1099 Int Form

What is the 1099 Int

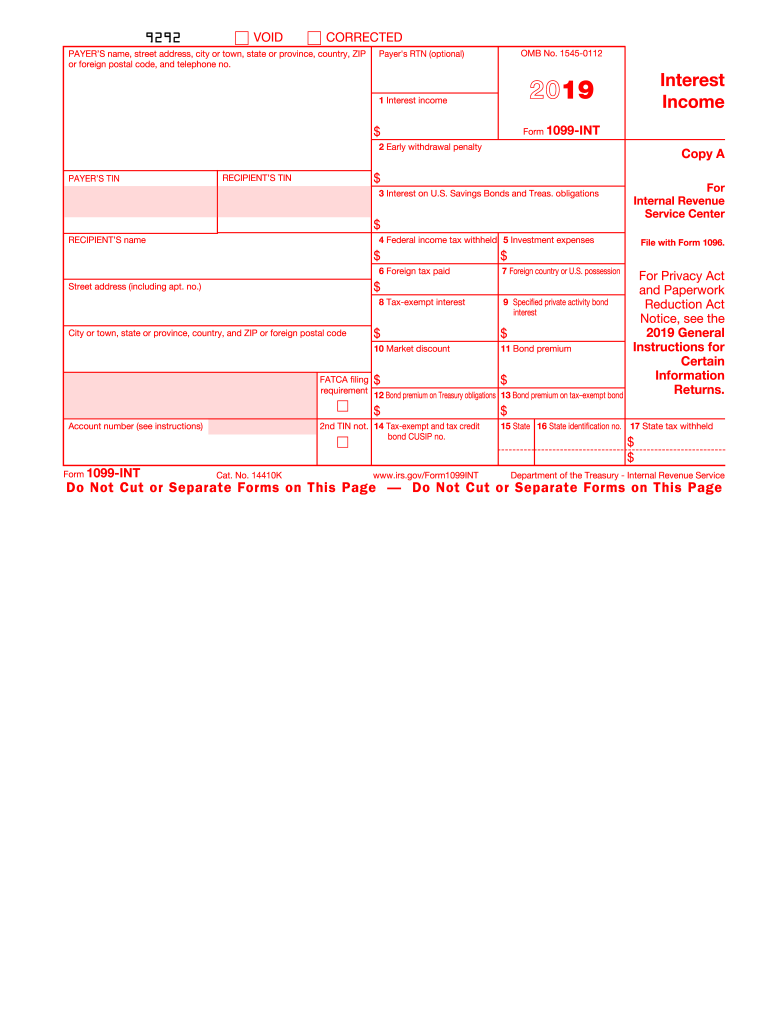

The 1099 interest form, officially known as the 1099-INT, is a tax document used in the United States to report interest income earned by individuals and entities. Financial institutions, such as banks and credit unions, are required to issue this form to account holders who earn more than ten dollars in interest during the tax year. The 1099-INT provides essential information for taxpayers to accurately report their income to the Internal Revenue Service (IRS). It includes details such as the payer's name, taxpayer identification number, the amount of interest earned, and any taxes withheld.

Steps to complete the 1099 Int

Completing the 1099-INT form involves several straightforward steps. First, gather all relevant information, including your personal identification details and the interest income received. Next, accurately fill in the payer's information, including their name and address. Then, enter the total interest earned in the appropriate box on the form. If applicable, include any federal income tax withheld. Finally, review the completed form for accuracy before submitting it to ensure compliance with IRS requirements.

Legal use of the 1099 Int

The 1099-INT form is legally binding and must be used in accordance with IRS regulations. It is essential for taxpayers to report all interest income to avoid penalties and ensure compliance with tax laws. The form serves as a record of income that can be verified by the IRS, making it crucial for maintaining accurate tax records. When properly filled out and submitted, the 1099-INT helps taxpayers fulfill their legal obligations regarding income reporting.

Filing Deadlines / Important Dates

Understanding the filing deadlines for the 1099-INT form is crucial for compliance. Typically, financial institutions must send out the 1099-INT forms to recipients by January thirty-first of the year following the tax year in which the interest was earned. Additionally, these institutions must file the forms with the IRS by the end of February if submitted on paper, or by the end of March if filed electronically. Taxpayers should be aware of these deadlines to ensure timely reporting of their interest income.

Who Issues the Form

The 1099-INT form is issued by financial institutions, including banks, credit unions, and other entities that pay interest to account holders. These institutions are responsible for accurately reporting the interest income earned by their customers. It is important for taxpayers to keep track of the forms they receive, as they will need this information for their tax filings. If a taxpayer does not receive a 1099-INT form but has earned interest, they are still required to report that income to the IRS.

IRS Guidelines

The IRS provides specific guidelines regarding the use and completion of the 1099-INT form. Taxpayers must ensure that all information reported is accurate and complete. The IRS requires that all interest income be reported, regardless of whether a 1099-INT form is received. Taxpayers should refer to the IRS instructions for Form 1099-INT for detailed information on how to fill out the form correctly, including what constitutes reportable interest income and how to handle any discrepancies.

Digital vs. Paper Version

Both digital and paper versions of the 1099-INT form are acceptable for reporting interest income. The digital version allows for easier completion and submission, often through e-filing platforms. It also provides benefits such as instant processing and confirmation of receipt. However, some taxpayers may prefer the paper version for record-keeping purposes. Regardless of the format chosen, it is essential to ensure that all information is accurately reported to comply with IRS regulations.

Quick guide on how to complete 2019 form 1099 int interest income

Prepare 1099 Int effortlessly on any device

Managing documents online has gained popularity among businesses and individuals. It offers an excellent eco-friendly substitute for traditional printed and signed documents, as you can easily find the right template and securely store it online. airSlate SignNow provides all the tools needed to create, edit, and electronically sign your documents quickly and without delays. Handle 1099 Int on any device using the airSlate SignNow Android or iOS applications and enhance any document-related workflow today.

How to modify and eSign 1099 Int seamlessly

- Find 1099 Int and click on Get Form to begin.

- Utilize the tools we provide to complete your document.

- Emphasize relevant sections of your documents or obscure sensitive information with tools specifically designed for that purpose by airSlate SignNow.

- Create your electronic signature using the Sign feature, which takes just moments and holds the same legal validity as a traditional ink signature.

- Review all the details and click the Done button to save your modifications.

- Choose how you want to share your form, whether by email, text message (SMS), invitation link, or download it to your computer.

Eliminate the hassle of lost or misplaced documents, tedious form searching, or errors that necessitate printing new document copies. airSlate SignNow meets your document management needs with just a few clicks from your preferred device. Modify and eSign 1099 Int and guarantee outstanding communication at every stage of the form preparation process with airSlate SignNow.

Create this form in 5 minutes or less

Create this form in 5 minutes!

How to create an eSignature for the 2019 form 1099 int interest income

How to make an eSignature for your 2019 Form 1099 Int Interest Income online

How to make an electronic signature for the 2019 Form 1099 Int Interest Income in Chrome

How to generate an electronic signature for putting it on the 2019 Form 1099 Int Interest Income in Gmail

How to make an electronic signature for the 2019 Form 1099 Int Interest Income right from your mobile device

How to create an electronic signature for the 2019 Form 1099 Int Interest Income on iOS

How to generate an eSignature for the 2019 Form 1099 Int Interest Income on Android

People also ask

-

What is the purpose of the 1099 2019 int form?

The 1099 2019 int form is used to report interest income earned by individuals or entities during the tax year. This form enables you to accurately report your earnings to the IRS, ensuring you comply with tax obligations alongside receiving potential deductions. It is essential for tracking investment income and preparing your tax returns efficiently.

-

How can airSlate SignNow assist with 1099 2019 int documentation?

airSlate SignNow provides a seamless way to electronically sign and send your 1099 2019 int forms securely. Our platform allows for quick document preparation and enhances the efficiency of the eSigning process. This ensures you can manage your tax documentation without hassle and keep your records organized.

-

What features does airSlate SignNow offer for handling 1099 2019 int documents?

With airSlate SignNow, you can utilize features such as customizable templates, multi-party signing, and secure cloud storage to handle 1099 2019 int documents effectively. These features streamline the process of obtaining signatures and ensure your documents are always accessible. Moreover, our platform enhances collaboration among parties involved in signing.

-

Is airSlate SignNow a cost-effective solution for managing 1099 2019 int forms?

Yes, airSlate SignNow is designed to be a cost-effective solution for managing all types of documents, including the 1099 2019 int forms. Our pricing plans accommodate businesses of all sizes, allowing you to optimize your document management process without excessive costs. This way, you can focus on your business while we handle your paperwork.

-

Can I integrate airSlate SignNow with my accounting software for 1099 2019 int reporting?

Absolutely! airSlate SignNow integrates seamlessly with various accounting software platforms, enabling you to automate the process of sending and receiving your 1099 2019 int forms. This integration reduces the manual effort required to manage tax documents and improves overall accuracy in your financial reporting. You can sync your data without any hassle.

-

What are the benefits of using airSlate SignNow for 1099 2019 int eSigning?

Using airSlate SignNow for 1099 2019 int eSigning streamlines your workflow by reducing paperwork and minimizing errors associated with manual signing. Our platform ensures that all signatures are legally binding and secure. This not only enhances productivity but also instills confidence in your document management processes.

-

How secure is airSlate SignNow for handling sensitive information like 1099 2019 int forms?

airSlate SignNow takes security very seriously and employs industry-standard encryption to protect sensitive information, including 1099 2019 int forms. We implement multiple layers of security protocols to ensure that your documents are safe during transmission and storage. You can trust us to keep your data confidential.

Get more for 1099 Int

- Schedule e form 1 supplemental income and loss

- Form 3533 change of address for individuals form 3533 change of address for individuals

- Vermont tax form co 411 dana and rahman tukan

- California schedule ca 540nr unable to fill out part ii form

- State conformity to federal bonus depreciation

- Ftb form 3587fill out and use this pdf

- In st 103 instructions fill out tax template form

- U s treasury offset program utah state tax commission form

Find out other 1099 Int

- Can I Sign Nevada Charity Bill Of Lading

- How Do I Sign Nebraska Charity Limited Power Of Attorney

- Sign New Hampshire Charity Residential Lease Agreement Online

- Sign New Jersey Charity Promissory Note Template Secure

- How Do I Sign North Carolina Charity Lease Agreement Form

- How To Sign Oregon Charity Living Will

- Sign South Dakota Charity Residential Lease Agreement Simple

- Sign Vermont Charity Business Plan Template Later

- Sign Arkansas Construction Executive Summary Template Secure

- How To Sign Arkansas Construction Work Order

- Sign Colorado Construction Rental Lease Agreement Mobile

- Sign Maine Construction Business Letter Template Secure

- Can I Sign Louisiana Construction Letter Of Intent

- How Can I Sign Maryland Construction Business Plan Template

- Can I Sign Maryland Construction Quitclaim Deed

- Sign Minnesota Construction Business Plan Template Mobile

- Sign Construction PPT Mississippi Myself

- Sign North Carolina Construction Affidavit Of Heirship Later

- Sign Oregon Construction Emergency Contact Form Easy

- Sign Rhode Island Construction Business Plan Template Myself