Alberta Consent Excluding Corporate Income Tax Stakeholders Use This Form to Grant Consent to Release Their Account Information

What is the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information

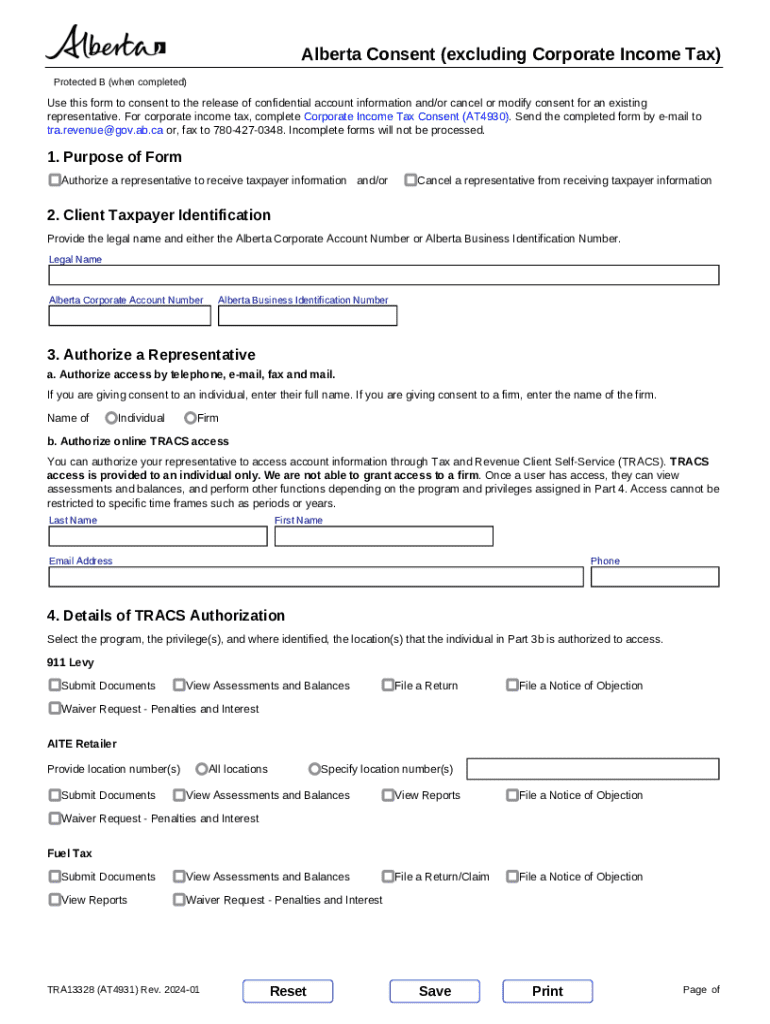

The Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information is a legal document that allows stakeholders to authorize the release of their financial account information. This form is particularly relevant for individuals and entities who need to share sensitive information with authorized parties while ensuring compliance with privacy regulations. By completing this form, stakeholders can facilitate the necessary disclosures without compromising their rights or privacy.

How to use the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information

Using the Alberta Consent form involves several straightforward steps. First, stakeholders must fill out their personal and account information accurately. Next, it is essential to specify the parties authorized to receive the information. Finally, stakeholders should sign and date the form to validate their consent. This process ensures that the release of information is legally binding and recognized by financial institutions and regulatory bodies.

Steps to complete the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information

To complete the Alberta Consent form, follow these steps:

- Gather necessary personal information, including full name, address, and account details.

- Identify the parties that will receive the account information, ensuring they are authorized to access such data.

- Fill out the form clearly, ensuring all fields are completed to avoid delays.

- Review the form for accuracy and completeness before signing.

- Sign and date the form to confirm your consent.

Key elements of the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information

Key elements of the Alberta Consent form include:

- Stakeholder Information: Details about the individual or entity granting consent.

- Authorized Parties: Identification of those who are permitted to receive the account information.

- Scope of Consent: A clear description of what information can be disclosed.

- Signature and Date: A legal affirmation of consent by the stakeholder.

Legal use of the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information

The legal use of the Alberta Consent form is crucial for compliance with privacy laws. This document serves as a formal agreement that protects both the stakeholder and the receiving party. It ensures that the release of information is conducted in accordance with applicable regulations, thereby minimizing the risk of legal repercussions. Stakeholders should retain a copy of the signed form for their records, as it may be necessary for future reference.

Eligibility Criteria

Eligibility to use the Alberta Consent form typically includes individuals or entities that hold accounts requiring disclosure of information to authorized parties. This may encompass personal account holders, business owners, or representatives acting on behalf of stakeholders. It is essential that all parties involved understand their rights and responsibilities under this consent agreement.

Quick guide on how to complete alberta consent excluding corporate income tax stakeholders use this form to grant consent to release their account information

Effortlessly Prepare Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information on Any Device

Digital document management has become increasingly popular among businesses and individuals. It offers an ideal environmentally friendly alternative to conventional printed and signed documents, as you can easily locate the appropriate form and securely store it online. airSlate SignNow provides all the tools necessary to create, edit, and eSign your documents swiftly without any delays. Manage Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information on any platform using the airSlate SignNow Android or iOS applications and simplify any document-related task today.

How to Edit and eSign Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information with Ease

- Find Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Highlight important sections of your documents or obscure sensitive information using tools that airSlate SignNow specifically offers for this purpose.

- Create your eSignature with the Sign feature, which takes seconds and holds the same legal significance as a conventional wet ink signature.

- Review all the details and click on the Done button to save your changes.

- Select how you wish to send your form, via email, text message (SMS), or an invitation link, or download it to your computer.

Eliminate the hassle of lost or misfiled documents, tedious form searches, or errors that necessitate printing new copies. airSlate SignNow meets your document management needs in just a few clicks from any device you prefer. Edit and eSign Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information and ensure excellent communication at every step of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the alberta consent excluding corporate income tax stakeholders use this form to grant consent to release their account information

How to create an electronic signature for a PDF online

How to create an electronic signature for a PDF in Google Chrome

How to create an e-signature for signing PDFs in Gmail

How to create an e-signature right from your smartphone

How to create an e-signature for a PDF on iOS

How to create an e-signature for a PDF on Android

People also ask

-

What is the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information?

The Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information is a legal document that allows stakeholders to authorize the release of their account information. This form is essential for ensuring compliance and transparency in financial dealings.

-

How can airSlate SignNow help with the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form?

airSlate SignNow provides an easy-to-use platform for creating, sending, and eSigning the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information. Our solution streamlines the process, making it efficient and secure for all parties involved.

-

What are the pricing options for using airSlate SignNow?

airSlate SignNow offers flexible pricing plans tailored to meet the needs of businesses of all sizes. Our plans include features that support the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information, ensuring you get the best value for your investment.

-

What features does airSlate SignNow offer for document management?

airSlate SignNow includes a variety of features such as customizable templates, secure eSigning, and real-time tracking. These features enhance the process of managing the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information, making it easier for users to stay organized.

-

Is airSlate SignNow compliant with legal standards for document signing?

Yes, airSlate SignNow is fully compliant with legal standards for electronic signatures, including those required for the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information. This ensures that your documents are legally binding and secure.

-

Can I integrate airSlate SignNow with other software?

Absolutely! airSlate SignNow offers integrations with various software applications, enhancing your workflow. This is particularly beneficial for managing the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information alongside your existing tools.

-

What are the benefits of using airSlate SignNow for consent forms?

Using airSlate SignNow for consent forms like the Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information provides numerous benefits, including increased efficiency, reduced paper usage, and improved security. Our platform simplifies the entire process, allowing for faster turnaround times.

Get more for Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information

- Maine dance application license form

- State of maine accident report form

- Legacy circle declaration of intent form

- Taser certification online form

- Fence inspection state of michigan michigan form

- Mi deq requisition water form

- Fraudulent ucc financing statement affidavit mi ucc7 fraudulent ucc financing statement affidavit mi ucc7 mi form

- Bsl cg form

Find out other Alberta Consent excluding Corporate Income Tax Stakeholders Use This Form To Grant Consent To Release Their Account Information

- Electronic signature Michigan Police Business Associate Agreement Simple

- Electronic signature Mississippi Police Living Will Safe

- Can I Electronic signature South Carolina Real Estate Work Order

- How To Electronic signature Indiana Sports RFP

- How Can I Electronic signature Indiana Sports RFP

- Electronic signature South Dakota Real Estate Quitclaim Deed Now

- Electronic signature South Dakota Real Estate Quitclaim Deed Safe

- Electronic signature Indiana Sports Forbearance Agreement Myself

- Help Me With Electronic signature Nevada Police Living Will

- Electronic signature Real Estate Document Utah Safe

- Electronic signature Oregon Police Living Will Now

- Electronic signature Pennsylvania Police Executive Summary Template Free

- Electronic signature Pennsylvania Police Forbearance Agreement Fast

- How Do I Electronic signature Pennsylvania Police Forbearance Agreement

- How Can I Electronic signature Pennsylvania Police Forbearance Agreement

- Electronic signature Washington Real Estate Purchase Order Template Mobile

- Electronic signature West Virginia Real Estate Last Will And Testament Online

- Electronic signature Texas Police Lease Termination Letter Safe

- How To Electronic signature Texas Police Stock Certificate

- How Can I Electronic signature Wyoming Real Estate Quitclaim Deed