsylvania Plumbing Work Order Free

- Can I eSign Pennsylvania Plumbing Purchase Order Template

- Help Me With eSign South Carolina Plumbing Promissory Note Template

- How To eSign South Dakota Plumbing Quitclaim Deed